choness/iStock via Getty Images

Conduent Incorporated (NASDAQ:CNDT) announced further investments in data management, artificial intelligence, and a potential spin-off. Management is also quite optimistic about the next three years. It expects stable EBITDA margin, further sales growth, and better profitability margins driven by further consolidation. I don’t really understand the current price mark. Under my DCF model, the company’s fair price should be close to $9 per share.

Conduent

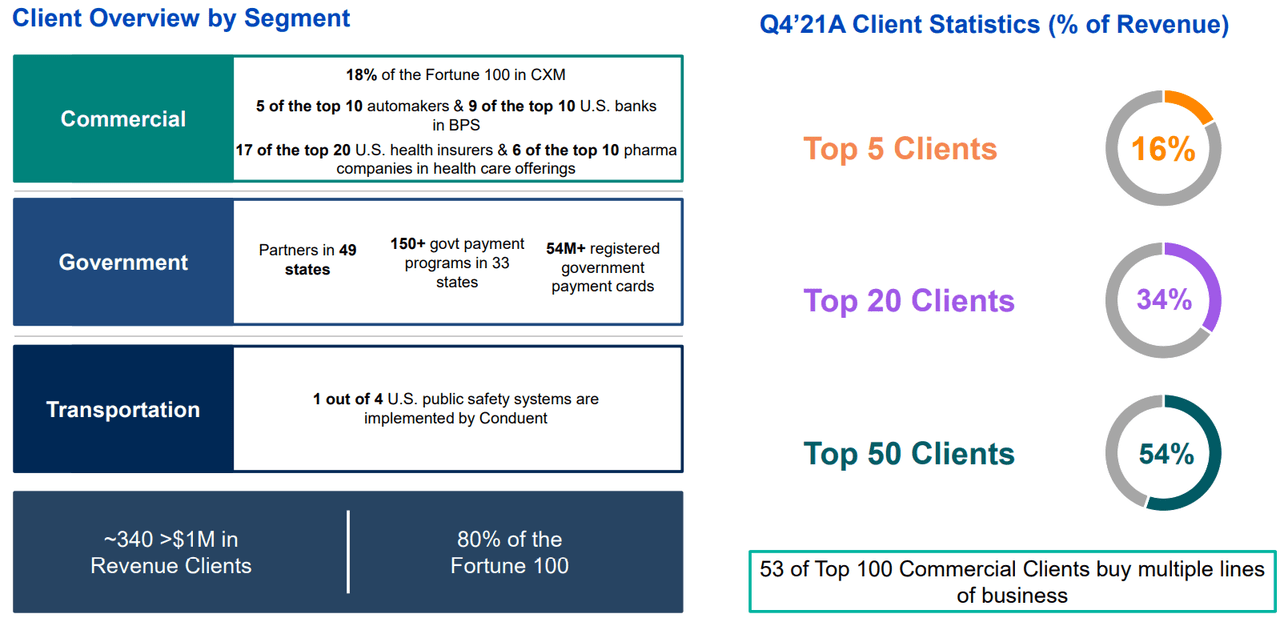

Conduent offers business process services, customer experience, and transportation products across clients in the commercial and government space. In my view, the biggest asset that the company offers is its diversification among different industries, which offers a non-volatile EBITDA margin.

Conduent Investor Deck

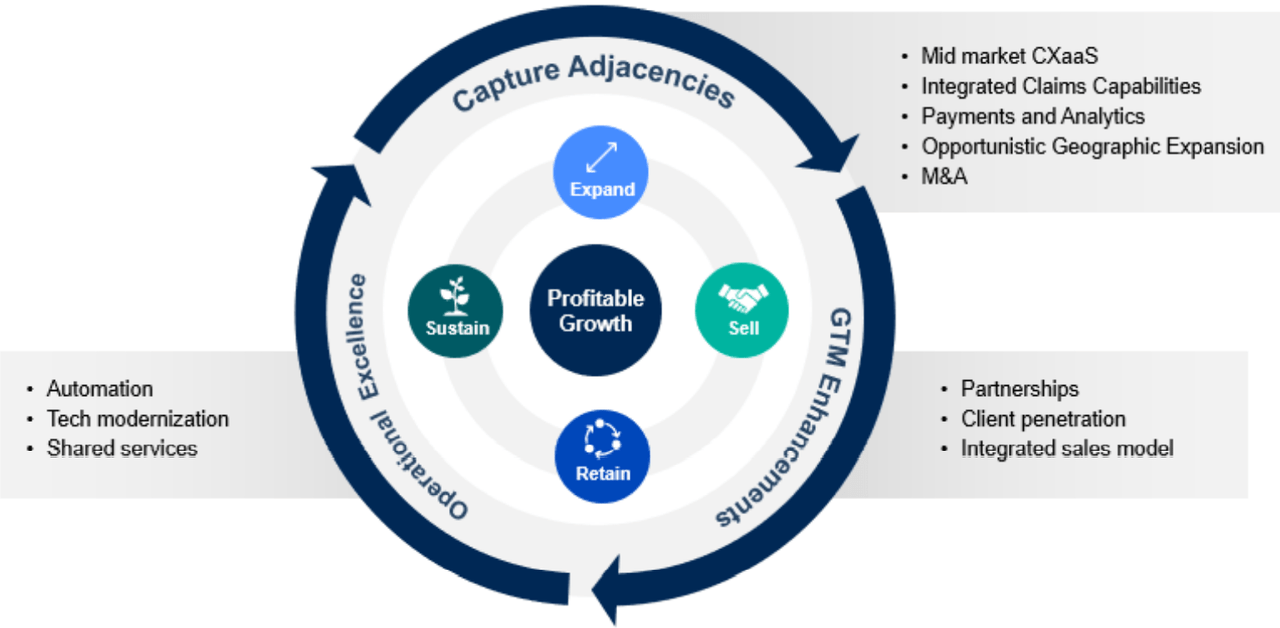

In the most recent presentation to investors, management noted that it expects to offer profitable growth through geographic expansion and M&A operations. Management also reported that automation, tech modernization, and shared services could bring operational excellence and enhancement in free cash flow margins.

Conduent Investor Deck

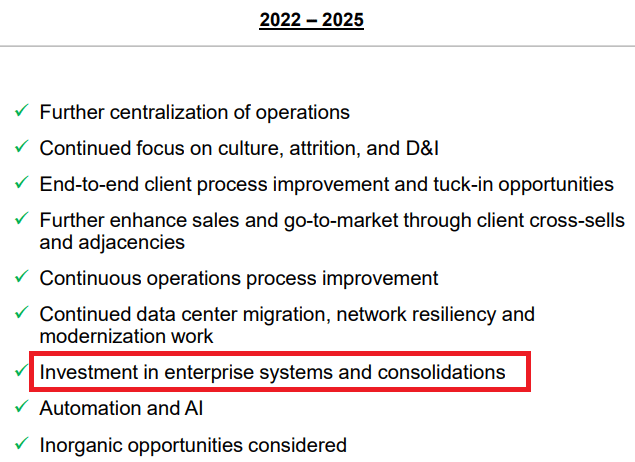

Management also gave very optimistic information about the future years 2022, 2023, 2024, and 2025. Conduent expects investment in enterprise systems and consolidations, further centralization of operations, and artificial intelligence capabilities.

Conduent Investor Deck

Let’s also note that the company expects to separate its transportation business through either a sale or a spin-off. In my view, if the transaction works out, shareholders will be enjoying a lot of cash in hand, which Conduent may invest for new technological innovation:

Separation will maximize shareholder value by simplifying Conduent’s business model, creating two separate businesses with dedicated focus on providing exceptional outcomes for clients in their distinct markets. (Source)

