metamorworks

Never interrupt your enemy when he is making a mistake.”― Napoleon Bonaparte

Today, we take a look at a name that seems very cheap even after a nice rally, but has some huge leverage. The company is coming off a disastrous acquisition made years ago but has seen some recent insider buying in the shares. The company was also upgraded earlier this week by Credit Suisse with a Street high $17 a share price target. An analysis follows below.

Company Overview:

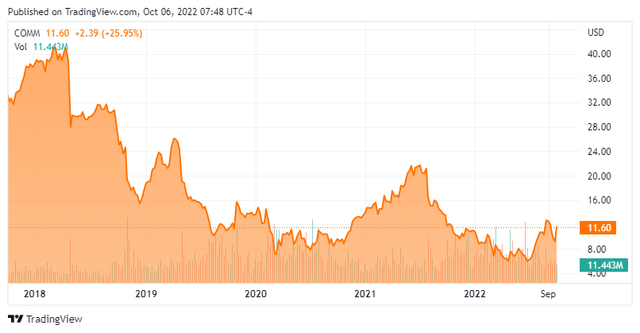

CommScope Holding Company, Inc. (NASDAQ:COMM) is a Hickory, North Carolina based provider of wired and wireless infrastructure solutions for communications and entertainment networks. The company is in the midst of a broad restructuring that will include the spinoff of its Home Networks segment once the supply chain environment is more settled. CommScope was founded as a division of Superior Continental Cable in 1961 to sell coaxial cable, becoming a standalone concern in 1976. After many subsequent transactions, it went public in 1997 when General Instrument split into three publicly traded concerns. Carlyle Group brought CommScope private in 2011 and subsequently laid the foundation for its exit when the private equity concern IPO’d the company at $15 a share in 2013. Its stock trades around $11.50 a share, translating to a market cap of $2.33 billion.

Although Carlyle does not currently own common equity in CommScope – having fully divested its position by 2016 – by virtue of a 2019 convertible preferred financing, it owns ~16% of the common stock on an if-converted basis and has the right to designate up to two directors.

Reporting Segments

Although providing essentially the same products and services since 2019, the company operated under five business units through 2020; then switched to four in 2021; then announced that it would again operate under five business segments starting sometime in 2022, of which one would be spun out. Below is how CommScope operated exiting FY21. The company had four business units: Broadband, Venue and Campus Networks (VCN), and Outdoor Wireless Networks (OWN) comprised CommScope’s ‘core’ divisions, while Home was (and still is) expected to be spun off.

Broadband is the combination of two former segments (Network Cable & Connectivity and Network & Cloud) that service the telco and cable provider broadband market with converged cable access platforms, passive optical networking, video systems, fiber and coaxial cable, as well as fiber and copper connectivity. It was responsible for FY21 net sales of $3.1 billion, or 37% of the company’s total.

VCN is primarily the former Ruckus Networks division of CommScope, offering wired and wireless connectivity to public and private networks for campuses, venues, data centers, and buildings. It generated FY21 net sales of $2.2 billion, or 25% of total.

OWN is mostly comprised of the company’s former Mobility segment, providing equipment generally found on macro and metro wireless tower sites such as cell tower antennae, cabling, equipment housing, and concealment. This area was expected to benefit significantly from the 5G buildout but has only contributed a mid-teens percentage (16% in FY21) of the company’s declining net sales since 2019.

The Home segment was the largest division of Arris when it was acquired by CommScope in 2019 – more on Arris shortly. Formerly known as Customer Premise Equipment, this segment provides the equipment that connects subscribers to service providers, such as digital subscriber line and cable modems, set top boxes, and digital video recorders. It also houses some broadband solutions formerly in the Broadband segment. Soon to be on the auction block, Home was responsible for FY21 net sales of $1.8 billion, or 22% of total.

