Ignatiev/E+ via Getty Images

A Quick Take On Cognyte Software Ltd.

Cognyte Software Ltd. (NASDAQ:CGNT) recently reported its FQ1 2023 financial results on June 28, 2022, missing revenue and earnings estimates.

The company provides investigative analytics software for security threat environments.

While management appears to be focusing on what it can control, namely costs and removing internal sales conversion slowdowns, I fear the company may be in for an extended period of sluggish customer deployments.

For the near term, I’m on Hold for CGNT.

Cognyte Software Overview

Herzliya, Israel-based Cognyte was founded to develop an open software platform to assist governments and enterprises in conducting security investigations.

The firm is headed by Chief Executive Officer Elad Sharon, who was previously president at Verint Systems.

The company’s primary offerings include an analytics platform covering networks, blockchains, the internet, cyber threats and situation intelligence environments.

The firm acquires customers through its direct sales and marketing efforts, as well as through partner relationships.

Cognyte also counts a number of national level agencies as significant customers, such as the U.S. NSA and various law enforcement agencies.

Cognyte’s Market & Competition

According to a 2021 market research report by MarketsAndMarkets, the global market for security analytics was an estimated $12 billion in 2021 and is forecast to exceed $25 billion by 2026.

This represents a forecast CAGR of a very strong 16.2% from 2022 to 2026.

The main drivers for this expected growth are an increasing threat environment in terms of the number of attacks and the complexity and sophistication of security breaches.

Also, companies have a greater need for modern systems to assist them in prevention of repeat attacks as well as maintaining regulatory compliance.

The rise in machine learning/artificial intelligence-enhanced systems will also continue due to demand for greater automation in monitoring and response activities.

Major competitive or other industry participants include:

