Khanchit Khirisutchalual

A Quick Take On Commvault Systems

Commvault Systems, Inc. (NASDAQ:CVLT) reported its FQ1 2023 financial results on July 26, 2022, beating expected revenue and EPS estimates.

The company provides a range of on-premises and cloud data storage and recovery technologies.

For the near term, I’m on Hold for CVLT due to its ongoing transition from on-premises to software as a service (“SaaS”), longer sales cycles in the current slowing economic environment, foreign exchange challenges and earnings downtrend.

Commvault Systems Overview

Tinton, New Jersey-based Commvault was founded in 1988 to provide organizations with data protection, backup and recovery solutions.

The firm is headed by Chief Executive Officer Sanjay Mirchandani, who was previously CEO of Puppet and SVP Asia Pacific Japan for VMware.

The company’s primary offerings include:

-

Backup & recovery

-

Disaster recovery

-

File storage optimization

-

Data governance

-

eDiscovery & compliance

-

Managed services

-

Security

The firm acquires customers via its direct and inside sales and marketing teams as well as through partner referrals.

CVLT counts more than 100,000 customers and 7,000 ecosystem partners.

Commvault Systems’ Market & Competition

According to a 2020 market research report by MarketsAndMarkets, the global market for cloud storage services was an estimated $50.1 billion in 2020 and is forecast to reach $137 billion by 2025.

This represents a forecast CAGR of 22.3% from 2020 to 2025.

The main drivers for this expected growth are growing demand for enterprises for ever larger amounts of data and a rising number of remote-located employees and contractors needing access to relevant data stores.

Also, a key challenge for the industry is to effectively defend against security threats and improve data privacy for corporate and personal data.

Major competitive or other industry participants include:

