Bill Pugliano/Hulton Archive via Getty Images

“Creativity is knowing how to hide your sources” – C.E.M

Today, we take our first in-depth look at Cricut, Inc. (NASDAQ:CRCT). A beneficial owner has been scarfing up shares as the stock has fallen substantially since debuting on the markets. Does this point to a rebound for the equity on the horizon? We attempt to answer that question via the analysis below.

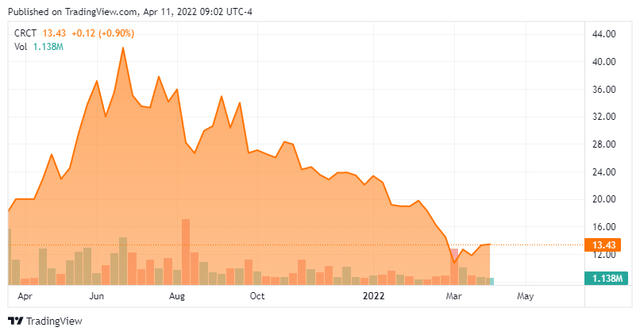

CRCT – Stock Chart (Seeking Alpha)

Company Overview:

Cricut, Inc. is based right outside of Salt Lake City. The company has developed a creativity platform comprised of connected machines and design apps whereby customers can turn their ideas into a variety of products such as personalized birthday cards, mugs, T-shirts, and large-scale interior decorations.

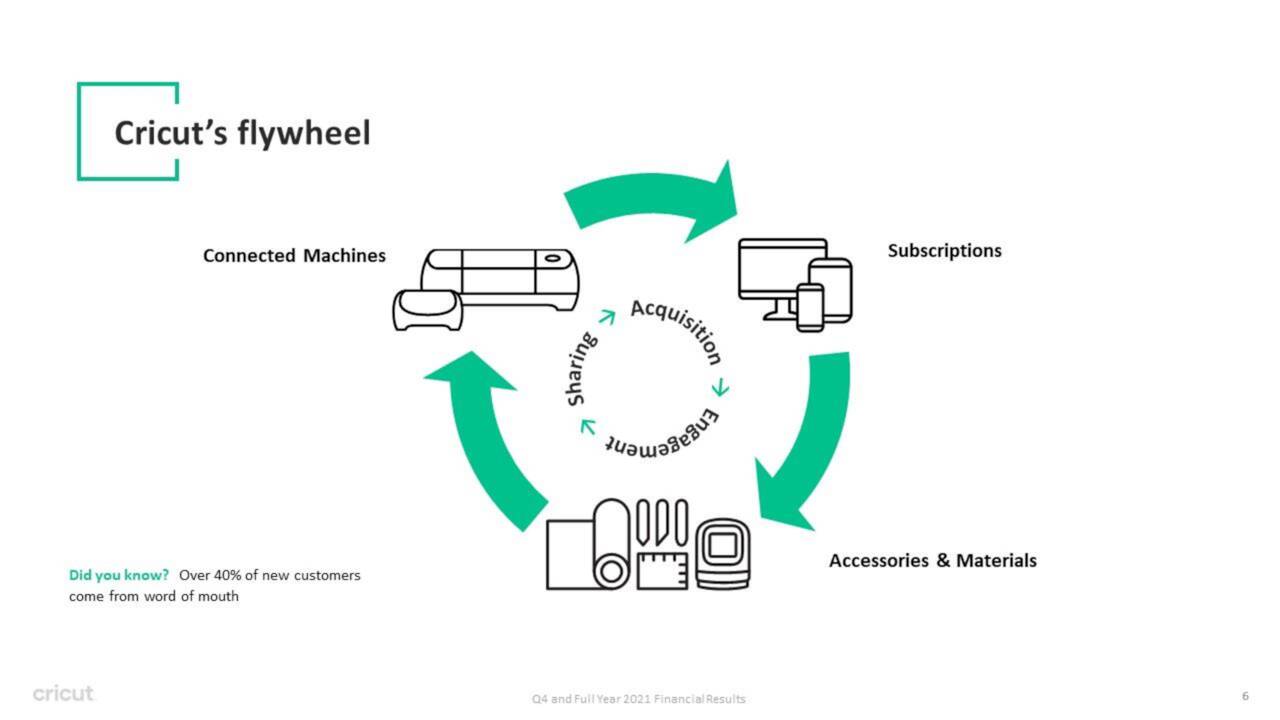

CRCT – Business Model (March Company Presentation)

