Charley Gallay/Getty Images Entertainment

Investment Thesis

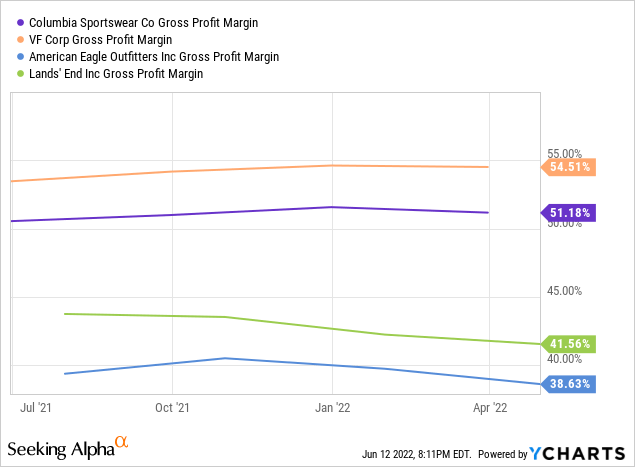

Columbia Sportswear Company (NASDAQ:COLM) is one of the most stable plays in the apparel industry. While the gross margin has contracted in the most recent quarter by 170 basis points, Columbia’s gross margin still remains on par with competitors like V.F. Corp. (VFC) and far above other apparel vendors such as American Eagle (AEO). Additionally, net sales for the quarter rebounded nicely and there is a dividend yield of 1.6%. SOREL (Columbia’s footwear brand) also continues to grow, and there was widespread strength across the international business.

Columbia’s business is one of the best, the hardest part is figuring out what price to invest at. The current price of $75 is pretty good, however, a better price would be $70. Columbia has already said that they expect Q2 to be weak, and it has historically been their weakest quarter. However, based on the current economic conditions, Columbia may be best poised to navigate a recession, if there is one, based on their performance in the 2008 financial crisis. Overall, Columbia is a long-term winner with some short-term headwinds.

Numbers

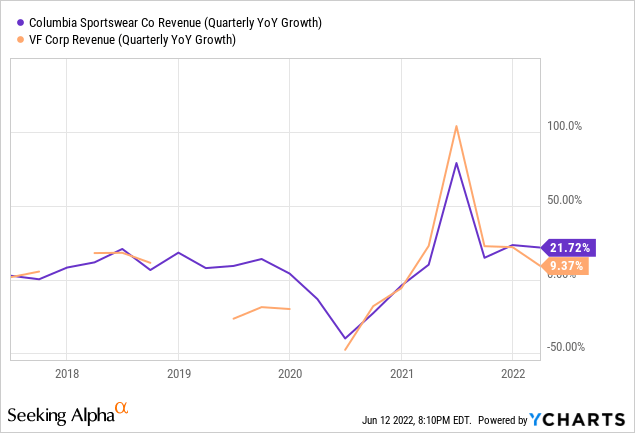

Overall net sales for Columbia are up 2.7% for fiscal year 2021 compared to 2019. This is compared to an 8% increase from 2018 to 2019. Ignoring growth rates from 2020 due to the nature of that year, Columbia has rebounded quite nicely. Compared to competitor VFC, Columbia is making a similar recovery with similar revenue growth rates. They both are valued at ~13 P/E with one of the only differences being the dividend yield. Columbia’s dividend yield is 1.6% and VF’s dividend yield is 4.2%. Besides Patagonia, which is a private company, Columbia’s biggest competitor remains VFC’s brand The North Face. Columbia’s international sales are up across the board as LAAP region net sales increased 14% and the EMEA increased by 42%. These numbers reflect an increasingly strong business, and the e-commerce business also increased double-digits by 21%. Wholesale and DTC both increased by 22%.

The biggest surpriser of the quarter was Columbia’s footwear brand SOREL posting the most impressive growth rate at 37%. Even though it is a smaller brand with more room to grow, it is important for Columbia’s broader diversification and allowing for more revenue streams besides the Columbia brand.

Margins

One of the main reasons why Columbia stock has fallen to these levels is the decrease in gross margins. Gross margin currently sits at 51% after a 170 basis point fall. This was attributed to freight expenses. This can be seen as a temporary headwind as supply chains are sorted out. However, Columbia’s margin was also offset by positive factors like a lower promotional environment.

In Columbia’s most recent 10-K they explained that –

In 2021, we operated in an extremely low promotional environment… We expect these trends to remain favorable in early 2022 and expect a gradual return to a more normalized promotional environment…for 2022, we do not expect these metrics to return to levels experienced in 2019 and prior years. (SEC Filing).