-

Amazon

-

Alphabet

-

Microsoft

-

Dell EMC

-

iDrive

-

pCloud

-

Dropbox

-

Icedrive

-

NordLocker

-

Others

Commvault Systems’ Recent Financial Performance

-

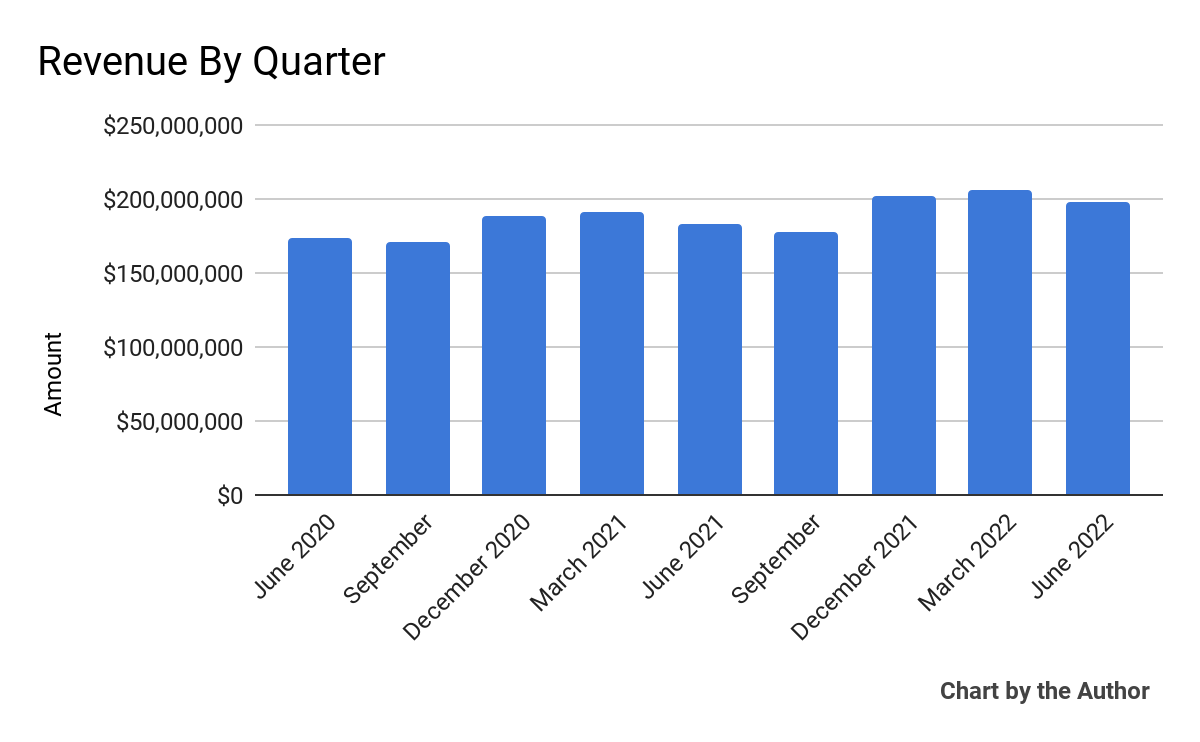

Total revenue by quarter has trended moderately higher in recent quarters:

9 Quarter Total Revenue (Seeking Alpha)

-

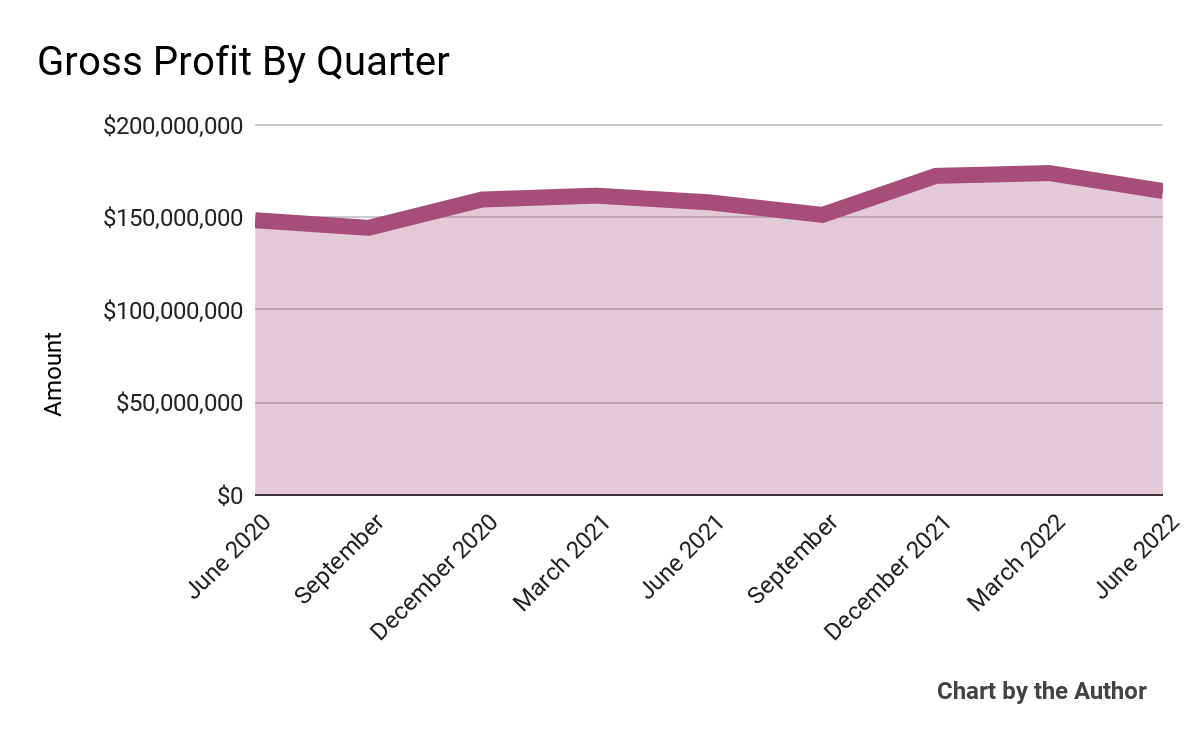

Gross profit by quarter has risen in the last three quarters:

