metamorworks

Cenntro Electric Group Limited (NASDAQ:CENN) operates in the growing electric vehicles (EV) market with a special design that would allow a significant amount of outsourcing. As a result, I believe that the incoming results would bring more free cash flow (FCF) margin than competitors. My discounted cash flow (DCF) models indicated that, with sufficient levels of successful R&D, the upside potential in the CENN stock price could be substantial. Even with certain risks, CENN is a stock to follow carefully.

Cenntro Electric

Cenntro Electric is a designer and manufacturer of electric vehicles. The company intends to offer vehicles for corporate and governmental organizations. Have a look at some of the models offered by Cenntro before I head to the most recent figures:

Source: Company’s Website

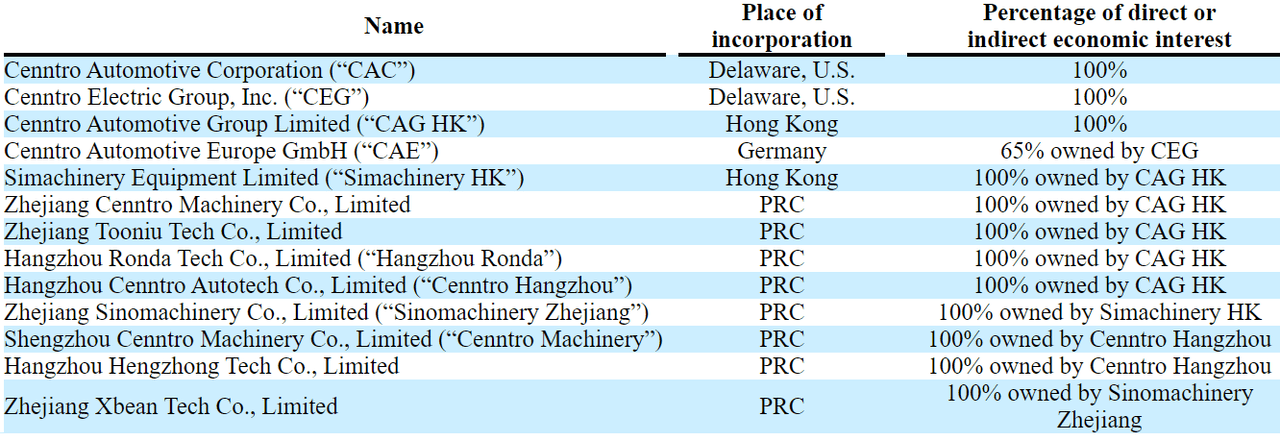

Considering the location of its subsidiaries, Cenntro Electric appears to be operating in many jurisdictions, which would most likely multiply the target market. Cenntro’s subsidiaries are located in Delaware, Hong Kong, Germany, and China.