The company makes a line of Internet of Things (IoT) connected crafting machines as well as a robust subscription service and materials business. The stock currently trades just above $13.00 a share and sports an approximate market capitalization of $3 billion.

Fourth Quarter Results:

On March 8th, Cricut reported fourth quarter numbers. The company had GAAP earnings of a nickel a share. Revenues rose some five percent from Q4 2020 to nearly $388 million.

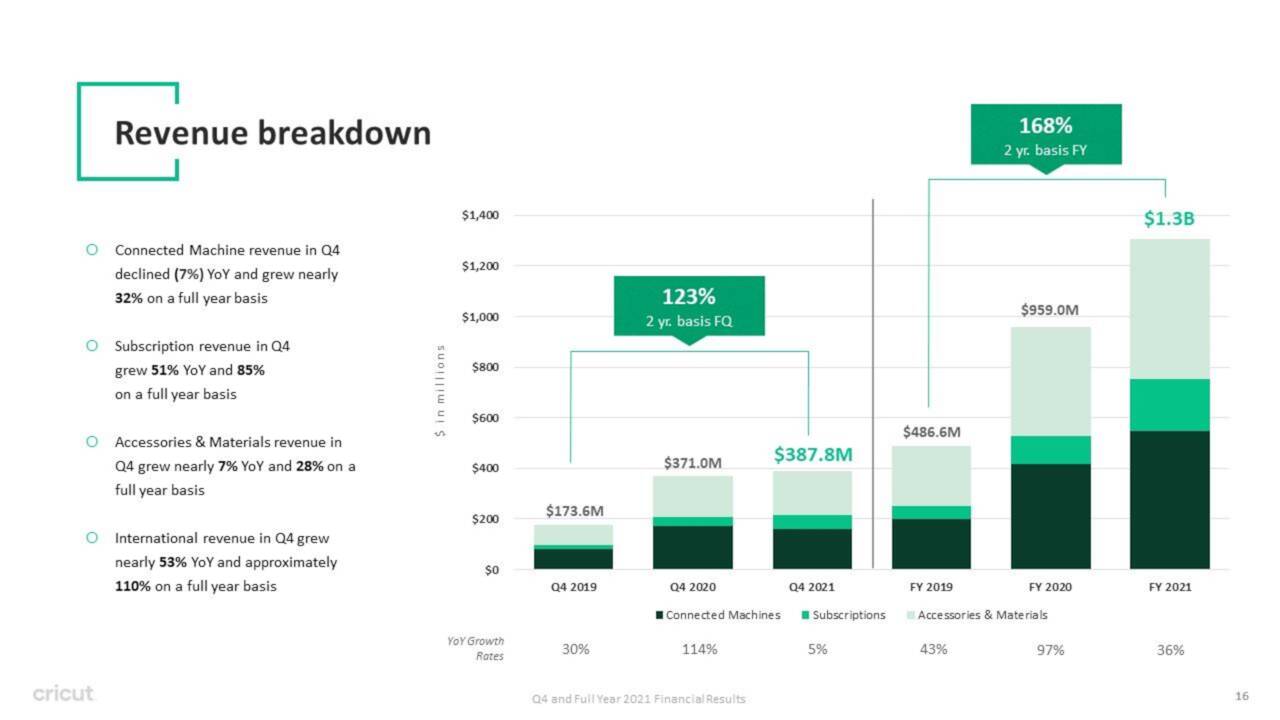

Here is the breakdown of revenues by business line.

