Chainarong Prasertthai/iStock via Getty Images

Concentrix Corporation (NASDAQ:CNXC) is a strong buy with excellent growth potential and strong profitability that investors can snap up at a steep discount.

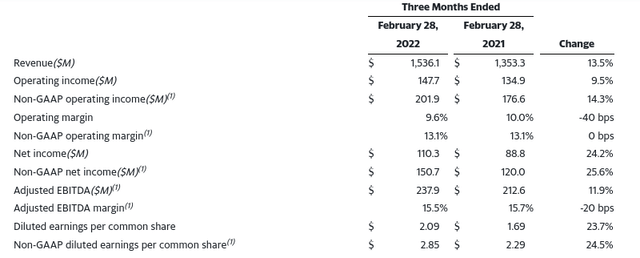

Shares of CNXC are down 15.27% for the month following the report of the company’s earnings for Q1 this year. The company beat its EPS estimate by $0.14, with an EPS of $2.85 and also beat its revenue estimate by $10 million, ending with $1.54bn, which represents a Y/Y growth of 14.1%. The stock is currently oversold on the daily charts according to the 14-day RSI indicator.

Company Overview

CNXC is a customer experience solutions provider that has a number of blue-chip Fortune 500 clients on its books and supports businesses across the world. Its main line of business is invested in call centers, of which it provides support for its customers across six continents.

IN CNXC’s earnings call, the company claims to have experienced strong increase in revenues from clients in a broad range of verticals, with the most growth seen in the technology, financial services, travel, transportation, tourism, and healthcare sectors. Overall, CNXC improved its financial performance across almost every metric last quarter.

I believe one reason for the slip in CNXC’s share price was the fact that it failed to repurchase shares in its previously announced repurchase program. The company currently has a remaining authorization of $474.9 million.

Industry analysis

In the earnings call, CNXC executives stated that most of the company’s growth came from its new economy clients which represented 23% of its first quarter revenue. It also gave guidance of 9% to 12% revenue growth for the rest of 2022.

There was also a hint as to an evolution of CNXC as a company as it seemingly pivots away from purely offering services delivered through call centers, which represents a shift in the needs of its customers. Executives also stated that the demand for outsourcing is growing.

They’re looking for a more total solution of – a complete set of services and end-to-end and some technology wrapper around it. And in order to kind of accomplish that type of outsourcing arrangement, you just tend to need to outsource more.

This statement to me ties in with CNXC’s acquisition of PK which it paid $1.6bn for in November 2021. The company stated that PK is a digital design and engineering firm that claims to provide digital outcomes for its customers. To me, part of the “technology wrapper” that executives mentioned in the earnings call is a reference to what PK is able to bring to the table.

For the rest of the year, the revenues for CNXC is expected to be in the $6.45 to $6.60 range while its operating income is expected to be between $660 to $700 million.

Financials

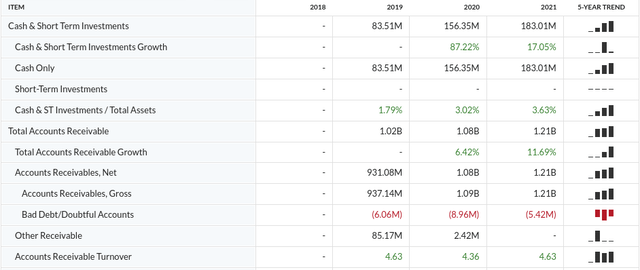

CNXC has a strong balance sheet with a growing cash account. Although the company had 1.21bn in accounts receivables, the company’s turnover of these accounts remains at a healthy 4.63 for 2021. Since a large number of the company’s clients are blue chip Fortune 2000’s it’s also not surprising that its bad debt/doubtful accounts are only a small fraction of its overall receivables, which is another positive for this stock.

CNXC is also more than prepared to meet its short- and long-term debt obligations. The company’s liabilities have shrunk each FY, dropping to 2.43bn in 2021 from 2.88bn. It has a current ratio of 1.57.

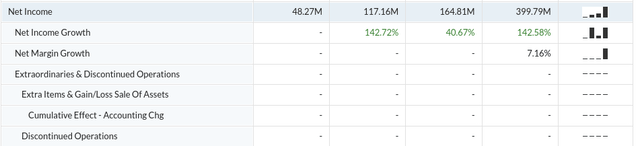

CNXC’s revenue growth numbers and net income are also steady and impressive. For FY 2021 its revenues grew 18.38% from $4.72bn to $5.59 billion while its net income surged 142.58% to $399.79 million, up from $164.81 million.

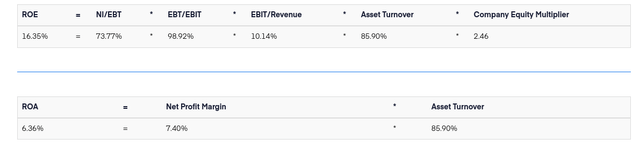

Overall, the company had a ROE of 16.35% with a ROA of 6.36% and a net profit margin of 7.40%. This is lower than its main rival and competitor’s ROE Accenture (ACN), which has a ROE of 32.04% as well as TTEC Holdings (TTEC), which has a ROE of 28.27%.