Source: Prospectus

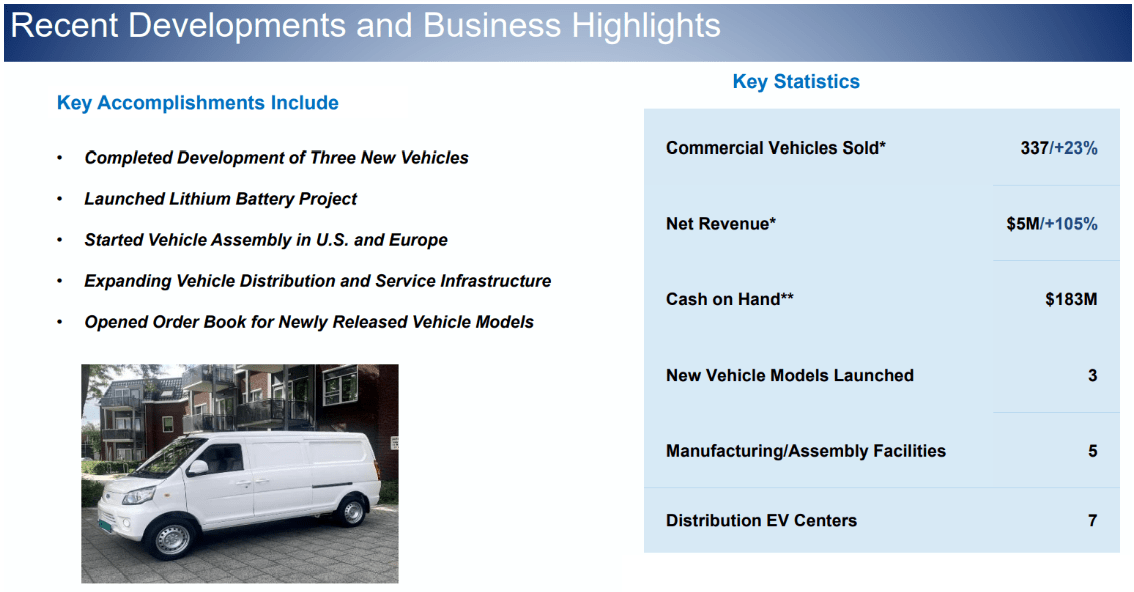

So far, the most recent numbers of commercial vehicles sold are encouraging. In the last earnings report, according to a recent presentation, total commercial vehicles sold in the first half of 2022 were 337. The company also launched a total of 3 new vehicles, and already counts 5 assembly factories and 7 EV distribution centers. Finally, let’s note that Cenntro Electric has already started vehicle assembly in U.S. and Europe.

Source: Half Year Results

Considering the expansion of the company’s activities in Europe and the United States, I became very interested in the feedback received from clients in these new markets. In this regard, let’s note the words of the CEO about the LS200 product line offered in Europe. Management was quite optimistic in a recent press release:

We are very pleased with the strong reception of our LS200 product line in Europe, said Peter Wang, Chairman and Chief Executive Officer of Cenntro. Despite supply chain and logistics challenges we have started shipping the LS200 to European markets, and are receiving positive feedback on the vehicle’s performance and abilities. Source: Press Release

Results Of The First Half Of 2022 And Impressive Annual Sales Growth

Cenntro Electric reported double digit sales growth in the first half of 2022, but the company’s EBITDA margin is still negative. Shareholders may need to wait a few more years to see free cash flow growth.

