David Tran/iStock Editorial via Getty Images

A Quick Take On Clear Secure

Clear Secure (NYSE:YOU) went public in June 2021, raising approximately $409 million in gross proceeds from an IPO that priced at $31.00 per share.

The firm provides identity management security technologies to organizations responsible for venues located in North America and other regions.

YOU certainly shows promise in the period ahead, but the company needs to produce better operating results before the stock gets a thumbs-up from me.

I’m on Hold for YOU in the near-term, but mindful of its potential for stock appreciation in the quarters ahead.

Clear Secure Overview

New York-based Clear Secure was founded to create a security platform enabling subscribers to demonstrate their identity and receive faster or more convenient access to venues and transportation systems in the U.S. and the broader Americas region.

Management is headed by Chair and CEO Caryn Seidman-Becker, who has been with the firm since 2010 and was previously founder of Arience Capital and managing director at Iridian Asset Management.

The company’s primary offerings include:

-

CLEAR – venue access subscription service

-

CLEAR Plus – CLEAR plus aviation system access subscription service

-

Health Pass – health identity connected to digital health credential

-

Atlas Certified – professional license verification

The firm has focused its direct sales & marketing efforts on U.S. airports, stadiums, major venues and enterprises.

As of May 31, 2021, it counted 38 airports, 26 sports and entertainment venues and 67 Health Pass-enabled partners and events for 100 unique locations as well as numerous offices, theaters, casinos, theme parks and restaurants.

More recently, the airport count has risen to 43 served.

