Adrian Vidal/iStock via Getty Images

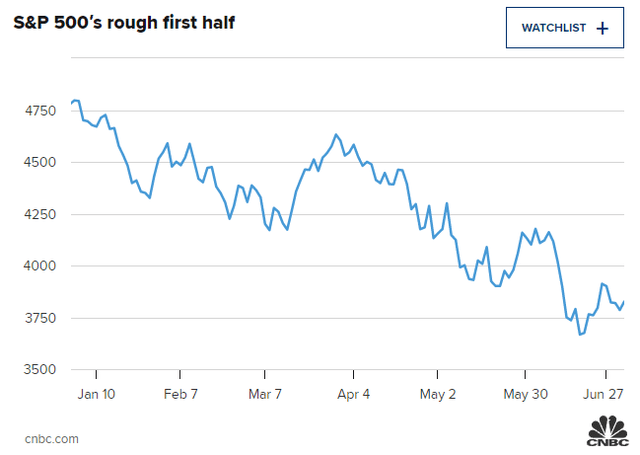

The first 6 months of 2022 are now in the record books for the worst first half for the stock market in 50 years. There haven’t been many places to hide out, and unless your investments have been skewed toward energy, 2022 hasn’t been much fun. Equities that are considered bellwethers, such as Apple (AAPL) and Microsoft (MSFT), which both generate over $50 billion in net income annually, have also seen their values compress. It’s always interesting to see how many people line up to shop on Black Friday but when the market declines, investors panic. Nobody can predict when the markets will bottom, but history has proven that investing during periods when the markets are declining becomes a tremendous opportunity for long-term investors.

I have been on the lookout for good income-producing investments during the market decline, and one of the sectors I have been focusing on is Real Estate. Most recently, I have added to Simon Property Group (SPG) and Medical Properties Trust (MPW). I have been looking for a well-rounded fund as many REITs seem to be on sale. The Vanguard Real Estate ETF (VNQ), which is one of the largest real estate funds, has declined -19.42% YTD, but it only yields 3.08%. It’s hard for me to get excited about individual REITs or real estate funds if the yield doesn’t exceed 5%. Investing in REITs or real estate funds isn’t about capital appreciation for me. I strictly look at these investments as income opportunities. I stumbled across the CBRE Global Real Estate Income Fund (NYSE:IGR), and the first aspect that caught my eye was the 9.81% yield. After looking further into IGR, I added it to my buy list and plan on adding it to my Dividend Harvesting portfolio (series on Seeking Alpha) and main dividend portfolio in the future.

The CBRE Global Real Estate Income Fund

IGR is a closed-end fund managed by CBRE Investment Management. CBRE Group (CBRE) is the world’s largest commercial real estate services and investment company in addition to being the largest commercial property developer in the United States. The investment management arm of CBRE has $146.8 billion of assets under management. When I saw that CBRE had its own closed-end fund, I became very interested. This isn’t a wealth management company that creates ETFs; CBRE is the Crème De La Crème in commercial real estate. CBRE lives and breathes real estate, and being a global powerhouse, there may not be a better company to put together a global real estate fund.

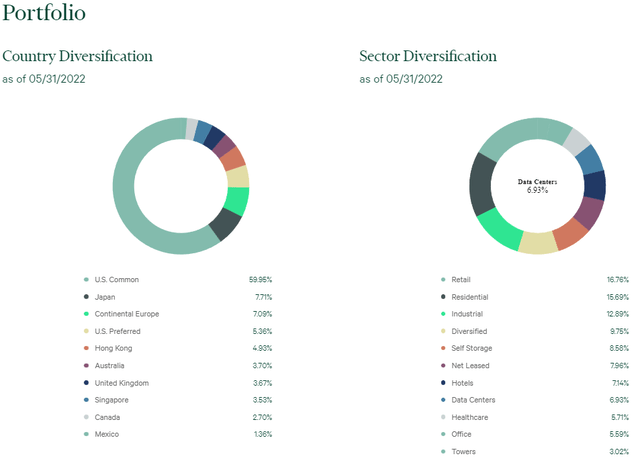

IGR’s primary objective is to generate large amounts of income for its investors. Capital appreciation is its secondary objective. IGR’s investment policy prohibits investments into other sectors outside of real estate. IGR invests at least 80% of its assets in income-producing global real estate securities. Real Estate Equity Securities include common stocks, preferred securities, warrants, and convertible securities issued by real estate companies. IGR focuses on developed countries but will allow its managers to utilize up to 15% of its total assets in Real Estate Equity Securities of companies domiciled in emerging market countries. IGR’s investments will primarily consist of Real Estate Equity Securities with market caps ranging from $40 million to approximately $12 billion. However, there are no restrictions on the market cap range for positions found in IGR’s portfolio. 25% of IGR’s holdings may be allocated toward preferred securities. IGR utilizes leverage and at the end of 2021 IGR’s leverage position was 21%.