CRCT – Revenue Breakdown (March Company Presentation)

- Connected machine revenue was $158.1 million, down 7% over Q4 2020 and up nearly 98% on a two-year basis.

- Subscriptions revenue was $55.7 million, up 51% over Q4 2020 and up nearly 257% on a two-year basis.

- Accessories and materials revenue was $174.0 million, up nearly 7% over Q4 2020 and up 123% on a two-year basis.

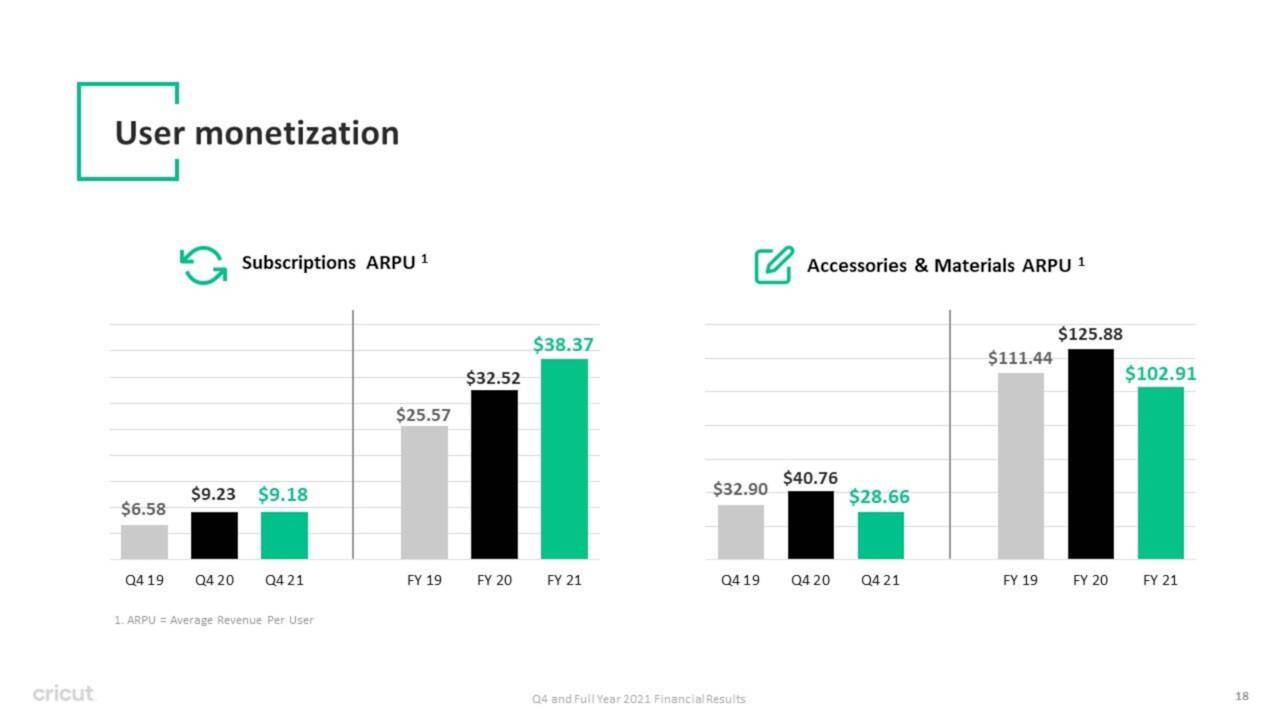

Shares fell hard on the earnings report for several reasons. Cricut sold fewer machines in the fourth quarter of 2021 than in 2020. This likely means pandemic tailwinds are ebbing. Growth in the company’s cash cow materials business will likely be hampered by slowing machine sales in the coming quarters. Despite solid growth in subscriptions, the average amount of materials and accessories per user or ARPU declined sharply in the quarter and was down overall for the year as well.