9 Quarter Gross Profit (Seeking Alpha)

-

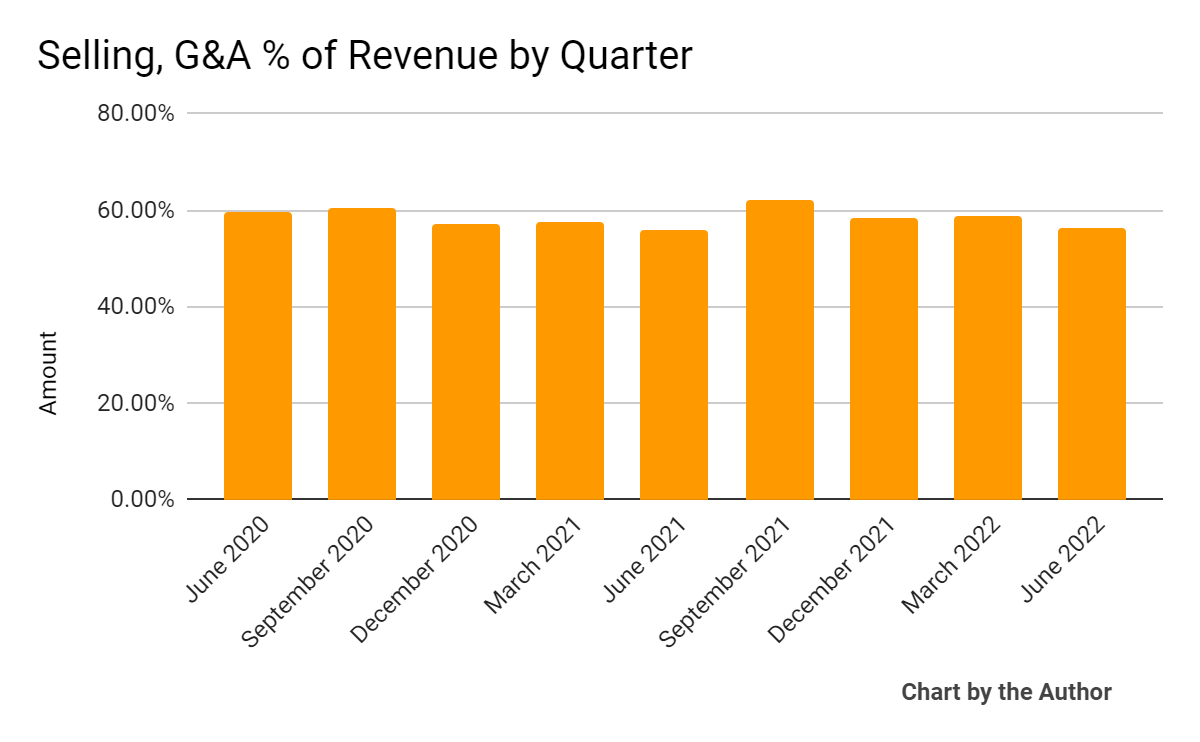

Selling, G&A expenses as a percentage of total revenue by quarter have remained relatively flat, as the chart shows below:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

