Georgiy Datsenko/iStock Editorial via Getty Images

Thesis

We highlighted in our article on The Coca-Cola Company (NYSE:KO) in June, urging investors to cut exposure. However, although KO has continued to fall from its April highs, we gleaned that it remains expensively configured. Therefore, even though it seems close to a near-term bottom, we aren’t convinced that its reward-to-risk profile is attractive at the current levels.

Notwithstanding, the company’s robust profitability and well-diversified geographical markets have continued to withstand the worsening macroeconomic headwinds. Hence, we can understand why KO investors remain confident in the company’s solid execution, even though growth may continue to normalize further.

We believe investors need to consider whether KO’s NTM dividend yield of 3% is adequate to justify KO’s valuations at the current levels. Given the bear market in growth and tech stocks, we deduce that investors could do better by rotating out of their KO exposure and repositioning some of it to capitalize on beaten-down stocks, given the recent market bottom.

Hence, we believe new investors should avoid adding exposure to KO. Existing investors can consider waiting for a short-term rally before cutting more exposure, as it’s near- and medium-term oversold.

As such, we revise our rating from Sell to Hold for now.

KO’s Valuations Are Unattractive

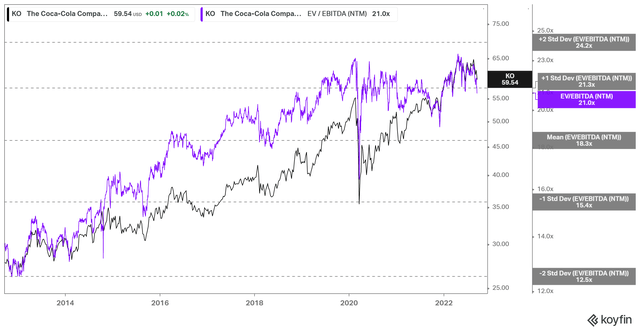

KO NTM EBITDA multiples valuation trend (koyfin)

KO’s NTM EBITDA multiples remain perched at the one standard deviation zone above its 10Y mean. Investors should note that KO had faced significant selling pressure since April when it was closer to the two standard deviation zone above its 10Y mean.

Hence, we believe KO’s valuation metrics have not been de-rated sufficiently to reflect a potentially weaker economic outlook. Therefore, despite its relatively defensive positioning and diversified market exposure, we surmise that even Coca-Cola will not be immune to a broad macro slowdown.

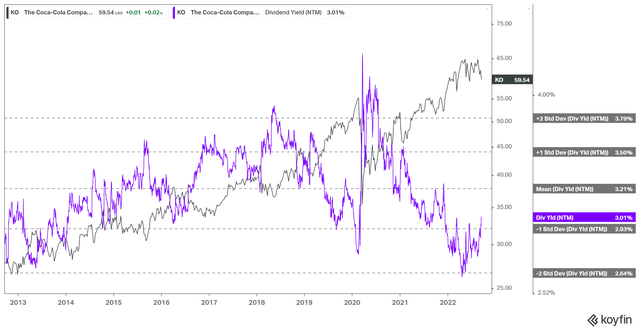

KO NTM Dividend yield % valuation trend (koyfin)

Furthermore, KO’s NTM dividend yield remains markedly below its 10Y mean, as seen above. While it has improved from its April lows, we believe that further digestion is necessary to lift the potential for KO’s outperformance moving ahead.

Coco-Cola Will Not Be Immune To Macro Headwinds

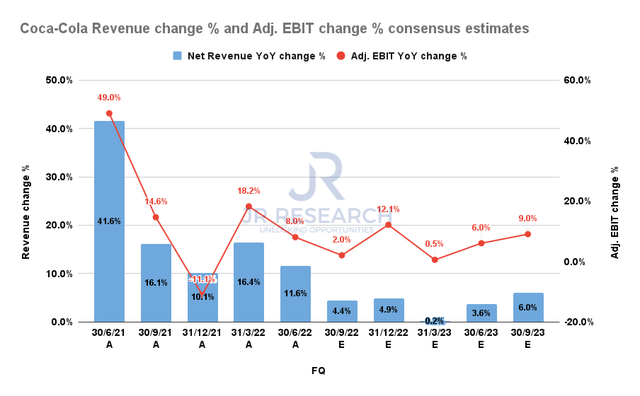

Coca-Cola revenue change % and adjusted EBIT change % consensus estimates (S&P Cap IQ)