Cricut – ARPU Snapshot (March Company Presentation)

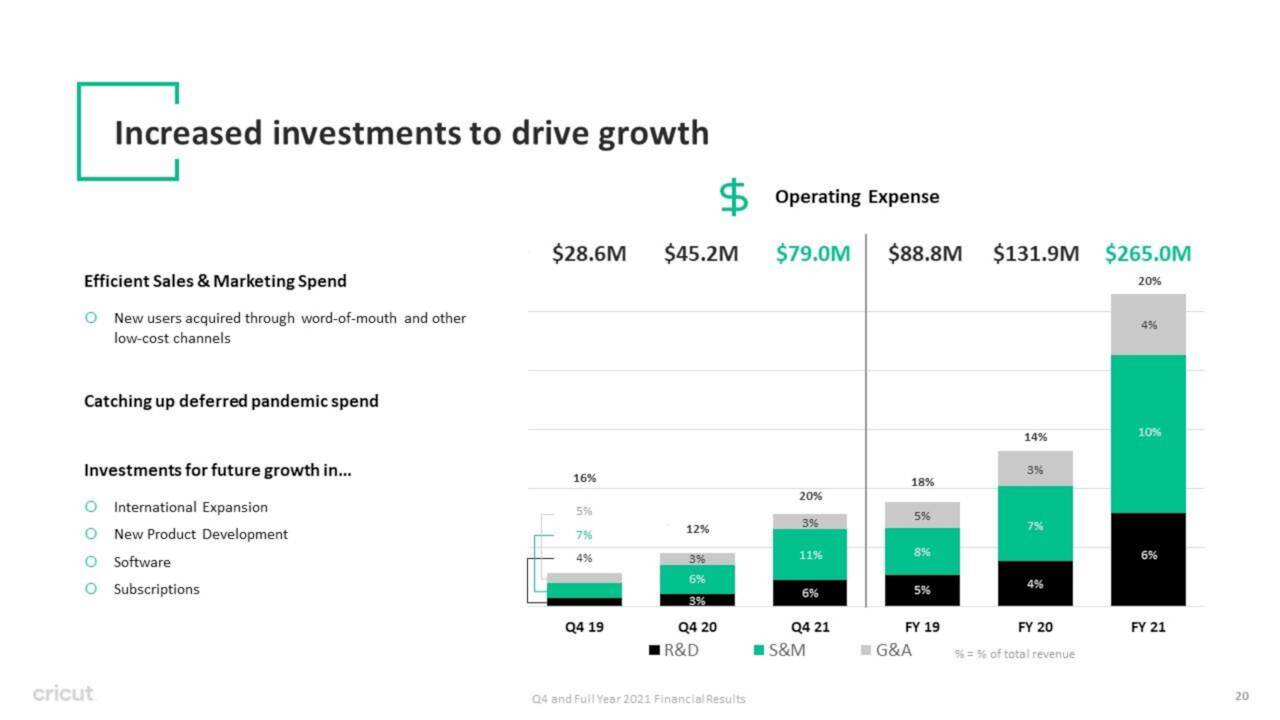

The consensus was also expecting 19 cents a share in profit instead of five cents. Revenues for the quarter were approximately $20 million light. Gross margins also fell sharply to 27% compared to 33.6% in the same period a year ago. For the year, gross margin was 35%, in line with that of FY2021. Part of this erosion was due to the company boosting expenses in the fourth quarter, partly to invest in future growth opportunities.