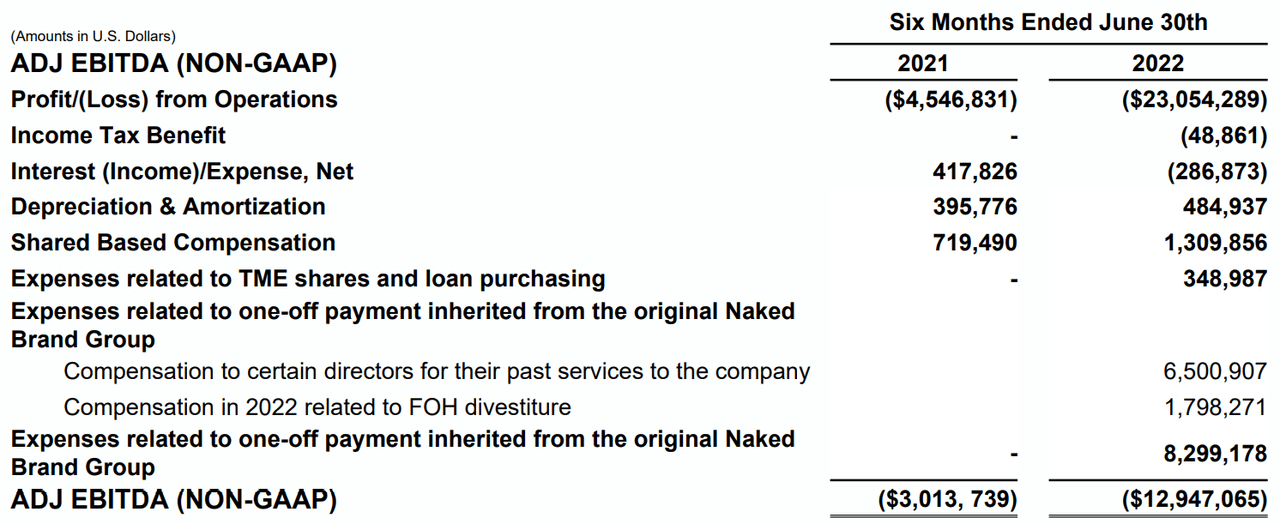

In the first half of 2022, Cenntro Electric reported a loss of $23 million, income tax benefit of $0.48 million, and interest expenses worth $0.28 million. D&A was equal to $0.48 million, and shared based compensation stood at $1.3 million, which may not be appreciated by certain investors.

The company also reported certain payments related to Naked Brand group, which seem a bit extraordinary. I wouldn’t expect to see many of these expenditures in the near future. These extraordinary payments stood at $8 million. Finally, the adj. EBITDA was equal to -$12 million.

Source: Half Year Results

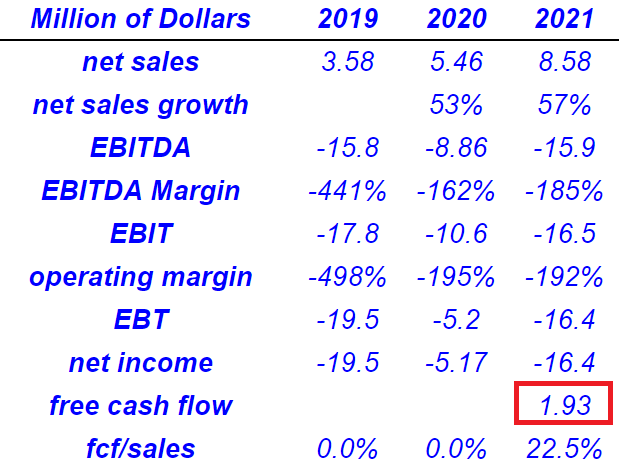

The revenue growth in 2020 and 2021 is quite impressive with a growth rate larger than 51%. 2021 net sales stood at $8.58 million, together with a net sales growth of 57%. In addition, 2021 EBITDA was -$15.9 million. 2021 EBIT was equal to -$16.5 million with a net income of -$16.4 million. Finally, 2021 free cash flow was equal to $1.93 million with FCF/sales of 22.5%.

