Bet_Noire/iStock via Getty Images

Thesis Summary

In ARK’s most recent investment research report, the investment fund predicted that Bitcoin (BTC-USD) could reach a $1.36 million price target by 2030. In this article, I will put those claims to the test, and derive my price target for Bitcoin in 2030.

Ultimately, I believe a $1 million price target is an ambitious, yet achievable target, and we can set that as a possible ceiling. Meanwhile, I will lay out what I expect should be the minimum price target that Bitcoin could achieve by 2030.

How Does Bitcoin Reach $1 Million?

ARK’s claim that Bitcoin will reach a +$1 million price level, is based on the assumption that it will penetrate various markets to a certain degree. ARK then estimates the combined market cap of these different markets to derive a total market cap for Bitcoin. Since the supply of Bitcoin is predictable and capped at 21 million, it is easy to translate this into the price per Bitcoin.

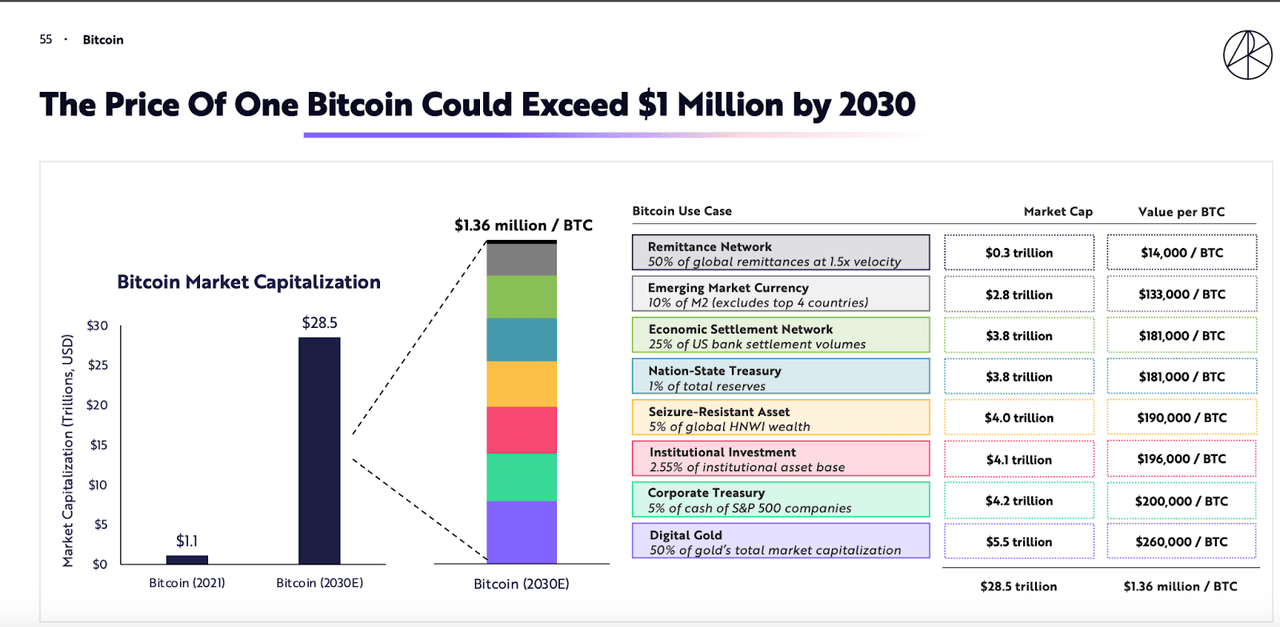

The analysis boils down to this chart:

ARK Invest Report BTC (ARK Invest)

ARK Invest believes Bitcoin’s total market cap could grow to $28.5 trillion by 2025. This is made up of 8 different markets, so let’s look at each of these individually, and assess if the projections laid out seem realistic.

Remittance Network

Remittance refers to money transfers, normally international ones. According to a market research study published by Allied Market, this market should reach $$1,227.22 billion by 2028, and the ARK’s estimate for 2030 is $600 billion. The Market Cap forecast seems quite conservative given this comparison. What isn’t conservative, however, is the idea that Bitcoin can take 50% of this market.

Don’t get me wrong, Bitcoin provides a significant advantage over traditional services, especially now that the lightning network is in full swing. However, I believe ARK could be neglecting the fact that Bitcoin also has to compete with other cryptocurrencies. While the lightning network substantially reduces Bitcoin’s fees and increases speed, there are numerous cryptocurrencies out there that are built to be faster and cheaper. Layer 2 solutions on Ethereum, are a good example of this.