CRCT – Operating Expenses (March Company Presentation)

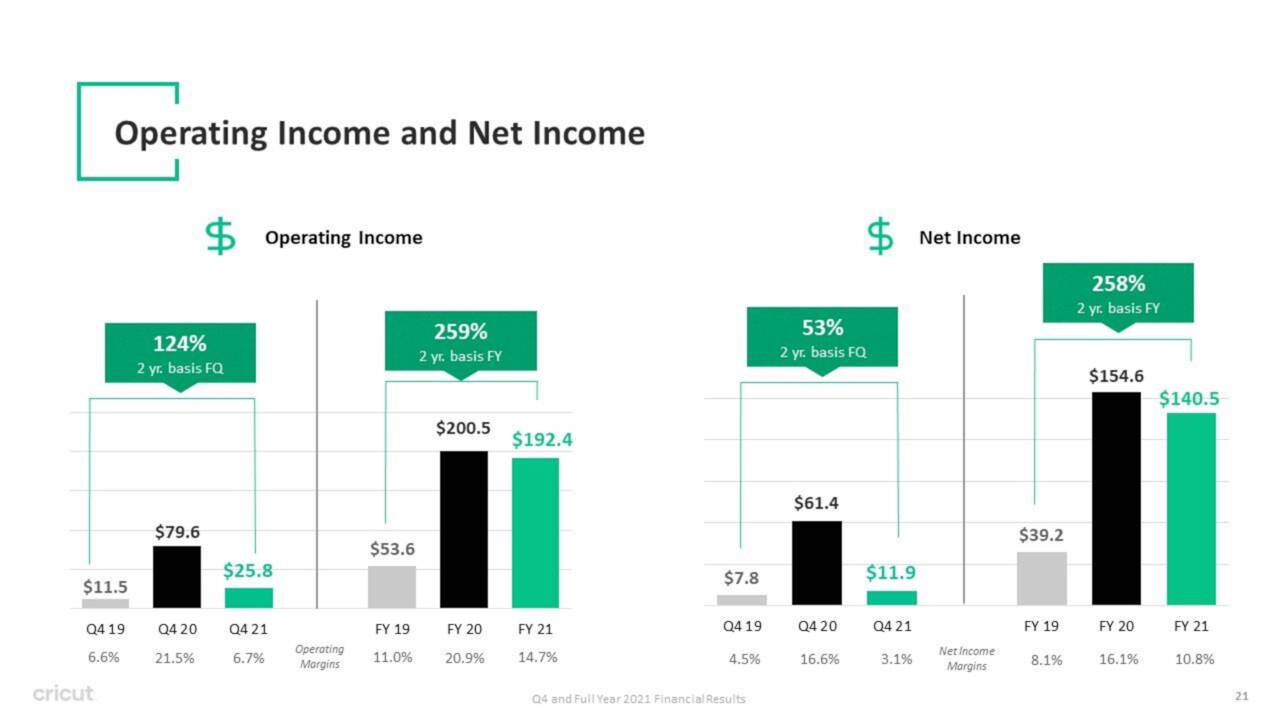

For the year, sales increased by 36% over FY2021 to $1.3 billion. Net and operating income fell sharply in the fourth quarter and were down overall for FY2021 despite the company’s sales growth.

CRCT – Net/Operating Income (March Company Presentation)

Analyst Commentary & Balance Sheet:

Cricut has little love in the analyst community at the moment. Most seem to like its business model but find the valuation of the stock non-compelling and are concerned about the company’s current growth prospects. Since fourth quarter results came out, Barclays maintained its Sell rating and lowered its price target from $20 to $7 on the stock. Morgan Stanley also reissued its Sell rating with a $9 price target while Robert W. Baird downgraded the name to a Hold with a $13 price target.

Bears appear to be circling the stock, given short interest in the shares is currently just over 20%. The company’s biggest beneficial owner (Abdiel Capital Management) is more sanguine on the long-term prospects of Cricut based on his purchases, however. They have added nearly $3 million in aggregate to his holdings so far in April after buying tens of millions worth of stock in the first quarter.

CRCT – 2021 Year-end Balance Sheet Snapshot (March Company Presentation)

The company’s balance sheet seems in good shape ending FY2021 with just over $240 million of cash and marketable securities as well as $150 million available on an untapped credit line.

