Editor’s note: Seeking Alpha is proud to welcome DGP Capital Management as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

John M Lund Photography Inc/DigitalVision via Getty Images

Investment thesis

I believe Charter Communications, Inc. (NASDAQ:CHTR) a is significantly undervalued stock both in terms of intrinsic value and multiples compared to its peers. The company presents an unmatched economic moat in terms of technological solution and pricing power which result in high customer stickiness. Moreover, as the quarterly results have recently shown increasing demand, technological improvements and expansion into new areas are boosting internet revenues. A very strong management, with a clear strategy and vision, is returning value to shareholders via buybacks and safely steering the balance sheet. For these reasons, I view the CHTR stock to be a “no-brainer” investment and assign a Strong Buy rating.

Business description

Business model

Charter is a broadband connectivity company and a cable operator serving US customers through the Spectrum band which includes Spectrum Internet, TV, Mobile and Voice. The network, owned and operated by the company, passes over 54 million households and small and medium businesses (SMBs) across the United States.

The core strategy of Charter is to leverage on its network to deliver high quality products at competitive prices, combined with outstanding customer service. The suite of connectivity services offered encompasses fixed Internet, mobile Internet and Wi-Fi. Video, advertising services as well as broadband communication solutions tailored to SMB and Enterprise customers complete the range of products and services delivered by Charter.

The capability and functionality of Charter’s network technology is allowing the company to expand in several areas, especially with respect to wireless connectivity. The internet service offers consumers the ability to wirelessly connect to the Charter network using Wi-Fi technology. In addition, Spectrum Mobile allows to extend Internet connectivity beyond home via the mobile virtual network operator (MVNO) partnership agreement with Verizon. In 2020, the company purchased the Citizens Broadband Radio Service (CBRS) Priority Access Licenses (PALs), which allowed Charter, together with the CBRS spectrum, to build its own 5G mobile data.

Competition

Charter faces, in theory, intense competition both from existing competitors and from rapidly evolving new technologies. On internet services, competition spreads across fiber-to-the-home (FTTH), fiber-to-the-node (FTTN), fixed wireless broadband, Internet delivered via satellite and DSL services, with AT&T (T), Verizon (VZ), Frontier (FYBR) and FiOS as the main contestants. However, unlike its competitors, which face high fixed costs to build and maintain the network, Charter can be defined as a MVNO, which means it purchases bandwidth from other operators at a wholesale price. Moreover, the company has made the decision to sell its Wi-Fi service only to already existing customers (namely cable and broadband), which is lowering its incremental cost.

The market is particularly concerned about the competition risk and keeps on penalizing the stock price. I do believe the market is wrong, for the following reasons. The main technologies against which Charter has to compete can be grouped into four main categories: FTTH, fixed wireless, 5G, and satellite.

FTTH leverages on optical fiber from a central point directly to individual houses to provide high-speed internet access. FTTH is the future as it dramatically increases connection speeds available, nearly 20 to 100 times as fast as a typical DSL. However, the main drawback for the providers of this technology is the cost associated with fiber optic cable installations and local permits which I believe will dramatically slow the time period for its full adoption.

In a fixed wireless type of connection, the signal is sent through airwaves and doesn’t require phone or cable lines. Despite allowing to bring the internet service to rural areas, without data limit, the signal can be highly impacted by trees and constructions. Moreover, usually the fixed wireless internet suppliers are locally owned and operated businesses that serve a specific area.

5G is the fifth-generation technology standard for broadband cellular networks which promises higher download speed, higher bandwidth and lower latency compared to its forerunners. Such network uses a grid of cell sites that divides the area and sends encoded data through radio waves. However, due to trees and buildings that obstruct the high-frequency radio waves that carry the 5G connection, thus decreasing the network’s broadcast distance, there is the need for many cellular towers to achieve a good coverage. This is one of the reasons why providers usually put a cap on the monthly data downloadable (which I estimated to be around 20%-40% of the overall data demand of a family). On the contrary, Charter’s broadband solution does not present any cap in its upper bound.

Satellite internet relies on a satellite sent up to orbit around the earth, which then transmits information back to a network operations center. New satellite internet constellations have been recently developed in low-earth orbit to enable lower latency compared to before. Nonetheless, the main drawback of this technology remains the weather conditions which can considerably increase the latency, together with the data download cap.