I would say that Crypto, in general, can take 50% of the market, but Bitcoin would only represent perhaps half of this. Using the $1.2 trillion market cap estimate gets us to a Bitcoin market cap of $0.3 trillion too.

In conclusion, I think ARK’s calculations here are reasonable.

Emerging Market Currency

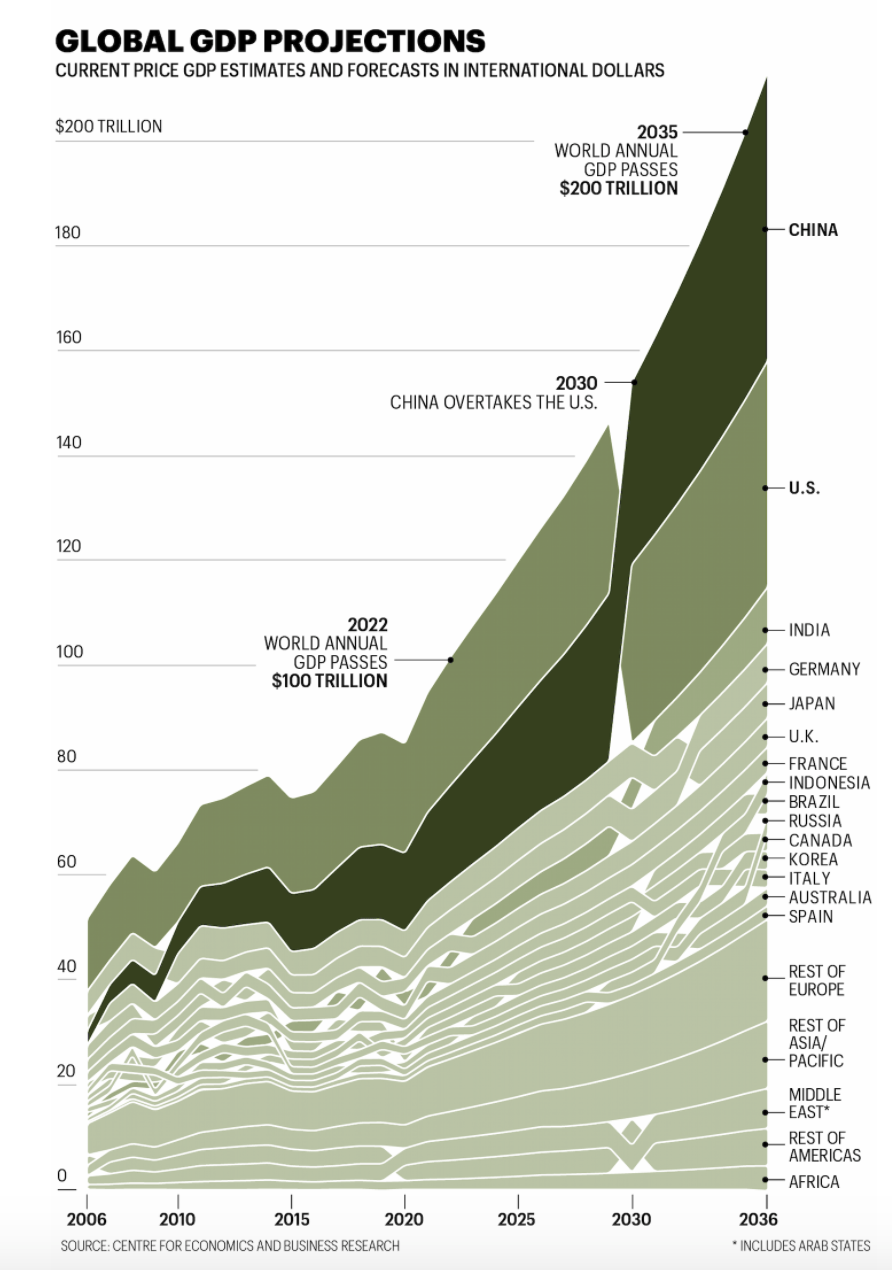

This is a challenging one. First off, let us look at projections for GDP in emerging markets:

Global GDP Projections (Center for Economics and Business Research)

GDP in 2030 is projected to be around $160 trillion by 2030. China’s GDP should account for $26.5 Trillion and would be the world’s largest economy at this point. Emerging markets should account for 50-60% of the world’s GDP. Discounting the four top countries, like ARK does, leaves us with around $43 trillion.