The company has been able to weather the macro headwinds resiliently in H1. However, even the bullish consensus estimates suggest that Cola-Cola will not be immune to worsening macroeconomic pressure as the global economy slows further. Therefore, the specter of a global recession is looking increasingly likely, as the World Bank warned in a recent report. It accentuated:

The global economy may face a recession next year caused by an aggressive wave of policy tightening that could yet prove inadequate to temper inflation. Policymakers around the world are rolling back monetary and fiscal support at a degree of synchronization not seen in half a century. That sets off larger-than-envisioned impacts in sapping financial conditions and deepening the global growth slowdown. – Bloomberg

Therefore, we believe KO investors need to consider the impact on its global operations, with added headwinds from the incredible strength of the USD. Given the expensive valuations of KO currently, we surmise that the market has yet to digest worsening global headwinds fully. As such, KO investors should be prepared for further downside volatility, as the market could adjust their expectations of KO’s valuation multiples to reflect these challenges.

KO’s Dividend Looks Secure

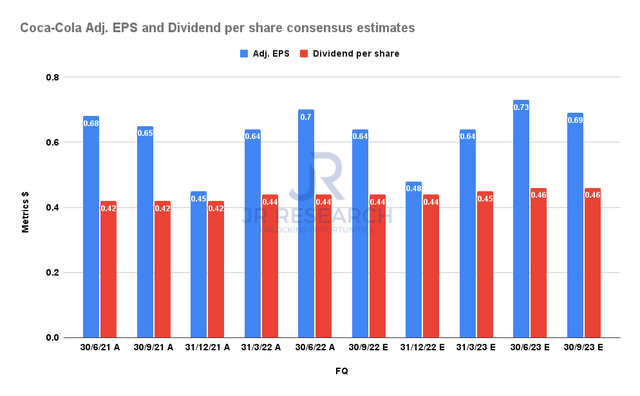

Coco-Cola adjusted EPS and Dividend per share consensus estimates (S&P Cap IQ)

Notwithstanding, its dividends look secure through FY23, given its relatively prudent payout ratios. Therefore, we don’t see a structural impact on its distribution strategy.

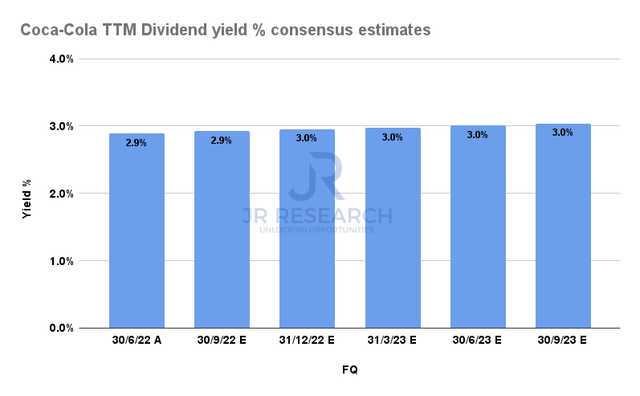

KO NTM Dividend yield % consensus estimates (S&P Cap IQ)

As such, its NTM dividend yield of 3% should continue to underpin its valuations. However, we presented earlier that it doesn’t seem attractive enough to accept the current yields, given intensifying global headwinds.

Is KO Stock A Buy, Sell, Or Hold?

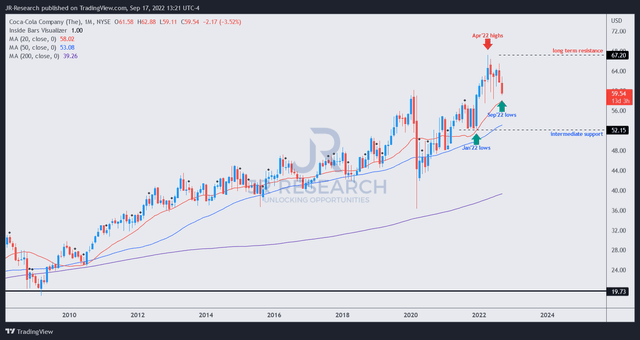

KO price chart (monthly) (TradingView)

KO’s robust long-term uptrend indicates the market’s confidence in its business strategy, competitive moat, and management’s execution. However, we believe the digestion from its April highs is still in progress, given its still expensive valuations.

Notwithstanding, it appears to be forming a potential near-term bottom, given oversold technicals. Hence, KO investors considering cutting exposure could wait for a rally first.

As such, we revise our rating on KO from Sell to Hold.

Be the first to comment