One of the reasons I am attracted to IGR is CBRE’s global footprint and its expertise in global real estate. I own several U.S. based REITs, but there are many sectors of the real estate market that I don’t have exposure to. IGR is concentrated in the United States but also provides exposure to other countries such as Japan and Hong Kong while diversifying its holdings across all sectors of the real estate market. IGR allows me to invest in one fund and generate a high single-digit yield from global real estate.

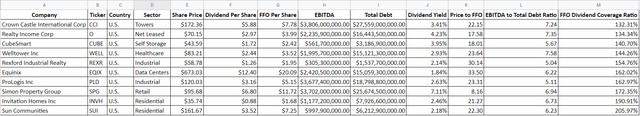

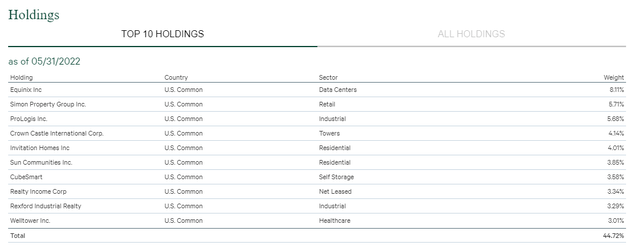

The CBRE Global Real Estate Income Fund Top Ten Holdings

I am invested in several REITs and have a methodology around how I vet them. When it comes to a real estate fund, I look at the same characteristics, but I change my prioritization. The fund managers certainly have more expertise than I do in real estate, so I won’t put as much emphasis on the price to funds from operations (FFO) metric. When I am investing in an individual REIT the price to FFO metric is important because I want to pay the cheapest valuation for a REITs FFO. As an overall fund, I am less concerned with this metric as IGR has 83 holdings, and not all are common shares of REITs. IGR’s top ten holdings represent 44.72% of the portfolio, so I built out my metric table to look at these ten securities as a group.

The two things I want to look at with these 10 securities are their EBITDA to total debt and FFO dividend coverage ratios.

Steven Fiorillo, Seeking Alpha

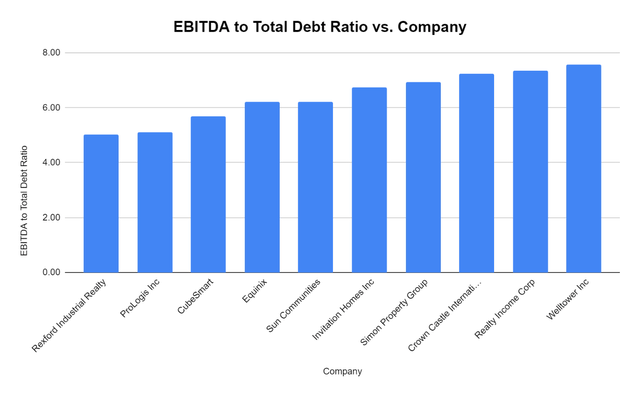

The EBITDA to total debt ratio when evaluating REITs provides the best way to assess the debt level of REITs. Almost every company taps the debt markets to fund its growth, but not all debt levels are equal. One company could have $10 billion in debt but generates $2 billion in EBITDA, while another has $2 billion in debt but only generates $100 million of EBITDA. Looking at the EBITDA to Total Debt ratio allows an investor to see how many years of EBITDA it would take to eliminate the company’s total debt and determine if the debt load is manageable or a liability that makes the company uninvestable.

There is a tight EBITDA to total debt range from 5.04x to 7.58x with an average of 6.41x. I am quite pleased with these numbers because none of the top 10 holdings seem to have debt levels that are unmanageable.

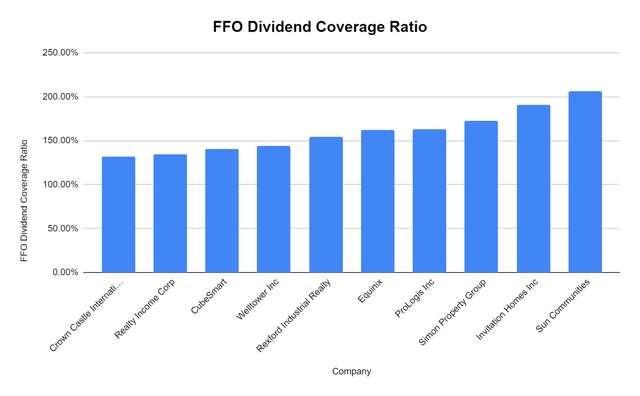

Steven Fiorillo, Seeking Alpha

Since there is such a large concentration in the top 10 holdings, I want to make sure that these companies can fully support their dividends. FFO represents the actual cash generated from the REIT’s operation. It is a widely used ratio for valuation purposes as it has become the primary earning metric in REITs. FFO = Net Income + Depreciation and Amortization+ Loss on Sales of Asset – Gain on Sales of Asset+ Interest Income. This is the capital that REITs utilize to pay dividends, so it’s important that there are adequate coverage ratios. I am not seeing any red flags as each of the top 10 companies has good FFO coverage ratios. I wouldn’t be worried about these companies suspending or reducing their dividends in the near future.