-

IBM

-

Cisco

-

Broadcom

-

Splunk

-

RSA Security

-

FireEye

-

LogRhythm

-

Securonix

-

Hillstone Networks

-

Exabeam

-

Rapid7

-

Alert Logic

-

Snowflake

-

Others

Cognyte’s Recent Financial Performance

-

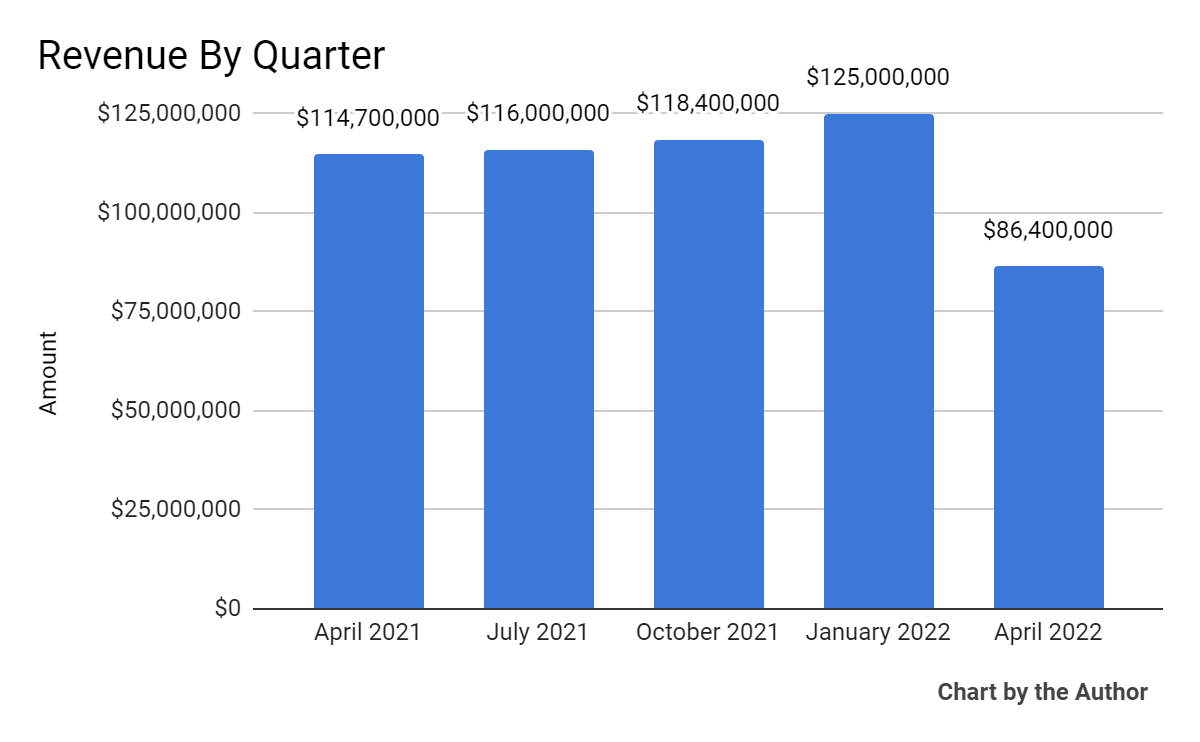

Total revenue by quarter has risen until the most recent quarter:

5 Quarter Total Revenue (Seeking Alpha)

-

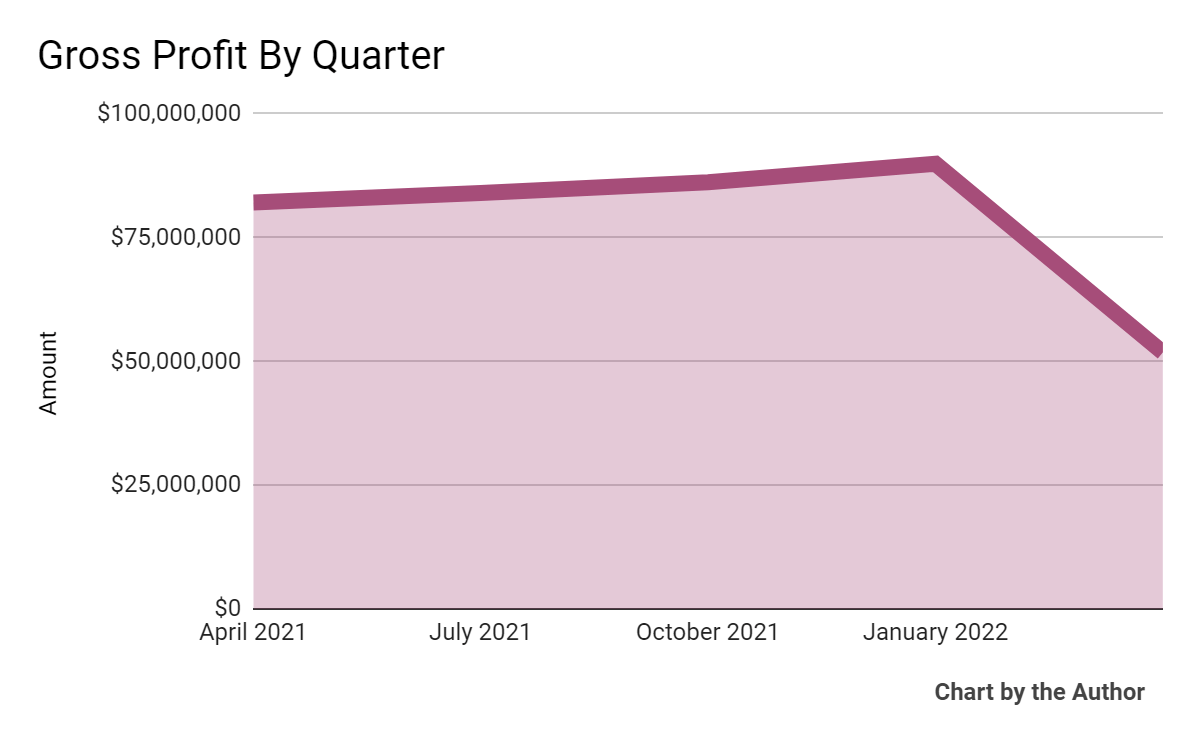

Gross profit by quarter has followed approximately the same trajectory as total revenue:

5 Quarter Gross Profit (Seeking Alpha)

-

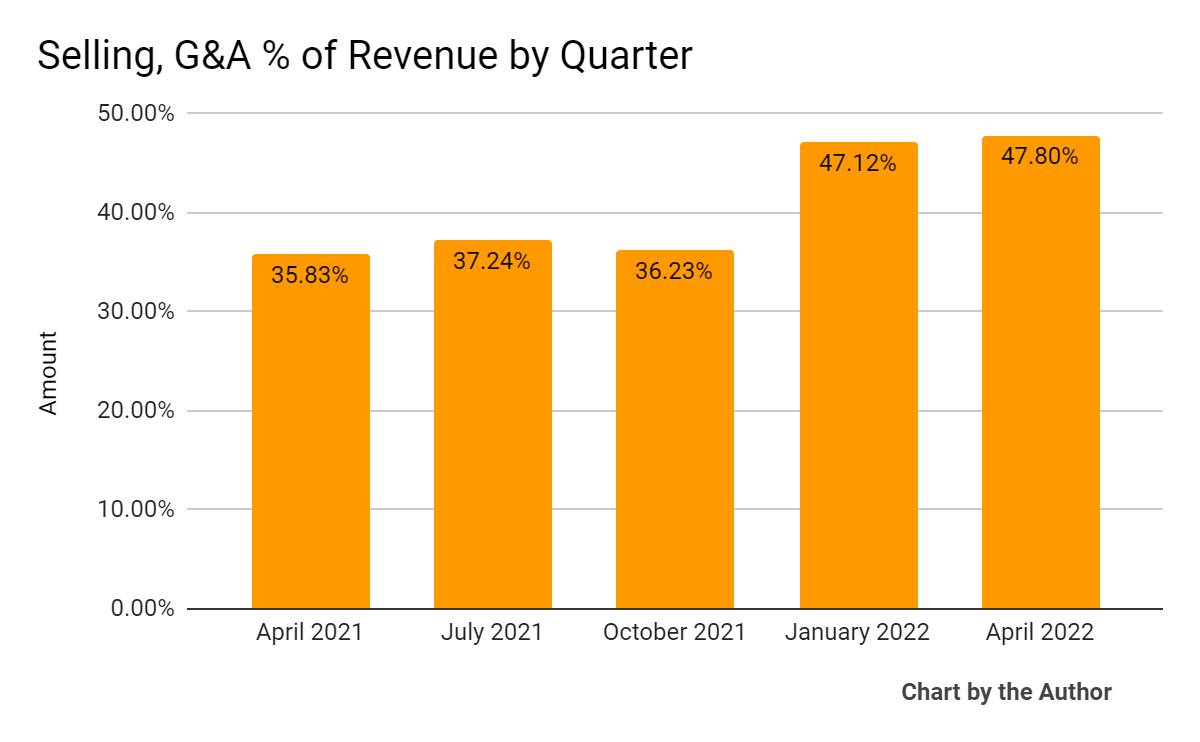

Selling, G&A expenses as a percentage of total revenue by quarter have trended significantly higher in recent quarters:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

