jetcityimage

ChargePoint Holdings, Inc. (NYSE:CHPT) was always destined to receive policymakers’ support because its business promotes environmental sustainability. In my previous article on ChargePoint, I claimed CHPT stock is a good pick for growth investors with an extensive investment time horizon. The last few weeks have been quite interesting for both potential and current ChargePoint shareholders as fiscal second-quarter earnings led to a rally in ChargePoint stock prices aided by a comfortable revenue beat and the management reiterating the guidance for the full year. Wall Street analysts praised ChargePoint’s financial performance amid macroeconomic challenges as well, improving investor sentiment further. In this analysis, I will briefly discuss second-quarter earnings and then evaluate the long-term prospects for the company to determine whether ChargePoint is still an attractive bet on the back of the recent strength in its stock price.

Business Overview

I’m sure many of you are familiar with ChargePoint but since we are not talking about a mega-cap, I thought it best to include a brief business overview to help investors who are new to the company.

ChargePoint Holdings is an EV infrastructure company that builds and maintains charging networks and other EV charging solutions in the U.S. and internationally. ChargePoint serves all types of vehicles in North America and Europe through personal and commercial EV charging options, across use cases (from L2 to DC fast charging), in parking lots, depots, and residential settings. ChargePoint is also integrated into vehicles via the infotainment system, payment systems, mobile wallets, fleet fueling cards, utility programs, and at-home assistants. To achieve its goal of making the transition to electric vehicles easier, the charging solutions provider has partnered with top retailers, OEMs, gas stations, parking companies, and residential real estate firms. ChargePoint has over 5,000 commercial and fleet customers worldwide, including 80% of the 2018 Fortune 50 list of companies.

Q2 Earnings Highlight ChargePoint’s Strengths

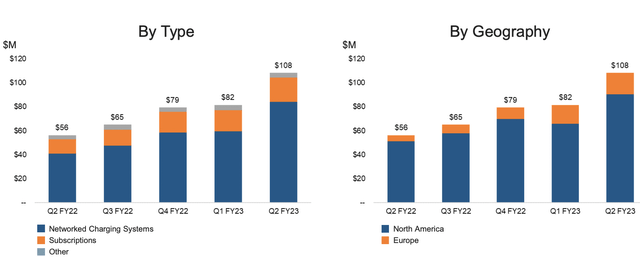

On August 30, ChargePoint reported fiscal second-quarter earnings, with a marginally higher loss due to supply chain challenges, but the company issued strong guidance for the remainder of the year. ChargePoint reported a loss of 28 cents per share, while analysts expected a loss of about 25 cents per share. ChargePoint’s revenue hit an important milestone this quarter reaching over $100 million. Revenue came at $108 million, up 93% year-over-year aided by growth across all business verticals and geographies.

The company’s business model is unique in that it combines network hardware, software subscriptions, and other professional services. This is one of the primary reasons why I continue to monitor ChargePoint closely as I believe it takes an integrated approach to dominate the EV charging infrastructure market in the long run given that novel technologies are being developed to address the challenges surrounding charging infrastructure. Revenue from networked charging systems came in at $84.1 million in the second quarter, up 106% year-over-year, and subscription revenue was $20.2 million, up 68% from the same quarter last year.

Exhibit 1: Q2 Revenue by type and geography

Source: Earnings presentation

Total operating expenses increased from $85.1 million to $108.5 million because of supply chain challenges and the inflationary environment. Despite widening losses, the company intends to continue investing in the business to stimulate growth as EV demand grows.

ChargePoint expects third-quarter revenue of $125 million to $135 million, which is in line with analyst estimates of $130.28 million. ChargePoint maintained its full-year sales forecast of $450 million to $500 million for fiscal 2023 as well.

The Long Runway for Growth

Renewable energy remains a major focus of the business world and policymakers today as many economies increase renewable energy investment to achieve carbon neutrality by 2050, with electric vehicles at the forefront of this movement. In the United States, the government intends to build a national network of 500,000 electric car chargers by 2030, replace 50,000 diesel vehicles, and electrify 20% of yellow school buses. The government has proposed to spend $174 billion to boost domestic EV manufacturing as well.

