tunart/E+ via Getty Images

Instead of an investment thesis

In this article, I revisit my buy thesis on Coda Octopus Group (NASDAQ:CODA) stock. I continue to believe in the company’s potential to monetize its technology and expand its customer base. However, given the current economic environment and recent financial results, I feel compelled to rate the stock a “hold” – in my opinion, it becomes a “buy” at around $3 per share.

My Reasoning

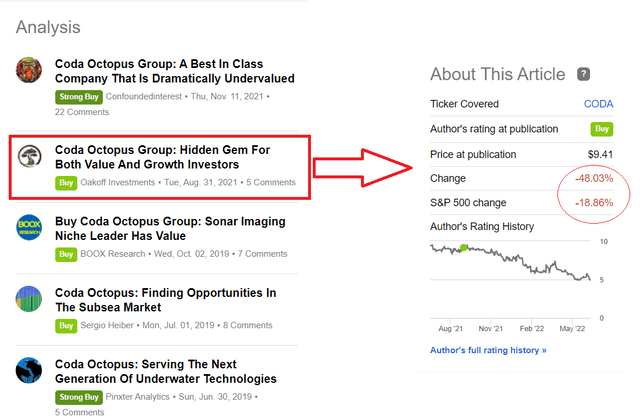

I first became aware of Coda Octopus Group in August 2021, when the stock was trading at $9.41. Since then, despite my bullish conclusions, the quotes have almost halved (my thesis turned out to be twice as bad as the market):

Seeking Alpha, author’s notes

To understand what went wrong, I suggest paying attention to what the company actually does and its unique selling proposition.

Coda Octopus was founded in 1994 in Orlando, Florida. The company operates in the marine products and engineering business segments and has offices in Florida, Utah, the United Kingdom, Australia, and Denmark.

The Marine Technology Business segment sells technology solutions for the underwater and subsea markets – primarily real-time 3D volumetric imaging sonars, which are the only ones of their kind capable of generating up to 40 million 3D data points and offer the ability to detect multiple underwater targets in real-time with a single sensor. As SA fellow contributor Confoundedinterest rightly noted in his November article on CODA, this business segment is the most important and innovative – it is the one we need to pay attention to if we want to understand the company’s future growth potential. In the second quarter of 2022, this segment accounted for 70% of total revenue and 41.8% of gross margin.

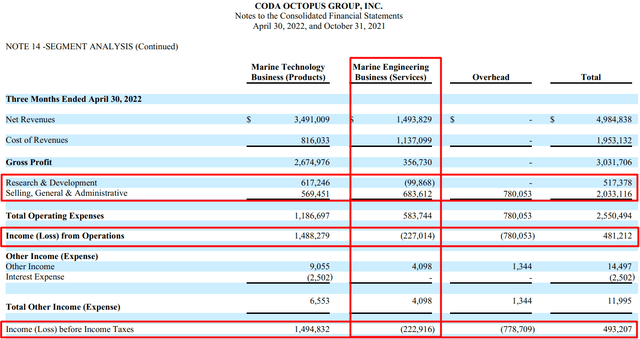

Another business segment – Marine Engineering Business – operates a consulting business model, so it can be assumed that its main costs consist of salaries and travel expenses (this fact explains the high gross margin). However, in Q2 2022 it was this segment that let the company down:

CODA’s 10-Q, author’s notes

These results were a one-time event – when discussing the operating losses of their non-core segment, management indicated that the “Marine Engineering Business” should show much stronger results in Q3 and Q4.