I do believe Charter has a currently unmatched competitive advantage in terms of technological solution (broadband internet), pricing power, as well as customer loyalty, as it would become more expensive for clients to switch to another operator.

Market outlook

Following the downturn last year, the weighted average share price of cable and satellite peers is down approximately 30% since the start of the year – lower than the S&P 500’s 21% decline – mainly due to a reduction in broadband subscriber gains. With operators expected to increase only by half the subscribers gained in 2018-2019, investors are concerned that broadband growth has reached its limit. The near-term outlook is muted but cable will still have a dominant market share at 65%.

Financial analysis

Profitability

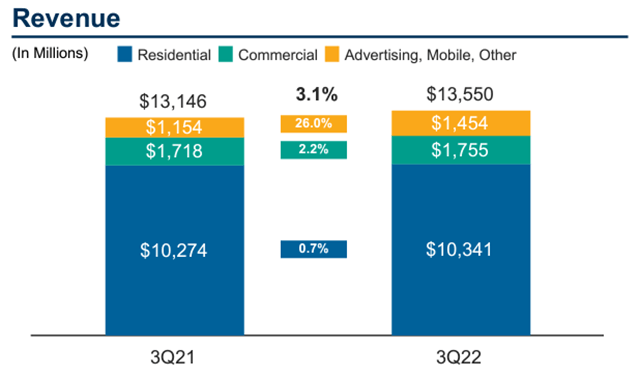

3Q22 Investors presentation

Despite the current mix of financial tightening, high interest rates and spiking inflation, Charter continues to exhibit solid growth in its numbers. Q3 2022 financial results saw the market reacting negatively at the beginning, due to the $100million+ shortfall in revenue and EBITDA estimates. The stock soon turned positive as management highlighted the 4Q 2022 broadband price increase and reiterated that “core capital intensity” would trend flat to down in the upcoming years.

Total revenue came at $13.5 billion (+3.1% YoY), with Residential standing at $10.3 billion (+0.7% YoY), Commercial at $1.8 billion (+2.2% YoY) and Advertising, Mobile and Other at $1.5 billion (+26% YoY). Charter managed to add 75,000 total broadband subscribers in the quarter vs +38,000 estimated by analysts. Total video sub losses came in at 204,000 while total mobile adds were 396,000.

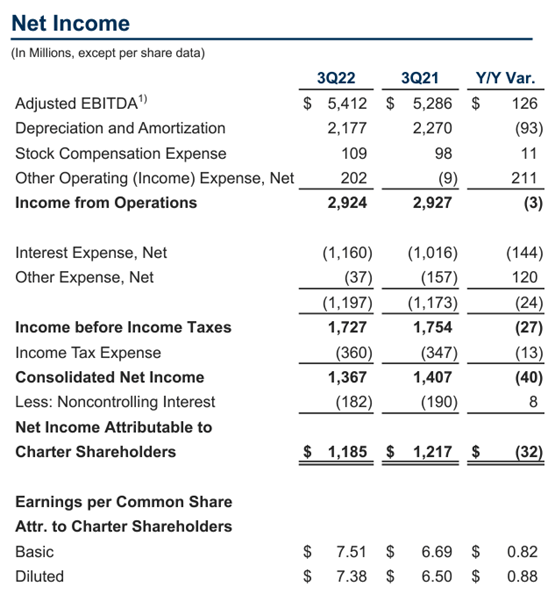

3Q22 Investors presentation

Adjusted EBITDA totaled $5.4 billion (+2.4% YoY) (margin of 39.9%), while Net income attributable to shareholders was equal to $1.2 billion (-2.6% YoY).