Source: MarketScreener.com

Cenntro Electric Reports An Impressive Amount Of Cash And No Financial Debt

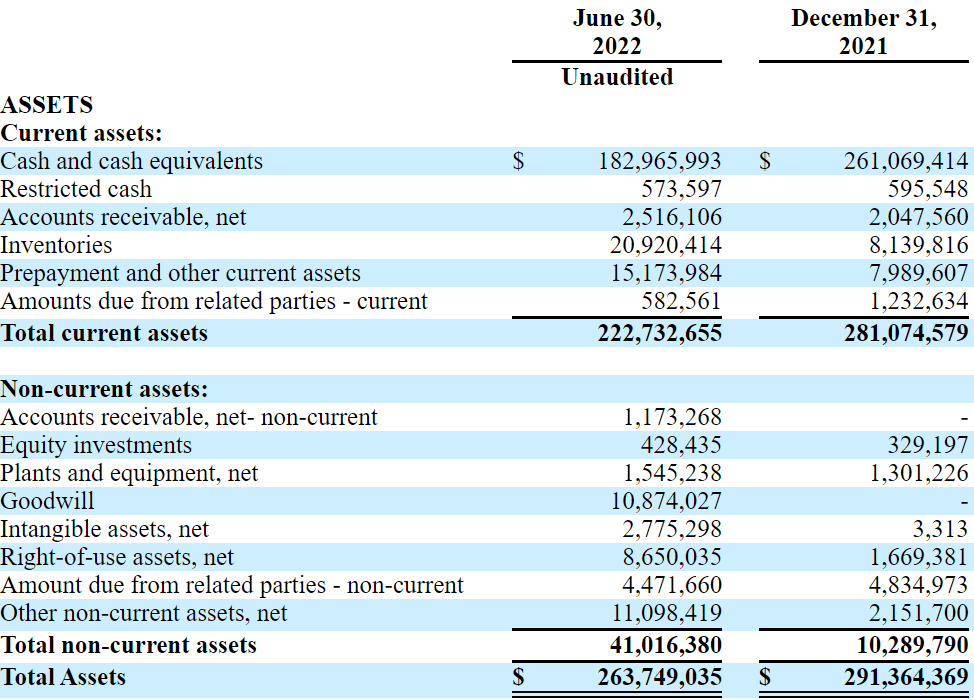

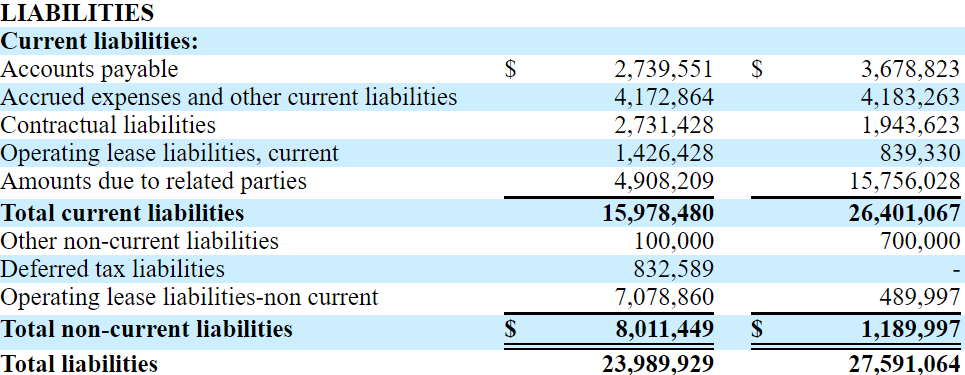

As of June 30, 2022, Cenntro Electric reported cash and cash equivalents of $182 million, which would, in my view, help management finance future development of EVs. Accounts receivable was equal to $2.5 million, with inventories of $20 million and prepayment and other current assets of $15 million. Finally, the amount due from related parties was equal to $0.58 million with total current assets of $222 million.

Moving on to non-current assets, we note that equity investments were worth $0.4 million, plants and equipment was worth $1.5 million, and goodwill was worth $10 million. Besides, the right to use assets were $8 million, and the total assets stood at $263 million. The company’s asset/liability ratio stood at more than 10x, so I would say that the balance sheet stands in good shape.

Source: Quarterly Report

Regarding the liabilities, we received the following figures. Accounts payable was equal to $2.7 million with accrued expenses and other current liabilities worth $4 million. The contractual liabilities stood at $2.7 million with operating lease liabilities of $1.4 million. The amount due to related parties was equal to $4.908 million, which I assumed is debt in my financial model. In sum, Cenntro Electric reports total current liabilities of $15 million, which is way below the total amount of cash in hand. I wouldn’t expect a liquidity issue any time soon.

The following information was provided about the other non-current liabilities. With deferred tax liabilities of $0.832 million and operating lease liabilities-non current of $7 million, the company does not appear to have long term debt. Total non-current liabilities were equal to only $8 million, and total liabilities stand at $23 million.

