John Moore/Getty Images News

In April 2022 I published an article explaining my reasoning why I sold Compass Minerals International, Inc. (NYSE:CMP). And in hindsight, the timing was good, as the stock was cut in half and declined as low as $30 in the weeks following the article. The stock now recovered a bit, but is still trading way below the previous levels.

Let’s look at the stock and the company again and try to find out if the stock is a buy now at lower prices, or if we should still avoid Compass Minerals International as an investment.

Debt

A major reason why Compass Minerals is not a good investment and huge part of the reason why I sold were the high debt levels of the business. My last article was published about seven months ago, and I know seven months is not enough to fundamentally improve a balance sheet, but let’s at least see if we can spot some positive trends.

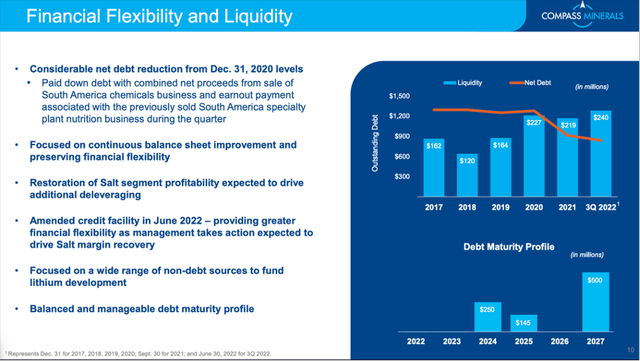

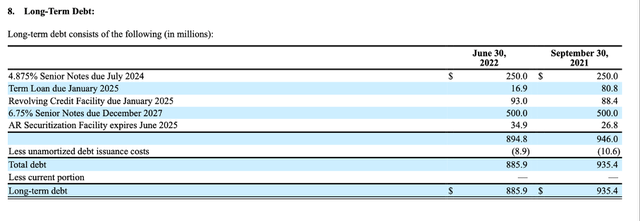

When looking at the last available balance sheet (for June 30, 2022) the situation improved a little bit. Compass Minerals is having no-short term debt and $885.9 million in long-term debt on its balance sheet. And while total debt decreased compared to my last article, total stockholder’s equity could improve slightly to $300.9 million. This is resulting in a debt-equity ratio of 2.94 and a clear improvement compared to 3.49 in my last article. But of course, a D/E ratio of 3 is still way too high.

Additionally, we can look how many years it would take to repay the outstanding by using the operating income. In the last four quarters, Compass Minerals International generated only $53.5 million in operating income, and, therefore, it would take about 15 years to repay the outstanding debt (we already included the cash on the balance sheet). And the dire situation CMP is in becomes obvious when pointing out that interest expenses, which were $54.1 million in the last four quarters, exceeded the operating income the business could generate. Of course, CMP was able to generate $200 million in operating income a few years ago. But not only does this seem far away, it would still take about 4.5 years to repay the outstanding debt.

We can also compare the outstanding debt to the free cash flow CMP can generate. In the last four quarters, Compass Minerals International generated a free cash flow of $65.1 million (but needs almost one third for dividend payments). We can look at the situation from many different sides – the conclusion is the same. CMP has too much debt and this is still problematic for the business.

When looking at the debt maturity profile, it is good for CMP that no debt is due in 2023, but $250 million must be repaid in 2024. With $50 million in cash right now and an additional $50 million of the Koch investment (we will get to this) being used for debt repayment, CMP still needs to generate about $150 million in free cash flow until 2024, and I honestly don’t see that happening in the coming quarters.

Quarterly Results

While the balance sheet improved a little bit, I don’t see much improvement when looking at the income statement. Yes, the third quarter results were solid – but when looking at the bigger picture, I don’t see any improving long-term trends. In the third quarter of fiscal 2022, Compass Minerals generated $214.7 million in revenue and compared to $199.4 million in revenue in the same quarter last year, this is resulting in 7.7% YoY growth. While the top line increased, the company had to report an operating loss of $3.5 million, compared to an operating profit of $0.9 million in the same quarter last year. And diluted earnings per share also switched from $1.63 earnings in the same quarter last year to a loss per share of $0.23 this quarter.

