Evgenii Mitroshin/iStock via Getty Images

2022 is already proving to be an incredibly volatile time for the oil and gas industry. We began the year with strong demand, pushing prices higher. Prices rose even further in response to the geopolitical issues regarding Russia and Ukraine. But now, we are seeing some weakness. In response to moves made by the Biden Administration, as well as due to concerns regarding a potential recession, prices have fallen from their highs. And with that, we have seen many of the companies focused in this space drop as well. But one interesting prospect that likely makes for an appealing opportunity, even in the event that prices fall further, is Centennial Resource Development (NASDAQ:CDEV). Due in large part to a pending merger, the company looks set to generate a significant amount of excess cash flow. Add on top of this just how cheap shares are today, and I cannot help but to think that it makes for an excellent prospect for investors who believe that oil and gas prices, while not necessarily staying as elevated as they are today, will still be at a heightened level compared to what they have been in prior years.

Centennial Resource Development – Big Changes Are Taking Place

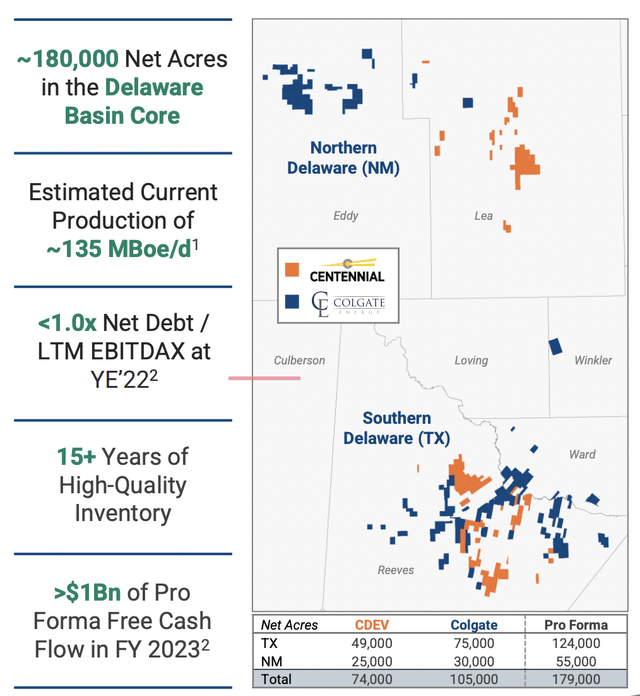

On May 19th of this year, the management team at Centennial Resource Development announced that it had agreed to merge with a privately held company called Colgate Energy Partners III, LLC. This multi-billion dollar transaction is slated to create an industry giant that should operate as the largest peer play exploration and production company in the Delaware Basin. In all, the combined firm will boast 180,000 net leasehold acres, 40,000 net royalty acres, and it will generate production, based on current levels of the firms individually, of 135,000 boe (barrels of oil equivalent) per day.

Centennial Resource Development

The overall terms of the transaction are fairly simple. According to management, the $7 billion merger values Colgate at $3.9 billion, based on the prices that shares were going for back then. The deal will ultimately result in Centennial Resource Development transferring to Colgate’s current shareholders 269.3 million shares of stock in Centennial Resource Development, combined with $525 million in cash payments. On top of this, Centennial Resource Development will also assume $1.4 billion in outstanding net debt that is currently on Colgate’s books.

Centennial Resource Development

In addition to the prospect of obvious synergies like consolidating general and administrative functions, the deal also makes sense, conceptually, because of some of their overlapping acreage. For instance, in the southern portion of the Delaware Basin, there is significant acreage that runs side by side. And in the northern portion of the Delaware basin, some acreage is not too far off. In addition to this, despite the debt that will come onto Centennial Resource Development’s books, the projected net leverage ratio will be lower than 1.0 if oil averages around $110 per barrel and natural gas is around $7.75 per Mcf. This kind of pricing, according to management, will also result in free cash flow of around $1 billion per year. Since this news broke, shares of Centennial Resource Development have declined by about 11.9%, likely due to market uncertainty more than anything.