Steven Fiorillo, Seeking Alpha

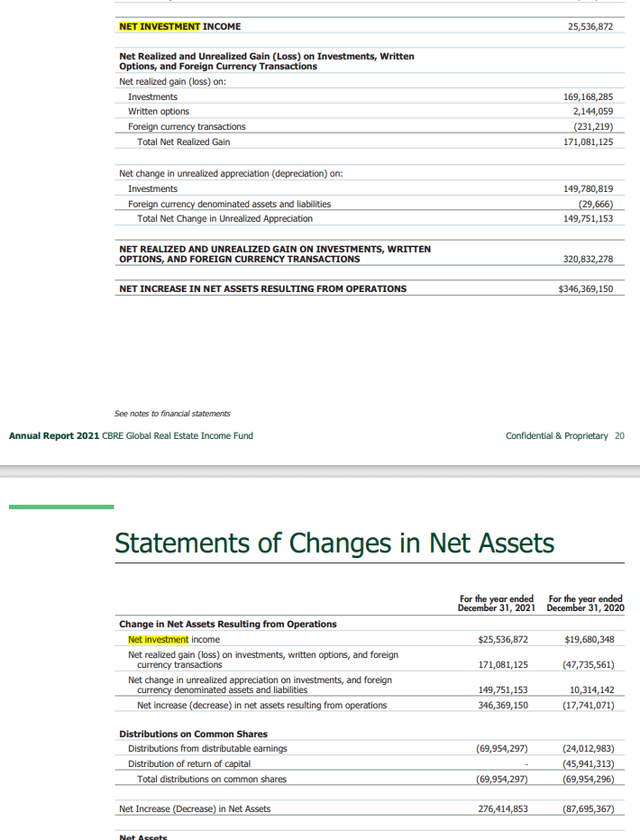

Understanding The CBRE Global Real Estate Income Fund Distributions

I think it’s important to understand how a fund pays its distributions, especially when the yield is approaching double digits. IGR’s distribution is comprised of net investment income, and net realized capital gains. If net investment income and net realized gains are not sufficient to fully cover the distribution, then a portion of the distribution would be a return of capital. The Board regularly reviews the coverage and composition of the distribution to ensure the distribution level is appropriate. You can find out IGR’s distribution characteristics by reading through the annual statement or reviewing the final determination on the Form 1099 DIV and sent to shareholders.

There are 3 components to the distribution I discussed here, and I want to highlight what they are:

- Net Investment Income – income received from investment assets

- Net Realized Gains- income generated from selling investment assets

- Return of capital – represents part of the shareholder’s initial investment capital

(You can read a full explanation of this here)

My preference is to have the entire distribution constructed from net investment income, and net realized gains. Page 20/21 of IGR’s annual report breaks down how the distributions were constructed in 2021. IGR paid $69.95 million in distributions throughout 2021, and not a single$1 was from return of capital. The fund generated $25.54 million in net investment income and $171.08 million in net realized gains. IGR’s investments generated $169.17 million, and the managers generated an additional $2.14 million on writing options.

IGR has established a strong track record over the past decade of paying its distribution. In July of 2015, IGR increased its monthly distribution from $0.04 to $0.05, and recently IGR’s distribution increased again in March of 2022 from $0.05 to $0.06. During the heart of the pandemic, the distribution wasn’t suspended or reduced, which is a huge plus, in my opinion. I like the track record which has been established, and after looking at the annual report, I am very happy with IGR’s distribution. Since I am considering IGR as an income play on the global real estate market, I want to ensure that the fund managers can generate the entire distribution from their investments and that it will be reliable income. They have succeeded in both areas.

Conclusion

I am glad I stumbled upon IGR, as I wasn’t aware that CBRE had an investment management arm offering Closed-End Funds. IGR has fallen with the market, and its -24.95% decline has pushed its yield to 9.81%. After reading through the fund’s documents, I am interested in adding IGR as an investment. CBRE is arguably the standard in commercial real estate, and if I am going to add a global real estate fund, I can’t think of a better company to manage it. I will be adding IGR as an income play, and its distribution which is yielding 9.81%, passes my inspection. 0% of the distribution came from return of capital in 2021, the distribution was recently increased, and a decade-long history of monthly distributions was established. It looks like IGR is on sale, and I am happy to buy its yield at these levels.

Be the first to comment