2023 And 2022 Guidance Implies Stable Growth And Very Solid EBITDA Margin

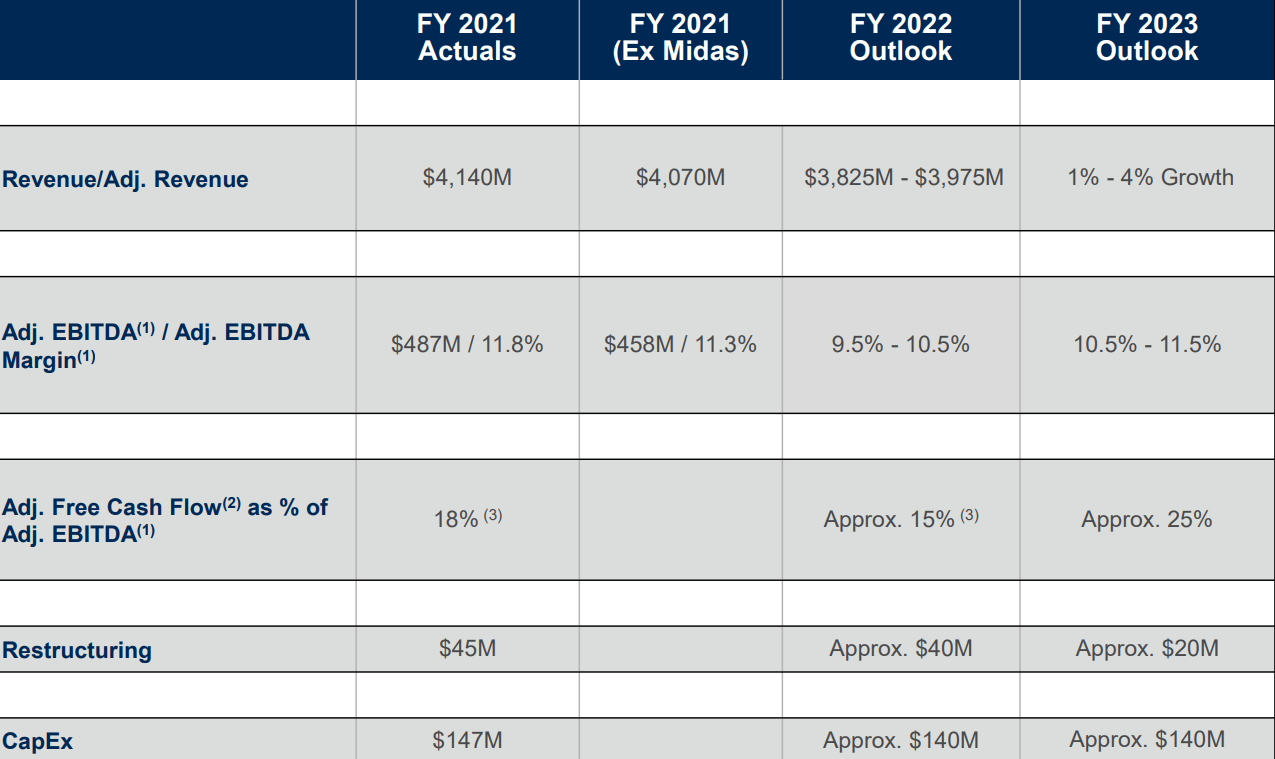

Conduent expects stable sales growth around 1%-4% in 2022 and 2023, and adjusted EBITDA margin of 10.5%-11.5%. Management also reported that free cash flow will also likely be positive, and capital expenditures will likely stand at $140 million, both in 2022 and in 2023.

Conduent Investor Deck

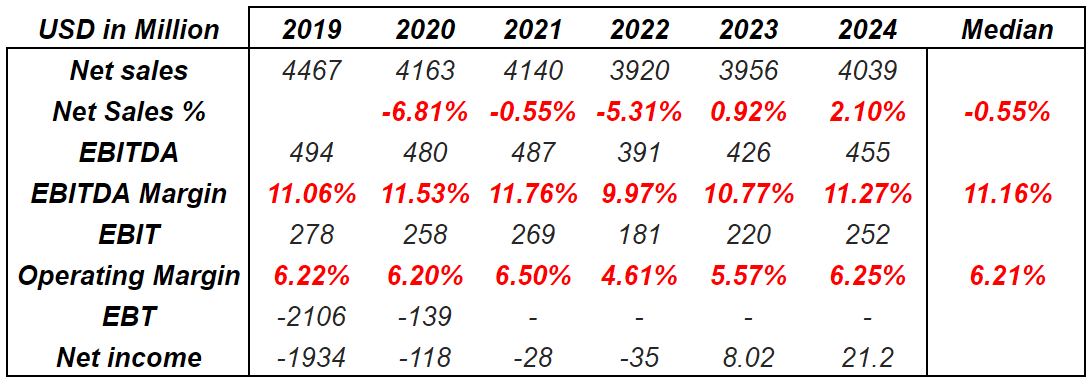

I checked the previous financial figures and saw that the expectations of management are mostly aligned with previous results. Analysts are also expecting financial figures that are close to that reported by management. Conduent’s median net sales growth stays close to 0.5%-1%, the median EBITDA margin stands at close to 11%, and the operating margin stands at close to 6%. I used some of these assumptions for my financial models:

Marketscreener.com

Base Case Scenario

Under the base case scenario, I expect that management will successfully invest in sales training and process improvements like the company did in the past. As a result, sales growth will continue, and the EBITDA margin will stay close to the level seen in the past:

The significant progress and investments in sales training and process improvements during the last couple of years, together with the foundational improvements in operational performance, have resulted in more selling opportunities for us to support the strategies of our existing clients with our portfolio of market-leading services and solutions. In 2021 our add-on sales grew by 44% compared to 2020. Source: 10-k

I also believe that Conduent will enjoy further economies of scale if management continues to centralize technology systems, and identify duplicative technology systems. In this regard, management disclosed potential improvements in the last annual report:

We have identified and are rationalizing duplicative technology systems across our lines of business. Centralizing technology systems will drive economies of scale, amplify the impact of investments, and will continue to strengthen consistent, resilient service delivery. Source: 10-k

Finally, I believe that in the next four years, management will obtain significant business traction from the process of data center optimization announced very recently. In my view, these efforts will likely bring further increase in the free cash flow margins:

We have made significant progress in our data center optimization program to consolidate our multiple data centers into a select few. For example, in 2021 we closed two of our largest facilities in the US, completing these highly complex closures that in turn drove a significant increase in service availability for our clients. Source: 10-k

