kali9

Companhia Siderurgica Nacional (NYSE:SID) is a Brazil-based steel producer with a vertically integrated operation that includes iron ore mining and the manufacturing of value-added steel products. The attraction here is the company’s profile as a low-cost producer backed by world-class assets. Income investors will also be attracted to the company’s generous dividends which we estimate to yield over 7% on a forward basis.

That being said, the stock price performance has been disappointing including the deep selloff in 2022 against a variety of macro headwinds. Part of the challenge is that SID generates more than half of its sales in the domestic market while the local Brazilian currency has depreciated significantly over the past several years.

Still, we highlight what are overall solid fundamentals including a trend of balance sheet deleveraging and stronger growth as the company expands its mining production. We like the stock as a materials sector value play which is well-positioned to rebound into what we see as an improving outlook.

SID Key Metrics

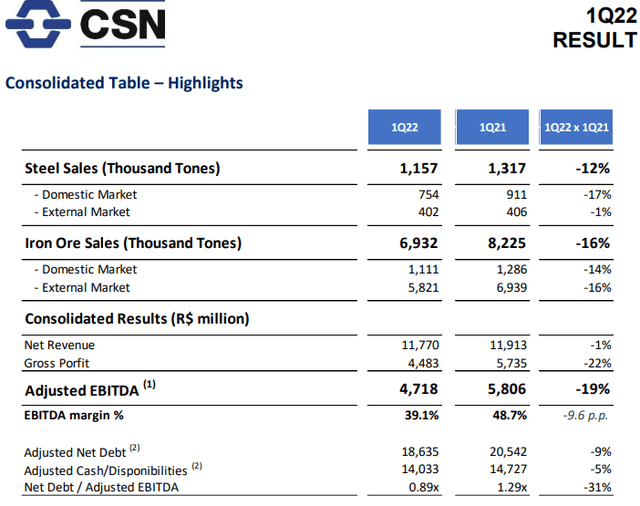

The company last reported its Q1 results back in May with net revenue of BRL 11.8 billion, representing approximately $2.1 billion at an exchange rate of BRL 5.5 per USD. Higher market prices for steel and iron ore during the quarter balanced a 12% decline in steel sales volume while iron ore sales were 16% lower.

Management explains that during the quarter, historically heavy rains in its operating region of Southern Brazil disrupted production. The impact was also felt through higher costs including on the logistics side leading to a 22% decline in the gross profit. From there, adjusted EBITDA of BRL 4.7 billion, declined by 19% from Q1 2021.

The takeaway here is that despite operational setbacks, the underlying business remains profitable considering Q1 net income of BRL 1.4 billion or around $250 million. The expectation is for production to normalize through the second half of the year. We mentioned the trend of deleveraging which is confirmed as SID ended the quarter with a net debt to an adjusted EBITDA leverage ratio of 0.9x, down from 1.3x in Q1 2021 and levels near 4x as recently as 2019.

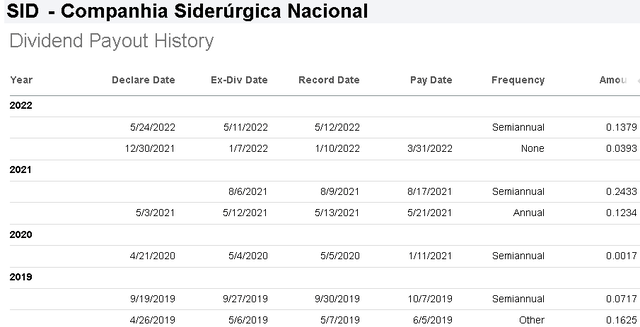

Companhia Siderurgica Nacional maintains a dividend policy to distribute between 80% to 100% of net income on an annual basis. The variable payout means the actual amount and timing to shareholders is unknown and simply at the discretion of the board of directors. Since 2019, the company has made between two and three distributions per year in Brazilian Reais and ultimately translated into USD at the prevailing exchange rate for ADR holders.