Several recent developments are expected to increase the demand for EVs even further. One such development is the passing of the Inflation Reduction Act, which includes tax credits for both EV buyers and charging network manufacturers. In addition, California has decided to prohibit the sale of all gasoline-powered vehicles by 2035, another victory for the EV industry. California’s 2030 EV penetration target is set at approximately 68%. Given the policy support, automakers are setting goals to completely electrify their fleets by 2050. Because of favorable policies and automakers boosting their EV production, EV demand will continue to rise, making the need for EV charging stations more critical than ever. In supporting this movement, EV infrastructure companies will unlock many new growth opportunities in the coming years.

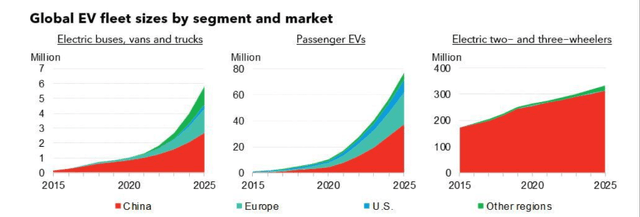

According to the IEA, sales of electric vehicles, including fully electric and plug-in hybrid vehicles, increased to 6.6 million in 2021. Electric vehicle sales in China nearly tripled to 3.3 million, 2.3 million in Europe, and 630,000 in the United States. In 2021, there were five times as many electric car models available globally as in 2015, which goes on to highlight the growing importance of EVs both from a policymaking perspective and a consumer perspective. Global electric car sales reached 2 million in the first quarter of 2022, with passenger EV sales expected to rise sharply driven by increasing policy support. According to BloombergNEF’s Electric Vehicle Outlook report, plug-in vehicle sales are expected to increase from 6.6 million in 2021 to 20.6 million in 2025. China and Europe are expected to account for almost 80% of EV sales in 2025.

Exhibit 2: Global EV fleet sizes by segment and market

Source: Bloomberg NEF

Despite the positive long-term trends we are seeing today, there are some short-term challenges to the growth of the EV industry, including the rising prices for critical minerals used in battery manufacturing, supply chain disruptions caused by the Russia-Ukraine war, and regional Covid-19 lockdowns in China. Rising material costs have an impact on overall EV sales and port sales are directly proportional to EV sales. In the short term, these challenges may lead to lackluster EV adoption, but I do not believe these challenges will permanently dent the expected growth of this industry.

Greater efforts from governments, including those in Europe and the United States, to promote industrial policies that support and encourage domestic development of EV supply chains will aid growth in the long run. Furthermore, factors driving battery raw material costs are also driving up gasoline and diesel prices and making internal combustion engine vehicles more expensive to manufacture as well, which should negate the impact on EV sales resulting from cost-push inflation to a certain degree.

Based on an evaluation of the macroeconomic trends in the EV market, ChargePoint seems well-positioned to grow as its expansion strategy has positioned the company at the forefront of EV adoption. With over 200,000 charging ports in North America and the EU, the company is strongly positioned to expand its market share and geographic footprint. The company is currently losing money, but its expansion plans position it for a long period of double-digit growth. The company’s latest collaboration with Volvo (OTCPK:VOLAF) and Starbucks Corporation (SBUX) which began in Q2 with plans for a DC fast charging network from Seattle to Colorado will be a strong driver of growth in the long run given that the company can build on this network to rollout fast-charging services nationwide. ChargePoint, in collaboration with Volvo, will install EV chargers at 15 Starbucks “Greener Stores” across five states. The chargers will be installed by the end of 2022.

Takeaway

Accelerating EV sales and sustained policy support will push the EV industry forward in the coming years, creating a strong platform for ChargePoint to launch into the next growth phase of its business. With the potential of becoming the go-to EV charging infrastructure solutions provider on a global scale, ChargePoint seems to enjoy a long runway for growth. I will closely monitor the company to evaluate how ChargePoint could convert the positive macroeconomic environment into profits.

Be the first to comment