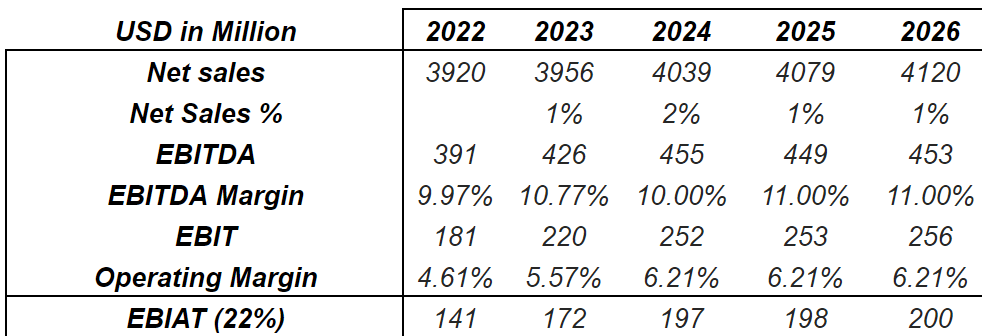

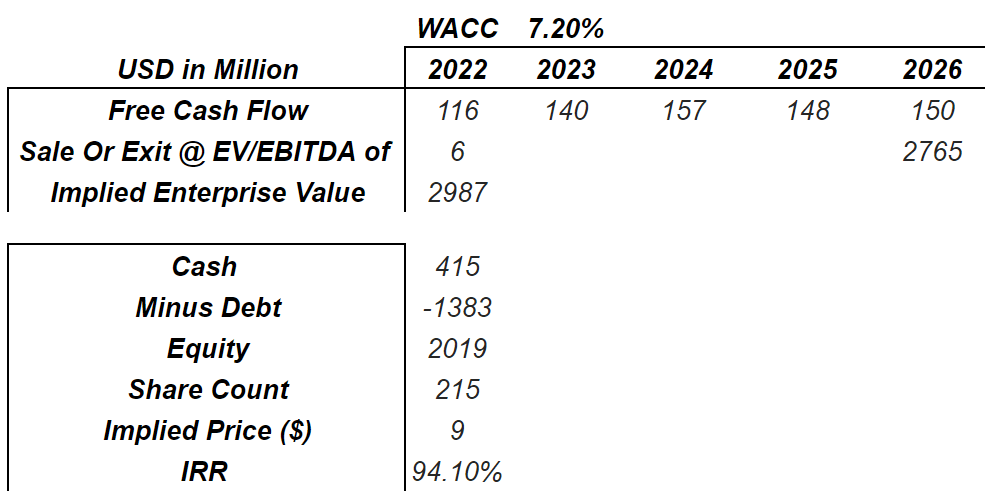

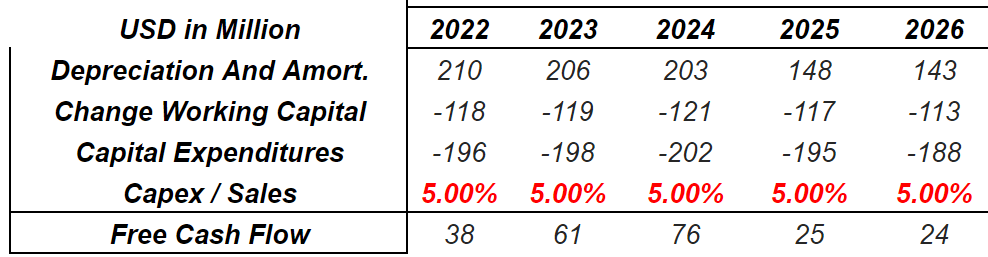

Under my base case scenario, I assumed sales growth between 1% and 2%, an EBITDA margin of 10%-11%, and operating margin of 5%-6%. The results include an EBIAT between $141 million in 2022 and almost $201 million in 2026.

Author’s Compilations

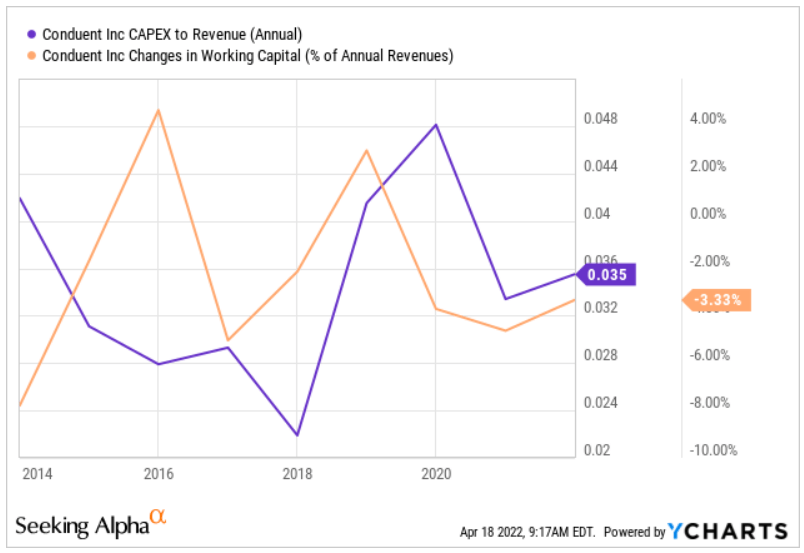

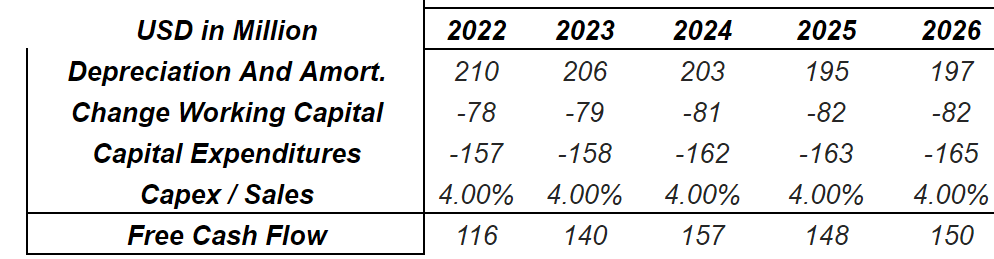

In the past, Conduent reported capital expenses / revenue around 2% and 4%, and changes in working capital / revenue around 2%. I used similar statistics in my financial models.

Ycharts

With the previous assumptions, the free cash flow will likely grow from $116 million in 2022 to $151 million in 2026. In my view, the fact that free cash flow is expected to remain very stable will likely interest private equity investors:

Author’s Compilations

If we also use a weighted average cost of capital of 7.2% and 2026 exit multiple of 6x, the sum of both the free cash flows and the terminal values stands at $2.9 billion. I also took into account Conduent’s debt, which is not small, but doesn’t really justify that the company trades at the current valuation. The implied fair price would stand at $9, which is significantly higher than the current stock price.