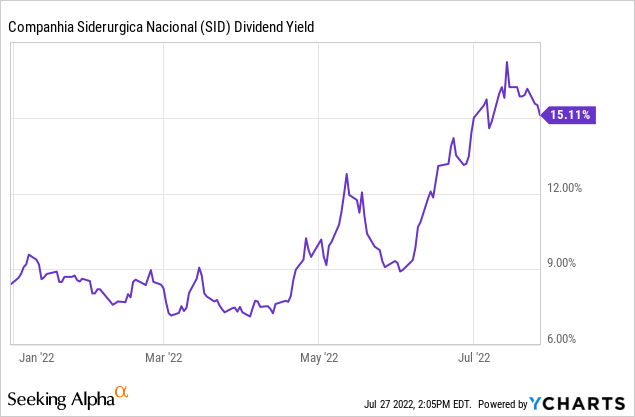

The current dividend yield is listed at 15% although this captures an exceptionally large payment in Q3 of 2021. While it’s difficult to estimate the per-share amount of dividends to be distributed in the year ahead, we estimate a net yield for ADR shareholders of at least 7%. This considers softer earnings for the full year 2022 compared to 2021 based on lower commodity prices thus far and including the mixed trends in Q1.

What’s The Outlook For SID?

It’s been a difficult period for the broader materials sector. From the strong global growth enthusiasm for much of 2021 during the early stages of the post-pandemic recovery, the story this year has been the deteriorating economic environment pressured by record inflation worldwide, rising interest rates, and the impact of the stronger U.S. Dollar. Separately, weaker trends out of China including a strict Covid lockdown during Q2 have also weighed on global trade activity.

These factors have driven a correction and extreme volatility in various market segments including industrial commodities. Benchmark prices for iron ore and steel have corrected sharply over the last several months, and are now trading down to 2020 levels.

A bullish case for SID is largely going to require the macro setup to cooperate. On that point, we argue that the selloff has already priced in many of the near-term headwinds with the potential for an improving narrative going forward supporting a rebound in not only metals prices but also related equities.

With the Fed’s latest rate hike, a scenario that could develop is a sense that we have reached “peak hawkishness” as it relates to monetary policy in the U.S. Indications that inflation is peaking, considering the correction in commodities including energy along with normalizing supply chain conditions for various industries may provide some flexibility for the pace of rate hikes to slow which would, in turn, support a new boost of confidence that the global economy will find its footing. A pullback in the Dollar would be positive for emerging markets like Brazil and generally more positive risk sentiment.

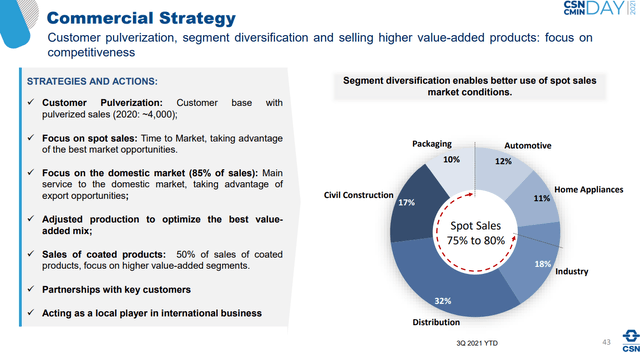

As it relates to SID, the company has exposure to various industries including automotive, construction, and manufacturing that are poised to recover as economic conditions stabilize. Putting it all together, the call here is that steel and iron ore prices will find a bottom supporting stronger operating and earnings trends going forward.