Since YE21, segment changes – more formerly detailed concurrent to its 1Q22 earnings report – are as follows: OWN is essentially unchanged; Home is now dubbed Home Networks and is still set to be spun off; Broadband and VCN have been reworked into three segments: Connectivity and Cable Solutions (copper and fiber cabling and connectivity products); Access Network Solutions (broadband cable and video technology); and Networking, Intelligent Cellular and Security Solutions (wireless communications for indoor and venue applications).

Arris Debacle and Resulting Restructuring

The problems for CommScope began in November 2018, when in an attempt to bolster its own stagnating top line, entered into an agreement to acquire Arris, an entertainment and communications solutions provider with a foothold in products that connect cable, telecom, and satellite service providers to a customer’s home. The all-cash transaction of $7.7 billion net of debt assumed was promoted as an expansion of CommScope’s addressable market from $25 billion to $60 billion, with the combined entity able to generate a 30% increase in earnings (non-GAAP) and operating cash flow of ~$1 billion in year one post-close, as well as delivering $150 million in cost synergies over three years. Financed almost entirely by debt, the company’s net leverage jumped to 5.1 at the time of the acquisition – 5.6 if Carlyle’s preferred stock investment is included – but was projected to drop to 4.0 two years post-close. At the time of the announcement, shares of COMM were trading at $24.49, equating to a market cap of $4.7 billion, or essentially 1.03x FY18 sales. The market, skeptical of these rationales, punished CommScope for paying 1.15x trailing twelve months net sales for Arris by selling its stock down 20% on the news.

It turned out that the market’s initial knee-jerk reaction was justified. If one were to include Arris’ first 93 days of 2019 – prior to the acquisition closing – the combined entity saw a 14% decline in FY19 net sales to $9.76 billion and a 20% decline in Adj. EBITDA to $1.37 billion versus FY18. The 30% increase in non-GAAP earnings did not materialize, instead plunging 38% to $1.79 a share in the twelve months after the deal consummated (2Q19-1Q20 vs. 2Q18-1Q19). The $1 billion of Adj. cash flow from operations outlook also fell well short, generating ~$751.4 million in the first twelve months post-close. Most of the disappointment stemmed from Arris, whose contributions were in considerable decline. It is not a strict apples-to-apples comparison, but three new business segments were created to represent Arris’ markets. Assuming those three segments were part of the company for the entirety of FY19, combined they realized a 35% fall in Adj. EBITDA to $526.0 million on a 19% drop in revenue to $5.44 billion versus FY18, making the $7.7 billion price tag exorbitant.

Most troubling was CommScope’s net leverage, which instead of declining to 4.0 by March 30, 202, stood at 7.8 as of YE21.

Recognizing the Arris acquisition for the debacle that it was, management announced the aforementioned realignment in December 2021 that included the company eventually spinning off its Home segment. The initiative (dubbed NEXT) is “designed to drive shareholder value through three pillars: profitable growth, operational efficiency, and portfolio optimization.” This plan will reallocate resources to areas that should provide organic growth. It will cost CommScope ~$210 million and won’t be fully completed until 2024. A major question of this realignment becomes: what price can be retrieved for its Home Network segment that generated FY21 Adj. EBITDA of $25.5 million on revenue of $1.85 billion? The proceeds from that sale will certainly be employed to deleverage the balance sheet.

With the disappointing results leading to extremely high leverage, shares of COMM were off as much as much as 77% in July 2022 from the time the Arris deal was first announced, trading below $6 a share.

2Q22 Earnings & Outlook

However, as it labors to put Arris in the rearview mirror, its stock has recently caught a bid, aided somewhat by its 2Q22 financial results announced on August 4, 2022. CommScope reported net income of $0.41 a share and Adj. EBITDA of $299.6 million on revenue of $2.30 billion versus $0.43 a share and Adj. EBITDA of $307.7 million on revenue of $2.19 billion in 2Q21. The bottom line was better than Street expectations by $0.12 a share while the top line represented a $40 million beat.

However, gross margin was off 300 basis points year-over-year to 29.9% and Home Networks’ Adj. EBITDA fell 12% to $12.8 million while its revenue decreased 7% to $423.9 million. Looking at the glass half full, this meant that Core revenue increased 9% to $1.88 billion, although Core Adj. EBITDA dropped 2% to $286.8 million. Also, management expressed confidence that recent low double-digit price increases were going to improve margins in 2H22 after it worked through its backlog.

CommScope called for Core FY22 Adj. EBITDA to land in a range of $1.15 billion to $1.25 billion and indicated that supply chain challenges for semiconductor chips it had been experiencing should ease in 2H22, removing inventory constraints.

Balance Sheet & Analyst Commentary:

Net leverage was still extremely elevated at 8.1 as of June 30, 2022 – 9.1 if the preferred stock were treated as debt – although down from 8.2 on March 31, 2022. If CommScope hits on its Adj. EBITDA forecast, leverage should drop to ~7.0 by YE22. The company’s $9.6 billion of debt starts coming due in 2025 ($1.3 billion) with a big payment ($4.5 billion) due in 2026. Between cash ($229.3 million) and undrawn lines, CommScope had ~$900 million of liquidity at the end of 2Q22.

Despite the beat, which precipitated a few upward price target revisions, Morgan Stanley used the opportunity to downgrade shares of COMM from an outperform to a hold. Outside of this week’s Credit Suisse upgrade, the Street is not very upbeat on the company’s prospects, featuring only two buys against one sell, two underperform, and six hold ratings. Price targets proffered range from $7 to $12 a share. On average, they expect CommScope to earn $1.67 a share (non-GAAP) on net sales of $9.17 billion in FY22, followed by $2.22 a share (non-GAAP) on net sales of $9.52 billion in FY23, representing a 35% year-over-year improvement at the bottom line.

CEO Charles Treadway is diametrically opposed to most of the Street, purchasing over 48,000 shares at an average price of $10.41 on August 26, 2022, following the lead of board member Claudius Watts, who bought 15,000 shares on August 9th-11th.

Verdict:

CommScope has bounced almost 110% off its intraday 52-week low of $5.56 a share set on July 5, 2022. There are two significant reasons for this sharp rally. First, from a technical standpoint, shares of COMM successfully tested its $5.50 pandemic low of March 2020, forming a long-term double bottom. Second, with the company expected to earn $2.22 a share in FY23, its forward P/E ratio of less than 3 (at that time) with 35% growth must have populated many quant and value investor screens, screaming ‘buy’.

From a fundamental standpoint, there are strong market tailwinds from what should be a multiyear build-out of fiber cable and connectivity. To take advantage of this undercurrent, CommScope is adding capacity as part of its NEXT initiative as its fiber cable and fiber connectivity business grew 39% year-over-year in 2Q22. Underscoring this push, the company spent ~$190 million in the quarter between R&D and capex.

That highlights the one item that these buyers are discounting: CommScope’s cash bleed. Although inventory build has played a significant role in the cash outflow, CommScope has burned through $220 million in the past three quarters. Even after removing costs related to its initiatives and restructuring, CommScope still burned through $141.6 million during that period.

So, as the company is earning money on a non-GAAP basis, it is not currently generating any cash against its impending debt wall. Wed this cash flow dynamic against the likelihood of a macro slowdown in the next twelve months and the over 100% move seems like it was stalling before the Credit Suisse upgrade. The forecasted easing of the supply chain situation for chips should help reduce inventory, which in turn should generate positive cash flow, but even at $1.2 billion of Adj. EBITDA, it’s questionable if it will make a big enough dent in its debt when it’s paying over $500 million annually in interest expenses. The spinoff of Home Networks should help, but until that situation becomes more visible, the advice is to side with the majority of Street analysts and stay away.

Never open the door to a lesser evil, for other and greater ones invariably slink in after it.”― Baltasar Gracian

Be the first to comment