scyther5

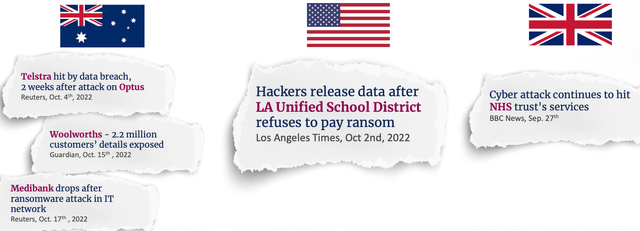

Check Point Software Technologies (NASDAQ:CHKP) is a legacy cybersecurity business that was founded in 1993. Its founder and CEO is the legendary Gil Schwed who is credited with inventing the first-ever firewall. Since, this invention the company has continued to innovate while keeping its margins high and debt level low. The increasing connectivity of our world has resulted in an increasing number of cyberattacks. You can see just a few recent examples below from the LA Unified School District ransomware attack to the National Health Service [NHS] attack in the U.K.

Cybersecurity attacks (Check Point Report)

Therefore it is no surprise that the Cyber Security market is forecasted to grow at a rapid 13.4% compounded annual growth rate [CAGR] and be worth $376 billion by 2029. In this post, I’m going to break down Check Point’s business model, financials, and valuation, let’s dive in.

Secure Business Model

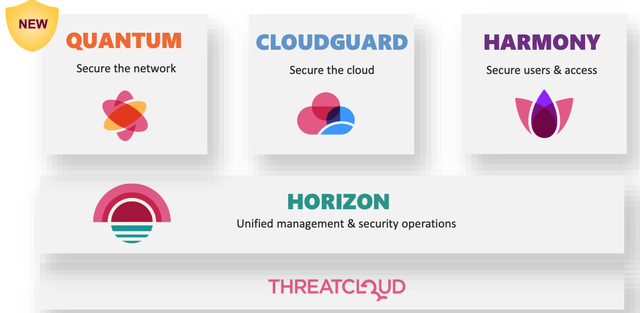

In previous posts on Check Point I have covered its business model in more detail. Here is a quick recap. Check Point has three main product lines which cover; Network Security (Quantum), Cloud Security (Cloudguard), and User Access Security (Harmony). Quantum includes a series of Firewalls, Web Gateways and access points. The idea of these physical devices is to continually monitor and inspect network traffic to mitigate threats.

Its second product line Cloudguard aims to secure the cloud across various multi-cloud environments from AWS to Azure. This product competes directly with Palo Alto Networks and its Prisma platform. Then finally we have Harmony which uses a “zero trust” methodology to ensure user access is secure. “Zero Trust” means users in the network are not trusted by default and are given “least privileged access” to only the applications they need. This product competes with companies such as Zscaler (ZS).

Check Point Products (Check Point)

Secure Third Quarter Results

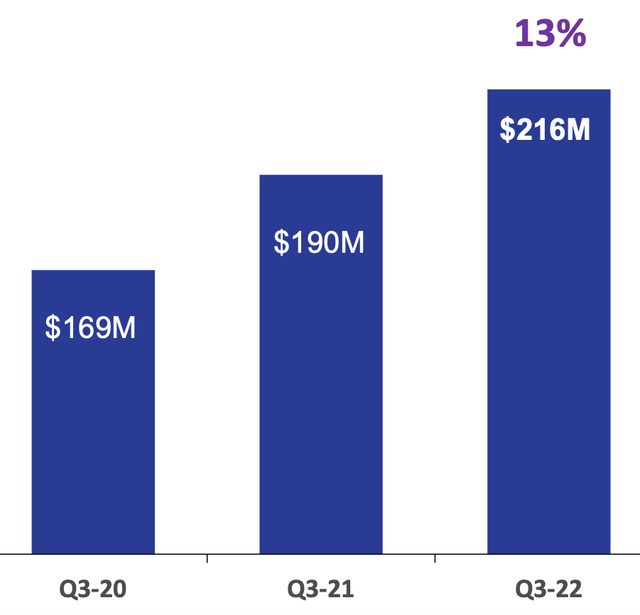

Check Point reported strong financial results for the third quarter of 2022. Revenues were $577.6 million, which beat analyst expectations by $5.82 million and increased by 8% year over year. A key metric to analyze for SaaS companies is Billings, which is the actual amount invoiced to customers and the true “top line”. In this case, Billings was $559 million which increased by 8% year over year. Deferred revenue, is the amount of customer payments that are not booked as revenue until the service is provided. In this case, deferred revenue was $1.65 billion in the Q3,22 up a solid 13% year over year.

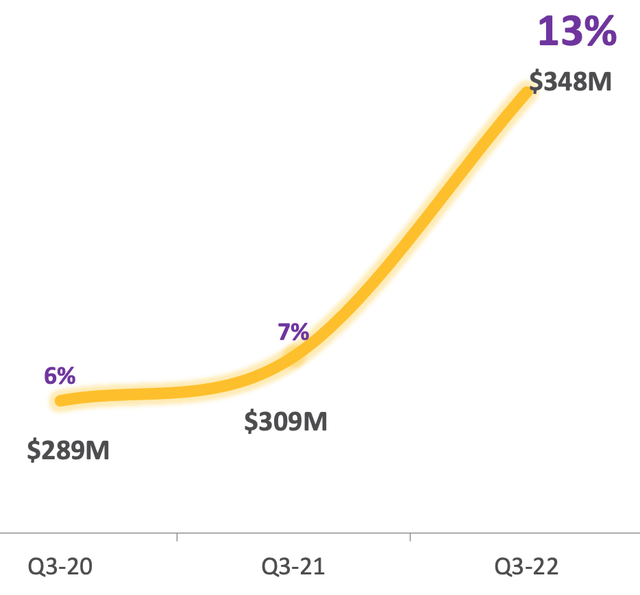

Overall revenue growth was driven by solid products and security subscription revenue which increased by 13% year over year to $348 million. This is greater than management’s prior expectations of above 10%, which they have achieved over the past three quarters. This growth has been reported across the board from its appliance lines both small, medium and large.

Products and Security Subscriptions Revenue (Q3,22 report)

Security Subscription revenue alone increased by 13% year over year to $216 million. This was driven by solid growth across Check Point’s three main product lines; Quantum, CloudGuard and Harmony.

Security Subscriptions Revenue (Q3,22 report)

In the third quarter of 2021, Check Point acquired cloud email security company Avanan. This was a solid acquisition in my eyes as 95% of cyber attacks towards enterprises occur via a simple “phishing” email. This usually involves a simple message but they are becoming more sophisticated and play immensely on human psychology. For example, these can be impersonating the CEO of the company or just include a curiosity enticing link which looks like it is from the HR department. I recently came across one email in the Nordics during my cybersecurity research which involved a mockup spreadsheet of the “salaries” for all the employees in a company. Users were told “not to open” the spreadsheet but of course, many did out of curiosity only to discover it was a phishing email.

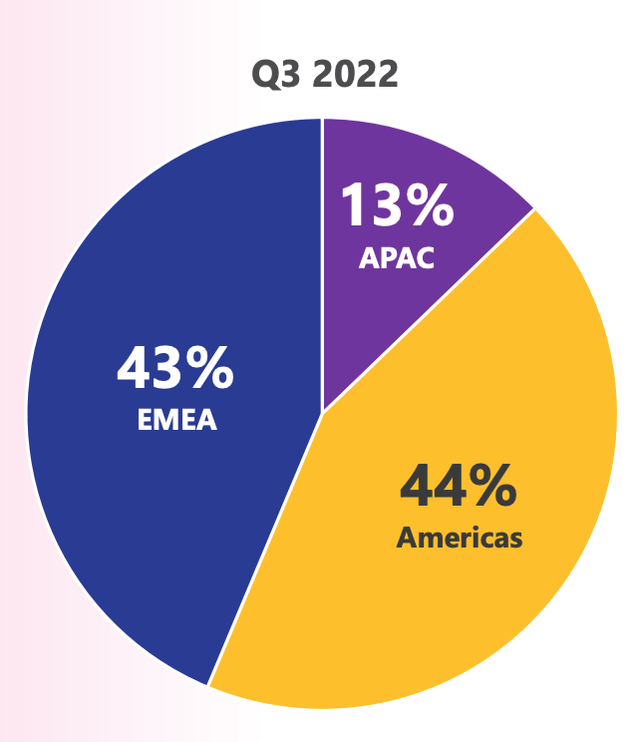

Breaking down revenue by geography, 44% of revenue is from the Americas, with 43% from EMEA and 13% from APAC, thus the company’s revenue is internationally diverse. Compared to the prior year there was only a +1% increase in APAC revenue and -1% increase in EMA revenue, which is fairly stable and not a significant enough movement to draw large conclusions.

Revenue by Geography (Q3,22 report)

On to profitability, Check Point reported gross profit of $506 million in Q3,22 which increased by 7% at a solid 88% margin. This is fairly impressive given, the company is paying out more for its raw materials and shipping due to inflation and supply chain shortages. For example, the company is paying between $8 million and $10 million in the cost of its goods sold for storage before customer delivery.

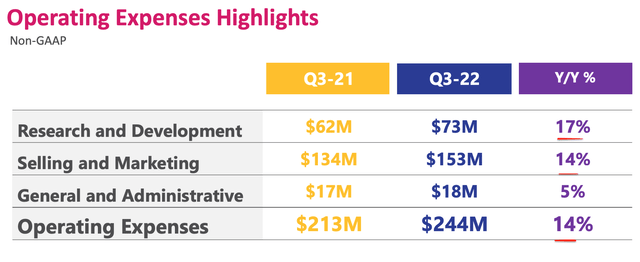

Check Point reported solid earnings per share of $1.47 which increased by 5% year over year and beat analyst expectations by $0.09. This was solid growth given many operating expenses rose over the year. For example, in the table below you can see the company reported a 17% increase in its R&D expenses to $73 million. Overall I don’t deem this to be a bad sign, as continual investments into innovation is necessary to stay ahead in the fast-moving cybersecurity industry.

Sales and Marketing expenses also increased by 14% year over year to $153 million, as the company rolled out its new products. In addition, General and Administrative expenses increased by 5% year over year to $18 million. Over time, I would like to see the business-generated operating leverage especially as it scales its software products and sells less physical hardware.

Operating expenses (Q3,22 report)

Check Point reported strong operating cash flow of $240 million and has a solid balance sheet with $3.6 billion in cash, short-term investments, and marketable securities. In addition, the business has very little debt at just $22 million in total debt which is fantastic given the company is fairly old by cybersecurity standards, founded in 1993. The company also invested $325 million into its share buyback program, which showed management has confidence in the value creation of the business long term.

Advanced Valuation

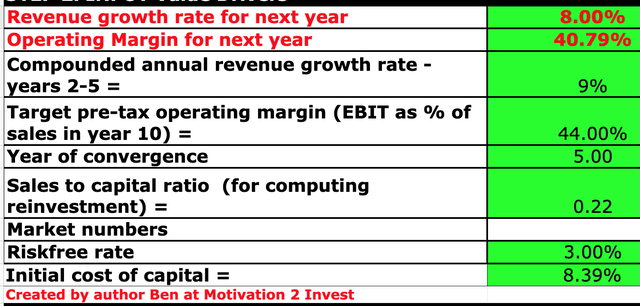

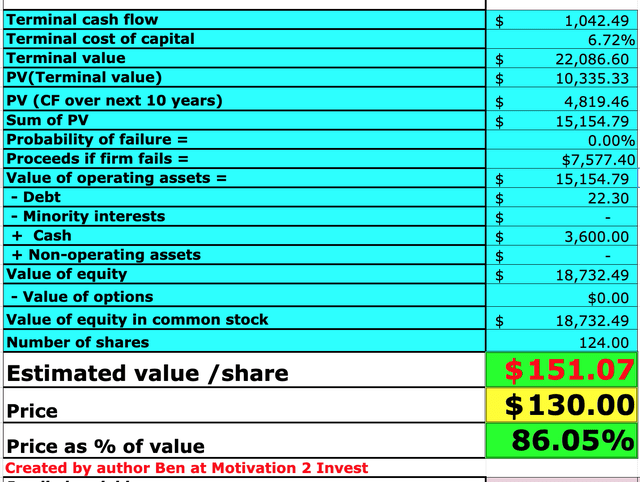

In order to value Check Point I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation.

I have forecasted 8% revenue growth for next year which is aligned with the most recent growth rate. In addition, I have then forecasted growth to accelerate to 9% in years 2 to 5 as the economy improves and Check Point’s new product range continues to gain traction.

Check Point stock valuation 1 (created by author Ben at Motivation 2 Invest)

In order to increase the accuracy of the valuation I have capitalized R&D expenses, which has lifted net income. I have forecasted the company to grow its pre-tax operating margin from 40.79% to 44% in 5 years, as supply chain issues ease.

Check Point stock valuation 2 (created by author Ben at Motivation 2invest)

Given these factors I get a fair value of $151 per share, the stock is trading at $130 per share at the time of writing and thus is ~14% undervalued.

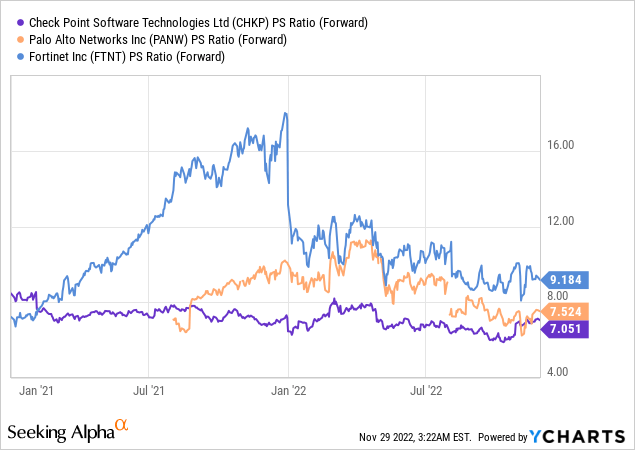

As an extra data point Check Point trades at a PE ratio = 21.68 which is fairly valued relative to its 5-year average. However, the business does trade at a price-to-sales ratio = 7, which is 12% cheaper than its 5-year average. Relative to peers Check Point trades at one of the cheapest valuations.

Risks

Recession/Longer sales cycles

The high inflation and rising interest rate environment has caused many issues from supply chain constraints to recession forecasts. For B2B companies this means a tepid environment for business and will likely result in deferred spending and longer sales cycles.

Final Thoughts

Check Point is a tremendous company that has continually innovated to stay at the cutting edge in cybersecurity. The company’s new product line is gaining traction and the stock is undervalued intrinsically. Due to the economic climate, I wouldn’t be surprised to see fairly stable/slow growth but longer term the business is poised to benefit from the secular shift towards cybersecurity protection.

Be the first to comment