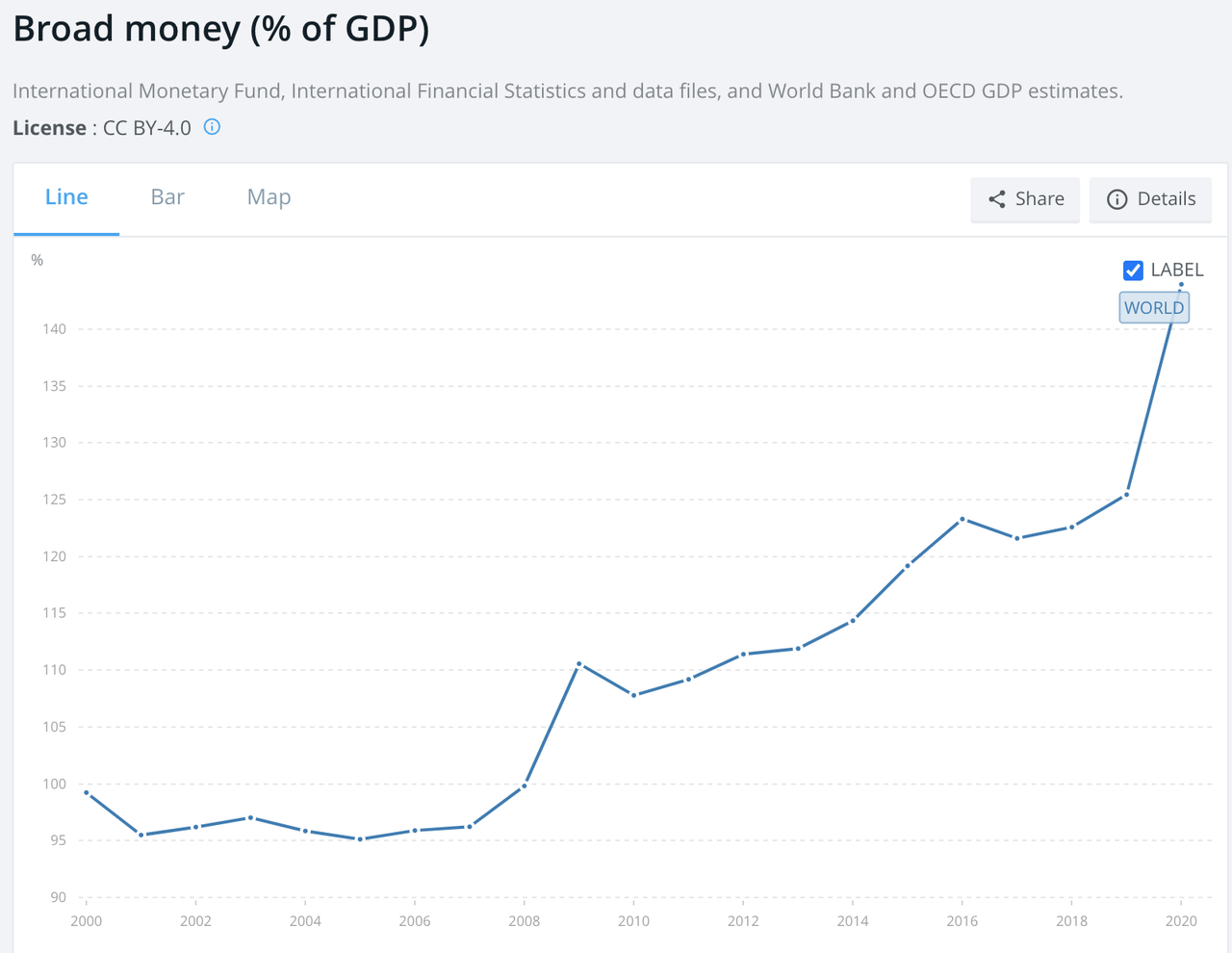

Now, we can calculate M2 as a proportion of GDP. The M2/GDP ratio is often used in economics.

Broad Money, M2 (IMF)

Broad money sits at around 140% of GDP at the moment. However, it is important to consider that developing nations tend to have much lower ratios, given that a lot more of the economy is unbanked or delinked from the financial system. Of course, this is precisely the issue that BTC aims to address. Brazil, for example, currently has a 40% GDP/M2 ratio.

