Eoneren/E+ via Getty Images

Investment Thesis

Demand for cloud computing services increased throughout the COVID-19 pandemic and is unlikely to decrease as work, education, and social activities shifted to digital experiences. Given the technology’s great development potential, cloud computing is one of the areas of focus for a number of well-established corporations and start-ups. According to Business Wire, the worldwide cloud computing industry is anticipated to grow from $445.3 billion in 2021 to $947.3 billion by 2026, at a compound annual growth rate of 16.3%, far faster than the projected US GDP growth rate over the same period. Some of this megatrend’s main drivers are organizations’ proclivity toward automation, the requirement for improved customer experience, and the surge in demand for remote workplaces.

In this article, I will review the Global X Cloud Computing ETF (NYSEARCA:CLOU), which invests in a basket of cloud computing companies.

Strategy Details

The Global X Cloud Computing ETF tracks the Indxx Global Cloud Computing Index. This index invests in companies positioned to benefit from the increased adoption of cloud computing technology, including companies whose principal business is in offering computing Software-as-a-Service, Platform-as-a-Service, and Infrastructure-as-a-Service.

If you want to learn more about the strategy, please click here.

Portfolio Composition

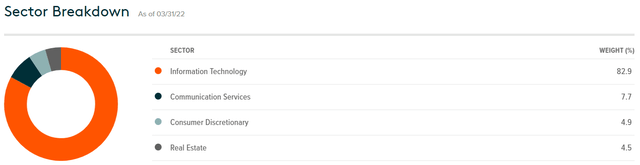

From the sector allocation chart below, we can see the index places a high weight on the Information Technology sector (representing around 83% of the index), followed by Communication Services (accounting for 8% of total assets) and Consumer Discretionary stocks (representing around 5% of the portfolio). The three largest sectors have a combined allocation of approximately 96%. Unsurprisingly, the strategy is tilted towards tech stocks. These stocks generally have high betas, thus I think it is important to see if you are comfortable with a higher level of volatility before purchasing CLOU.

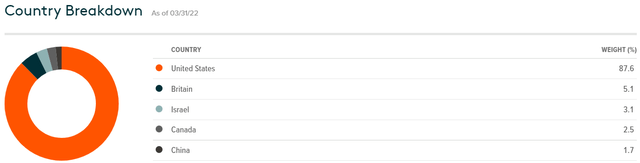

In terms of geographical allocation, the top five countries represent 100% of the portfolio. The US accounts for 88% of assets, whereas other countries such as China, which are catching up fast to the technology, seem to be underrepresented (only a 2% allocation to China).

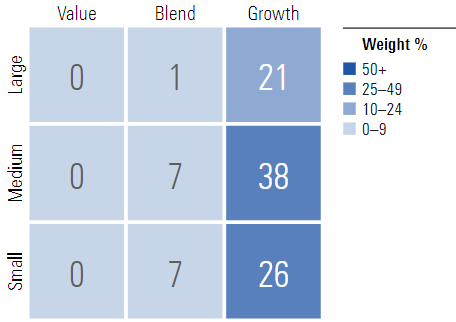

CLOU invests over 38% of the funds into mid-cap growth issuers, characterized as mid-sized companies where growth characteristics predominate. Mid-cap issuers are generally defined as companies with a market capitalization between $2 billion and $8 billion. The second-largest allocation is small-cap growth equities. Unsurprisingly, CLOU allocates approximately 85% of the funds to growth stocks, with a tilt towards small and medium-cap issuers.

Morningstar

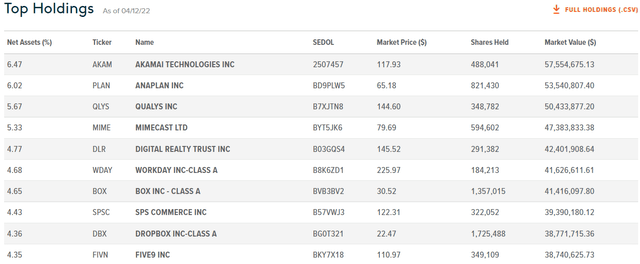

The fund is currently invested in 34 different stocks. The top ten holdings account for 51% of the portfolio, with no single stock weighting more than 7%. CLOU is concentrated and a few names are likely to drive future returns. If you are looking for more diversification, the WisdomTree Cloud Computing ETF (WCLD) is a better choice, in my opinion.

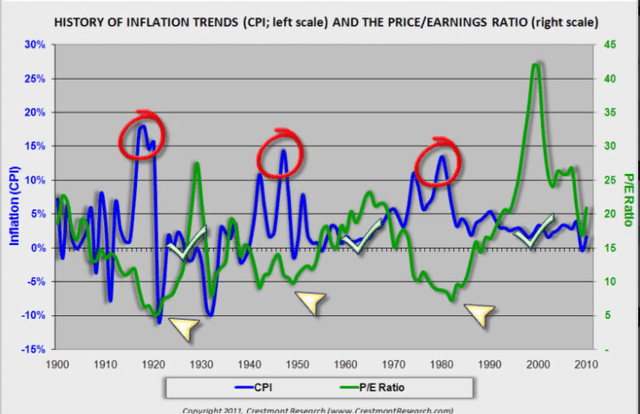

Since we are dealing with equities, one important characteristic is the portfolio’s valuation. According to Global X ETFs, the fund currently trades at a forward average price-to-book ratio of 6 and a forward average price-to-earnings ratio of ~52. These are asset-light businesses that generally earn a high return on capital, which is one of the popular explanations for lofty valuations. As a result, I am not surprised that CLOU trades at more than 5x book value. Having said that, I believe the current tightening cycle will harm high multiple equities the most. At the same time, we have record-high inflation, which is negatively correlated to P/E ratios. In other words, when the CPI is above 5%, stocks generally trade below 15x earnings.

Is This ETF Right For Me?

I have compared the price performance of CLOU against the Invesco QQQ ETF (NYSEARCA:QQQ) and the WisdomTree Cloud Computing ETF over the last 2.5 years to assess which one was a better investment. Over that period, QQQ outperformed both cloud strategies. It is interesting to see that most of QQQ’s outperformance came on the back of a brutal drawdown for cloud stocks since Q4 2021. In my opinion, the recent pullback shows some of the perils associated with investing in high multiple stocks.

To put CLOU’s performance into perspective, a $100 investment in CLOU at its inception would now be worth ~$135.48. This represents a compound annual growth rate of ~13%, which is a good absolute return. That said, I don’t think that past returns are a good indicator of future returns, especially in CLOU’s case, as we are now entering a new monetary regime where liquidity will become scarce.

Key Takeaways

In my opinion, the technology sector, particularly cloud computing, will continue to develop rapidly. CLOU gives investors access to a portfolio of fast-growing international firms largely focused on cloud software and services. While I am confident that cloud computing is here to stay, I believe it is difficult to predict today’s winners. Furthermore, cloud stocks trade at high multiples going into a new monetary regime where liquidity will be inadequate to sustain such valuations. All in all, I believe patient investors will be able to pick up CLOU shares cheaper in the next 12 months.

Be the first to comment