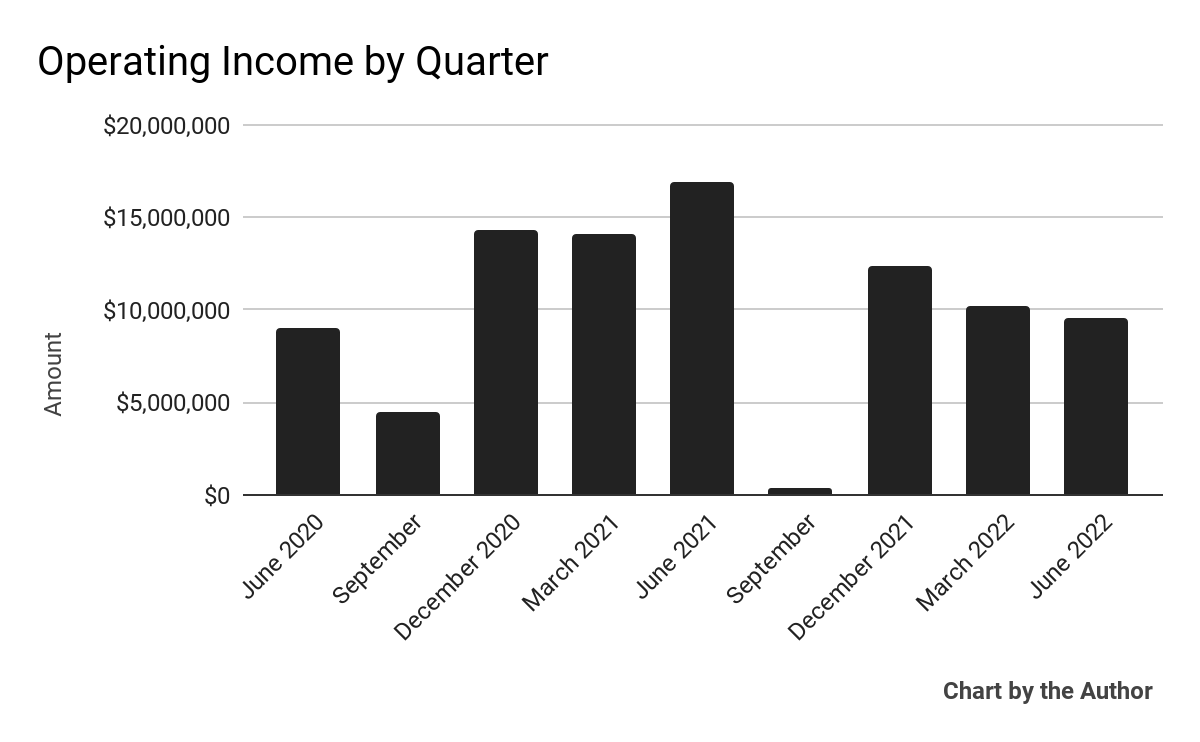

Operating income by quarter has produced the following results:

9 Quarter Operating Income (Seeking Alpha)

-

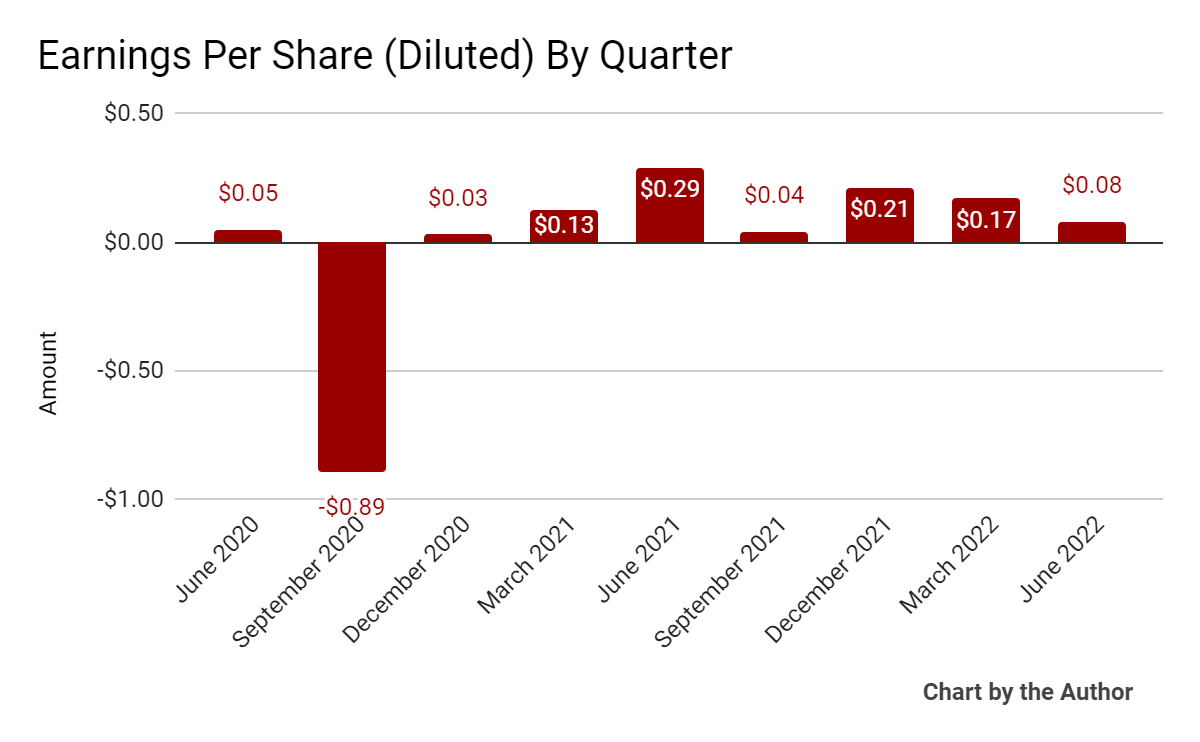

Earnings per share (Diluted) have been positive in most of the last 9 quarters:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

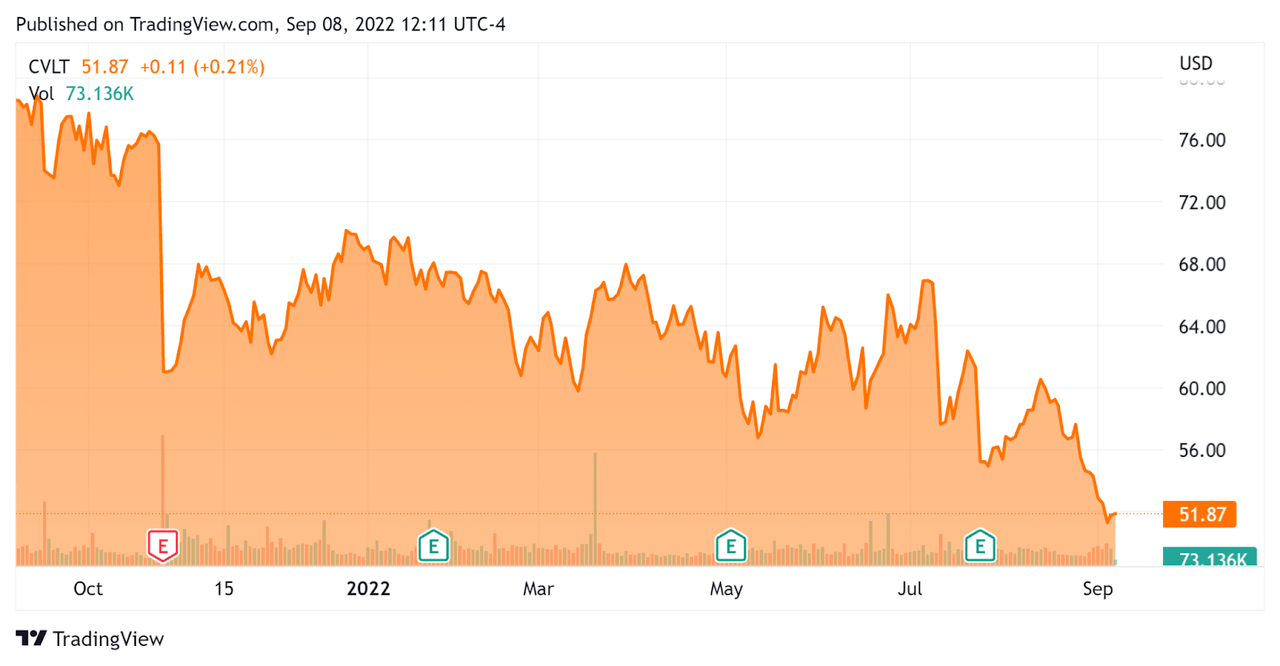

In the past 12 months, CVLT’s stock price has fallen 34.3% vs. the U.S. S&P 500 index’ drop of around 12.1%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Commvault Systems

