jetcityimage

Investment Thesis

I like Charter Communications, Inc.’s (NASDAQ:CHTR) consistent customer growth from both residential and commercial clients. The business also shows high growth in its mobile segment. Its valuation is cheap relative to its free cash flow. However, I am worried about the company’s ability to raise its prices to offset inflation. I am bullish on the stock, although I would like to see average revenue per customer increase over the next few quarters before I would buy.

Customer Growth

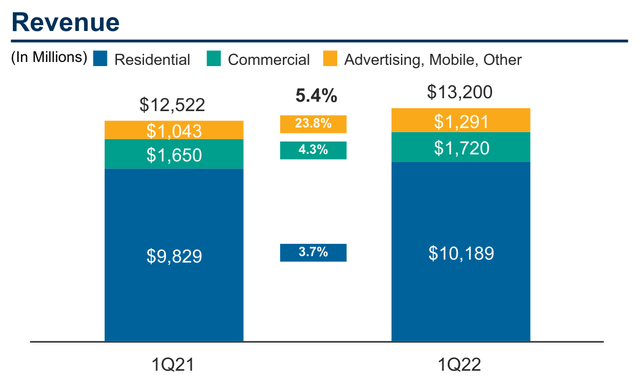

Charter has shown an impressive ability to grow its total subscribers. This is especially important for the company’s residential services. About 80% of Charter’s total revenue is brought in by this single segment.

Charter Q1 Earnings Presentation

Charter has seen consistent losses in residential cable TV and wireline voice customers. Over the past five years, the company has lost 8% of its cable TV subscribers and 18% of its wireline voice customers. These reflect broader industry trends which will likely continue in the future.

Charter has been effective at offsetting these losses with solid growth in its internet services. The company has increased its internet subscriptions by 23% over the past five years. There’s still room to grow. On Charter’s fourth quarter earnings call, the company described their market adoption. Their services only cover 27% of local household spending on connectivity in key segments. The company has space to increase revenue by selling existing services and by creating new offerings.

A good example of this is Charter’s mobile service. This is a speculative segment of the company that is growing rapidly. Even though the segment isn’t profitable yet, it could be a major driver in future growth. I will be watching for updates on the service’s progress.

I think this mix of products is healthy and sustainable over the long term. It’s not especially high growth, but it is strong considering the company’s valuation.

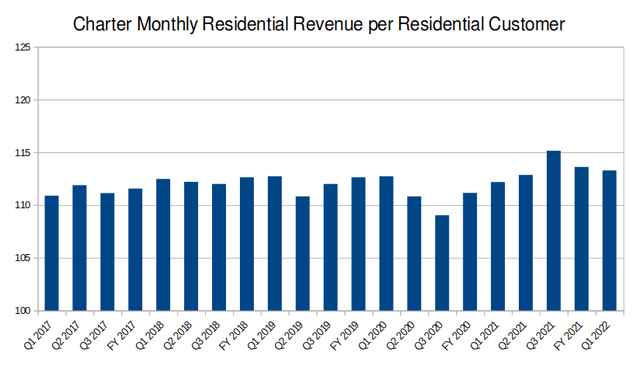

Average Customer Revenue Growth

Charter relies heavily on new customer adds to grow its top line. Over the past five years, the company’s average monthly revenue per residential customer has only increased by two percent. This isn’t great when inflation is almost 20% over the same time period. Average monthly revenue per SMB customer even declined.

Created by author with data from Charter’s 10-K and 10-Q filings

While Charter has grown its top line by 26% since the 2017 fiscal year, most of this growth is attributable to new customers. It’s unclear how much pricing power the company has.

The company addressed inflation in its last earnings call. Management described high inflation as a slight tailwind for the company. The company’s CFO highlighted Charter’s higher starting wages and long-term supply contracts. These should make the company more resistant to cost inflation. Management also believes customers looking to save money may switch to Charter’s services.

This reliance on subscriber adds could be a problem. Many analysts are calling for an extended slowdown in cable subscriber growth. This slowdown is attributed to increased competition and economic headwinds. During the Credit Suisse Communications Conference, Charter’s CFO announced that the company may lose 60 to 70 thousand subscribers due to changes in a federal benefit program. Some analysts now expect the company to lose subscribers this quarter.

Without the ability to consistently raise prices, Charter’s continued revenue growth could be at risk.

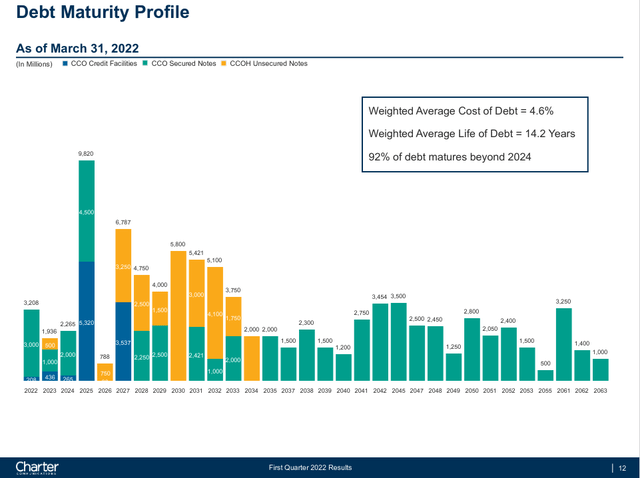

Debt

One of the greatest concerns I have about Charter is its high debt load. The company has over $95 billion in debt, even higher than its equity value of about $85 billion. It isn’t uncommon for telecommunications companies to have high debt loads. Verizon (VZ) and Comcast (CMCSA) are similar companies with high amounts of debt.

In its most recent earnings presentation, Charter provided some more details about its debt.

Charter Q1 Earnings Presentation

The chart shows that a lot of Charter’s debt is reasonably low interest. Many of their notes don’t mature for a long time, either. These numbers should also be compared to Charter’s profitability. Last year, the company generated almost $9 billion in free cash flow. I believe Charter will be able to repay its debt if it maintains its revenue and profitability. These may decrease returns to shareholders if rates continue to rise, however.

Another way to assess a company’s sustainability is through its credit rating. Charter’s credit ratings are solid. Their bonds are rated at BB and BBB, which is the line between investment grade and junk bonds.

I agree with these ratings. Charter’s debt makes the company more risky and may hurt shareholder returns over the next few years. But I don’t think the company is going to default anytime soon.

Valuation

Charter is trading at a moderately cheap valuation. The company is priced at less than ten times its TTM free cash flow. Even after accounting for debt, the company’s enterprise value to FCF is under 20. This is within the range of what I’d be willing to pay for a company with this profile. Charter is growing its top line each quarter. Free cash flow is increasing at a much higher rate. However, I would feel more comfortable if the company had demonstrated more pricing power.

Charter is also aggressively buying back its stock. The company has repurchased almost three-eighths of its shares over the past five years. The business is clearly focused on returning money to its shareholders.

Final Verdict

Charter is trading at a cheap valuation, even though the company is growing. The business generates strong free cash flow, and I like the potential for growth in the mobile segment. However, the business has a lot of debt. It also has not shown the ability to raise prices even during high inflation.

This isn’t a business I would buy right now, but I am bullish on the company in the long term. I could see this pick doing well in a more defensive portfolio.

Be the first to comment