jetcityimage

Thesis

ChargePoint Holdings, Inc. (NYSE:CHPT) is due to report its FQ3’23 earnings results on December 1. CHPT has been battered since the approval of the EV funding lifted investor sentiment in September.

We urged investors to be cautious as we downgraded our rating on CHPT, anticipating a potential bull trap. Accordingly, CHPT has underperformed the market significantly since our previous update, as it drew in over-optimistic buyers at its September highs.

We noted that CHPT seems to be consolidating constructively along its July lows as buyers returned to support it at its November lows. Therefore, we believe it’s appropriate to revisit whether it’s an opportune moment for investors looking to capitalize on its recent pessimism to add exposure.

Our analysis suggests that valuing CHPT remains challenging, as it’s still expected to burn a significant amount of cash through FY26. Notwithstanding, the company’s guidance for its upcoming FQ3 release suggests that management expected ChargePoint to post a recovery of its adjusted gross margins, seeing an improvement in its supply chain challenges.

We postulate that the market has likely anticipated a relatively tepid earnings release from ChargePoint. Therefore, the potential for a re-rating from a better-than-expected 2023 outlook could be in store as ChargePoint continues its operating leverage gains.

However, CHPT’s 7x NTM Revenue multiple is embedded with significant value compression risks if it fails to deliver on its highly aggressive revenue growth projections. Hence, we urge investors to consider any opportunity in CHPT speculative and are reminded to size their allocation appropriately.

Revising from Hold to Speculative Buy, with a price target (PT) of $17.50.

ChargePoint Could Underperform In FQ3

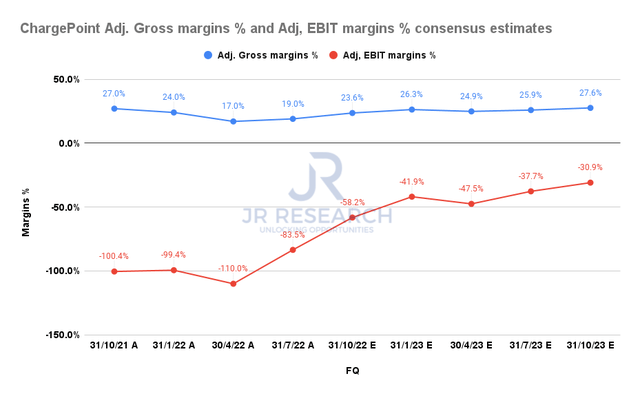

ChargePoint Adjusted Gross margins & Adjusted EBIT margins % consensus estimates (S&P Cap IQ)

Management highlighted that it was confident of recovering its adjusted gross margins in H2, as it expected improvement in the supply chain disruptions.

Accordingly, global supply chain pressure eased further through October, “falling back in line with historical levels.” Therefore, we believe the consensus estimates are credible, suggesting ChargePoint could post an adjusted gross margin of 23.6%, up significantly from FQ2’s 19%.

However, we postulate that the market could be anticipating ChargePoint to underperform on its adjusted EBIT growth, predicated against aggressive revenue growth metrics.

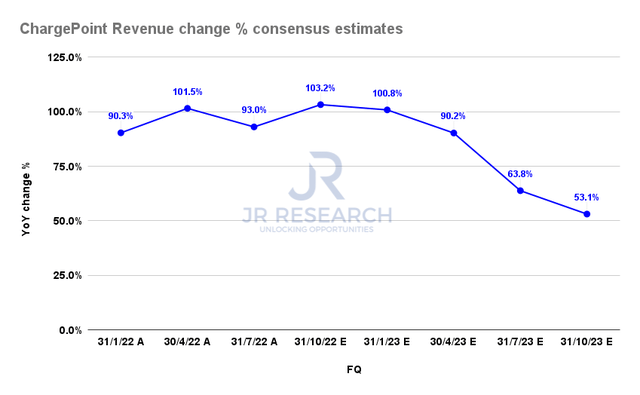

ChargePoint Revenue change % consensus estimates (S&P Cap IQ)

Management’s guidance of $130M in FQ3 revenue implies revenue growth of 100%. The consensus estimates are slightly more optimistic, expecting a revenue uptick of 103%.