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

2.62 |

|

Revenue Growth Rate |

6.9% |

|

Net Income Margin |

3.0% |

|

GAAP EBITDA % |

5.6% |

|

Market Capitalization |

$2,300,000,000 |

|

Enterprise Value |

$2,050,000,000 |

|

Operating Cash Flow |

$162,400,000 |

|

Earnings Per Share (Fully Diluted) |

$0.50 |

(Source – Seeking Alpha)

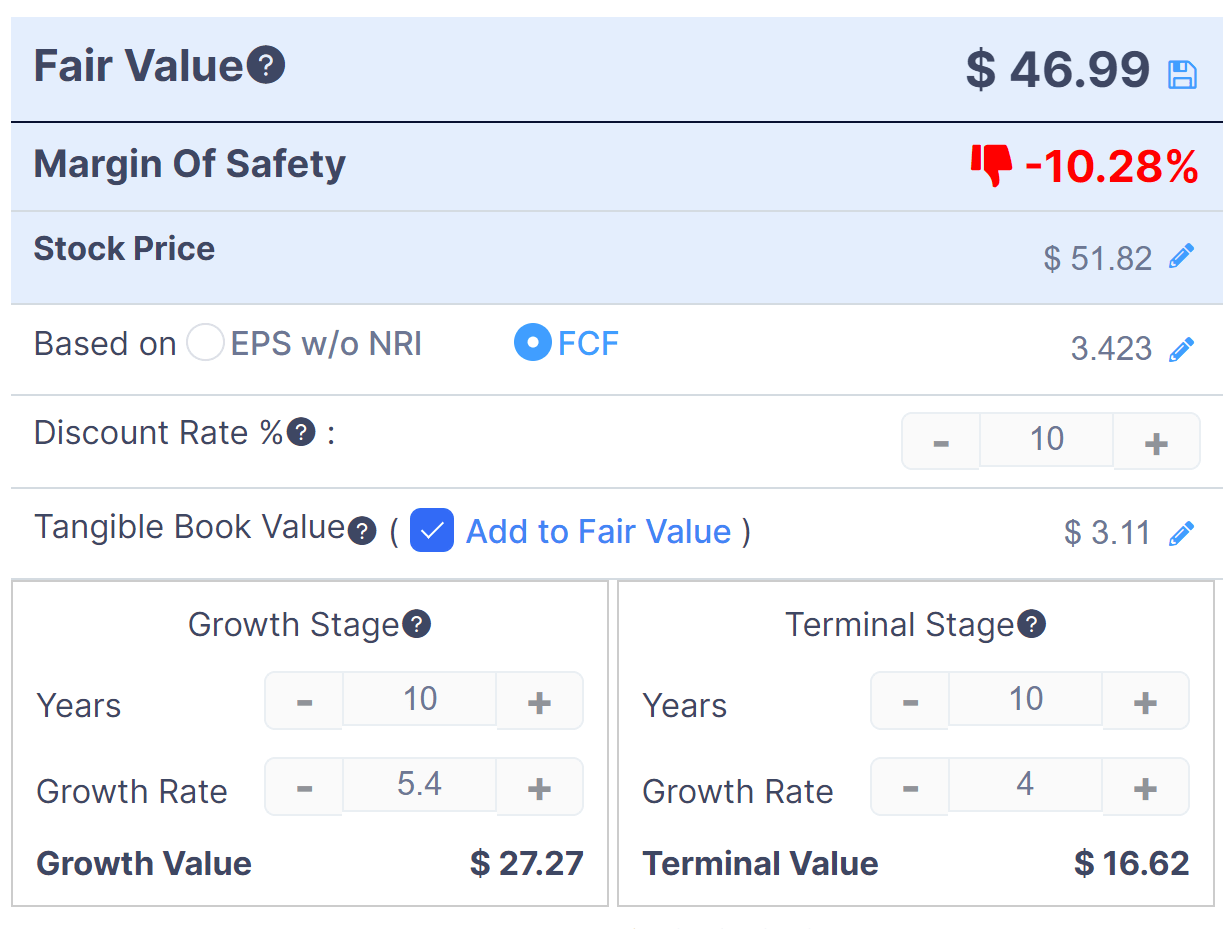

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and free cash flow:

Discounted Cash Flow – CVLT (GuruFocus)

Assuming generous DCF parameters, the firm’s shares would be valued at approximately $46.99 versus the current price of $51.82, indicating they are potentially currently overvalued, with the given earnings, growth and discount rate assumptions of the DCF.