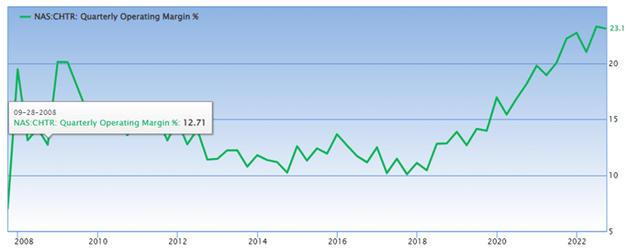

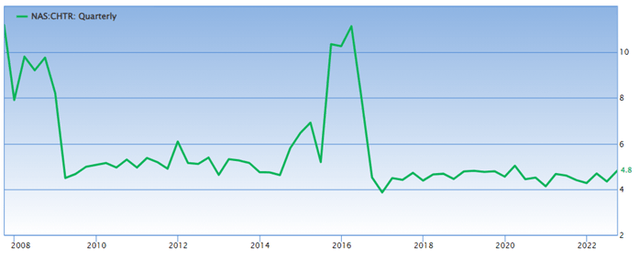

GuruFocus

Charter’s operating and net margin are among the best in the industry, at 22.5% and 10.2% respectively.

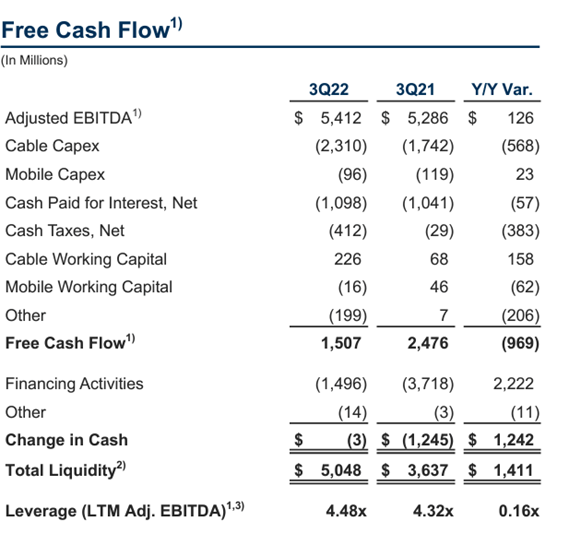

3Q22 Investors presentation

Free Cash Flow came in at $1.5 billion (-39% YoY) primarily driven by higher Capex ($2.4 billion) as a result of the rural construction initiative. Charter bought back $2.6 billion in stock. Charter’s stock currently returns a 10% Free Cash Flow Yield.

Financial strength

GuruFocus

Charter’s management relies on a levered-buyback strategy meaning that approximately half of the capital repurchased is funded through debt. In this respect, management is committed to maintaining leverage at about 4.5x net debt-to-EBITDA.

After its mergers with Time Warner Cable and Bright House Networks, Charter repurchased $67 billion of its stock, retiring about 46% of equity from September 2016 through the end of 2Q2022. It is expected to retire roughly another 39% of its free float by 2027.

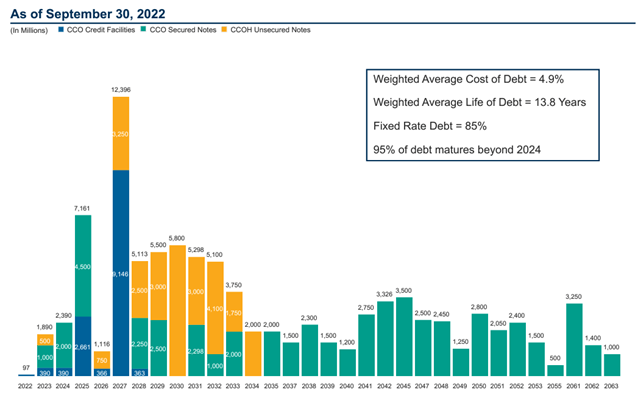

3Q22 Investors presentation

Debt maturities are spread wisely throughout the years, with nearly 85% of it locked in with a fixed rate, which is definitely favoring the company in an inflationary and raising interest rates environment.

Governance

Thomas M. Rutledge, a long-dated executive in the communication sector, has been the chairman and CEO of Charter since 2012. During this period, the company has managed to become the connectivity provider of the future for both residential and business customers.

Insiders own a negligible 0.5% of total shares outstanding, while institutional ownership is equal to approximately 70%.