Competitive Analysis

CNXC has a number of competitors in the customer experience space including ACN, Sitel Group, TTEC, and others.

One of CNXC’s competitive advantages to me is the fact that the business continues to innovate new solutions as it pivots from being seen as a provider of customer service workers in call centers. The brand’s acquisition and integration of PK is one example of this, so it could be seen that CNXC is already ahead of the curve of its competitors.

Another key advantage is the quality of clients on its books. CNXC boats a large array of Fortune 2000 and Fortune 500 companies with many of them also in the process of innovating into digital transformations. This gives the company a great scope for growth to continue providing services these companies need to reach their strategic objectives.

Valuation

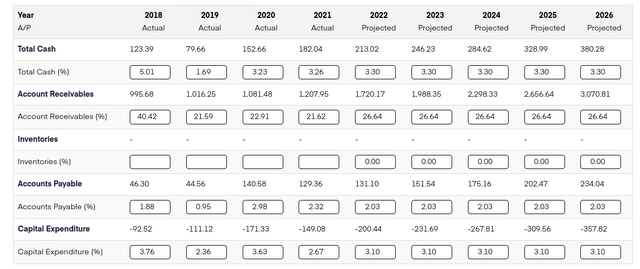

For this 2-stage DCF model, I am using the assumption that the company’s revenues will grow in the future at the stated guidance level of 15.59% per year, with an EBITDA margin of 13.25% and a WACC of 7%, which I believe to be a conservative discount rate.

All numbers are in USD millions.

Financial Modelling Prep, Author’s Estimates

I believe that the balance sheet numbers will remain stable for this forecasting period so I am not making any extraneous adjustments to these.

Financial Modelling Prep, Author’s Estimates

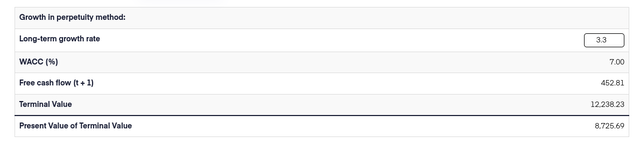

As a long-term growth rate to calculate terminal value, I am using 3.3%. This number could be adjusted higher seeing as the 10-year average growth rate of inflation currently hovers around 2.86%. However, I wanted to make a very conservative estimate seeing as this is only a 2-stage DCF model.

Financial Modelling Prep, Author’s Estimates

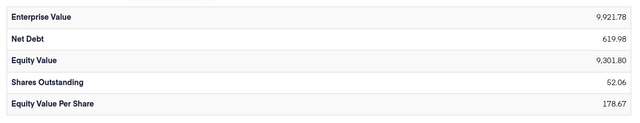

Financial Modelling Prep, Author’s Estimates

I should note here that this 2-stage DCF model is incomplete as it does not forecast other financials of the company such as its balance sheet. A 3.3% perpetual growth rate is also on the higher side, but it was chosen to account for today’s macroeconomic climate. Normally I would be happy to choose an even more conservative estimate such as 2.5%, but in today’s climate that would defeat the purpose of a DCF as it would mean the company would not grow faster than the average level of inflation. Another issue here is that 3.3% is on the upper average limit of the GDP growth in the USA. A company cannot logically grow faster than the average growth of GDP in perpetuity otherwise it would eventually become the economy, which is absurd.

This 2-stage, “back of the envelope” model was chosen to quickly illustrate that CNXC’s future cash flows, and ultimately its long-term valuation, has been unfairly discounted. It’s also a starting point for people to create a comprehensive model with more detailed assumptions to arrive at a more refined ballpark figure.

Risks

In the short term, CNXC’s momentum is clearly to the downside. The sell-off in its stock price was fast and violent as can be seen from the record volume numbers on the red candles. This means there could still be room for a lower stock price despite being oversold on the technical indicators. I would wait for a couple bars of confirmation that momentum is changing to the upside before buying this stock if one wants to optimize their entry.

In the long-term, CNXC faces the issue that it has many competitors with low levels of differentiation between its services. Leadership will need to ensure that it stays ahead of the curve in terms of being able to predict what its clients need and expect otherwise they could see their high-value clients churn to a competitor which can give them much of the same that they get from CNXC.

Another risk is that management may not have the experience needed in order to fully pivot the company towards offering the digital transformations that its clients require. The company has offered customer experience services delivered through call centers, so it may struggle in this regard to fully adjust to its changing market.

Conclusion

CNXC has great revenues and profitability, an adaptive business model and can currently be bought for a bargain. I believe that shorts and bag dumpers will be sorely disappointed when this stock makes a recovery due to its strong upside potential. I am giving this stock a strong buy recommendation.

Be the first to comment