Author’s Compilations

Worst Case Scenario Would Include Failure Of Agreements With Governmental Agencies And Tensions With Third-party Providers

Conduent works with local governments and their agencies, which may discontinue their contracts with the company for many reasons. As a result, we may see a significant decline in the company’s revenue, which may affect the share price. Management was very specific about these risks:

A significant portion of our revenues is derived from contracts with U.S. federal, state and local governments and their agencies, and some of our revenues are derived from contracts with foreign governments and their agencies. Government entities typically finance projects through appropriated funds. Changes in government or political developments, including budget deficits, shortfalls or uncertainties, failures to enact appropriation legislation, government spending reductions or other debt or funding constraints, have resulted in, and in the future could result in, lower governmental sales and our projects being reduced in price or scope or terminated altogether, which also could limit our recovery of incurred costs, reimbursable expenses and profits on work completed prior to the termination. Source: 10-k

Conduent works with a significant number of third-party providers and software vendors. In my view, these partners may soon decide to increase their prices, or may not deliver the same amount or quality services for the same price. If Conduent has to negotiate its terms with business providers, or they don’t deliver quality services, revenue may decline, or the EBITDA margins may decline:

Our ability to service our customers and clients and deliver and implement solutions depends to a large extent on third-party providers such as subcontractors, a relatively small number of primary software vendors, software application developers, utility providers and network providers meeting their obligations to us and our expectations in a timely, quality manner. Source: 10-k

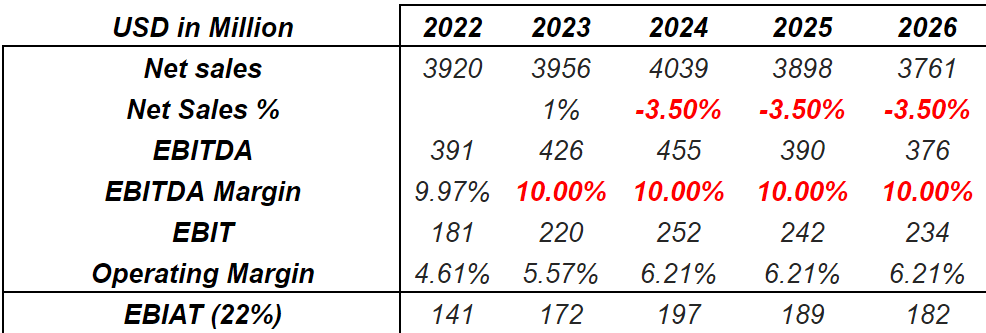

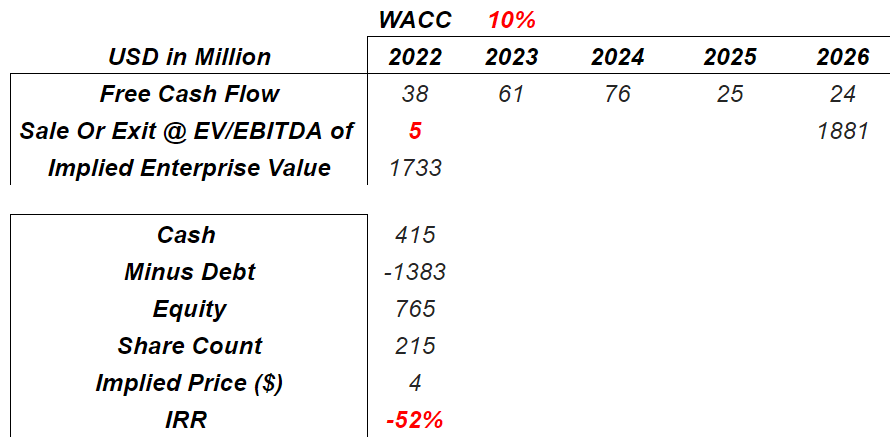

In this scenario, I assumed net sales growth of -3.5% from 2024 to 2026, an EBITDA margin of 10%, and operating margin close to 4%-6%. The results include an EBIAT between $140 million and $185 million.

Author’s Compilations

I also assumed a capital expenditures/sales ratio of 5%, and used a change in working capital around $100 million and $125 million. The results include free cash flow between $35 million and $25 million.

