jetcityimage

Thesis

In our pre-earnings article on ChargePoint Holdings, Inc. (NYSE:CHPT), we presented that it had likely bottomed in the near term and urged investors to add to their positions.

Accordingly, CHPT has surged close to our price target (PT) of $19, as it outperformed the market in the recent broad market pullback. Therefore, investors who leveraged our previous call can consider using the recent rally to cut some exposure, as CHPT’s valuation looks well-balanced now.

Yesterday’s (September 14) announcement that US President Joe Biden approved the first $900M of funding from the $7.5B Infrastructure Act to build the nationwide EV infrastructure has stoked investors’ interest. However, as a reminder, the Act was passed in November 2021, leading to CHPT forming a high in November before collapsing.

Therefore, we believe it’s appropriate to provide a timely update for investors considering investing in CHPT in response to the recent approval.

Our thesis on CHPT remains speculative, as the company has yet to prove that it can operate profitably. Therefore, given the recent surge, and more well-balanced valuation, we are revising our rating from Speculative Buy to Hold.

China Is The World’s Largest EV Market, But The US Is At A Critical Inflection Point

Investors need to note that ChargePoint is a leading AC (Level 2) EV charging player in the infrastructure space focusing on an asset-light operating model. Therefore, it doesn’t have to incur massive CapEx costs to scale. In addition, we believe its operating model is helpful in light of the current economic environment.

BloombergNEF projected in its early June study that EV sales globally would “more than triple by 2025.” China, the global EV market leader, is expected to grow faster than previously estimated. In addition, China’s success in driving new electric vehicle (NEV) sales has seen its estimates for 2022 revised upward to 6.62M (above previous estimates of 6M). As a result, China is way past its inflection point in spurring NEV sales, leading to rapid adoption, despite weak consumer spending in China, as NEVs gain share.

Therefore, it’s critical for investors to assess whether the US EV market is at an inflection point, despite the weakness seen in auto spending in 2022. Bloomberg’s study in early July suggests that the US has crossed the 5% BEV share of sales. That threshold is considered a critical hurdle for EV sales to gain rapid adoption, as consumers and manufacturers focus their attention and operations on EVs. Bloomberg highlighted:

The US is the latest country to pass what’s become a critical EV tipping point: 5% of new car sales powered only by electricity. This threshold signals the start of mass EV adoption, the period when technological preferences rapidly flip, according to the analysis. – Bloomberg

ChargePoint Is An Early Leader In The EV Infrastructure Race

Therefore, we deduce that ChargePoint is expected to benefit tremendously from the market share gains of EVs in the US. As a reminder, ChargePoint generated 84% of its sales in North America in its recent Q2 earnings release.

Despite that, the company’s operating model has not been predicated on the successful rollout of the benefits of the Infrastructure Act or the more recent Inflation Reduction Act (IRA). ChargePoint still expects to reach free cash flow (FCF) breakeven by the end of 2024 as it continues to scale.

CEO Pasquale Romano has also reiterated several times that he sees no immediate need to update its model despite the incentives driven by the US government to promote EV infrastructure. Moreover, Romano accentuated that he is confident that ChargePoint will continue to grow rapidly even without the IRA or the Infrastructure Act boost.

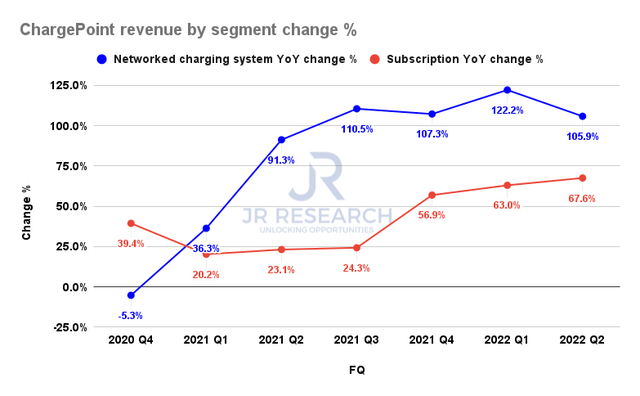

ChargePoint revenue by segment change % (Company filings)

As seen above, its networked charging system segment has continued its massive growth in Q2, up 106% YoY. Also, its subscription segment has leveraged the growth in its commercial and fleet sales. Notably, it posted a revenue increase of 68% YoY. Management’s Q3 guidance of 100% YoY growth suggests that it continues to see substantial growth opportunities even without the benefits from the IRA or the Infrastructure Act.

