jetcityimage/iStock Editorial via Getty Images

With a market capitalization of $16.35 billion as of this writing, Conagra Brands (NYSE:CAG) is one of the larger companies in the US that focuses on the production and sale of various food products. With its extensive portfolio of name brands, the company has established itself as a major player in the space. Historically speaking, revenue growth and profitability growth has been impressive. Though the company has not been without its down years when talking about its bottom line.

Currently, shares of the business look to be trading at roughly fair value relative to similar players. Though on an absolute basis, I would make the case that the company might be slightly undervalued. With that said, the business is due to report financial results covering the third quarter of its 2022 fiscal year prior to the market opening on April 7th. With the first half of this current fiscal year already being a disappointment on the bottom line, even as sales have increased, it is vital for investors to keep a close eye on how the company fares in the face of continued inflationary pressures. Also, on the off chance that management does surprise in a positive way, something that is definitely not out of the question, the low share price of the business could result in some nice upside in response.

Conagra Brands – A Play On Name Brand Food

Though the name ‘Conagra Brands’ may not be in everyone’s lexicon, odds are that you have either purchased or at least seen one of their products. From its origins as a Midwestern flour-milling company in the early 1900s, the company has grown into a global operation with a large number of quality brands. The company’s portfolio includes product lines such as Birds Eye, Duncan Hines, Healthy Choice, Marie Callender’s, Reddi-wip, Slim Jim, Angie’s, BOOMCHICKAPOP, Duke’s, Earth Balance, Gardein, and Frontera. In addition to developing its own brands, the company has invested heavily in buying up others. The most recent sizable deal was of Pinnacle Foods back in late 2018.

In terms of operating segment, the company has four that are reported. One of these is the Grocery & Snacks segment, which includes the company’s portfolio of branded, shelf-stable food products that are sold to retail channels across the US. This particular segment was responsible for 41.5% of the company’s sales last year and for 51.1% of its operating profits. The largest segment, in terms of revenue, is the Refrigerated & Frozen segment. Through this, the company sells branded, temperature-controlled food products to various retailers in the US. It accounted for 42.7% of sales in 2021 and just 39.1% of operating profits. Next in line, we have the International segment, which is responsible for selling the company’s products to both retail and foodservice customers outside of the country. It made up a more modest 8.4% of sales and 6.2% of profits last year. And finally, we have the Foodservice segment. This includes the sale of branded and customized food products, including meals, entrees, sauces, and different culinary products that are packaged for sale, to restaurants and other foodservice establishments in the US. According to management, this segment made up 7.5% of sales in 2021 and 3.7% of profits.

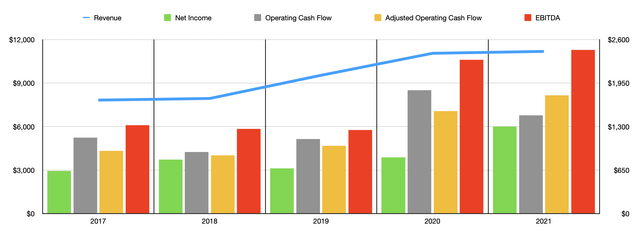

Author – SEC EDGAR Data

Over the past few years, management has done well to grow the business. Revenue has increased each year for at least the past five, rising from $7.83 billion in 2017 to $11.19 billion in 2021. As I mentioned already, the company did rely on the Pinnacle Foods transaction to help boost sales. But it has generally also benefited from organic growth. The company is also not afraid to sell off different assets. In the final quarter of its 2021 fiscal year, for instance, the company sold, in exchange for $50.6 million, Egg Beaters. One quarter before that, the business completed the sale of its Peter Pan peanut butter business in exchange for $101.5 million. When it comes to the 2022 fiscal year, management does now expect revenue to rise by about 3%. That compares to prior expectations of just 1%.

As revenue has risen, profitability has generally followed suit. Net income at the business has grown from $639.3 million in 2017 to $1.30 billion in 2021. Operating cash flow has been a bit bumpier, but the general trend has been positive when you look at it from the perspective of operating cash flow without the changes in working capital. Between 2017 and 2021, this metric grew from $936.5 million to $1.77 billion. And over that same timeframe, EBITDA for the company expanded from $1.32 billion to $2.45 billion.

What To Watch Out For In Conagra’s Q3 Earnings

At present, analysts covering Conagra Brands have rather mixed expectations as to how the company will perform when it reports financial results covering the third quarter of its 2022 fiscal year. For instance, on the sales side, the expectation is that the company will see continued growth. Revenue for the quarter is expected to come in at about $2.84 billion. This would represent an increase of 2.5% over the $2.77 billion the company generated the same time one year earlier. For those who follow the company closely, this wouldn’t be much of a surprise of course.