Author’s Compilations

Under these circumstances, investors may decide to sell equity, which may lead to a significant increase in the cost of equity. Hence, I used a weighted average cost of capital of 10%. I also assumed that the business wouldn’t be worth a lot if net revenue keeps declining, and used an EV/EBITDA multiple of 5x. The result is an implied enterprise value of $1.72 billion, and an implied stock price of $4:

Author’s Compilations

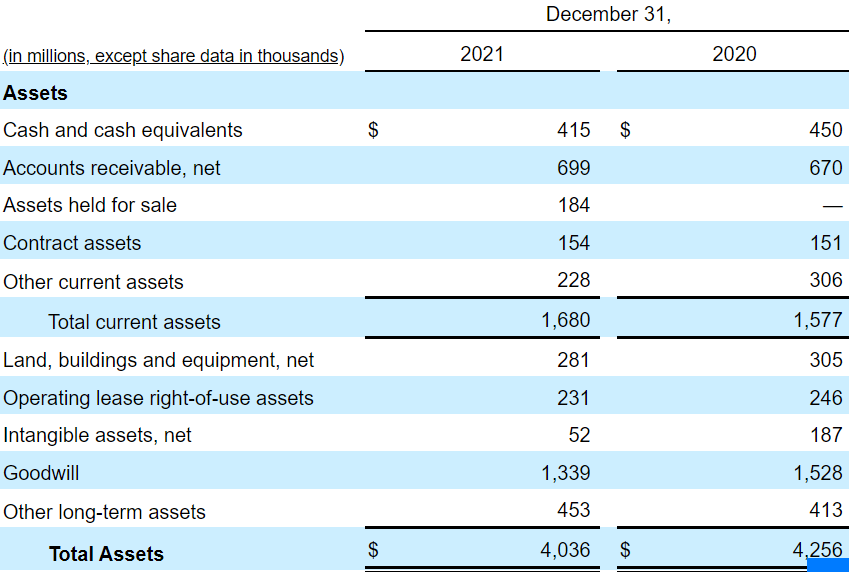

Balance Sheet

With $415 million in cash and an asset/liability ratio of 1.4x, I believe that Conduent’s financial health is quite beneficial. I wouldn’t expect shareholders to be afraid of the company’s financial position.

10-k

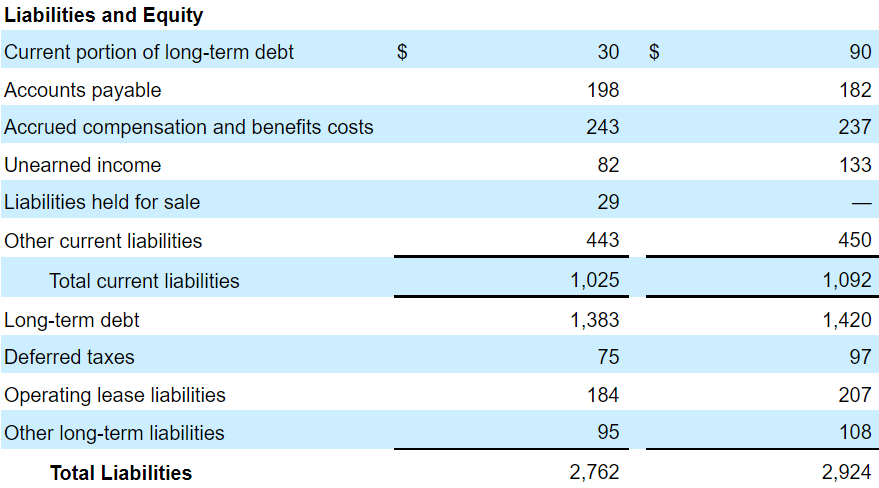

The company’s long-term debt is equal to $1.38 billion. If we use our assumption of 2026 EBITDA of $453 million, the net debt is close to 2x-3x, so I wouldn’t expect investors to be afraid of the company’s net debt. Keep in mind that we are talking about a business with stable and in some way predictable EBITDA margins.

10-k

Takeaway

With management expecting stable EBITDA and free cash flow, investment in enterprise systems, and some consolidation including a potential spin-off, Conduent could soon receive a lot of attention from investors. Also, the company’s investments in artificial intelligence and data management will most likely improve the company’s profitability ratios. I don’t see why Conduent is currently trading at $5-$6. In my view, the fair price should be closer to $9 per share.

Be the first to comment