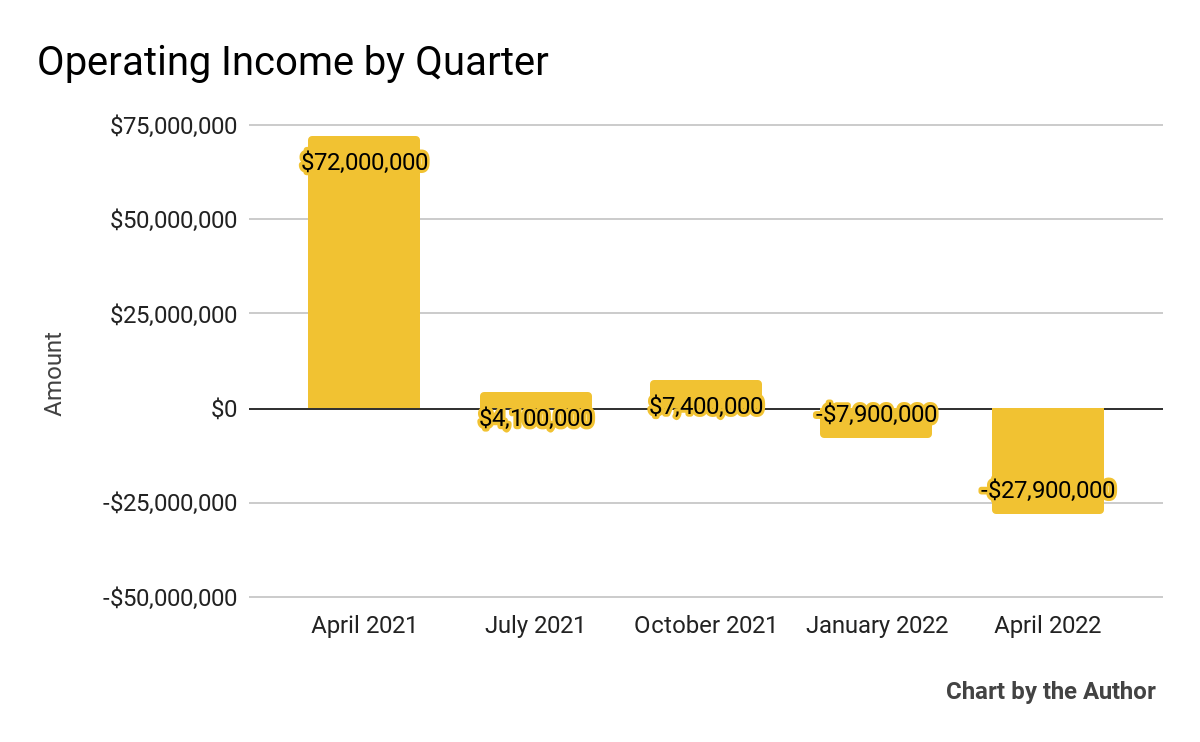

Operating income by quarter has turned substantially negative in the past 2 quarters:

5 Quarter Operating Income (Seeking Alpha)

-

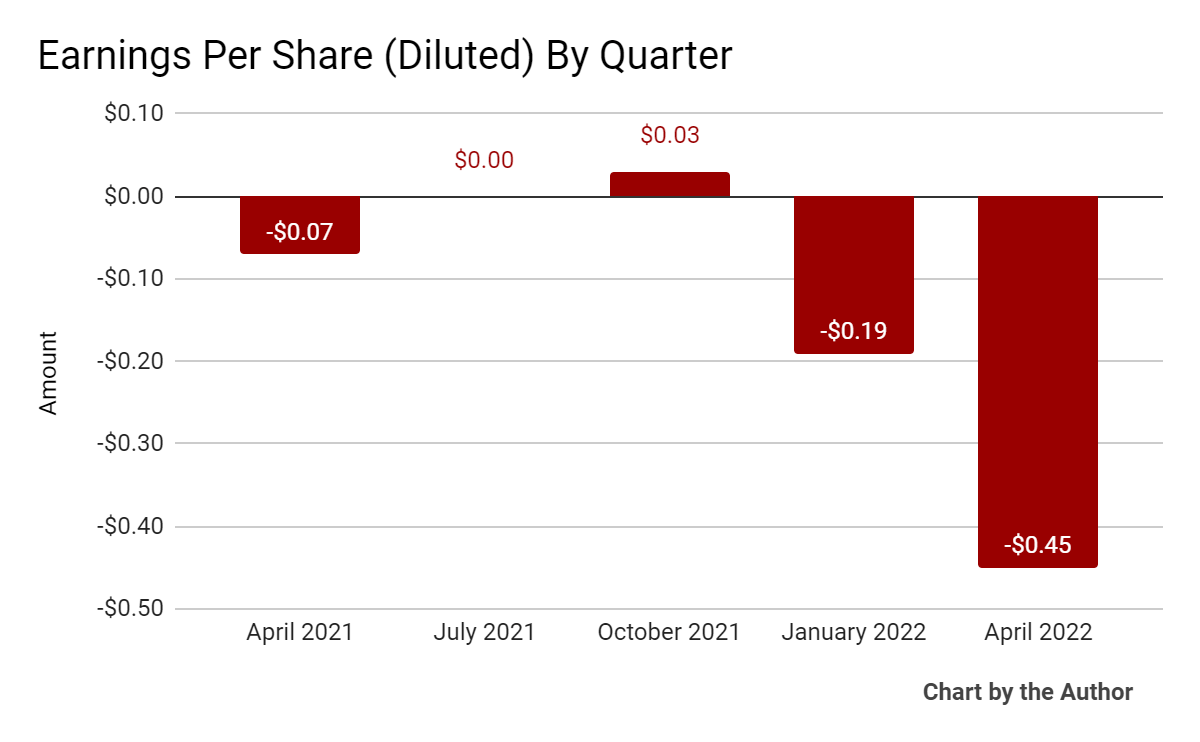

Earnings per share (Diluted) have become extremely negative in the most recent reporting period:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

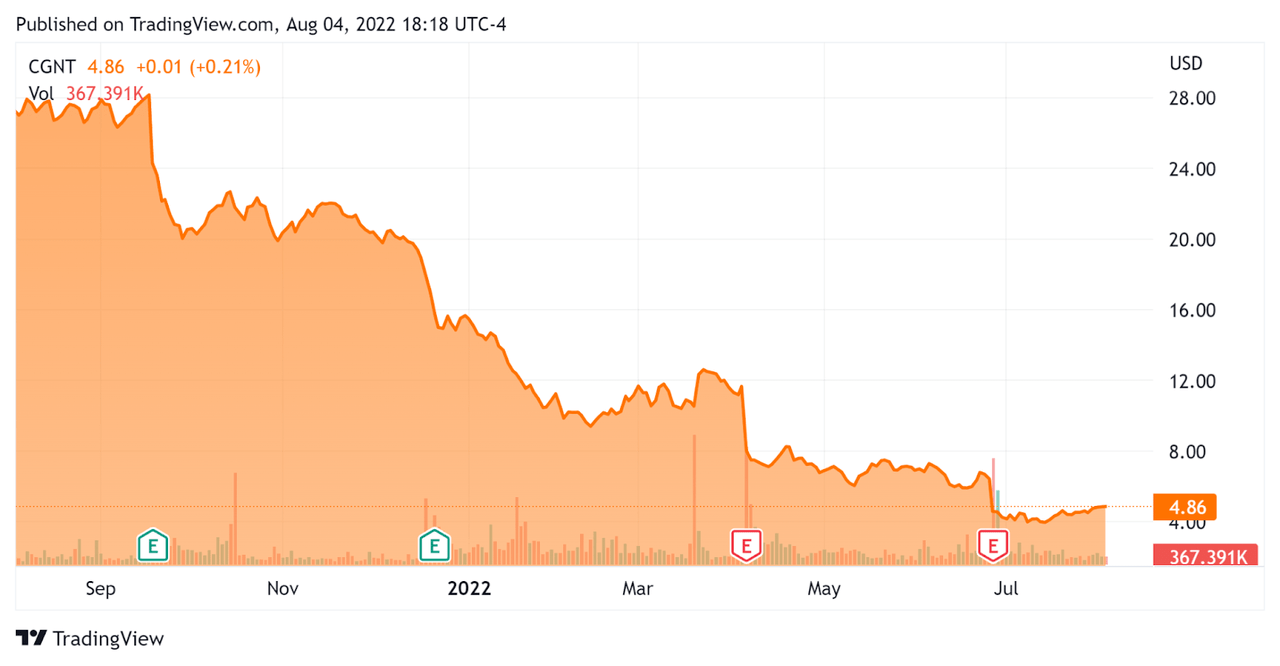

In the past 12 months, CGNT’s stock price has fallen 82.2% vs. the U.S. S&P 500 index’s drop of around 5.6%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Cognyte Software