It’s also expected to be above FQ2’s 93% increase. Hence, there’s little doubt that ChargePoint remains in a high-growth phase and is under pressure to deliver massive revenue growth to justify its valuation.

However, analysts have continued to reduce revenue and earnings estimates for the S&P 500 through October. Therefore, we believe the market has likely baked in the expectations of ChargePoint missing its revenue guidance and the Street’s projections.

We believe the market positioning is prudent as macroeconomic headwinds have worsened through October. Hence, the market needs to discount ChargePoint’s aggressive growth metrics to lower the bar for management to cross in FQ3.

Is CHPT Stock A Buy, Sell, Or Hold?

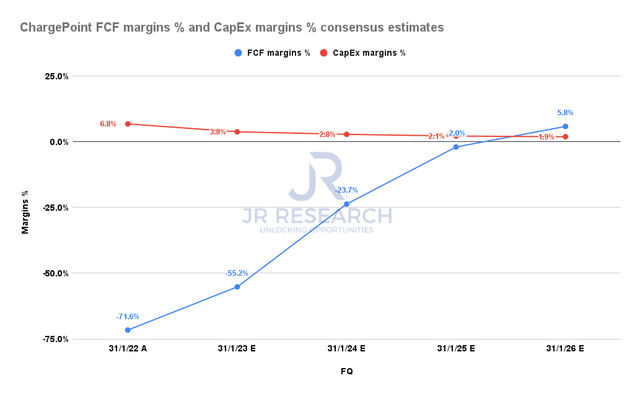

ChargePoint FCF margins % & CapEx margins % consensus estimates (S&P Cap IQ)

Despite operating an asset-light model, ChargePoint is burning a significant level of cash.

As seen above, ChargePoint’s CapEx margin for FY23 is estimated to be 3.8%. However, the company is expected to post a free cash flow (FCF) margin of -55% for FY23.

Hence, the company’s OpEx base is significant to deliver its highly aggressive topline growth. However, if its revenue growth is expected to slow due to macro headwinds, then the market would likely expect management to pull material OpEx reduction levers to drive down costs significantly.

As such, we believe the market is cautiously positioning for management to have the flexibility to slow down hiring in lifting its operating leverage. In its previous earnings call, management highlighted that “70% of [the company’s] operating expenses are people.” Hence, we deduce that the market would carefully parse management’s commentary on its hiring cadence moving ahead.

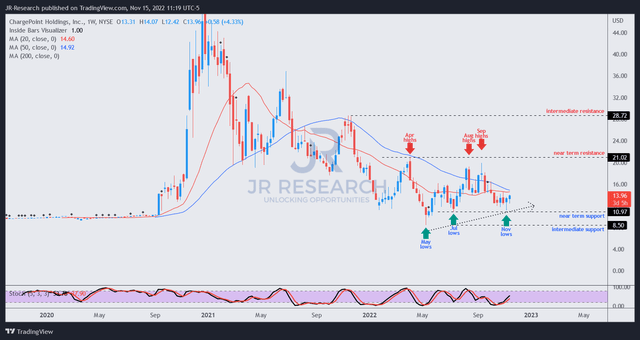

CHPT price chart (weekly) (TradingView)

Investors need to note that any buying opportunity on CHPT is speculative. Also, CHPT is a highly volatile stock. Therefore, investors considering adding exposure need to execute robust risk management strategies and also be able to tolerate significant volatility.

Our price action analysis indicates that CHPT remains mired in a medium-term downtrend. However, its bearish bias has been losing momentum since May 2022. Hence, CHPT bulls are likely trying to retake its bullish bias, but sellers remain in decisive control.

Therefore, CHPT is heading into its FQ3 report at a critical juncture. But, we assess that the price action is more constructive for buyers at the current levels, with the market likely baking in a worse-than-expected Q3 release.

Revising from Hold to Speculative Buy with a PT of $17.5.

Be the first to comment