Cecilie_Arcurs/E+ via Getty Images

Back in September, I wrote an article that summed up the development of the dispute between Centerra Gold (NYSE:CGAU) and the Kyrgyz government, when the government technically nationalized the mine. But even without the Kumtor mine, Centerra Gold with its Canadian and Turkish assets and a huge cash pile was undervalued. Several months have passed, the share price hasn’t moved much, but the situation regarding the Kumtor mine was developing positively, with numerous rumors of advanced negotiations between the company and representatives of the Kyrgyz government. As a result, I featured Centerra as the December “Idea of the Month” for the members of the “Royalty & Streaming Corner“. Positive outcomes of negotiations were later confirmed by both parties which helped to elevate Centerra’s share price nearly 40% higher. However, the recent stock and gold market weakness, along with some issues at Centerra’s Turkish operations, pushed the share price back down where it was a year ago. With the final resolution of the Kumtor problem imminent, a huge cash pile still in place, and the recently acquired Goldfield District project, Centerra offers significant short-term, as well as long-term upside.

The Kumtor Drama

To sum up the main points. On May 16, 2021, the Kyrgyz parliament instructed the government to install external management at the Kumtor mine. This technically meant that the mine was nationalized. Centerra immediately initiated an arbitration against the Kyrgyz Government, and restrictions were imposed on the 26% equity interest in Centerra held by a Kyrgyzstan-controlled company named Kyrgzaltyn. Both parties subsequently started legal proceedings against each other and their representatives.

But the drama is coming to a conclusion. On July 25, a special meeting of Centerra’s shareholders will be held. The shareholders should approve the proposed resolution of the dispute there. The Management Information Circular with details regarding the resolution can be found here. But to sum it up:

- Kyrgyzaltyn will transfer its 26% equity interest in Centerra back to Centerra for cancelation.

- Kyrgyzaltyn will receive 100% equity interest in Kumtor Gold Company and Kumtor Operating Company, gaining 100% control over the Kumtor mine, plus a cash payment of C$46 million

- Centerra will pay Kumtor Gold Company $50 million

- The Kumtor reclamation trust funds will be transferred to a Kyrgyz-based reclamation account held by Kumtor Gold Company

- Kyrgyzaltyn and the Kyrgyz Republic will assume all responsibility for the Kumtor mine, including all reclamation and environmental obligations

- All legal proceedings involving both parties in all jurisdictions will be terminated, with no admission of liability

So the main outcome for Centerra is that it will cut its ties to Kumtor, Kyrgyzaltyn, and the Kyrgyz government, it will get rid of all the past, current, and future responsibility for the mine, it will pay nearly $90 million, and in an exchange for all of this, its share count will be reduced by 26%. Of course, under normal circumstances, keeping the interest in the Kumtor mine and collecting the cash flows generated by this world-class asset would have been the best outcome. However, given the situation, the deal looks good for Centerra and its shareholders. The most important point is that Centerra is about to get rid of the Kyrgyz burden that has been weighing on the company for years. This should open the way for reaching higher valuation multiples.

The Problems in Turkey

Another issue that has been weighing on Centerra lately is mercury at the Turkish Oksut mine. On March 18, Centerra announced that it has temporarily suspended gold dore production at Oksut, as mercury was detected in the gold room of the adsorption-desorption recovery plant. Fortunately, although the dore production has been halted, the mining activities, processing of the ore, and concentrate production continued. During the Q1 earnings call, the CEO mentioned that Centerra was working on improvements to the recovery plant, while considering processing the gold in carbon concentrate at some third-party facilities as a short-term solution. However, no more information has been provided since the conference call that took place on May 4.

In this case, the worst-case scenario is that Centerra will have to sell its gold in the form of concentrate which would mean lower revenues per ounce sold, or to let it processed at a third-party facility, which would translate into higher production costs. Fortunately, in both cases, the impact on the profitability of the Oksut mine should be relatively small. However, it looks probable that the majority (if not all) of Oksut Q2 production will be accounted for as an increase in inventories. As a result, the Q2 financial results may look pretty bleak. On the other hand, the production not realized in Q2 will boost the financial results in the quarters that follow. Just a reminder, the Oksut mine is expected to produce 210,000-240,000 toz gold this year.

