everythingpossible

Overview

I recommend buying Clearwater Analytics (NYSE:CWAN). The investment accounting industry has been strained by the need to increase speed and accuracy while lowering costs, the proliferation of complex alternative assets, and the global nature of holdings. Clearwater’s purpose-built single instance platform offers a solution to these problems by providing clients with real-time information about their holdings and by utilizing machine learning, automation, and direct connections with custodians, managers, and exchanges.

Business description

Clearwater’s cloud-native software streamlines investment accounting processes for customers so they can allocate more time and resources to strategic initiatives. They provide accounting, data, advanced analytics, and individualized reporting for global investment assets on their platform. (Refer to the annual report for more details).

The investment world is governed by a complex network of compliance and regulations

Financial reporting and analysis are CWAN’s bread and butter. In the years leading up to the subprime mortgage crisis of 2008, investors stuck to a relatively small group of asset classes that were easily monitored by dated computer systems and manual procedures. The manual and disjointed nature of the investment accounting industry has been strained and broken over the years by a number of problems. Among these new phenomena are the pressures to increase speed and accuracy while lowering costs, the proliferation of complex alternative assets, and the increasingly globalized nature of holdings.

In light of these shifts, I think asset owners and asset managers need to insist on a more global, integrated approach to portfolio construction. Despite the obviousness of the trend, these businesses’ initial responses included buying products that were specific to asset classes, countries, and reporting regimes, increasing headcount in accounting and compliance. Slow, expensive, rigid, and inconsistent investment accounting processes were the direct result of these practices, leading to routinely erroneous data and reporting. In my opinion, the purpose-built, single-instance platform that CWAN offers its clients is the best way to meet their dynamic requirements.

The pressure is coming not only from regulators, who want to avoid a repeat of the 2008 crisis, but also from investors. Investors seek the most accurate and comprehensive investment information and portfolio transparency so that they can optimally allocate capital, monitor risks, and evaluate returns. The need for openness regarding investment holdings has become more apparent in light of the recent emphasis on environmental, social, and governance [ESG] compliance. Reason being investors desire a means of gauging how well companies are doing in terms of ESG goals. Therefore, asset owners and asset managers need up-to-the-moment data on their holdings for risk management and to satisfy stakeholder expectations.

CWAN offers a comprehensive platform

In my opinion, CWAN is already superior to many available point solutions because it is a unified system. The CWAN platform was developed specifically for it and is hosted in the cloud (i.e., SaaS). The significance lies in the fact that the single-instance, multi-tenant architecture facilitates efficient upgrades and new module rollouts to meet the ever-evolving requirements and regulations of the industry. Any and all updates and enhancements are made available to users everywhere. This means that CWAN has a structural cost advantage over legacy incumbents due to its more efficient R&D spend per dollar. If CWAN wants to, they can pass on these savings to clients, who will benefit from price reductions as a result of these efficiencies.

In addition, CWAN’s platform offers asset managers in-depth views and robust analytics on their investment data. Clients gain a birds eye view of their entire investment portfolios in a comprehensive and accurate manner, as well as the adaptability to meet the reporting challenges posed by varying regulatory regimes. As investors, we know how important it is to have a complete picture of our holdings; asset managers are the same way, except they have a much larger number of assets in more locations around the world.

In addition, users of CWAN no longer have to manually process and reconcile data from disparate systems and sources. The CWAN platform utilizes machine learning, automation, and direct connections with roughly 1,000 custodians, over 1,000 managers, over 200 trading data sources, and all of the leading third-party market data providers to automate the aggregation, reconciliation, and validation of data for each security in clients’ investment portfolios (as per the prospectus). In my opinion, this is a huge benefit because it enables CWAN to provide its clients with data from a “Golden Copy” that is trustworthy, verifiable, and trackable.

At the end of the day, the most important aspect of CWAN is that it allows clients to see their portfolios in a transparent, on-demand, and customizable way from any device, at any time, and in any place. While this may not seem important to the average investor, it is crucial for an asset manager to have constant access to key performance indicators.

CWAN enjoys a strong network effect as it scales

Each new customer CWAN adds to its roster helps to enrich the global data set. The firm routinely processes and verifies all aspects of its clients’ investment securities, centralizing all of their investment information in one place. Since this helps CWAN find and fix data inconsistencies that could otherwise lead to errors and losses in investment portfolios, it has significant positive spillover effects for other clients. The ability to identify and rectify such problems is crucial, as it saves customers the trouble and expense of starting over. In addition, if the software can detect and fix errors without user intervention, customers are more likely to be satisfied.

In addition, CWAN’s offering is constantly at the forefront of innovation because of the analytical requirements of their customers. As I mentioned before, the CWAN single-instance, multi-tenant platform allows them to make the most of these advancements by making all of the new Clearwater features and functions tailored to the needs of any client instantly accessible to all Clearwater users. In this way, all of Clearwater’s customers share in the advantages afforded by the company’s extensive holdings and the diversity of its customers’ wants and needs.

All of these things give Clearwater a big advantage over the other companies, in my opinion.

Forecast

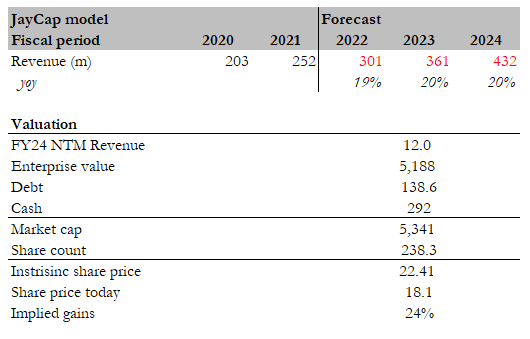

Based on my investment thesis, I expect CWAN to continue growing at a healthy rate, as it has in the past. I used management guidance in FY22. As anyone can imagine, the asset management world is extremely huge, so there should be no issues for CWAN to continue capturing dollar share by capturing new clients or increasing monetization. I expect CWAN to generate $430 million in revenue in FY24. Assuming CWAN does that and trades at the same forward revenue multiple as today, it should be worth $22.41.

Author’s estimates

Key risk

Highly competitive industry

The competition is fierce in the market for financial applications and services. In addition, the market is extremely segmented, with many companies catering to only niche subsets of customers. Firms like SS&C (SSNC), State Street (STT), SAP (SAP), BNY Mellon (BK), Grupo Simec (SIM), BlackRock (BLK), and Fidelity National Information Services (FIS) are just some of the companies that CWAN faces competition from. When compared to other options, including in-house solutions, CWAN is a strong contender. That said, CWAN runs the risk of rapidly losing market share unless it rapidly innovates.

Valuation is not cheap

Presently, the market values CWAN at a multiple of nearly 12 times its expected future revenues. CWAN’s continued trading near its pre-rate hike levels indicates that the market has priced in a great deal of expectation, given that many software companies have been rerated downward in the last six months as interest rates have risen. If CWAN is unable to achieve the predicted results, it won’t be a happy ending.

Conclusion

CWAN is undervalued. Clearwater Analytics offers cloud-native software that streamlines investment accounting processes for its customers. The platform provides accounting, data, advanced analytics, and individualized reporting for global investment assets. The platform offers asset managers in-depth views and robust analytics on their investment data. Users no longer have to manually process and reconcile data from different systems and sources, allowing for more time and resources to be allocated to strategic initiatives.

Be the first to comment