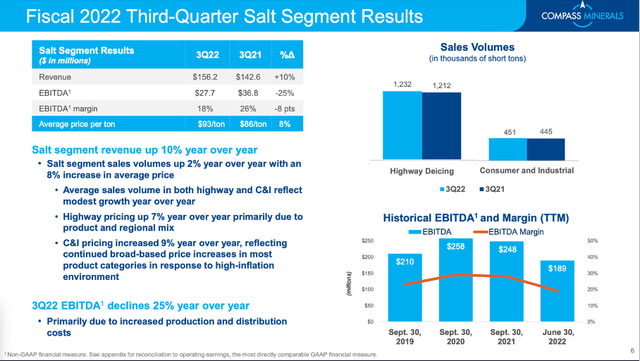

When looking at the Salt Segment, revenue increased 10% year-over-year to $156.2 million, but EBITDA declined 25% YoY to $27.7 million. While volume increased only slightly, about 2%, increased prices (8% YoY growth) contributed the most to revenue growth. But over the last few years, we see negative trends for EBITDA and EBITDA margin.

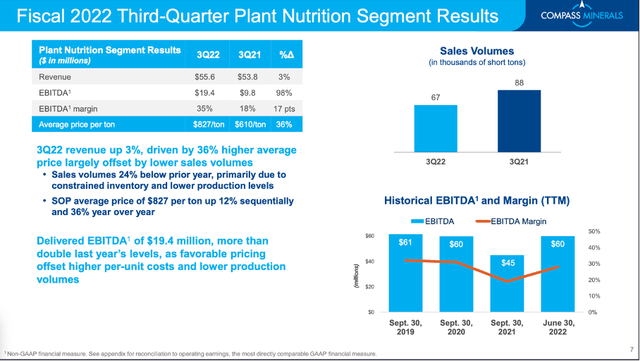

When looking at the results for the Plant Nutrition Segment, revenue increased slightly to $55.6 million – resulting in 3% YoY growth. While sales volumes declined 24% compared to the same quarter last year, this was offset by 36% higher average prices. And EBITDA could almost double and increased 98% YoY to $19.4 million.

The quarterly results are not a complete disaster, but I also don’t see real signs of improvement as the business once again had to report a loss.

Lithium Development

Compass Minerals International has extremely high debt levels (see section above) and extracting the lithium resources makes huge upfront investments necessary. But spending high amounts on CapEx does not seem possible for Compass Minerals without taking on additional debt. In September 2022, it was announced that Koch Minerals & Trading will invest $252 million in Compass Minerals International. For this amount, KM&T will purchase 6.8 million shares of CMP and own about 17% of outstanding shares. This private placement is expected to close in Q4 and will increase the number of outstanding shares by 20%.

And aside from $52 million which will be used for repaying debt (see above), the biggest part of the investment will be used for phase 1:

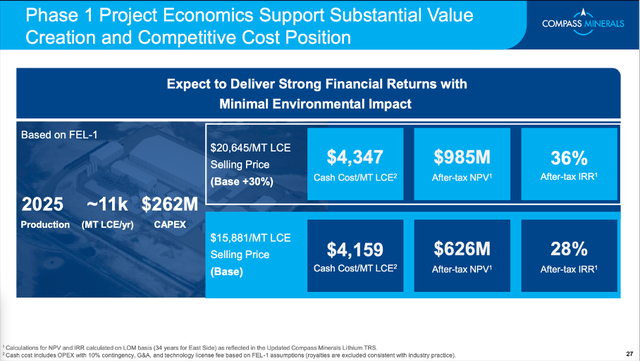

Approximately $200 million of the proceeds from the investment are expected to be used to advance the first phase of the company’s sustainable lithium development project. This figure represents approximately 75% of total phase-one funding needs, according to the company’s FEL-1 level project cost estimates, including the full funding required through calendar year 2024 toward the construction of a commercial scale, direct lithium extraction (DLE) and lithium conversion plant at the company’s Ogden, Utah, solar evaporation facility. Compass Minerals expects the project’s annual commercial production capacity to ultimately be approximately 35 kMT LCE, with an initial phase-one capacity of approximately 11 kMT LCE coming online by 2025.