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Enterprise Value |

$300,840,000 |

|

Market Capitalization |

$327,280,000 |

|

Enterprise Value / Sales [TTM] |

0.67 |

|

Revenue Growth Rate [TTM] |

-2.41% |

|

Operating Cash Flow [TTM] |

-$19,310,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.61 |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

CGNT’s most recent GAAP Rule of 40 calculation was negative (5%) as of FQ1 2023, so the firm needs significant improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

-2% |

|

GAAP EBITDA % |

-2% |

|

Total |

-5% |

(Source – Seeking Alpha)

Commentary On Cognyte

In its last earnings call (Source – Seeking Alpha), covering FQ1 2023’s results, management highlighted delays in delivery of software orders due to both external hardware supply chain slowdowns and clients impacted by the ‘overall macroeconomic and geopolitical environment’, including agency budget reductions.

In response, management has begun to reduce headcount, which is now 5% lower than at the start of the year, while seeking to improve pipeline conversion metrics.

Management has suspended forward guidance due to a wide range of potential outcomes, which does not exactly inspire confidence in the stock for the near term.

As to its financial results, total revenue produced a ‘significant decline’ of 24.7% year-over-year due to customer deployment delays and slow pipeline conversions.

Gross profit dropped accordingly and operating losses worsened sharply, with the company generating $27.9 million in operating losses for the quarter.

For the balance sheet, the firm finished the quarter with cash, equivalents and short-term investments of $107 million, while the company spent $11.2 million in free cash use.

Looking ahead, management believes the downturn is temporary and will resume forward guidance ‘as soon as practical.’

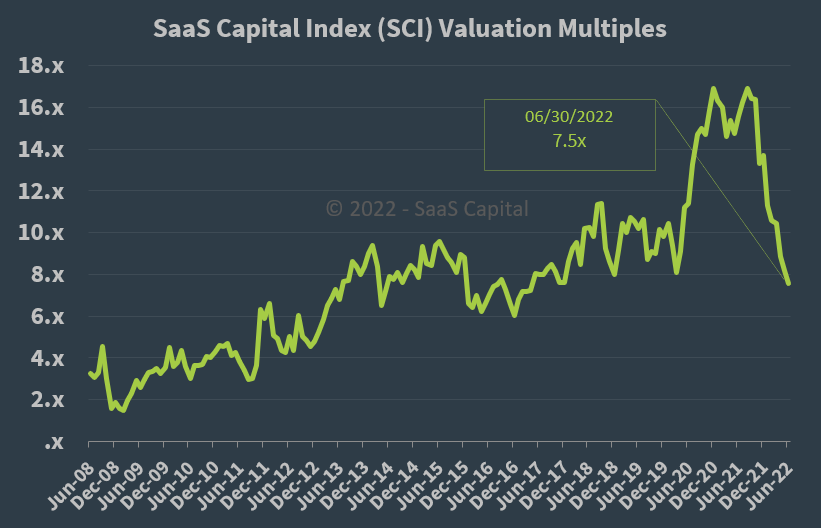

Regarding valuation, the market is valuing CGNT at an EV/Sales multiple of around 0.67x.

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 7.5x at June 30, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, CGNT is currently valued by the market at a heavy discount to the SaaS Capital Index, at least as of June 30, 2022.

The primary risks to the company’s outlook are a potential macroeconomic slowdown or recession, which may continue to slow sales conversions along with slower customer deployments due to ongoing supply chain challenges.

A possible upside catalyst is that combination of reduced headcount and faster sales conversion results due to greater focus of management on removing conversion slowdowns to the degree it can do so.

It is difficult to get excited about CGNT’s near-term prospects, as even before the recent 2 quarters, the company wasn’t growing that quickly.

While management appears to be focusing on what it can control, namely costs and removing internal sales conversion slowdowns, I fear the company may be in for an extended period of sluggish customer deployments.

For the near term, I’m on Hold for CGNT.

Be the first to comment