D. Lentz

Constellium (NYSE:CSTM) may have seen more margin compression in its latest quarter, but the company continues to manage the inflationary pressures well in a challenging climate. The key to this resilience has been its pricing power, allowing CSTM to pass through a majority of its increasing costs on to the consumer. That said, the company isn’t insulated completely from a challenging macro and operating environment ahead, as guidance is now for a “moderately lower” FY23 adj EBITDA outlook relative to FY22 levels.

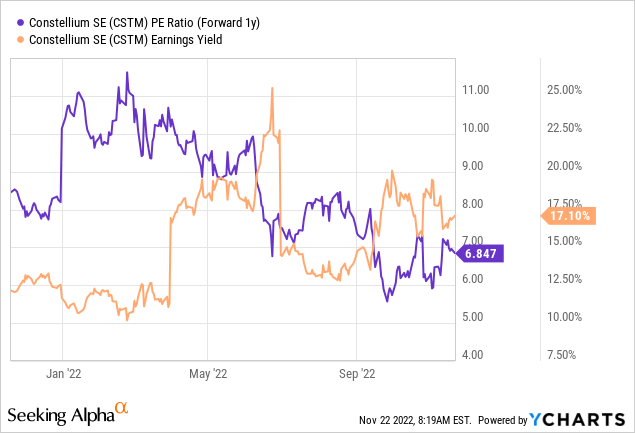

Any upside from here will depend on management’s ability to extract more contract pricing improvements to offset the energy cost pressures, although the deleveraged balance sheet should help in the meantime. The valuation is attractive, though, with the annualized earnings yield already in the high teens %, so investors willing to ride out the near-term choppiness stand to be well-rewarded.

Input Cost Headwinds Cloud an Otherwise Solid Quarter

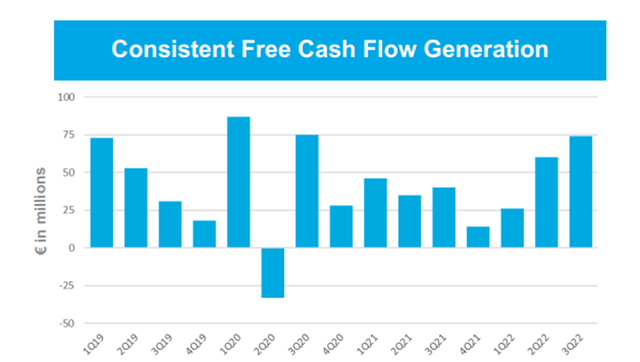

CSTM posted healthy adj EBITDA growth of +12% YoY and healthy FCF generation yet again in its latest quarter. The performance was supported by a continued recovery in Aerospace & Transportation (A&T) segment demand and FX tailwinds, which more than outpaced any packaging cost inflation. While EBITDA margins still declined ~100bps YoY in a challenging macro environment, the strong group FCF generation of EUR74m was a highlight, translating to a high-teens % annualized FCF yield. The headline FCF number was helped by a EUR93m release in net working capital, though, and adjusted for leases, it would have been lower (but still solid) at EUR67m.

By segment, packaging was the key drag, although this was largely down to transitory inventory adjustments from can makers and labor-related operational inefficiencies at the Muscle Shoals facility. By contrast, there was positive momentum elsewhere in the automotive and aerospace segments, with the latter being the key driver of the adj EBITDA growth this quarter. Of note, the aerospace segment has already recovered two-thirds of its pre-COVID level, highlighting the underlying momentum here. Meanwhile, strong automotive end-market demand and low inventories should support segmental results for the coming quarter as well.

Guidance Update Highlights the Near-Term Challenges

Management sees its larger end markets as a key advantage in the face of the volatility ahead, but spots of weakness in select industrial end markets could still weigh on the P&L. The good news from the quarterly call was management reaffirming packaging demand resilience despite “short term inventory adjustments” in North America. The aerospace recovery still has legs and should continue into Q4, but elevated costs mean that for FY22, adj EBITDA is now guided to run at the lower end of the EUR670-EUR690m guidance range. That said, the unchanged FCF guidance of >EUR170m, helped by the capex outlook also remaining constant, will be well-received by shareholders.

Beyond FY22, management guided to FY23 EBITDA being “moderately lower” than in 2022 due to higher input costs. In particular, energy costs, particularly in Europe, have shown no signs of abating – total energy costs for this year are already expected to be at a record high of ~EUR250m, and another step change in FY23 seems likely at this juncture. The company’s ability to protect margins will thus depend on the extent to which it can continue to flex its pricing power amid more market volatility ahead. Management has been making good progress so far, citing improved inflationary protection with new contract signings. When and by how much cost inflation moderates in FY23 and beyond is uncertain, but I expect some relief in FY24 or so, given management’s mid-term guidance for EBITDA of >EUR800m remains intact.

Continued Deleveraging to Mitigate Sanction Risks

One of the key risks CSTM faces is the supply tightness of primary metals, driven by the curtailment of ~1.4m tonnes of smelting capacity. For now, CSTM’s access remains intact, but the need to source from alternate producers has led to some inflationary cost pressures. Along these lines, potential Russian metal sanctions could result in elevated costs, given CSTM purchases up to 5% of its required metal from Russia-based Rusal (OTC:RUALF). To some extent, the elevated metal costs can be passed through to customers, but expect some margin pressure anyway.

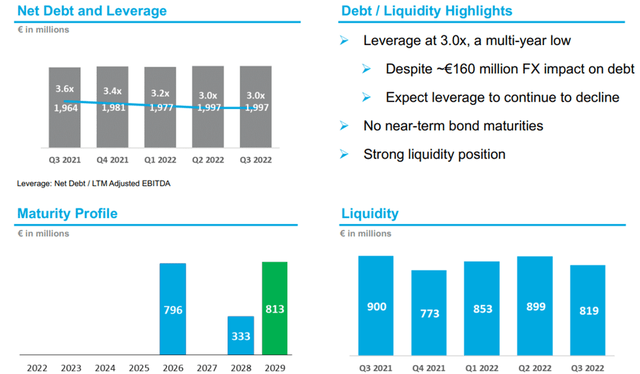

To mitigate the risk of a sanctions-driven supply shock, CSTM has loaded up on inventory into year-end in case of any near-term policy changes. In addition, the company has also cleaned up the balance sheet, with net debt now at EUR2.0bn or a 3.0x leverage ratio (down from 3.6x in the prior year), helped by the solid through-cycle FCF generation. As of Q3, CSTM’s liquidity position of EUR819m (comprising EUR171m of gross cash and EUR648m in available facilities) leaves it with a good runway as well. Heading into FY23, management will look to free up more balance sheet capacity, targeting a net leverage ratio of 1.5x-2.5x.

Multi-Industrial Growth Story at a Reasonable Price

CSTM revised its full-year EBITDA guidance lower following the Q3 report, but the silver linings were that it also reiterated the FCF outlook and committed to further deleveraging the balance sheet. While the near-term challenges are material, particularly on energy costs, the secular trends in automotive (e.g., lightweighting and EVs) and packaging (shift to aluminum) remain intact and should support continued demand for CSTM products going forward. Plus, CSTM can still lean on its pricing power to maintain solid FCF generation through FY23. With this multi-industrial growth story trading at an attractive annualized earnings yield in the high-teens % as well, patient, long-term oriented investors stand to be well-rewarded, in my view.

Be the first to comment