Centennial Resource Development Centennial Resource Development

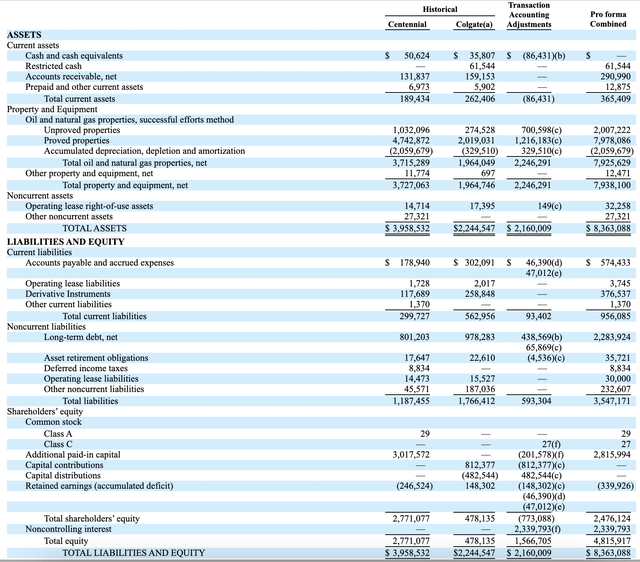

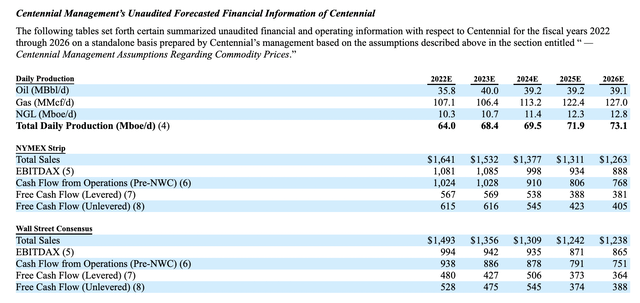

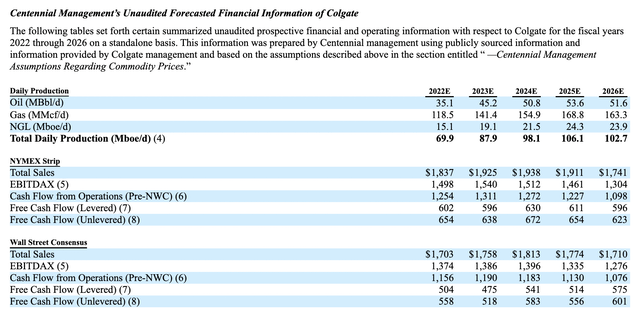

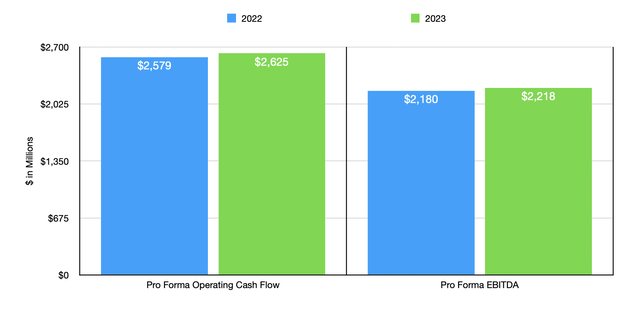

As for the company, there was some uncertainty at the time of the announcement. Besides the free cash flow number that management provided, we had no real idea of what the future would hold for the combined business. That changed on June 10th of this year when management filed a proxy statement with detailed financial projections for the individual companies, as well as some pro forma financial statements. Assuming nothing changes with the company fundamentally, the current share price of Centennial Resource Development of $6.60 should result in a combined market capitalization of $3.66 billion. Net debt should be roughly $2.22 billion, while its enterprise value should total roughly $5.88 billion. Operating cash flow for the combined company should be roughly $2.58 billion this year, while EBITDA should come in at $2.18 billion. Using 2023 estimates, these numbers are $2.63 billion and $2.22 billion, respectively. Investors may be worried about the company overreaching, as many did prior to the last energy price plunge a few years ago. However, given the significant free cash flow projected for the company based on 2021 results and elevated energy prices, not to mention the fact that projected spending plans will push production up 16.7% in 2023 compared to what the combined firm should generate this year, it’s likely that the company has a good deal of wiggle room to cut spending without drastically reducing production in the event of a downturn.

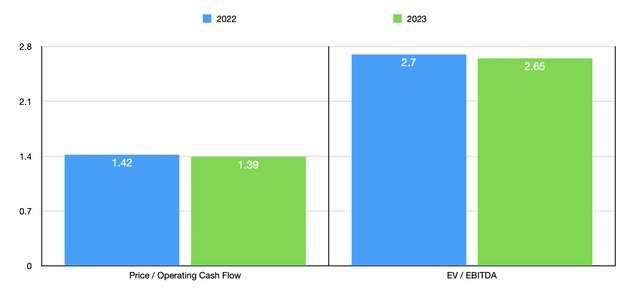

In terms of overall pricing for the company, the picture looks quite appealing. Using our 2022 figures, the firm is trading at a price to operating cash flow multiple of 1.42. This should drop to 1.39, if 2023 estimates are correct. Meanwhile, the EV to EBITDA multiple should drop from 2.70 this year to 2.65 next year. Overall, these are quite low levels for investors. That means that attractive upside potential might exist. It also means that the company has plenty of flexibility in a down market. For instance, if we take results from 2021, the combined firm would have generated operating cash flow of $1.26 billion. This was based on crude oil prices of $68.67 per barrel and natural gas prices of $3.54 per Mcf. However, if we factor hedges into the equation, then effective prices would have been $53.80 per barrel and $2.56 per Mcf, respectively. Even in this case, the price to operating cash flow multiple for the company would be just 2.91.

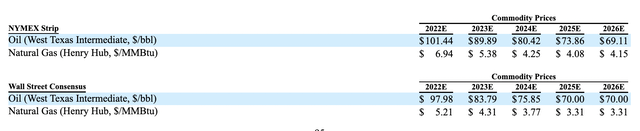

One positive though is that management is already forecasting a return to more normal energy prices. For 2022, the expectation is for oil to average $101.44 per barrel, while natural gas should be $6.94 per Mcf. For 2023, prices are expected to drop to $89.89 per barrel and $5.38 per Mcf, respectively, while by 2026 we should see pricing drop to $69.11 per barrel and $4.15 per Mcf, respectively. The fact that management’s own forecasts factor this in is great, since it demonstrates the company’s potential even in the event that prices fall from here, as they eventually must.

Centennial Resource Development

Takeaway

I understand how concerned the market is about the energy space right now. However, the overall fundamental health of the combined company should be quite robust. Even if energy prices plunge from here, shares are priced at levels that shouldn’t be overpriced. If anything, the company likely warrants some additional upside moving forward. As such, I have decided to rate it a ‘buy’ for now.

Be the first to comment