The Goldfield District Acquisition

Another important event that occurred over the recent months is Centerra’s acquisition of the Goldfield District project. Centerra agreed to pay $175 million, plus milestone payments of $31.5 million for the shovel-ready Nevadan project. The location of the project in a safe and mining-friendly jurisdiction is an important factor that should further diminish the jurisdiction risks traditionally related to Centerra.

Source: Centerra Gold

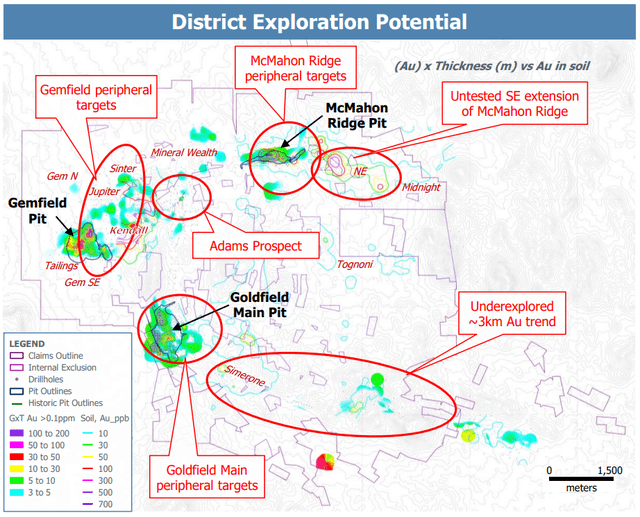

The Goldfield District project contains three known deposits, Gemfield, McMahon Ridge, and Goldfield Main, and numerous exploration targets. Unfortunately, Centerra hasn’t provided more detailed information regarding the resources or the projected shape of the proposed mining operation. Centerra only stated that it has identified many similarities to Oksut, not only the mining process proposed for Goldfield, but also the expected capital intensity and future production costs.

Only Maverix Metals’ (MMX) webpage states that Goldfield (Maverix lists the project under its original name Gemfield) should be producing around 125,000 toz gold per year. Maverix provides this information, as it holds a 5% NSR royalty on the project.

Unfortunately, for some more specific numbers, we will have to wait for another year. Centerra plans to release a new resource estimate sometime in H1 2023, followed by an updated feasibility study. The construction could start in the middle of 2024, with production start-up in late 2026.

Conclusion

Since early May, Centerra’s share price declined by nearly 35%. Last week, the share price tested the long-term support in the $6.6 area. For now, it held. However, the downward trendline held as well. In the coming days, either the support or the resistance should be broken. If the share price breaks the resistance, the next one should be in the $8.5 and after this, in the $10.5 area.

Source: TradingView

Centerra’s market capitalization is $2.12 billion. As of the end of Q1, Centerra held cash of $768 million and it was debt-free. It leads to an enterprise value of $1.35 billion. The pro-forma market capitalization that takes into account the cancellation of shares currently held by Kyrgyzaltyn is $1.57 billion. As a part of the deal, Centerra will pay approximately $86 million, therefore, the pro-forma enterprise value is around $887 million. This is a very low price paid for a company with two operating gold mines (Mount Milligan and Oksut) that should produce 380,000-430,000 toz gold and 90-100 million lb copper this year, at an AISC of only $450-500/toz gold on a by-product basis. At the current gold prices, the operating cash flow should exceed the $500 million level (assuming that Centerra manages to sell all the gold produced at Oksut, whether in the form of dore or concentrate). This leads to a pro-forma price-to-operating cash flow of only 3.1, which is well below the current industry median of 7.64. Moreover, Centerra holds also the Kemess project, the Goldfield District project, and the idled molybdenum operations.

It means that there is a good chance for Centerra’s share price to double over the coming months (assuming that there is no major stock or gold market collapse). And in the longer term, the upside is even bigger, depending on the progress at Goldfield, and potentially also at Kemess and the molybdenum assets.

Be the first to comment