jetcityimage/iStock Editorial via Getty Images

In June 2022, we have published an article about Comcast (NASDAQ:CMCSA) on Seeking Alpha, titled: “Comcast: Attractive Long Term Play, Despite Declining Consumer Confidence“. In that article, we have given a short overview of the business, and detailed some of the main reasons, why we were bullish on the stock back then.

These reasons included:

- Strong financial performance in the first quarter of 2022, with double digit revenue growth.

- The firm appeared to be undervalued according to the traditional price multiples.

- Growing dividend payments combined with attractive share buyback programs.

We have also underlined that the fierce competition in the communication services sector, coupled with changing consumer behaviour and low changing costs across platforms, can negatively influence Comcast’s financial performance in the near term, and may result in further downside risk.

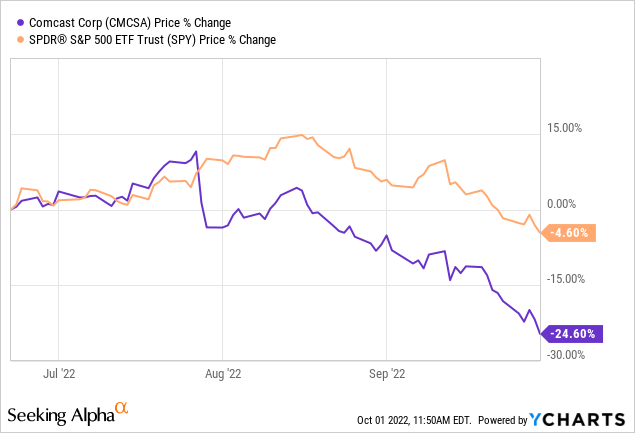

Since June, the stock price has fallen significantly. Comcast has lost almost 25% of its market value, in contrast to the 5% decline of the broader market.

Today, we are going to look at Comcast again and give an updated view on the firm, taking the last news, events, and developments into account.

Let us start with a short review of the latest quarterly earnings report.

Second quarter results

In the second quarter of 2022, Comcast has beaten both top- and bottom-line estimates. Non-GAAP EPS came in at $1.01, $0.09 above analyst estimate, while revenue reached $30.02B beating the estimates by as much as $300M. Consolidated adjusted EBITDA has increased by 10.1% year-over-year, reaching $9.8B. The financial highlights of the different segments of the firm are summarised below:

Communications Adjusted EBITDA Increased 5.3% and Adjusted EBITDA per Customer Relationship Increased 3.0%; Adjusted EBITDA Margin Increased 70 Basis Points to 44.9%

Cable Communications Total Customer Relationships of 34.4 Million and Total Broadband Customers of 32.2 Million Were Consistent with the Prior Quarter and Increased 1.7% and 2.5%, Respectively, Compared to the Prior Year Period

Cable Communications Wireless Customer Line Net Additions Were 317,000, the Best Second Quarter Result on Record; Wireless Penetration of Residential Broadband Customers Increased to 7.9%

NBCUniversal Adjusted EBITDA Increased 19.5% to $1.9 Billion, Including Peacock Losses

Peacock Paid Subscribers Stayed Relatively Flat at 13 Million, Following a Very Strong First Quarter That Was Driven by a Variety of Extraordinary Programming

Studios Revenue Increased 33.3% to $3.0 Billion, Driven by the Successful Theatrical Performance of Jurassic World: Dominion; Adjusted EBITDA in the Second Quarter Reflected the Timing of Costs for Future Theatrical Releases, Including the Premiere of Minions: The Rise of Gru in the Third Quarter

Theme Parks Adjusted EBITDA Increased $411 Million to $632 Million, Its Highest Adjusted EBITDA on Record For a Second Quarter, Reflecting Improved Results at Each Park Compared to the Prior Year Period. Universal Orlando Generated Its Highest Adjusted EBITDA on Record for Any Quarter

Sky Adjusted EBITDA Increased 54.1% to $863 Million; On a Constant Currency Basis, Adjusted EBITDA Increased 70.7%

In our opinion, the second quarter financial results of the firm were strong, especially when we take the challenging macroeconomic environment into account. Despite the low consumer confidence, “theme parks adjusted EBITDA” has increased by as much as $411 million. One can say that in 2021 the theme park business was still negatively influenced by Covid-19 related restrictions, therefore the growth is exaggerated. While it is somewhat true, this Q2 still represents the best-ever second quarter for the theme park business, driven by the growth across all parks. We are also pleased with how CMCSA is growing its number of subscribers in the wireless segment.

