Editor’s note: Seeking Alpha is proud to welcome Alessio Pace as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

fotografixx/E+ via Getty Images

Chewy (NYSE:CHWY) is a leading online retailer of pet food, treats, supply and medication in the United States. The company has an incredible focus on the customer satisfaction, famously delivering hand-crafted notes to customers that suffered the loss of their favorite pets when trying to return unopened food supply. This strive for customer excellence has definitely been one of the pillars of Chewy’s success, which managed to attract about 20.5 million active customers as per their latest Q2 2022 earnings release.

The company has seen staggering revenue growth since going public as well as early signs of reaching economy of scale; however, my thesis is that Chewy’s future will be one of slower growth primarily due to the limited number of untapped US households that has a pet and fierce competition. Let’s see more in detail why that is the case.

From boom to bust

Over the past few years, Chewy stock has experienced a real roller coaster of volatility. Once the COVID pandemic hit the world, the stock market quickly adjusted to the new trends, and Chewy was immediately elected to the pantheon of the so-called “stay at home” stocks, enjoying meteoric rises. From the depth of the COVID bottom (March 2020) to the zenith of the “Everything bubble” around February 2021, Chewy’s stock was pumped to an incredible high of around $118 per share, up over 355%. Unfortunately, from that moment onwards the story was much different and the stock deflated to much more normal levels, crashing to today’s value of about $33 per share for a staggering loss in value of about -72%. Despite the incredible losses Chewy still trades today for a relatively high valuation, making it a somewhat risky bet especially considering the wild uncertainties of today’s macro environment.

If we try to ignore the crazy stock movements and only focus on the business we would actually see a very upbeat story. Over the past 5 years, Chewy indeed grew revenue on an average clip of about 44% per year reaching quarterly sales of $2.43 billion in the last Q2 2022, an astounding growth for any type of retailer. Unfortunately, the same cannot be said about the company’s profitability: since becoming public in 2016, Chewy was never Net Income GAAP profitable, while also generating negative Free Cash Flow in each year except 2021, an exceptionally positive time considering the impact of COVID on consumer trends and the general overheating of anything related to e-commerce. Despite that, 2021 only saw a modest $8 million of free cash flow, basically, breakeven.

This should not hide the fact that every metric is actually trending in the right direction. Between 2018 and 2021, Chewy’s gross margin improved from 17.47% to 25.48% while net income margin improved from -16.07% to a much better looking -1.29%. This is a clear indication that Chewy is reaping benefits of economy of scale, which should meaningfully improve the business performance in the future assuming that there is still substantial market share to gain from either an expanding Total Addressable Market or simply by attracting more customers and performing better than competitors. The margin improvement is also a clear testimony of the success of Chewy in managing private labels and the launch of automated fulfilment centers, of which the company now owns and operates three. Both initiatives have helped the company lower costs over the years, which is reflected in the margin improvement.

The future might not be so favorable

My main concern with Chewy’s stock is a combination of a potential saturation of the available market plus a valuation that seems too optimistic even after seeing the stock price falling 72% from all-time highs.

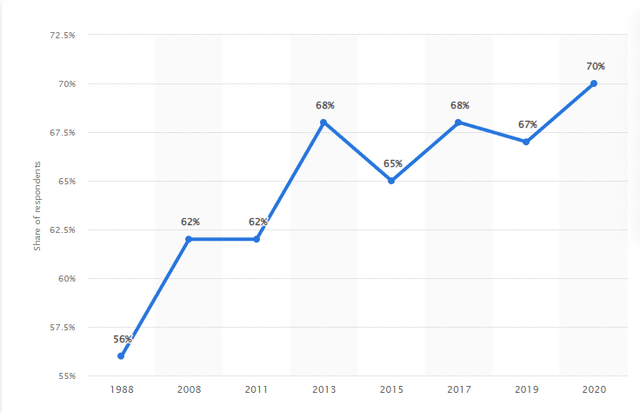

According to the American Pet Products Association, or APPA, 90.5 million families (or about 70% of total US households) own at least one pet. During the COVID pandemic a common narrative that also indubitably boosted Chewy’s stock price was that with so many people leaving the cramped city apartments for more convenient, working-from-home suburban houses, many more people would seek the comfort of having a new pet added to the family. Indeed the same survey conducted by APPA in 2019 showed that 67% of US households owned pets, which means that over the course of the pandemic there was a meaningful rise of pet adoptions. It is however worth mentioning that between 2008 and 2019 the number of US families that owned a pet increased only from 62% to 68%. The data clearly suggests we are approaching a saturation point, and that excluding one-off events such as a global pandemic the trend will probably stabilize for the future.