Clear Secure’s Market & Competition

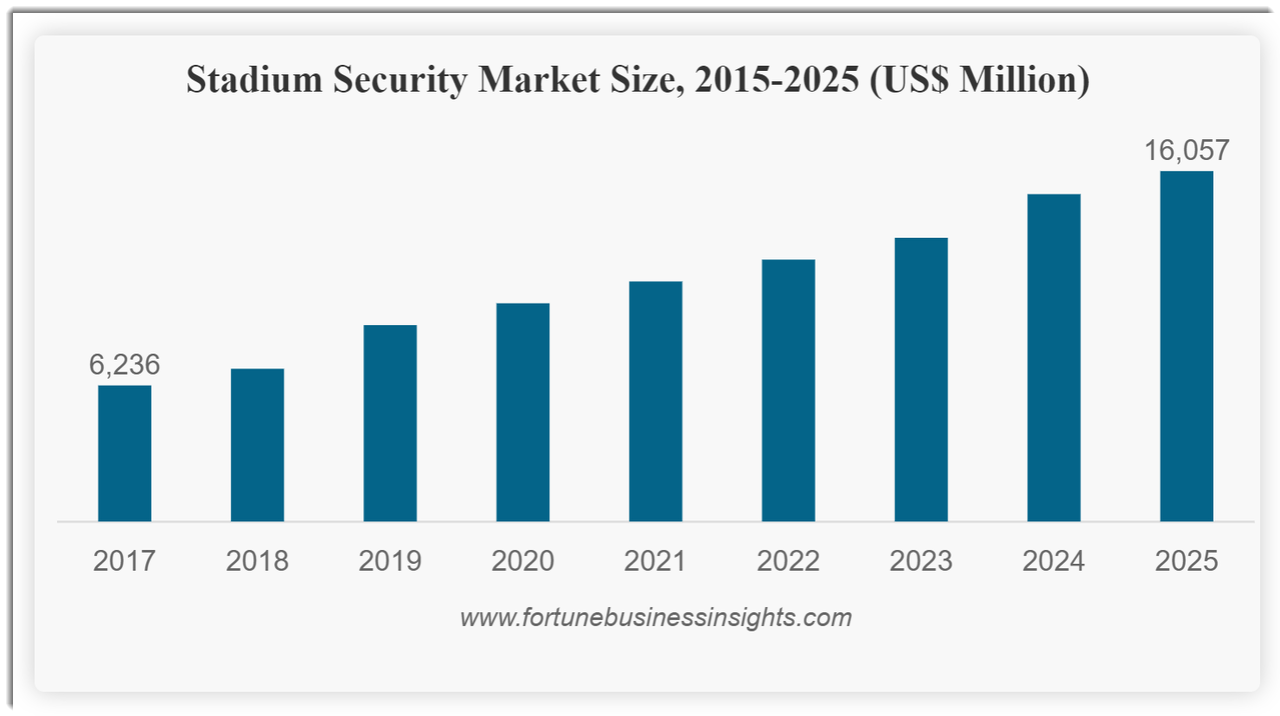

According to a 2018 market research report by Fortune Business Insights, the global stadium security market was an estimated $6.2 billion in 2017 and is forecast to reach $16 billion by 2025.

This represents a forecast CAGR of 12.8% from 2018 to 2025.

The main drivers for this expected growth are a rise in terrorist threat scenarios as well as a need to handle large crowds in a safe manner.

Also, stadium and venue owners are seeking advanced security measures as more options become available.

Below is a chart showing the stadium security market historical and forecast growth trajectory:

Stadium Security Market (Fortune Business Insights)

Notably, the software & services segment was expected to grow at the fastest rate through 2025.

Major competitive or other industry participants include:

-

Telos Identity

-

Idemia Identity & Security

-

Avigilon

-

AxxonSoft

-

BOSCH Security Systems

-

Honeywell International

The company operates in other markets, including professional license and certification verification and airport security.

Clear Secure’s Recent Financial Performance

-

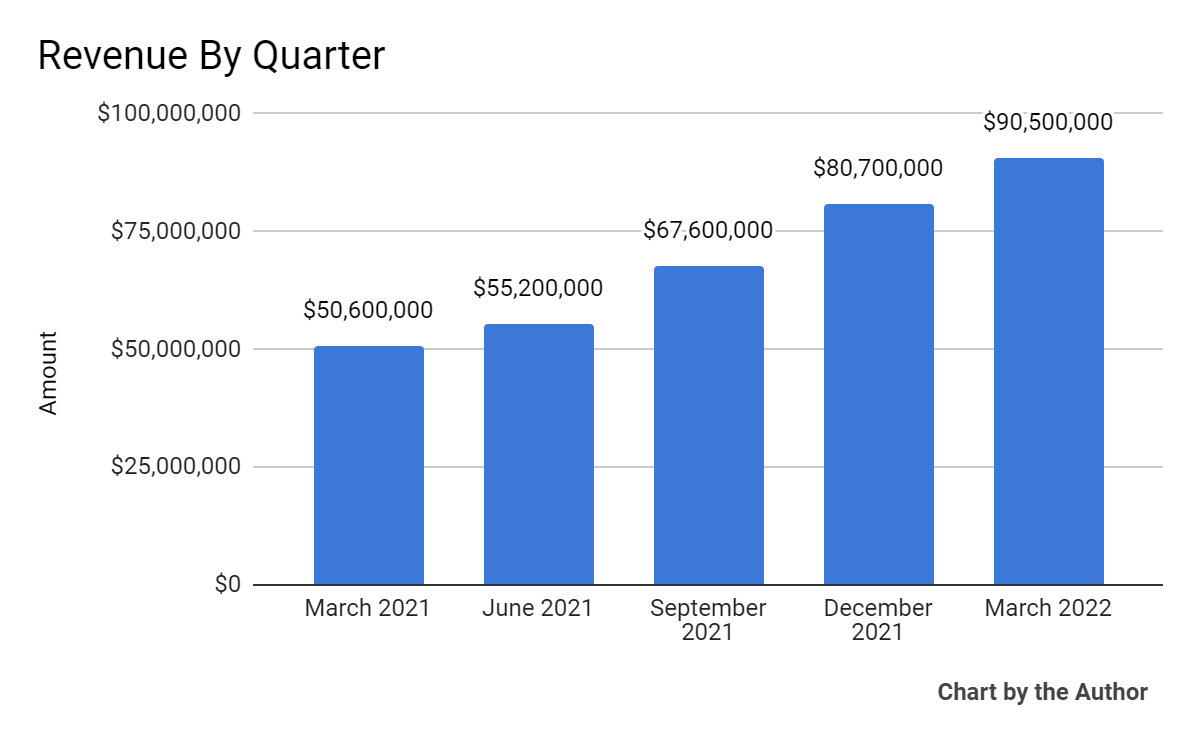

Total revenue by quarter has grown considerably over the past 5 quarters:

5 Quarter Total Revenue (Seeking Alpha)

-

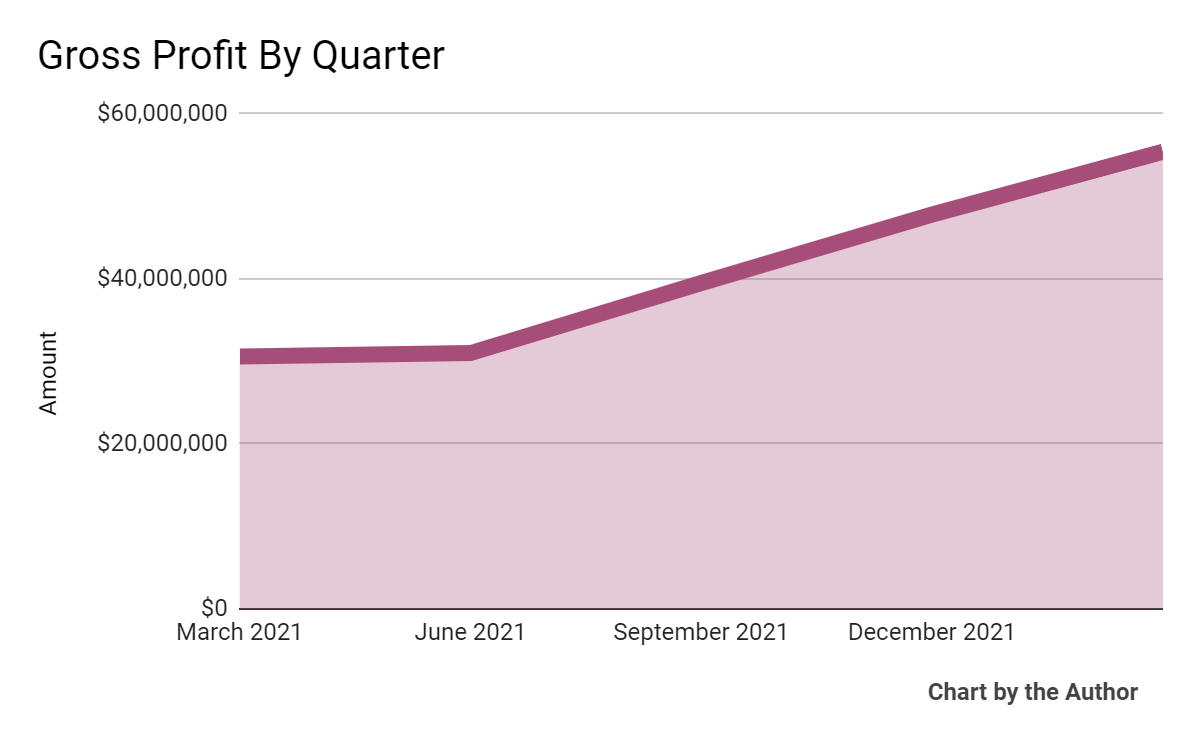

Gross profit by quarter has also grown markedly over the same period:

5 Quarter Gross Profit (Seeking Alpha)

-

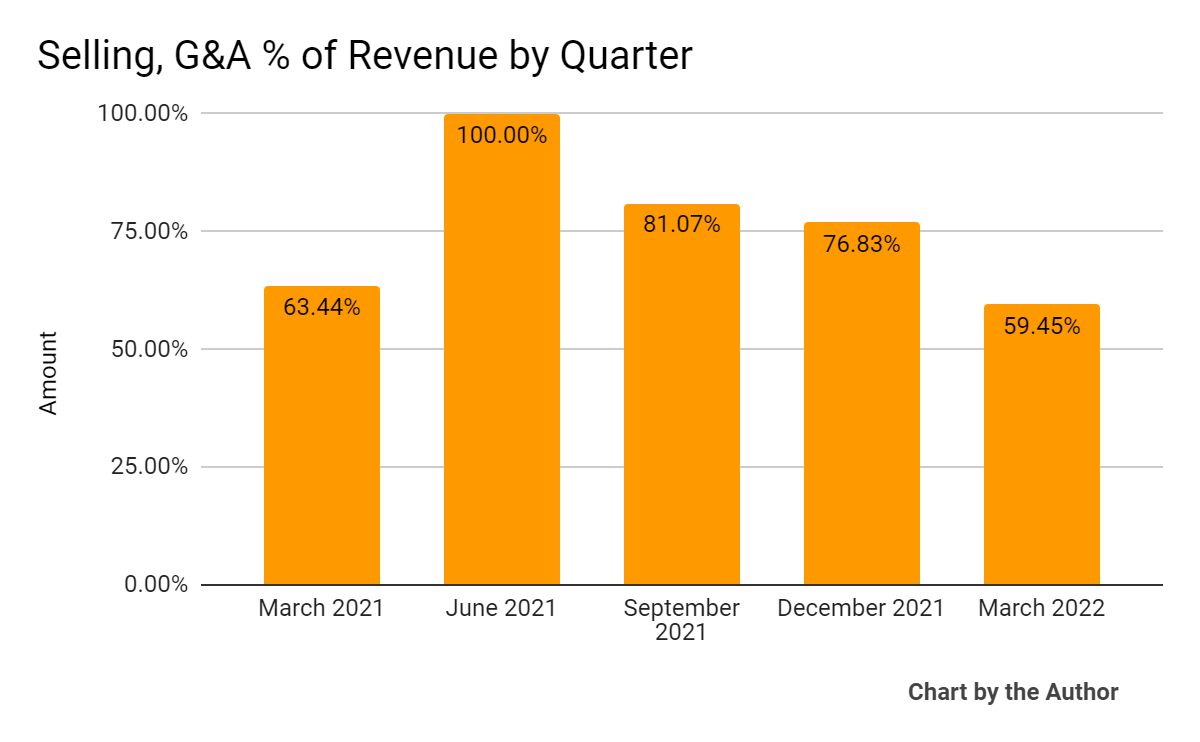

Selling, G&A expenses as a percentage of total revenue by quarter have trended lower in recent quarters:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