However, management highlighted that it still sees its supply chain being constrained in the near term, even though it’s expected to improve. Our assessment of the global supply chain suggests that these headwinds have improved dramatically over the past three months. Furthermore, freight rates have continued to decline from 2022 highs through September, adding another tailwind for ChargePoint to recover its gross margins.

In addition, management highlighted that it sees its fleet business as being “vehicle limited.” Therefore, it’s critical for the leading US manufacturers, like Ford (F), General Motors (GM), and Tesla (TSLA), to increase their production dramatically. Both Ford and GM plan to overtake Tesla in terms of EV sales by 2026, even though it remains to be seen. Tesla remains in the catbird seat as a highly profitable EV maker with a well-diversified supply chain.

Nevertheless, the IRA could spur some rethinking of bringing back assembly operations to the US to benefit from the EV credits. For example, the Wall Street Journal reported that Tesla is rethinking its battery strategy in Germany as it paused its plans. Therefore, the EV leader will likely consider leveraging more domestic production/assembly of EV batteries to benefit from the IRA.

Hence, we deduce that the Infra Act and the IRA could help spur a broad market re-rating for ChargePoint if it helps to improve the adoption rate for EVs in the US.

Notwithstanding, we are still very early in the journey and unlikely to move the needle in the near term, as Bloomberg highlighted:

Clean-vehicle incentives tucked into the Inflation Reduction Act will have a negligible effect on EV sales, accounting for less than 1% of an assumed 15 million US automobiles sold annually through 2028, based on our analysis, topping out at 1.3% in 2031. – Bloomberg

Is CHPT Stock A Buy, Sell, Or Hold?

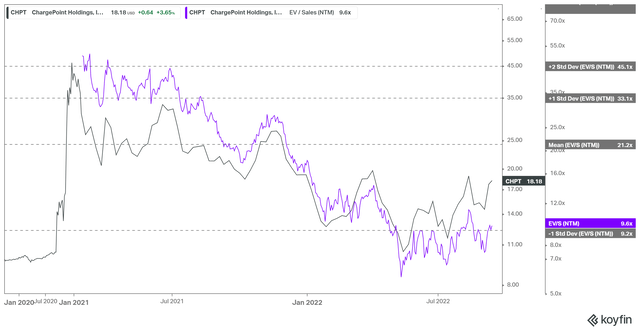

CHPT NTM Revenue multiples valuation trend (koyfin)

CHPT’s NTM revenue multiples last traded close to the one standard zone below its all-time mean, as seen above. However, investors could also glean that zone has consistently denied further buying upside for CHPT since May. Hence, we believe CHPT has been significantly de-rated by the market. Even though we don’t consider it overvalued, we think it’s pretty well-balanced.

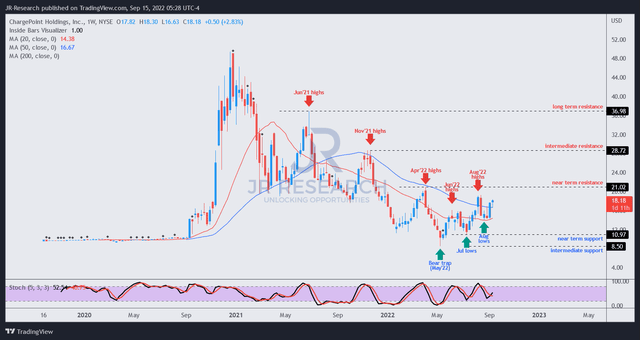

CHPT price chart (weekly) (TradingView)

Also, CHPT has surged remarkably from its July and August lows, as it closed in on our PT. We assess that it could face robust resistance at its near-term resistance (16% upside). Therefore, we postulate that the reward-to-risk profile for CHPT seems well-balanced now.

As such, we revise our rating on CHPT from Speculative Buy to Hold.

Be the first to comment