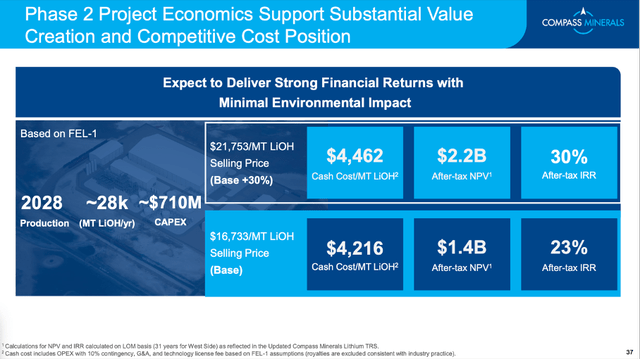

While Compass Minerals is estimating to extract about 11k MT LCE per year in phase I starting in 2025, it is expecting to extract 28k MT LIOH per year from 2028 going forward.

The Situation Is Dire

Compass Minerals International is still facing high debt levels and reporting mediocre results, but another aspect changed about the business – the price we must pay to purchase shares. When my last article was published, Compass Minerals was trading for $65 – now the stock is trading for $41. And as we all know, the price we must pay for an investment is an important component in every investment decision.

In the past, I estimated that a fair intrinsic value for Compass Minerals could be around $60 and although the stock is clearly below that price right now, I still won’t invest. Before I invest in Compass Minerals International again, I like to see a clear path for reducing debt levels, growing the business and make it really profitable again.

And we can certainly make the argument that the lithium resources will contribute to revenue (and therefore to earnings per share and free cash flow) in a major way. From 2025 till 2027, CMP is estimating to sell about 11,000 MT LCE per year at an average selling price of $15,881 to $20,645 resulting in an additional annual revenue of $175 million to $227 million for Compass Minerals. From 2028 going forward, the company is expecting to sell 28,000 MT LIOH per year for an average selling price of $16,733 million to $21,753 million, resulting in an additional revenue of $469 million to $609 million.

But we should not forget the necessary capital expenditures and the debt Compass Minerals has to repay in the next few years. Let’s look at the years until 2025 again. Compass Minerals still needs about $60 million in capital expenditures for its phase I and must repay $250 million in outstanding debt in 2024 and $145 million in 2025. I see no way for Compass Minerals to generate about $400 million in free cash flow in the next three years (this is already taking into account $50 million in cash on the balance sheet).

And until 2028, the company must spend $710 million in additional CapEx for its phase II to extract the lithium resources and in 2027 $500 million in debt are due. Therefore, in the three years between 2026 and 2028, Compass Minerals needs to generate a free cash flow of $1,210 million – even with additional revenue (and free cash flow) from selling lithium from 2025 going forward this seems impossible.

To realize these plans, Compass Minerals International either must take on additional debt or it will need another investment (maybe from Koch) again. Of course, this would lead to further dilution for the stock. And it seems likely that Compass Minerals International will have to refinance. The senior notes due in July 2024 have a 4.875% interest rate, and the notes due in December 2027 have an interest rate of 6.75%. If Compass Minerals must refinance – and I think this will be the case – it remains to be seen if Compass Minerals can refinance for similar rates (I highly doubt it).

Compass Minerals will survive – due to the valuable assets it has – but the situation is not great in my opinion.

SEC Fined Compass Minerals International

Recently, Compass Minerals International also had to pay $12 million in fines to the Security and Exchange Commissions. On September 23, 2022, the SEC wrote:

The Securities and Exchange Commission today announced settled charges against Compass Minerals International Inc. for misleading investors about a technology upgrade that the company claimed would reduce costs at its most significant mine, but in reality, had increased costs, and for failing to properly assess whether to disclose the financial risks created by the company’s excessive discharge of mercury in Brazil. Compass is ordered to pay $12 million to settle the charges.

I don’t want to make this a bigger deal than it is, but it seems worth mentioning as it is fitting the larger picture of management making promises but not being able to fulfill these promises. In my opinion, Compass Minerals International should be a great business as it has a wide economic moat based on structural advantages that are hard to match by competitors (see here and here). And management seems not really being able to generate high returns despite the cost advantages Compass Minerals International has.

Conclusion

Compass Minerals is trading for a more attractive price than in April 2022 when my last article was published. But the company is not an investment for me. I like to see clear signs of improvement before I would invest in the business again. The lithium resources are great and could provide additional revenue for several years to come. But the combination of high debt levels, a struggling business and high capital expenditures necessary to sell the lithium resources will make me stay away from Compass Minerals International.

Be the first to comment