As mentioned at the beginning of the article, Chewy has already over 20 million active customers. If we factor in the main competitors, we can see how it won’t be easy at all to attract new customers forward. Petco (WOOF), which operates over 1,500 stores since the 1960s and is arguably Chewy’s main competitor, recently disclosed about 24.1 million active customers. BARK (BARK), a recent IPO focused on dog owners, claims to have 2.3 million subscriptions. The big elephant in the room, as it is often the case, might also be Amazon (AMZN). We cannot know for sure how many customers use Amazon for pet-related products but we can definitely assume that it is a meaningful number.

Overall it appears to me that the market seems somewhat saturated already. I would not bet my money on any meaningful expansion of the number of US households that own pets, hence the only way to improve the TAM for Chewy would be to steal market share from its competitors or open new adjacent businesses. Possible, but hard and expensive.

Pet ownership in US since 1988 to 2020 (Statista)

Chewy is indeed trying to expand into new businesses such as pet health, with the launch of the insurance CarePlus into 31 States in the US during this quarter. As highlighted by management in the latest shareholder letter, the initiative will have no financial impact in fiscal year 2022 but will play an increasingly important role for the future of customer retention and increase in TAM. This will be an endeavor to keep an eye on in 2023 and beyond, as it might help Chewy penetrate a new market which also carries much higher margins than the retail business.

Chewy valuation – expensive compared to peers

If the concerns of a saturated market overall were not enough, Chewy’s valuation currently is still quite rich. We are obviously very far from the astronomical valuations that the stock reached in 2021 at the peak of the bubble; however, current levels might not really indicate a positive risk-reward scenario.

Due to the company being unprofitable, there is no PE ratio to be used. The Price to Free Cash Flow is also currently useless as the company is reporting high CAPEX expenditures in an attempt to open new, automated fulfilment centers. In 2021, when Chewy managed to post positive free cash flow, the ratio was over 200, clearly distorted by the inflated stock price. On a price to sales ratio, the stock appears more reasonably priced at about 1.50. When comparing Chewy’s valuation to Petco, however, Chewy is currently trading at a clear premium. Petco currently is traded at about P/E of 33, P/S of 0.65 and P/FCF of around 90. And this is for a company that is well established, already profitable and with astonishingly better gross margins that Chewy (currently 41.79% vs. 26.70%).

The difference in gross margin is particularly worrying considering the macro environment we are experiencing. Inflation is seemingly unstoppable and is definitely starting to hurt discretionary spending: pet food is notoriously recession resistant given that no pet owner would let their furry friend starve; however, Chewy is actually starting to experience difficulty in moving high-dollar items from their inventory, usually linked to discretionary items such as toys and treats. A company with low gross margin such as Chewy is generally less protected from inflationary spikes, especially if direct competitors have much higher margins. For example, the difference in gross margin could indicate that Petco might decide to keep their prices steady or only marginally increase them below the general inflation. This would effectively lower both their gross and net margins, but it might also be an advantage as Chewy would be unable to do the same as they are currently still in growth mode, are net income negative, and the lower margin indicate they do not hold pricing power. This is effectively a position of weakness in which Chewy is currently entering uncertain times.

Key takeaway

Chewy was once a market darling while now many investors have apparently given up on the future for this e-commerce retailer. It is hard to criticize the business results in terms of margin improvement, customer satisfaction and revenue growth, however, the current valuation represents a risk that the stock might be further under pressure in the future.

Chewy appears at the moment more vulnerable to the macro environment than direct competitors while at the same time is trading at a premium price. For this reason, at present value, Chewy appears as an unfavorable bet, one which requires a combination of a very long time horizon and perfect execution from the management to pay off. Buying at current levels means being exposed to multiple risks coming from macro environment (inflation, raising interest rates) and a potential for margin compression due to higher customer acquisition costs (market saturation) as explained above. The bet might pay off in the long run if Chewy is successful in entering new businesses such as pet health, however, it is too early to say.

I will personally keep monitoring Chewy as they are definitely doing good, but will wait for fundamentals to materially improve (especially gross margins) or the valuations to fall substantially from current levels before considering to buy.

Be the first to comment