Source: Quarterly Report

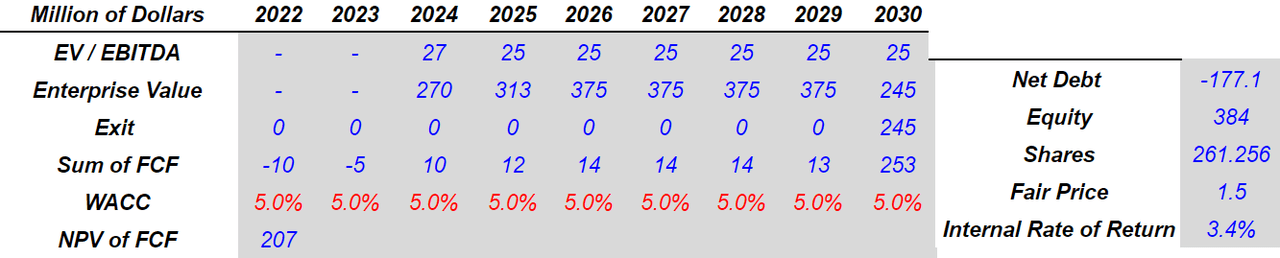

Case 1: Under Normal Circumstances, Cenntro Electric Would Be Worth $1 Per Share

I believe that the company’s modular design will most likely help Cenntro Electric grow faster than competitors. Let’s note that outsourcing of certain manufacturing processes could help Cenntro Electric offer a better FCF margin than other competitors. Management gave further explanation in a recent report.

Each of our vehicle models has a modular design that allows for local assembly in small factory facilities, which allows us to focus our efforts on the design of ECV models and related technologies while outsourcing various portions of the manufacturing, assembly and marketing of our vehicles to qualified third parties, allowing the Company to operate with lower capital investment than traditional vertically integrated automotive companies. Source: Prospectus

I also assumed that the center in Germany and the collaboration with a logistics partner in Hungary will help Cenntro Electric be close to European clients. With this in mind and considering the new registration of electric cars and vans in Europe, Cenntro Electric’s revenue growth may creep up too:

We have established a European Operations Center in Dusseldorf, Germany with a logistics company in Budapest, Hungary to house spare parts for our ECVs. Source: Prospectus2021 saw a significant increase in the uptake of electric cars and vans in the EU-27. Electric car registrations for the year were close to 1,729,000, up from 1,061,000 in 2020. This represents an increase from 10.7% to 17.8% in the share of total new car registrations in just 1 year. Source: New registrations of electric vehicles in Europe.

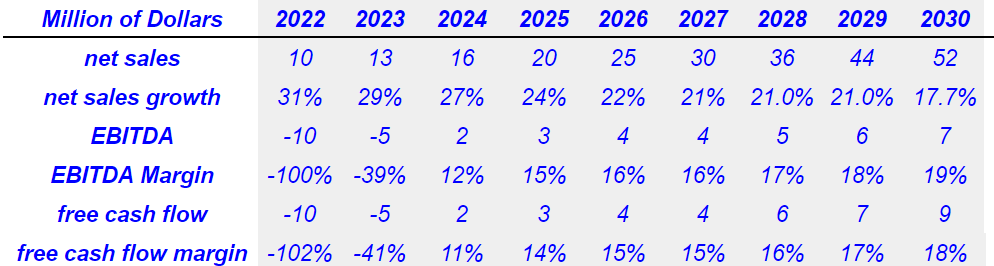

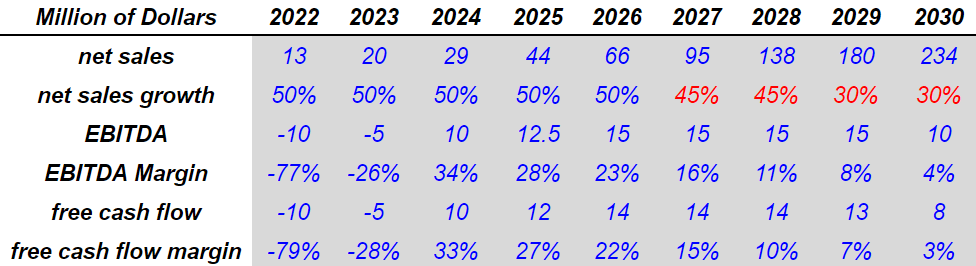

The EV market is expected to grow at close to 17.75% until 2027. The company is small, and its revenue grew at more than 57% y/y in 2021. Hence, under normal circumstances, I would expect larger sales growth than the target market for some time. I assumed sales growth around 27%-17% from 2024 to 2030 and an EBITDA margin of 12%-19%. Free cash flow would also grow from $2 million in 2024 to $9 million in 2030. I believe that free cash flow margin around 11% and 18% would also be very reasonable.