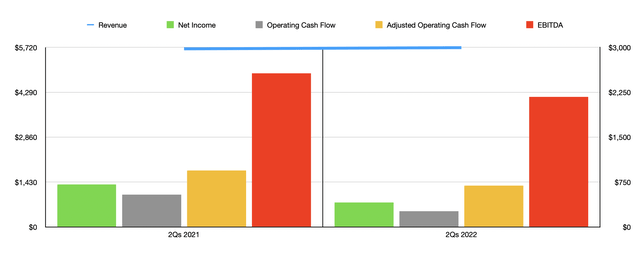

Author – SEC EDGAR Data

As I mentioned already, the company has a nice track record of growing revenue. And performance this year has been no exception. In the first half of 2022, for instance, sales came in at $5.71 billion. That represents an increase of 0.7% compared to the $5.67 billion reported one year earlier. Of course, growth has not been across the board. For instance, during this two-quarter timeframe, sales associated with the Grocery & Snacks segment actually declined, falling by 3.1% year over year. Meanwhile, growth for the Refrigerated & Frozen segment increased only modestly, rising by just 0.4%. The real growth came from the company’s smaller segments, with its International unit seeing revenue rise by 6.4% and with the Foodservice segment reporting a sales increase of 17.8%.

Although analysts are expecting continued revenue growth for the company, admittedly with that growth coming in lower than what the company achieved in many prior years, the same cannot be said of profits. Earnings per share are currently forecasted to be $0.56. Given the company’s current share count, this implies net earnings of $268.6 million. That is 4.5% below the $281.4 million the company generated one year earlier. Just as has been the case with revenue, this decline in net earnings is not new. In the first six months of the company’s 2022 fiscal year, for instance, net income totaled just $510.9 million. That compares to the $707.9 million reported one year earlier. Operating cash flow dropped from $541.4 million to $262.1 million, while the adjusted equivalent of this dropped from $942.1 million to $691.9 million. Meanwhile, EBITDA for the company declined from $2.57 billion to $2.17 billion. No estimates were given for these other profitability metrics, but given their recent performance, they likely will drop if earnings drop as well.

CAG Stock Is Attractively Priced

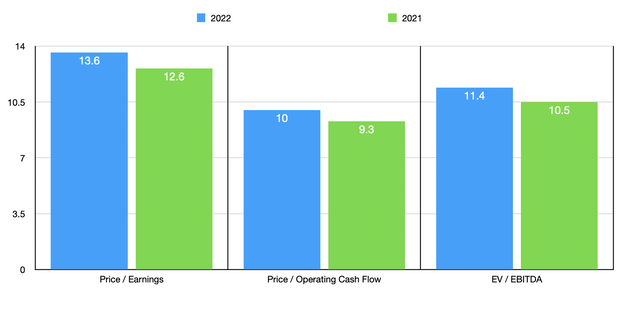

Author – SEC EDGAR Data

When it comes to valuing the company, I have decided to do so based on the company’s 2021 results as well as based on 2022 projections. For 2022, I merely assumed that operating cash flow and EBITDA would decline by the same rate that net income should. Given the company’s current projections of $2.50 per share for the 2022 fiscal year, this implies net profits of $1.20 billion. This should translate to operating cash flow of $1.63 billion and EBITDA of $2.26 billion. Taking these figures, I calculated that the company is trading at a price to earnings multiple of 13.6, at a price to adjusted operating cash flow multiple of 10, and at an EV to EBITDA multiple of 11.4. If we instead look at the 2021 figures, these multiples would be 12.6, 9.3, and 10.5, respectively. To put this in perspective, I decided to compare the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 6.5 to a high of 195.1. On a price to operating cash flow basis, the range was from 4.6 to 87. And from an EV to EBITDA perspective, the range is from 3.5 to 43.7. In all three scenarios, two of the five companies were cheaper than Conagra Brands.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Conagra Brands | 13.6 | 10.0 | 11.4 |

| Cal-Maine Foods (CALM) | 155.0 | 87.0 | 43.7 |

| Sanderson Farms (SAFM) | 6.5 | 4.6 | 3.5 |

| Pilgrim’s Pride Corporation (PPC) | 195.1 | 19.0 | 14.6 |

| Mondelez International (MDLZ) | 20.7 | 21.5 | 17.7 |

| Tyson Foods (TSN) | 8.9 | 8.5 | 6.0 |

Takeaway

Generally speaking, I would consider Conagra Brands to be a solid operation that is trading at fairly attractive multiples. Relative to its peers, the company is likely more or less fairly valued. But on an absolute basis, shares do look perhaps slightly undervalued. More likely than not, this year will be a difficult one for the company from an earnings perspective and a cash flow perspective due to supply chain issues and inflation. But in the long run, the company will likely do well for investors. Because of this, I would consider this a ‘buy’ opportunity at this time, but certainly not a strong one. But of course, depending on how financials look when management reports data for the third quarter, that picture could definitely change. Whether it be for the better or worse is something only time will tell.

Be the first to comment