Therefore, for the rest of fiscal year 2022, they should have a favorable promotional environment. Columbia is also expecting another 130-basis point drop in gross margin to 50.3%. Even at 50.3%, Columbia’s gross margin is still significantly higher than most of the apparel industry, which sits at around 40%.

Forecast & The Economy

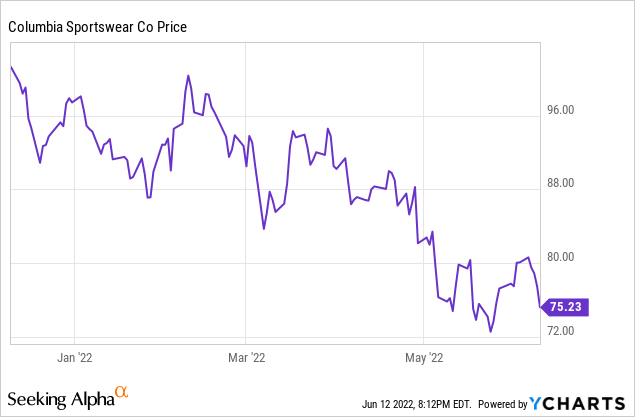

One of the best articles I read this week was in The Economist called ‘America’s Next Recession.’ The gist of the article is that a recession is more than possible, but will not be as bad as 2020 nor 2008-2009. “Since 1955, rates have risen as fast as they will this year during seven economic cycles. In six of them, recession followed within a year and a half,” (The Economist). The author then predicts a recession is imminent by the end of 2024. This is important to figure out the best price to purchase Columbia. Columbia’s share price has already dropped significantly and is on the climb up once again. However, management has already issued guidance that next quarter will be far from pretty due to Russia and China and historically Q2 is their lowest performing quarter. Columbia will be reporting Q2 earnings August 9, 2022.

For the time being, I think Columbia’s share price will be moving within 5% of the current price of $75. This is not a bad time to purchase shares. However, I think an even better time may be to purchase after Q2 earnings or even when the stock touches $70 again. Based on the 6-month price chart, the stock has touched $80 twice and is yet to break past that resistance level. Due to changes in fall deliveries, revenue growth is expected to be more prevalent in the third quarter. While this Economist article predicts a mild recession by the end of 2024, it is important to remember that there is money to be made till then.

Additionally, if a recession were to hit mild or not, Columbia has proven to be able to weather a recession. From 2008 to 2009, Columbia suffered a 6% drop in net sales and a fractional reduction in gross margin (SEC Filing). In terms of retail players, Columbia is one of the ones with more flexibility to navigate a recession due in part to the wealthier price points of the goods.

Technical Analysis

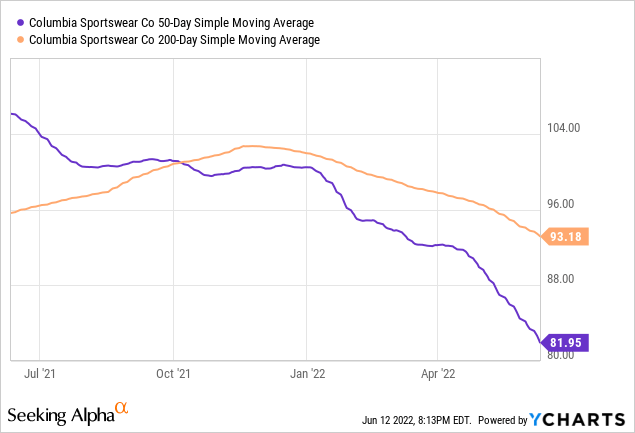

Columbia bottomed at around $70 and is currently at $75 around a 7% jump from the 52-week low. RSI remains at moderately bought levels at around 40, and the 200-day SMA is far above the 50-day SMA. While the 200-day SMA is above the 50-day SMA, which is a traditionally bearish sign, there is little indication of Columbia’s price going lower than $70. Especially since a lot of bad news has been priced into the stock already, and the last time Columbia’s stock went below $70 was in 2017 when revenues were far lower.

Conclusion

Columbia remains a long-term winner and is attractive at these prices. However, seeing the consensus built upon next quarter, it may be best to pick up some shares following Q2 or at the buy target of $70. While Columbia suffered some margin contraction, they still have a fairly high margin of 50%, and with a P/E of 13 the valuation is solid. Current economic forecast indicates some headaches to come, but Columbia is uniquely positioned to weather the storm and I think it is a future winner.

Be the first to comment