Stock performance

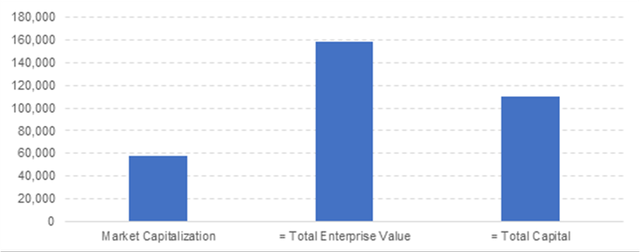

DGP Capital Management

As of 20 November 2022, the market capitalization of Charter is equal to $58.1 billion, while the Total Enterprise Value at $158.4 billion.

Seeking Alpha

The stock, in line with the entire sector, has been severely hit by the market in the last year (-45% year to date and -57% from its high in September 2021), mainly because of perceived threats from the competition.

Charter Communications – Valuation

Charter trades at significant discount compared to its peers. In terms of P/EBITDA, the company currently stands at 3x close to its historical minimum and below the average of its competitors (11.3x). Even more meaningful appears the discount given to Charter’s price when looking at P/FCF, which is equal to 9.2x compared to an average of 15x for the sector. Using the latter multiple, at a 12-15x P/FCF (still below the sector average), the stock would trade at $780 – $975, on the 2022 estimated FCF (+107% to +161% implied upside).

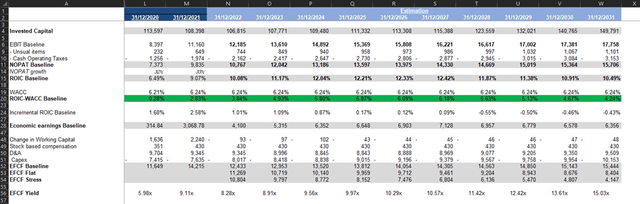

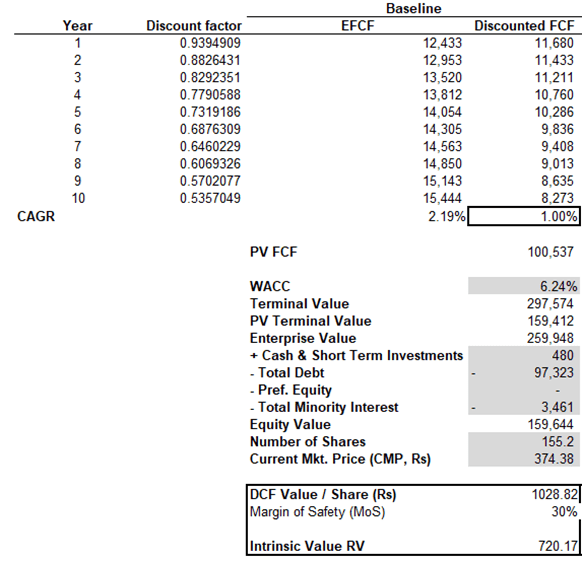

In the 10-year DCF analysis, I have modeled revenue growth in a very conservative way (+5% the first 3 years, then +2%), and similarly for the terminal growth rate (+1%). The WACC has been estimated at 6%. The margin of safety applied at the end is equal to 30%, to account for any possible estimation error.

DGP Capital Management

DGP Capital Management

In the baseline scenario, I get an intrinsic value for Charter’s stock of $720 (+92.5% potential upside).

Investment risks

I do not see particular risks for this company. The business is highly competitive and the market is currently worried about new competing technologies, on which I disagree as explained in the previous sections. However, as we prefer to also weigh possible tail events, I always include some stressed valuations in the assessment.

In this respect, assuming my line of reasoning is completely wrong and Charter gets severely hit by the competition, the market will still continue to price the stock at discount compared to its competitors. Assuming a P/FCF equal to 9x, with the estimated FCF for YE2022, I still get a price of $570 (+52% potential upside).

Conversely, a stagnating growth (0%) applied to the DCF model, with the management still committed to deliver on its buyback program, would nevertheless return a stock price equal to $368, which is very close to the current stock price. This implies that the market does not believe that Charter can exhibit any growth in its revenues in the future.

Conclusion

In my view, Charter stock is a Strong Buy against the background of an unmatched economic moat in terms of its technological solution and pricing power. I believe investors continue to over-penalize the stock, which is offering an important window of opportunity to purchase a great business at a deep discount. The inflationary environment will cause the gap with its competitors to widen further and thus propel the stock price soon.

Be the first to comment