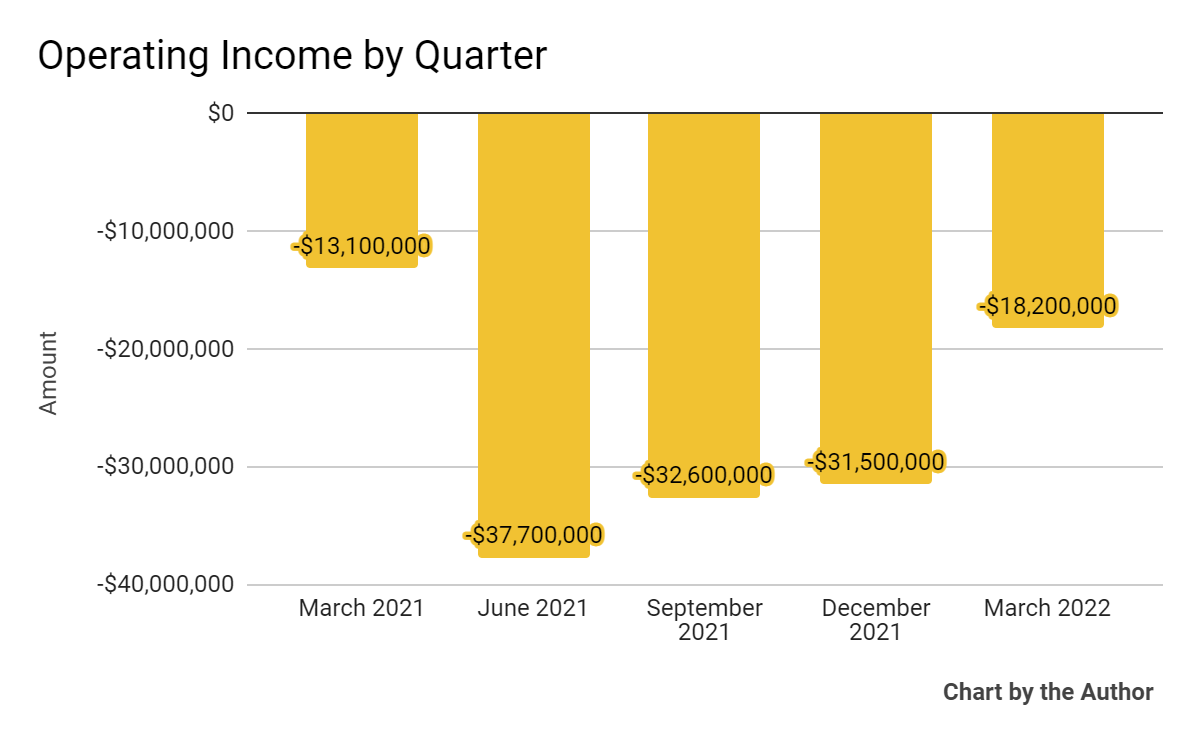

Operating losses by quarter have remained substantial:

5 Quarter Operating Income (Seeking Alpha)

-

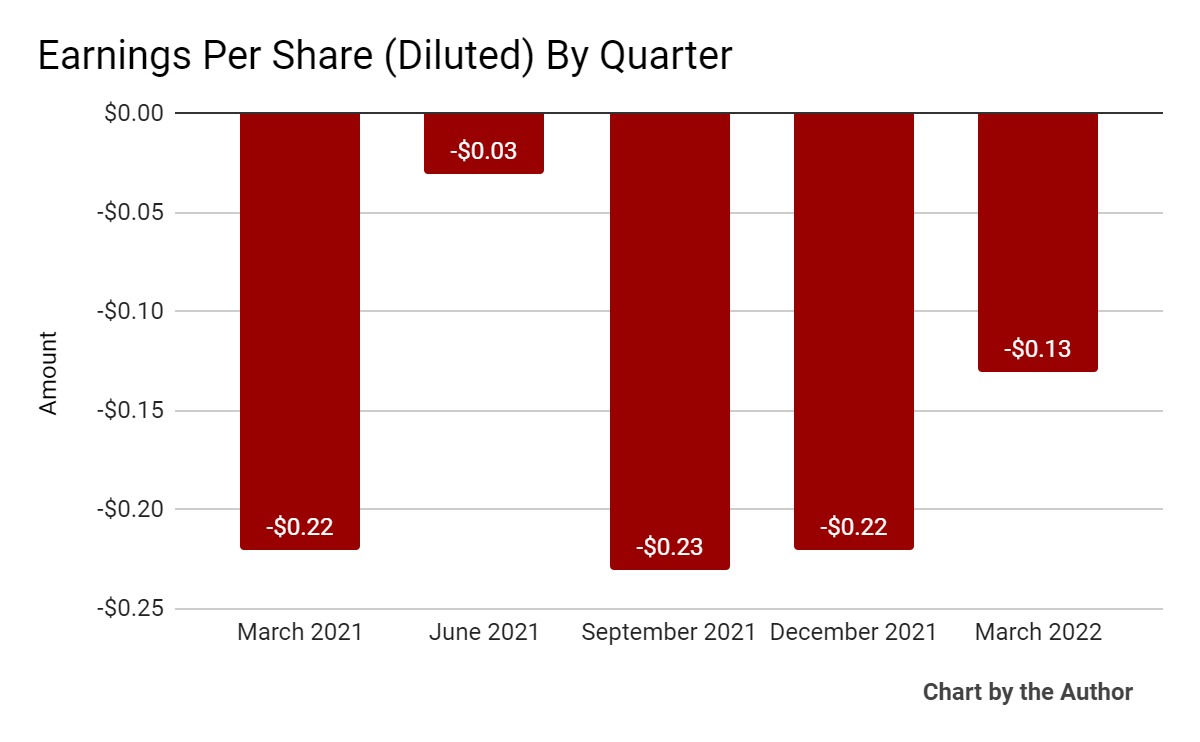

Earnings per share (Diluted) have also remained negative in the past 5-quarter period:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

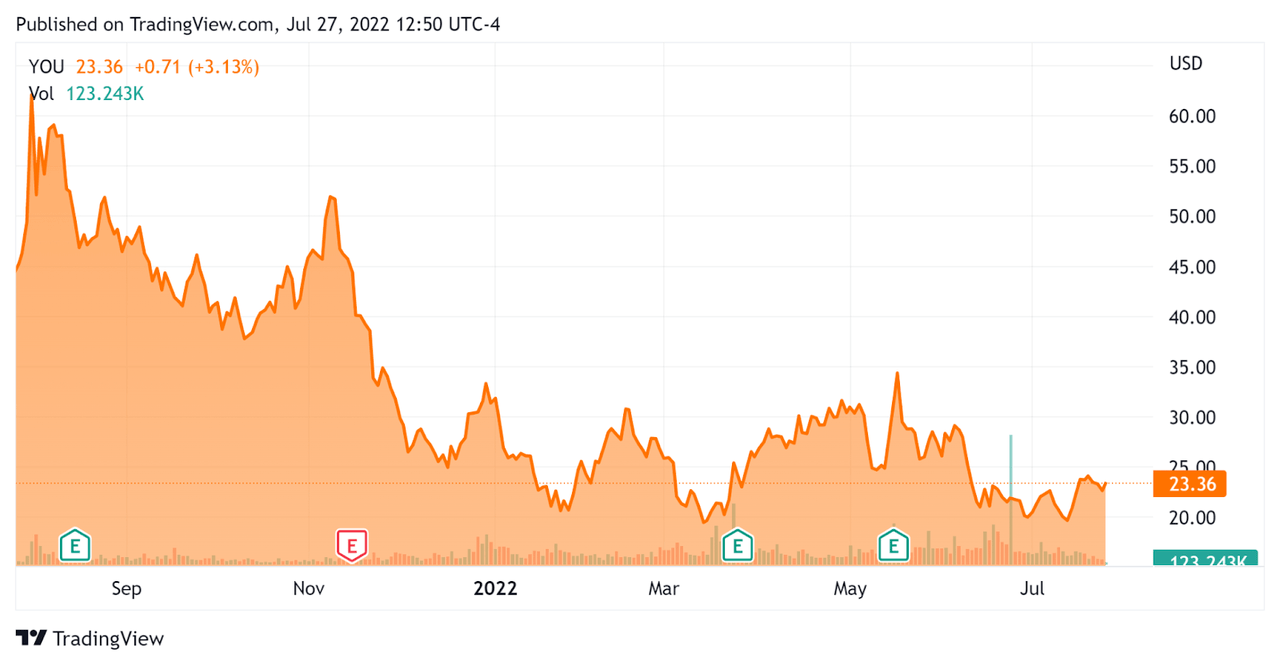

In the past 12 months, YOU’s stock price has dropped 47.4 percent vs. the U.S. S&P 500 index’s fall of around 9.6 percent, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Clear Secure

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Enterprise Value |

$1,450,000,000 |

|

Market Capitalization |

$3,390,000,000 |

|

Enterprise Value / Sales [TTM] |

4.94 |

|

Price / Sales [TTM] |

6.27 |

|

Revenue Growth Rate [TTM] |

33.57% |

|

Operating Cash Flow [TTM] |

$94,970,000 |

|

CapEx Ratio (Op C.F./CapEx) |

3.82 |

|

Earnings Per Share (Fully Diluted) |

-$0.61 |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

YOU’s most recent GAAP Rule of 40 calculation was negative (5%) as of Q1 2022, so the firm needs significant improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

34% |

|

GAAP EBITDA % |

-38% |

|

Total |

-5% |

(Source – Seeking Alpha)

Commentary On Clear Secure

In its last earnings call (Source – Seeking Alpha), covering Q1 2022’s results, management highlighted the return of strong travel demand post-pandemic as contributing to its growth.

