Scott Olson

It might seem counterintuitive to suggest a chain of fast casual restaurants fully exposed to food price inflation and whose most popular menu option is a chicken burrito bowl be used as an inflation hedge. But hear me out. Shares of Newport Beach-based Chipotle Mexican Grill (NYSE:CMG) have held up extremely well in a market whose most extreme gyrations in prices for the last 6 months have been dictated by monthly inflation numbers.

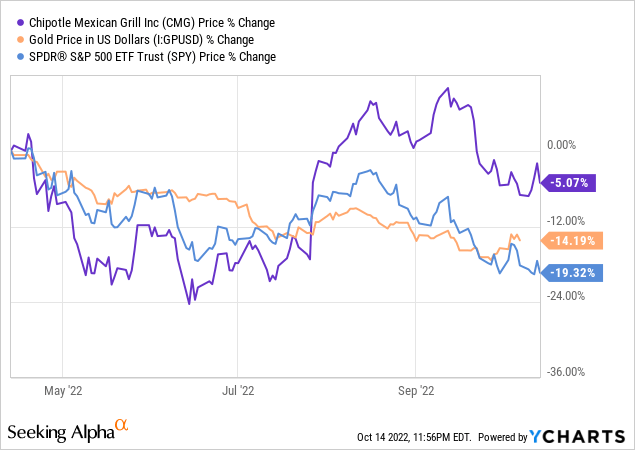

The company has outperformed both gold and the S&P 500 over the last 6 months as inflation remained at elevated levels and a hawkish Fed in its response sapped liquidity out of the market with a series of consecutive interest rate hikes. The reasons for Chipotle’s relatively strong performance are multifaceted but all predominantly centre on the company’s strong brand and premium valuation.

It’s The Burritos, Stupid

Chipotle’s chicken burrito bowl is made up of chicken with rice, beans or fajita veggies, and topped with guac, salsa, queso blanco, sour cream or cheese. Most of these ingredients have realized strong price accruals with rice up 15% year-to-date, avocado reaching a 24-year high back in March, and chicken up 13% year-over-year in August. Variable cost factors like this and labour drive a significant amount of Chipotle’s cost base and overall sales momentum. Hence, when the company reported fiscal 2022 second quarter earnings most were expecting some margin deterioration or sales slowdown.

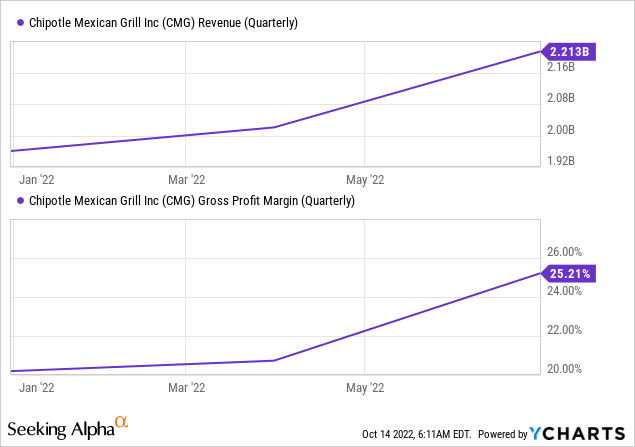

The company reported a restaurant level operating margin of 25.2%, an increase of 70 basis points over the year-ago quarter. This was against sales for the quarter which grew to reach $2.2 billion, a 17% increase from the year-ago quarter but a $32.7 million miss on consensus estimates. This was driven by a 10.1% increase in comparable restaurant sales. Growth in the company’s revenue mix also remained healthy with in-restaurant sales growing by 36%.

Digital sales, capturing revenue generated through Chipotle’s website, app, and third-party delivery channels, also saw strong growth. Management stated this division is now tracking towards $3.5 billion in sales with 29 million reward members. Chipotle has been able to data mine its members to extract insights to influence behaviour and drive greater sales frequency. Other innovative methods have been used by management to increase sales with the company partnering with Roblox (RBLX) to launch Burrito Builder on National Burrito Day and award rewards to thousands of players.

The growth and viscosity of digital sales have formed a significant part of the long base as it helps the company grow sales at a lower cost than it otherwise would have been able to. When combined with Chipotle’s strong marketing acumen and brand image, we get the base reasons the company has been able to better weather the market pullback of the last few months.

Adjusted diluted EPS rose to $9.30, a 25% growth over the year-ago quarter with cash generated by operations coming in at $286.8 million. With capital expenditure at around $100 million during the quarter, free cash flow was $186.8 million. This is as the company continues to expand its restaurant footprint with the addition of 42 new restaurants, which included 32 drive-thru Chipotlanes.

The company’s sticky premium valuation has been another reason the stock has held up even amidst the broader market carnage. Indeed, its price to trailing 12-month sales of 5.37x is almost 600% higher than its sector average of 0.77x. Its price to forward GAAP earnings of 47.83x is 283% higher than its sector average of 12.48x. Fundamentally, the extent to which Chipotle will be able to maintain its current trajectory will be dictated by the extent to which it remains expensive relative to its peers. Bears would be right to flag this as a huge downside risk. The deteriorating macro backdrop could very well see the US tipped into a prolonged recession next year, with inflation still high the Fed would be left stuck. Hence, 2023 holds the risk that Chipotle realizes a rerating of its shares as the risk and reward paradigm is now somewhat blurry.

Outperformance Likely On The Edge As A Recession

With inflation likely to be nearing a peak and forecasted by around 2.3% by the end of 2023, the broad macro pressure on the company should start to fall from the 2024 fiscal year. The next few quarters will be critical. The company instituted a 4% pricing increase across its menu in August to help offset incremental inflation pressures and most of these ingredients have already seen material retracements from their recent highs. The company also has no real competition in its market segment, its burritos are in extremely high demand, and its margins are set to remain healthy even against inflationary pressures.

The underlying bearish consensus could very well play out with the common shares rated at such a premium. But the likely outcome will be somewhere in the middle. Chipotle is a hold.

Be the first to comment