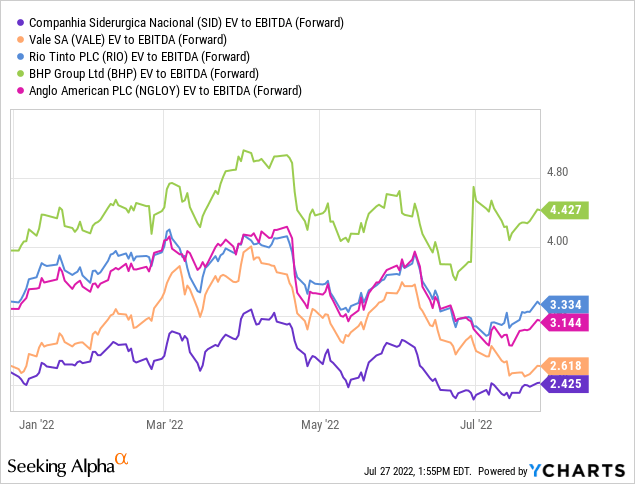

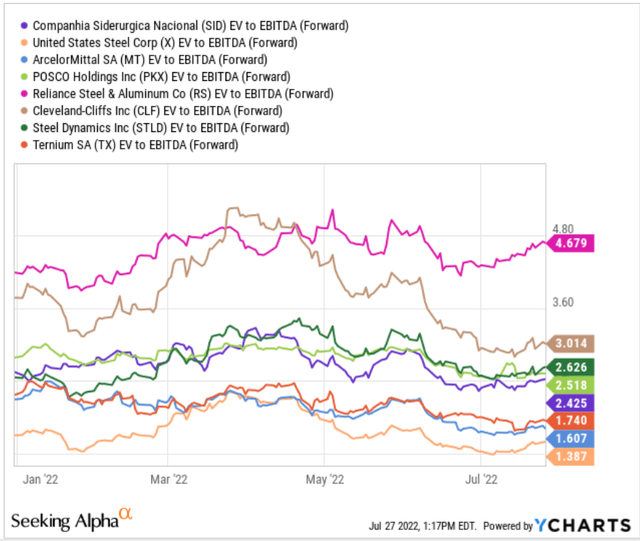

In terms of valuation, SID trading at an EV to forward EBITDA multiple of 2.4x is not necessarily the “cheapest” steel stock in the world, but screens well relative to a peer group from names like South Korea’s POSCO Holdings Inc (PKX), Steel Dynamics Inc (STLD), and Cleveland-Cliffs Inc (CLF) which trade at a premium by the same metric. Keep in mind that the current consensus EBITDA for SID this year includes the softer Q1 results and can rebound into 2023.

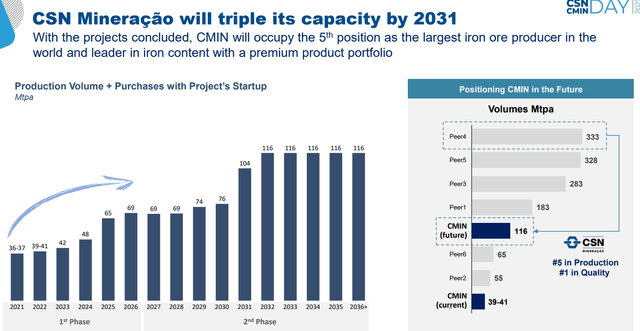

The reason we like SID is the combination of its short-term operational leverage and long-term growth outlook. One of the initiatives the company is moving forward with is an expansion of its mining facilities set to nearly double production from 2021 levels by 2026 and triple total output by 2021. Management explains that after the project, Companhia Siderurgica Nacional will stand among the top-5 largest iron ore producers in the world with significant synergies for its steel capacity.

The result is that over the next decade, SID will transform from being a “steel” pure-play into more of an international miner. What’s interesting here is that this operating profile shift opens the door for its valuation to converge higher toward comparable iron-ore mining names like Rio Tinto Plc (RIO), Vale S.A. (VALE), and BHP Group Ltd (BHP). SID’s growth momentum is expected to accelerate between 2024 and 2025 and should result in a valuation multiple expansion if it executes the strategy effectively.

SID Stock Price Forecast

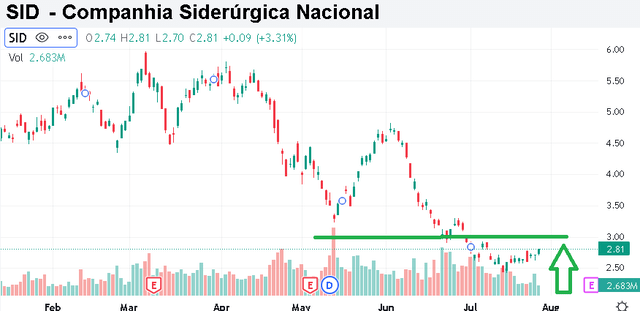

We are bullish on SID and are looking ahead to a breakout above $3.00 which should kick start some new positive momentum in the stock. The idea here is that shares have been beaten down but should be able to outperform both the commodity price of steel and iron ore to the upside on a broader materials sector rebound. We view shares as undervalued with room to reprice higher supported by a positive long-term outlook.

In terms of risks, keep in mind that SID as a foreign stock with operations in an emerging market adds an incremental layer of volatility. The possibility that the macro-outlook deteriorates further or the Brazilian Real currency depreciates significantly from the current level would open the door for another leg lower in the stock.

The company is set to report its Q2 earnings on August 8th which could work as a catalyst for shares to rally higher. Monitoring points will include sales and production levels along with cash flow trends. Positive guidance related to operating conditions and demand in the core Brazil market would help improve sentiment towards the stock.

Be the first to comment