The Electric Vehicles market in the world is projected to grow by 17.75% resulting in a market volume of $869.30 billion in 2027. Source: Electric Vehicles – Worldwide | Statista Market Forecast

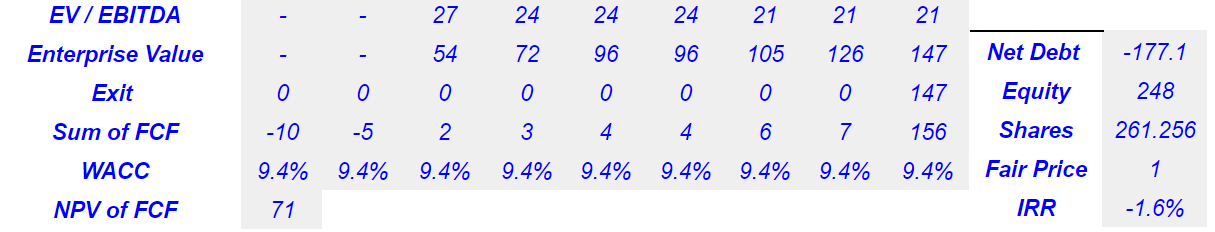

Bersit’s DCF Model

If we assume a general decline in the EV/EBITDA ratio from 2024 to 2030 and 2030 EV/EBITDA of 21x, 2030 enterprise value would be $147 million. If we include a WACC of 9.4%, the equity valuation would stand at $248 million, and the fair price would be $1 per share.

Bersit’s DCF Model

Case 2: Successful Development Of Autonomous Driving Capabilities

Under my best case scenario, I assumed that Cenntro Electric’s research and development efforts will successfully bring revenue growth and free cash flow. More in detail, I am optimistic about the company’s vehicle digitization and further improvements in lithium battery technology.

We have invested resources in the research and development not only of ECV design and manufacturing processes, but also in digitally enabled components, intra-vehicle communication, vehicle control and vehicle automation, or what we collectively refer to as “vehicle digitization,” as well as in the improvement of lithium battery technology. Source: Prospectus

Let’s keep in mind also that Cenntro Electric appears to be developing autonomous driving capabilities. There are EV manufacturers out there trading at large multiples because of these technologies.

We have developed a prototype system-on-chip for vehicle control and an open-platform, programmable chassis, with potential for both programmable and autonomous driving capabilities. Source: Prospectus

Under the previous assumptions, I believe that net sales growth close to 50%-30%, 2030 EBITDA margin of 4.5%, and FCF margin of 3.5% make sense. We would be talking, therefore, about a 2030 FCF of almost $8.5 million.

Bersit’s DCF Model

If we include an EV/EBITDA of 25x and a discount of 5%, the net present value of future free cash flow would stand at $207.5 million. Besides, the equity valuation would stand at almost $385 million, and the fair price would be $1.5 per share.