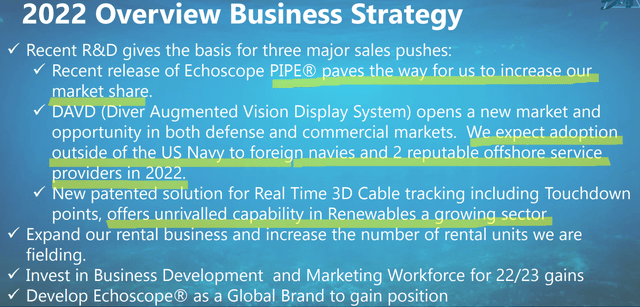

Be that as it may, in recent years management has been actively developing the “Marine Technology Business” segment – the company’s underwater imaging sonar technology has quite a bit of potential if we look at the possible applications – both commercially and in terms of meeting the defense needs of various countries:

codaoctopus.com, author’s notes

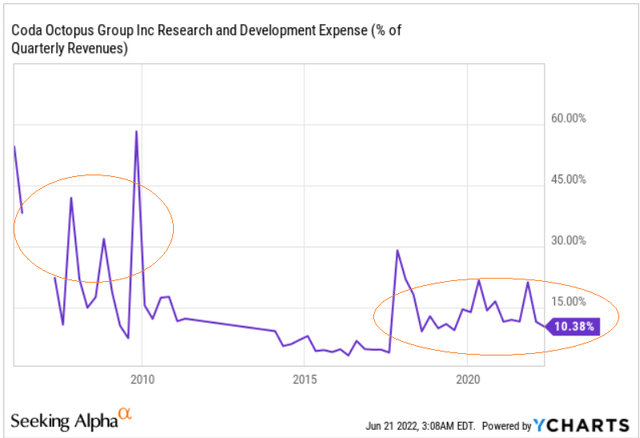

How much the company spent on R&D expenses is evidenced by the dynamics of the ratio of this expense item to revenue in recent years:

YCharts, author’s notes

Roughly speaking, CODA has returned to the stage of vigorous scientific and technical activity after a long period to bring to the market as quickly as possible the Diver Augmented Vision Display System (DAVD), Echoscope PIPE, and a new patented solution for real-time 3D cable tracking. In the coming years, these investments should bear fruit – both in terms of expanding the addressable market and developing the existing market.

CODA’s IR materials, author’s notes

I think that CODA, because of its unique technology that other companies do not have, can quickly achieve its goals if everything goes as it has in the last few years – increasing its customer base, improving its product line/services, and consequently growing TAM and SAM (the key components for any fast-growing micro-cap company).

What’s the catch then? Why “Hold”?

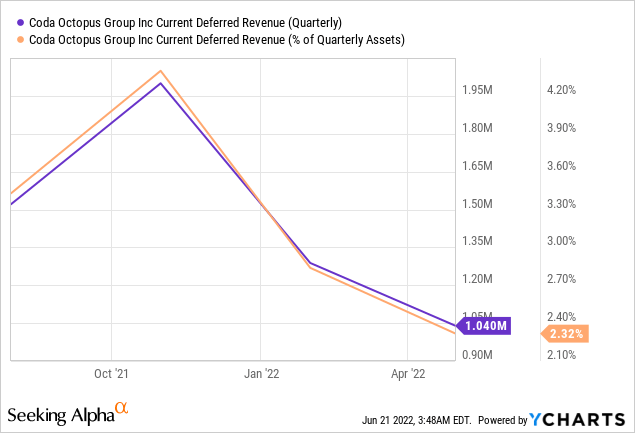

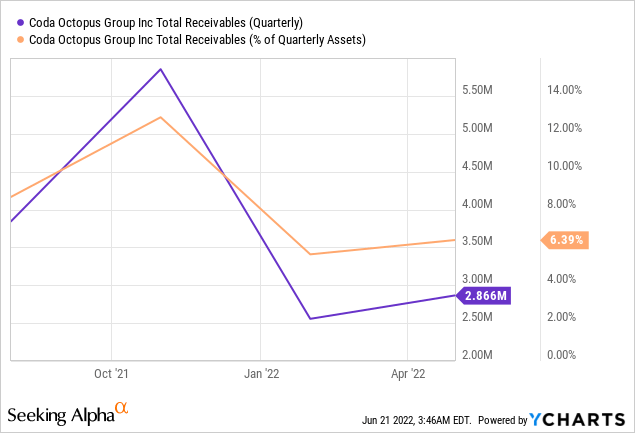

To be honest, buying growth companies in the current macroeconomic conditions is a pretty risky thing to do. Many projects in which the CODA team has been involved are being completed more slowly than expected, which is undoubtedly having an impact on order intake. This is reflected in the dynamics of deferred revenue and receivables in the last quarter:

The management of CODA itself talks about the current problems of the company’s customers:

In the Current Quarter [Q2 2022] our overall quotation percentage rate was higher than the Previous Quarter [Q1 2022]. However, we are experiencing a much slower rate of closure including projects moving out in time. We believe this is reflective of the challenging environment particularly the supply chain issues that persists globally and also the ongoing constraints caused by the Pandemic, particularly in Asia which is an important market for our solutions.

Source: From CODA’s most recent 10-Q

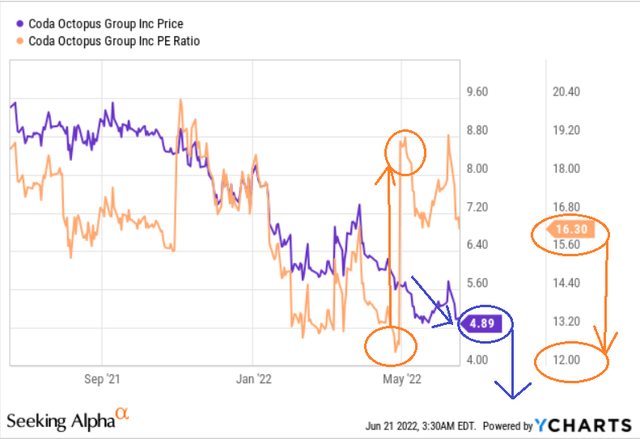

Furthermore, in my opinion, the company’s valuation is still too high to reflect the current market situation. I justified my opinion below – after a bad quarter, the P/E multiple (TTM) rose from ~12X to ~19X because the stock price did not react strongly to the EPS cut. After that, the market started to adjust the higher P/E ratio – now it stands at ~16X. At the same time, the stock has corrected ~12% – if the market continues to shrink to 12X, the stock should fall to $3.5 – 3.6 by the next report (Sept 15, 2022). The bottom could prove to be even lower – the market overreacts quite frequently, so that should not be forgotten either.

YCharts, author’s notes

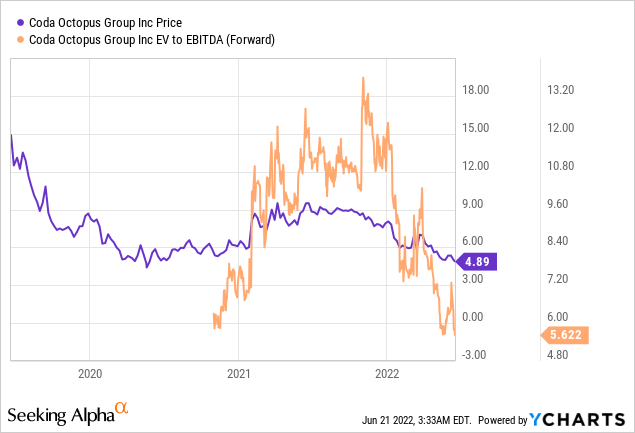

On the other hand, the forward EV/EBITDA multiple is already at an all-time low – if the market develops positively, CODA may recover without falling further.

Takeaway

I believe in the long-term future of the company – as the addressable market expands and the innovation base grows, Coda Octopus has every chance of doubling or tripling its market cap (today’s market cap is only ~$53 million).

In the medium term, however, CODA may face operational difficulties – if talks of an impending recession are true, the company’s customers are likely to further delay the implementation of their new projects. In that case, CODA’s valuation multiples should fall even further – both through a drop in share price and a medium-term decline in earnings. Therefore, I remain a bull internally, but I do not recommend new potential investors to open positions at current prices – it is better to wait until the stock has fallen by about a third.

I’d love to read your thoughts in the comment section below!

Be the first to comment