Trial conversion rates have recently achieved record levels, and the company sees more of its membership utilizing its family plan capabilities as families have begun to travel in greater numbers.

Net member retention reached 95.3% during the quarter, well above its historical average in the upper 80s percentage.

The company is preparing to launch its integration with TSA PreCheck capabilities.

As to its financial results, Q1 revenue was up 79% year-over-year and the company generated approximately $20 million of free cash flow as it continues to generate free cash flow over several years.

Operating losses were reduced in Q1, indicating that the company has some operating leverage that may put it on a path toward operating breakeven.

For the balance sheet, the firm finished the quarter with cash and equivalents of $663 million, so the company has ample resources for its needs.

The board announced a $100 million share repurchase program, which should provide a meaningful floor to the stock in the near term.

Looking ahead, for Q2, management guided revenue of $100 million at the midpoint of the range, which, if achieved, would be a meaningful milestone for the company.

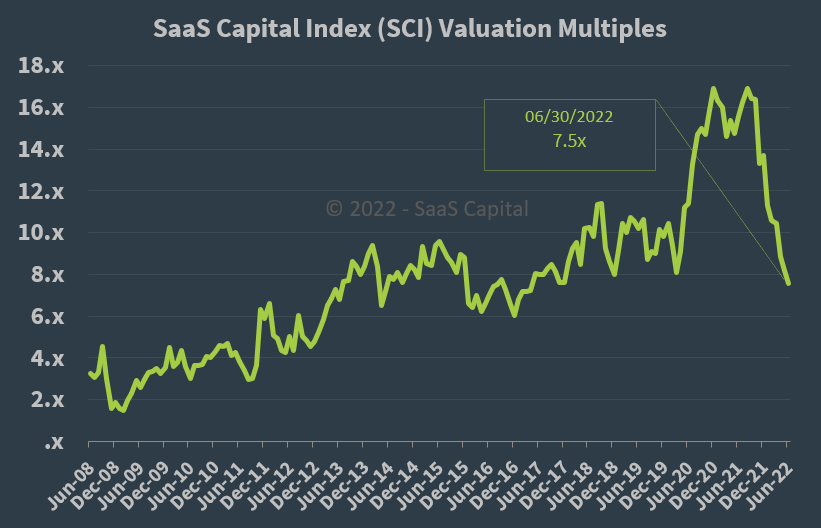

Regarding valuation, the market is currently valuing YOU at an EV/Revenue multiple of around 5x.

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 7.5x at June 30, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, YOU is currently valued by the market at a discount to the SaaS Capital Index, at least as of June 30, 2022.

The primary risk to the company’s outlook is a potential macroeconomic slowdown or recession, which may slow consumer travel growth and reduce its revenue growth estimates.

A potential upside catalyst to the stock could include an upcoming launch of its integration with TSA PreCheck and other new product launches in the works.

Clear Secure looks well positioned to take advantage of new product launches, a return of the general public to significantly higher travel activity, while the stock appears reasonably priced from a revenue multiple valuation.

The issue management has to show results on is getting the firm’s operating losses down, with a clear path to operating breakeven.

In a rising cost of capital environment, technology companies with substantial operating losses have been severely punished by the market.

So, while YOU certainly shows promise ahead of it, the company needs to produce better operating results before the stock gets a thumbs-up from me.

I’m on Hold for YOU in the near-term, but mindful of its potential for stock appreciation in the quarters ahead.

Be the first to comment