DINphotogallery/iStock via Getty Images

Investment Thesis

Cenovus Energy (NYSE:CVE) has a very compelling narrative of deleveraging its balance sheet combined with its intention of returning capital to shareholders. However, once we pull back that narrative, and look at Cenovus’ balance sheet, we meet the reality that there simply isn’t enough flexibility in its fiscal position.

If you are like me, super bullish on oil and gas, this could be compelling. But even in that event, I’m inclined to believe that there are even better opportunities elsewhere. Here’s why.

Investor Sentiment Facing Oil and Gas Producers

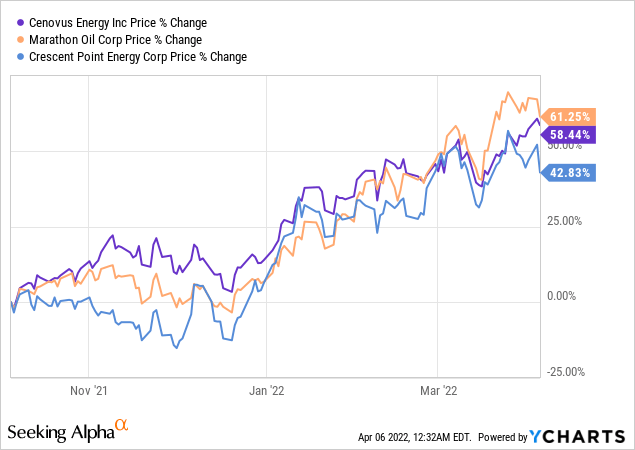

A lot of investors appear to believe that it makes a huge difference which oil and gas producer they pick. I’ve attempted to explain that the risks and opportunity amongst them are to a very large extent the same. And the graph above exemplifies that.

Of course, over a +10-year period, it makes a lot more difference with regard to the management teams, the acquisitions that are made, how hedged their book has been, their balance sheet, etc.

That being said, the overarching risk here boils down to whether or not oil prices remain elevated near-term.

If one has a view that oil and gas prices remain around $80 or higher on the WTI and $4 MMBtu for gas, then being exposed to oil and gas is certainly a compelling opportunity. But perhaps not Cenovus in particular.

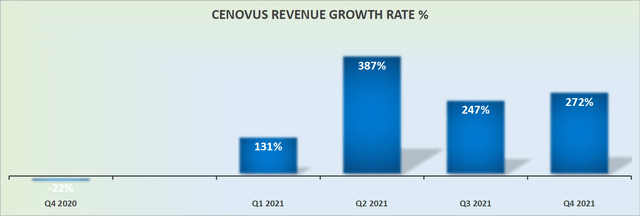

Revenue Growth Rates Are Volatile

Cenovus revenue growth rates

Relative to other oil and gas companies, Cenovus’ revenue growth rates are more volatile. That can be great if one believes that oil and gas prices are going to remain elevated. But it doesn’t provide much margin of safety if, for whatever reason, oil and gas prices were to retrace lower.

On that line of thinking, Cenovus had run a meaningfully hedged book against WTI prices. Something that I’ll discuss next.

Discussing Cenovus’ Hedges

Let’s consider Cenovus’ hedges. A market update earlier this week informed investors that if prices remain where they are, Cenovus’ hedges will lead to it losing $1.4 billion in realized losses.

In a period when most oil producers are for the first time in a long time making a killing, this is a serious mismanagement of capital. There are no two ways about it.

Cenovus is quick to highlight that it will announce details ”for increasing shareholder returns” together with its Q1 2022 results at the end of this month.

But if you think about this rationally, Cenovus poorly managed its exposure and wished to get ahead of the bad news by getting it out early before the quarterly results came out.

However, I make the case that shareholders should not expect a meaningful change in shareholder returns to be announced during its quarterly earnings results. The reason for that thesis, we discuss next.

Balance Sheet Is Restricted

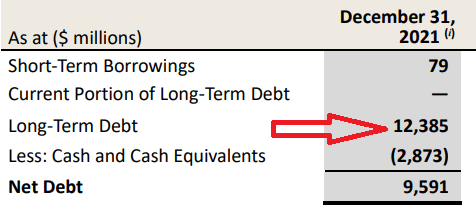

Let’s put Cenovus’ hedge losses into perspective. For Q4 2021, its free fund flows reported $1.1 billion. Meanwhile, the expected losses from its hedges in 2022 are expected to reach $1.4 billion.

Cenovus Q4 2021 results

What this means in practice is that Cenovus’ ability to return meaningful capital to shareholders will be restricted given that Cenovus holds close to $12 billion of debt on its balance sheet, after it redeemed the remaining principal amount of its notes due in 2023 and 2024, which accounted for $384 million.

On the other hand, Cenovus believes that if present market conditions continue, it can bring its net debt position closer to $8 billion rather imminently. And that’s perfectly fine, but nothing to get one’s heart racing.

CVE Stock Valuation – Cheaply Priced to Free Fund Flows

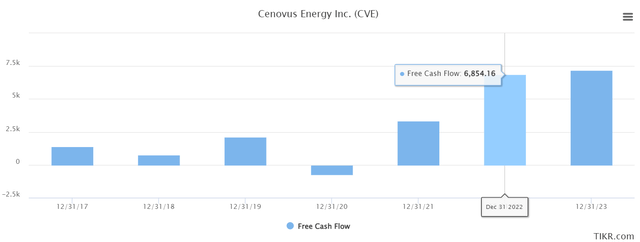

TIKR.com

Analysts following Cenovus Energy are expecting that its free cash flows could reach approximately $6.9 billion. However, this estimate would not factor in its hedged book.

On the other side of the argument, one must consider that relative to what an investor is likely to pay outside of oil and gas stocks, an investor would often be having to pay more than 10x free cash flow for a business with substantial hairs on them.

On yet the other hand, if you look at something like Marathon Oil (MRO), it has a very clean balance sheet, no hedges, very strong returns of capital, and it’s priced at approximately 6x free cash flow.

The Bottom Line

Despite being very bullish on gas and oil stocks, I’m not finding myself compelled to deploy capital into this company. I believe that I’ve found a better opportunity to deploy my own capital that I’m sharing in my Marketplace.

The issue with Cenovus boils down to its management not being a reasonable capital allocator, which has culminated in Cenovus’ balance sheet ending up more restricted than that of its peers, at a time when it should be running much leaner. Whatever you decide, good luck and happy investing.

Be the first to comment