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

CVLT’s most recent GAAP Rule of 40 calculation was only 12.4% as of FQ1 2023, so the firm needs substantial improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

6.9% |

|

GAAP EBITDA % |

5.6% |

|

Total |

12.4% |

(Source – Seeking Alpha)

Commentary On Commvault Systems

In its last earnings call (Source – Seeking Alpha), covering FQ1 2023’s results, management highlighted the growth of its Metallic offering and its contribution to revenue.

Also, subscription and SaaS annual recurring revenue [ARR] rose 50% year-over-year and now accounts for 64% of the firm’s total ARR.

Earlier in the year, CVLT acquired TrapX for its cyber deception technologies and has integrated it into its Metallic system, its enterprise grade backup and recovery SaaS system operating across a variety of cloud environments.

As to its financial results, total revenue grew by 8%, or 13% on a constant currency basis. Revenue from over $100K customers represented 75% of software revenue and increased by 24%.

Management did not disclose the company’s net dollar retention rate, which is an important metric to provide visibility into product/market fit and sales & marketing efficiency.

Gross margin dropped sequentially from 85% to 83.6%, due to ‘the modest shift in our gross margin profile with the success of our accelerating SaaS business.’

Operating profit and EPS fell sequentially despite headcount ‘roughly flat quarter-over-quarter.’

The company repurchased $19 million worth of its common stock.

For the balance sheet, the firm finished the quarter with cash and equivalents of $258.7 million and no debt.

Free cash flow over the trailing twelve months was $159.1 million, so the company generates impressive free cash flow.

Looking ahead, management only provided guidance for FQ2 and not for the full year ahead. IT expects total revenue to be around $186 million at the midpoint of the range, up 8% on a constant currency basis, which may be more than as-reported due to a strong US dollar environment.

Regarding valuation, the market is valuing CVLT at an EV/Sales multiple of around 2.6x.

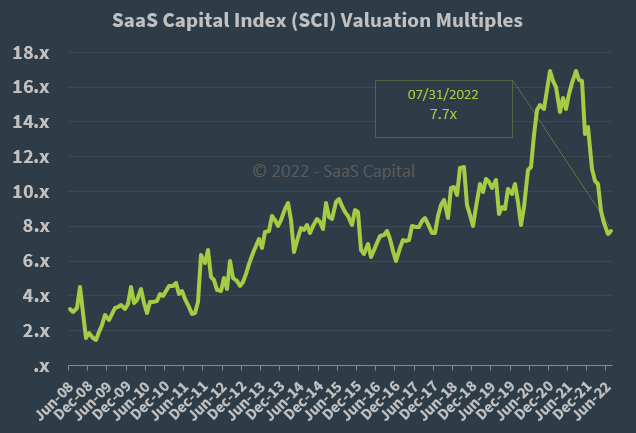

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 7.7x at July 31, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, although the company is not on a pure SaaS/subscription revenue model, CVLT is currently valued by the market at a significant discount to the broader SaaS Capital Index, at least as of July 31, 2022.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown or recession, which may slow sales cycles and reduce its revenue growth trajectory.

Commvault is pursuing a cloud-centric approach and appears to be making progress in that regard.

However, its legacy business may continue to slow its growth rates while the subscription revenue model also represents a slower revenue recognition ramp while expenses remain high.

While the firm looks to have ample resources to fund its transition, it could take a significant amount of time to convert the bulk of its operations to a subscription model.

A potential upside catalyst to the stock would be a pause in interest rate hikes or other reduction in the cost of capital, increasing its valuation multiple in the process.

But, for the near term, I’m on Hold for CVLT due to its ongoing transition to SaaS, longer sales cycles in the present macroeconomic environment, foreign exchange challenges and earnings downtrend.

Be the first to comment