da-kuk

More of the same on housing

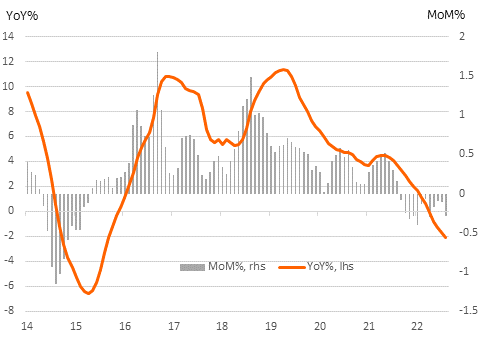

The slew of data for August released by China got off to a bad start with a 0.29% MoM decline in new home prices. This marks the 12th consecutive month-on-month decline in Chinese home prices and takes house price inflation down to -2.1%YoY. As a major pool of Chinese household wealth, this won’t help encourage spending. Residential property sales were not much better either, though at -30.3%YoY, they were at least marginally less bad than the July numbers (-31.4%YTD YoY). It will take some time for the pool of unfinished property construction projects to be completed with local government support for developers, and in turn, for Chinese households to consider investing in property in scale again. Consequently, these numbers are likely to remain a blot on the economic landscape for quite a while.

70-City Home Prices (CEIC)

Some better signs elsewhere

There were some more encouraging signs elsewhere, suggesting that the lockdowns in August as Covid cases spiked above 700 mid-month did not have such a big impact on activity, maybe helped through shorter, more focused restrictions.

The key standout was retail sales, which rose 5.4%YoY, up from 2.7% in July, beating the 3.3% consensus expectation. The growth in retail sales was most evident in the restaurant/catering section, an area normally hit hard by lockdowns. There was some reasonable growth in consumer goods too. And though high petroleum prices probably helped lift the spending total, automobile sales were also strongly up, helping to offset weakness in housing-related areas like furnishings, household electronics and construction materials. A slight fall in the surveyed unemployment rate, from 5.4% to 5.3%, may also have helped the retail sales figures to firm up.

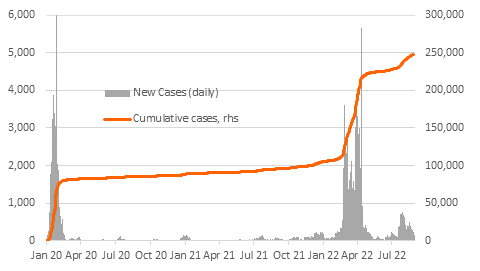

China’s Covid numbers continue to bubble along, with about 160 daily cases reported on average currently. And though the current trend is downwards, the risk of a renewed upsurge is never very far away. For now, though, this is a more encouraging sign.

Mainland China Covid Cases (CEIC)

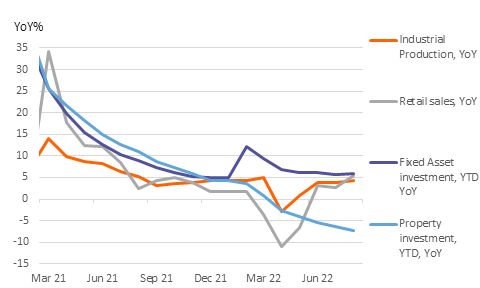

Other activity data little changed

Other activity series showed some marginal improvements. Industrial production grew by 4.2%YoY in August. That’s an improvement from 3.8% in July, but still weak by China’s normal standards. There was some improvement in manufacturing output, though it looks as if utilities (electricity etc.) may have played a role, which looks hard to reconcile with the power shortages reported at times in August due to the heatwave. The auto sector, reflecting the retail numbers, also experienced stronger growth in August.

Fixed asset investment delivered 5.8% growth, fractionally up from 5.7% in July. Infrastructure spending on transport and the environment stand out as some of the stronger-looking numbers in the breakdown by industry, with auto manufacturing also growing faster and adding to the message that cars are in the driving seat of a lot of today’s better data.

Today’s data were not enough to save the CNY from trading above USDCNY7.0, the first time it has done so since July 2020. We look for USDCNY to reach 7.05 by the end of this month.

China Activity Series (CEIC)

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment