MBPROJEKT_Maciej_Bledowski

Russia’s invasion of Ukraine has changed everything. There now exists a near existential need for more diversified energy supplies against the prospect of Russia weaponising its gas pipelines to Europe against the stream of sanctions implemented to try to starve Russia’s war effort.

Texas-based Cheniere (NYSE:LNG) was the first US company to export liquified natural gas in 2016. The company is the largest producer of LNG in the United States and the second-largest producer globally. Hence, the global energy crisis which has seen EU natural gas spike to unprecedented levels has created a boom for Cheniere’s once lagging financials. To keep it simple, Cheniere is able to make outsized profits by selling comparatively cheap US natural gas to the more expensive global market.

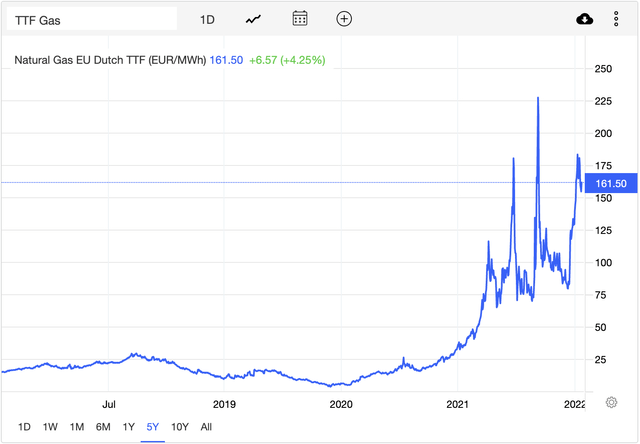

Indeed, EU natural gas futures currently trade around €160 per megawatt hour, up 348% year-over-year. There are unfortunate signs that the situation might worsen for the continent with winter approaching and the war soon entering its sixth month.

Such prices for natural gas ahead of the tight winter period are virtually unprecedented hence bears have made a strong argument that current conditions are abnormal and cannot possibly last. This spike in gas prices cannot possibly be conducive to healthy economies, and so a recession would be the natural consequence. This would indeed cause a significant pullback in natural gas prices and presents a salient risk for Cheniere bulls hoping the current heightened conditions remain for the long term.

Riding The Coming LNG Boom

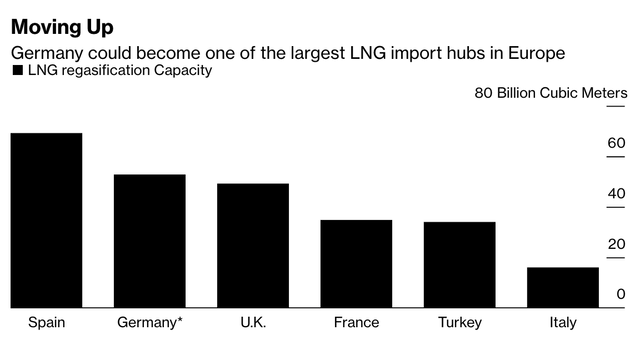

The bull case for Cheniere is built around permanency to the current abnormal conditions we have seen for natural gas prices. To be clear here, these conditions are terrible for the European and global economy and LNG presents a bitter pill for many European countries who resisted it for years. This is changing with Germany set to become an LNG powerhouse with plans to develop six new LNG terminals with many other European countries racing to do the same. The country is also advancing legislation that would reduce the time it takes to build a new LNG terminal from years to months.

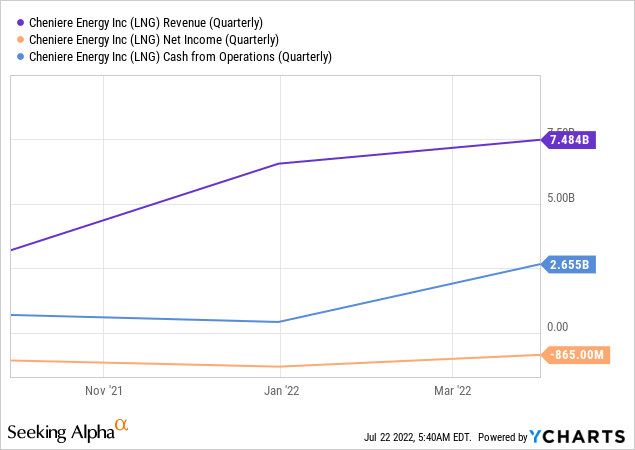

Hence, when Cheniere last released earnings for its fiscal 2022 first quarter, revenue came in at $7.48 billion. This was an increase of 142% from its year-ago figure and a beat of $1.92 billion on consensus estimates.

Whilst the company actually lost around $3.41 per share as a result of a non-cash derivative item, it generated $2.65 billion in cash flow from its operations. This was up from $1.06 billion in the comparable year-ago quarter with higher natural gas prices being the main driver of this growth. Capital expenditure during the quarter came in at $178 million, down $12 million from the year-ago period even as the company moves to expand capacity at its Corpus Christi LNG Terminal. The expansion project will see the addition of 10+ million tonnes per annum of LNG export capacity with the first deliveries to the global market set to start in 2025.

Management upwardly revised their consolidated EBITDA guidance for 2022 by 16.6% to $8.5 billion and also increased distributable cash flow guidance by 26% to $5.8 billion. With cash and equivalents on Cheniere’s balance sheet of $2.48 billion against long-term debt of $28.9 billion, the company’s enterprise value stands at $65.68 billion. This places its enterprise value to distributable cash flow multiple at 11.3x. Not quite cheap, but also not expensive.

Natural Gas Is Unlikely To Be Transitory For A While

Natural gas has been a silent unsung hero in lowering carbon emissions since the onset of the new millennium. Indeed, according to the U.S. Energy Information Administration, natural gas emits almost 50% less CO2 than coal and does not come with acid rain. This has driven many highly developed nations to start replacing their old coal-fired power stations with gas-fired power plants. For Europe, this feedstock would be provided mainly by pipelines from Russia.

Renewables are also intermittent, a feature that requires the use of another source of power for baseload generation. Hence, even with material investment in utility-scale battery storage, the perfect weather conditions for renewables to generate enough electricity to power the whole of Europe cannot possibly be reflected in perpetuity. Continued investment in renewables is important, but natural gas will form a part of European energy generation for decades. So even if Russia walks back on its invasion and cedes all territory back to Ukraine, the momentum is firmly behind LNG to drive European natural gas supply for the decades to come. This comes as Cheniere expands its gas export capacity to fully ride the boom. The company is likely one to consider for investors looking to take gain exposure to the expected growth of LNG in the years ahead.

Be the first to comment