Bersit’s DCF Model

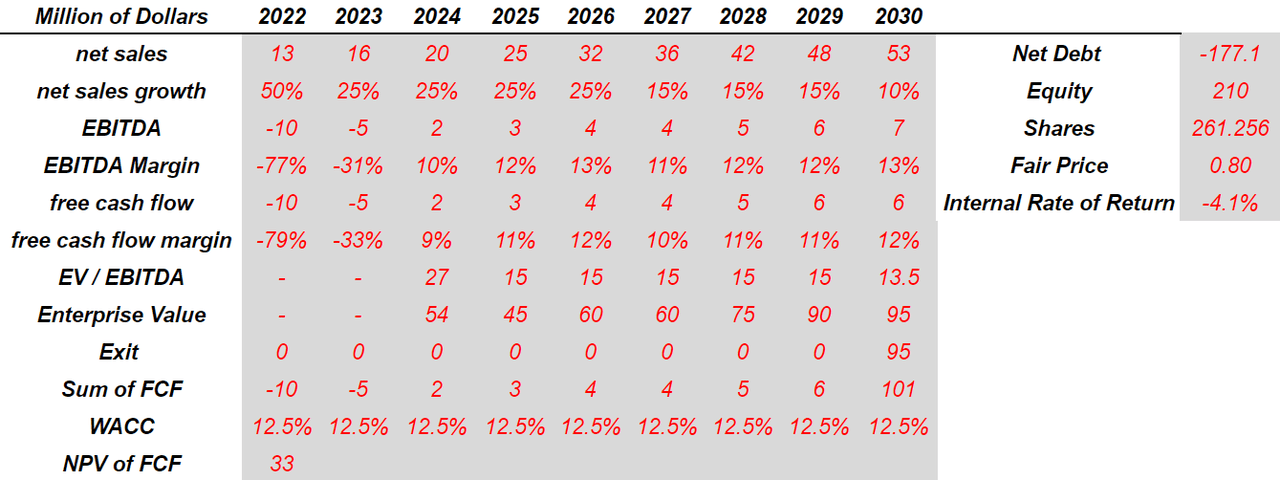

Case 3 And Risks

Cenntro Electric is a holding company incorporated in Australia along with operations in Germany, China, and other parts of the globe. The securities law in Australia is different from that in the United States. As a result, certain investors may not feel that comfortable investing in Cenntro Electric, and the demand for the stock may not grow.

Cenntro is a holding company incorporated in Australia and with principal executive offices in New Jersey. Investors are purchasing securities of an Australian holding company which has no operations. Source: Prospectus

It is also worth noting that Cenntro’s operations in China may create certain trouble in the future. If rules and regulations in China change, or the interpretation of the law changes, Cenntro Electric may suffer sanctions. As a result, the company’s reputation may be damaged.

While a significant portion of our business functions are located in the United States, including executive management, corporate finance and sales, our operations in China through our PRC subsidiaries subject us and our investors to unique risks due to uncertainty regarding the interpretation and application of currently enacted PRC laws and regulations and any future actions of the PRC government relating to the foreign listing of companies. Source: Prospectus

Trading prohibition on U.S. markets could also occur as authorities in China continue to prohibit investigations of PCAOB-registered public accounting firms in mainland China. As a result, I believe that the cost of equity would increase substantially, and the fair price could decline.

In addition, if the PCAOB continues to be prohibited from conducting complete inspections and investigations of PCAOB-registered public accounting firms in mainland China and Hong Kong, the PCAOB is likely to determine by the end of 2022 that positions taken by authorities in the PRC obstructed its ability to inspect and investigate registered public accounting firms in mainland China and Hong Kong completely, then the companies audited by those registered public accounting firms would be subject to a trading prohibition on U.S. markets pursuant to the HFCA Act. Source: Prospectus

Under very traumatic conditions, I believe that 2030 sales growth of 10% could happen. I also assumed a FCF margin of 12.5%, an EV/EBITDA of 13.5x, and a WACC of 12.5%. My results include a fair price of $0.8 per share and an equity valuation of $210 million. I really believe that these results are not that likely.

Bersit’s DCF Model

Conclusion

Cenntro Electric is targeting a large market that grows at a double digit. With a considerable amount of cash in hand and the company’s modular design, in my view, we could expect rapid sales growth and large FCF margins. We cannot really say exactly when future free cash flow margin will trend to double digit, however with more models in the market, it should not take a long time. Under my discounted cash flow models, the upside potential appears more significant than the downside risk.

Be the first to comment