Verdict:

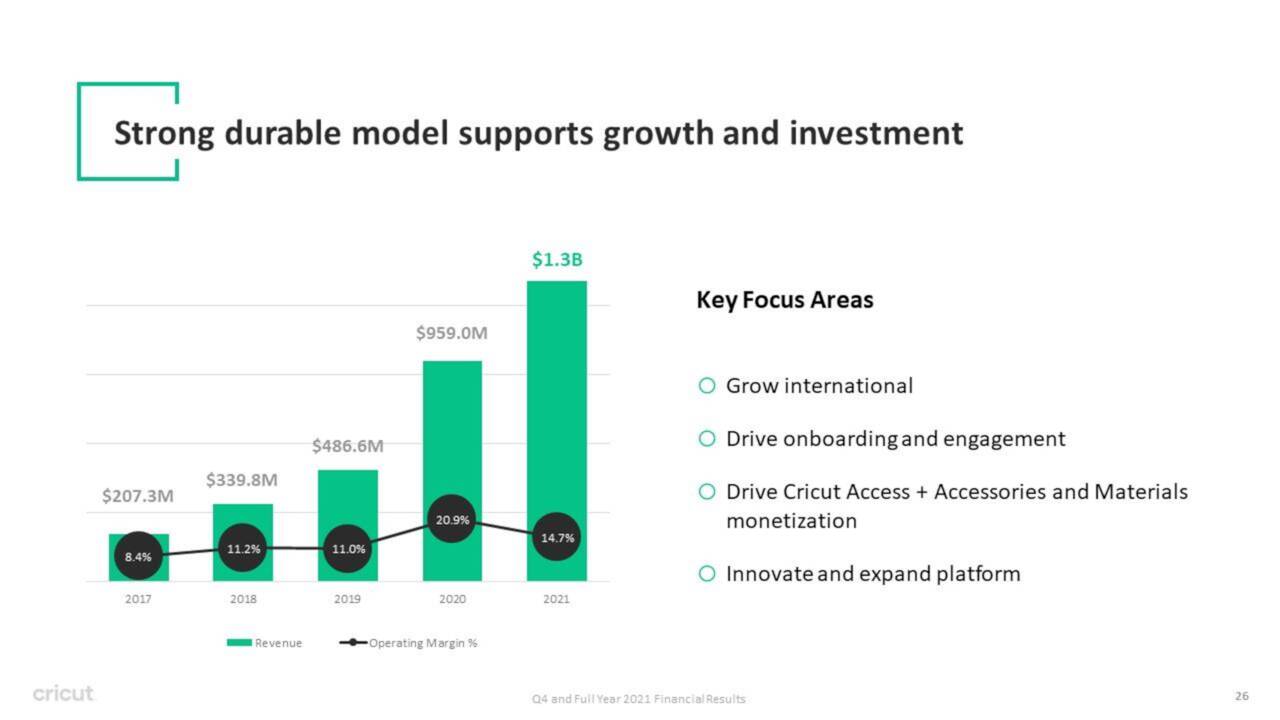

The current analyst consensus has both revenue and earnings being flat to their FY2021 with 60 cents of earnings per share projected on $1.3 billion in revenues. This leaves the stock selling at 20 times forward earnings and more than two times revenues. Both ratios are cheaper if you equate for cash on the balance sheet.

CRCT – Growth History (March Company Presentation)

This is not an unreasonable valuation at all if earnings and revenues were projected to grow at a decent clip in FY2022. Unfortunately, that is not the case currently. The company is profitable and has a solid balance sheet, which at some point should put a floor under the shares. However, until management reignites sales growth and improves margins, the stock is likely to be range-bound in a best-case scenario.

“Great minds discuss ideas. Average minds discuss events. Small minds discuss people.” – Henry Thomas Buckle

Bret Jensen is the Founder of and authors articles for The Biotech Forum, Busted IPO Forum, and Insiders Forum

Be the first to comment