Many analysts and investors have overlooked these results and focused on the net loss of 10,000 residential broadband subscribers – the company’s first decline in this segment. This triggered a sharp sell-off after the earnings release.

On the other hand, the firm has recently announced that it has succeeded in test of tech for full-network 10G-powered speeds. The aim of the firm is to deploy multi-gigabit symmetrical speeds throughout its entire broadband network. This could become attractive for a certain group of customers and could potentially fuel broadband customer growth in the future. The deployment of the multi-gigabit speeds for internet service in some areas of the United States has already started.

In our opinion, the firm has delivered strong financial results in the second quarter. Despite the decline in broadband subscribers, the top-and bottom-line figures have exceeded expectations. In our opinion, the sell-off is not justified and the firm has become even more attractive from a valuation point of view.

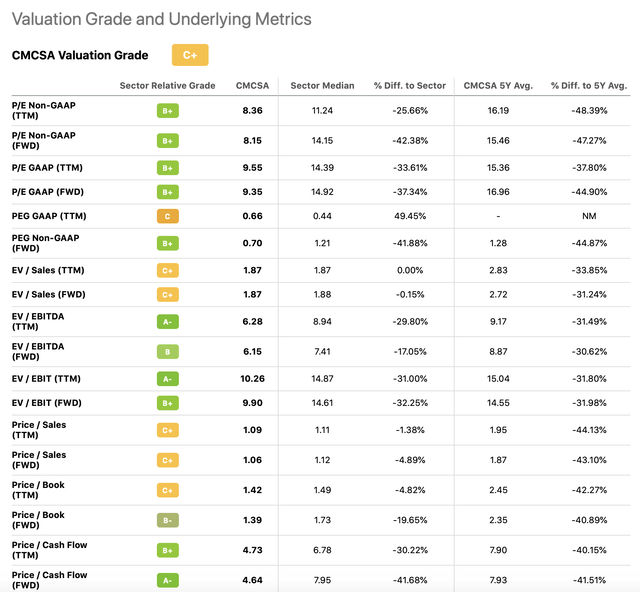

According to the traditional price multiples, the firm is trading at a significant discount to both the sector median and its own 5Y historic average.

Based on these facts, we believe that our previous “buy” rating can be reiterated.

Share repurchases and dividend

Comcast has recently announced to increase its share repurchase authorisation up to $20 billion. In the second quarter, the firm has returned $4.2 Billion to shareholders through a combination of $1.2 Billion in dividend payments and $3.0 Billion in share repurchases. To date, CMCSA has already repurchased $9 billion worth of its Class A common stock.

The firm has also declared a quarterly dividend of $0.27 per share in the third quarter, in-line with the previous amount.

In our previous article, one of the reasons for rating the stock as a “buy” was the commitment of the firm returning value to its shareholders. In our opinion, the recent declaration of the dividend and the extension of the share repurchase program are both positive news for the shareholders. We believe the firm remains attractive from this perspective and we see no reason to downgrade the stock from our previous “buy” rating.

Conclusion

Despite the declining number of broadband subscribers, the firm’s second quarter results were strong. We believe that the more than 25% decline since our writing is not justified and the company has become even more attractive from a valuation point of view.

The increase of the share repurchase authorisation, combined with the newly declared dividend, is also a positive development for shareholders.

For these reasons, we reiterate our “buy” rating.

Be the first to comment