We can also see that M2 has increased dramatically in recent years. Let’s say that by 2030 emerging economies, minus the top 4, have an 80% ratio. That would mean total M2 is equal to $34.4 trillion. ARK’s estimate of Bitcoin accounting for 10% of this would give us a total of $3.4 trillion using these numbers, while their estimate is $2.8 trillion, not so far off.

The big unknown though is, will Bitcoin account for 10% of M2? M2 is a measure of cash and checking deposits. The idea here is that Bitcoin can replace day-to-day cash in these countries. The idea isn’t far-fetched, given that countries like El Salvador have made Bitcoin legal tender. So far, this experiment hasn’t worked too well it seems. A recent report stated that 86% of El Salvadorian businesses still hadn’t conducted a transaction in Bitcoin.

There are still numerous problems with using Bitcoin for day-to-day transactions, but the technology is getting there. I do believe that by 2030 technology will be allowed to do so comfortably. However, the technology existing and countries having and implementing it are different things. Furthermore, most governments are opposed to Bitcoin by nature.

I believe 10% of M2 by 2030 is a large number, and I will apply a 5% ratio to be cautious. This leaves me with a market cap of $1.7 trillion.

Economic Settlement Network

According to the National Settlement Service, in 2021 $25 trillion was “settled” amongst banks. ARK predicts a fourth of this could be done in Bitcoin, which would mean $6.25 trillion in market Cap. It is not stated in the report where ARK gets its source for this part, but, in any case, the data I found suggests a larger market cap.

Once again though, I find myself wondering how exactly Bitcoin would be used to settle ¼ of all bank transactions. More likely, transactions will be settled using CBDC, or other stablecoins. Even if Bitcoin is regarded as a store of value, like gold, it doesn’t mean banks would choose it as a settlement vehicle. Banks would rather settle with stablecoins, or CBDCs, which act as currency.

Therefore, I believe that at most 5% of settlements will happen in Bitcoin.

Nation-State and Corporate Treasury

What we are talking about here is the role that Bitcoin will have as a reserve asset, for both countries and corporations.

It’s important to note that ARK uses a “multiplier” here. The idea, which is discussed in-depth in this article, is that flows into an asset don’t necessarily translate into a 1:1 price change. Specifically, the article points to the fact that during the Bitcoin bull market, the effect of money flowing into Bitcoin was amplified by anywhere from 2-25x.

Now, according to the link provided by ARK, total nation-state reserves, including gold, were worth around $15 trillion in 2020. Reserves grew by 5.8% in 2019. If they keep growing at a rate of 5% until 2030, that would be close to $24.43 trillion by 2030. ARK applies a 25x multiplier and assumes 1% will be held in Bitcoin. That takes us to 6.8 trillion in market cap.

ARK’s figure of $3.8 trillion seems to come from the 2020 figure, which means that no growth rate is applied to reserves. This seems unrealistic, given the data provided.

Furthermore, what also seems unrealistic is the 25x multiplier applied to the market cap effect on Bitcoin. At the height of the bull market, it was estimated to be 25-50x. However, this wouldn’t make so much sense in a more mature and established market, where Bitcoin is held as a reserve due to its stability and store of value characteristics.

I will instead apply the lower bound of the ratio, which is 2x. This gives me a total BTC market cap of $0.48 trillion.

Moving on to corporate treasury, there is an estimated $2.7 trillion in cash held in the S&P 500. 5% of this in Bitcoin, would imply a $0.135 trillion market cap. Applying the 25x multiplier gives us $3.375 trillion. ARK’s figure implies total cash of $3.36 trillion, so either their source is different or they have applied a growth rate this time.

I’m going to go ahead and apply last year’s growth rate, 4%, and use the 2x multiplier, but I will keep the 5% Bitcoin reserve ratio. This gives us $3.7 trillion and a market cap of $0.37 trillion.

Seizure-Resistant Asset

This part of the analysis I agree with. ARK provides us with a good source for High Net Worth Individual’s total wealth, and the 5% assumption is reasonable.

What’s important to take into account here, is the large transfer of wealth that is taking place from Gen X and Baby Boomers to Millennials and Gen Z. The latter have a much higher tendency to invest in Bitcoin.

Also, there are well-documented benefits to diversifying wealth into Bitcoin.

Institutional Investment

Estimates suggest a total worldwide Assets Under Management of $103 trillion in 2020. AuM has grown at a rate of approximately 7.7% in that period. Given the historical growth of the market rate, this seems reasonable, so let’s assume AuM grows by 7% from 2020 to 2030. This gets us around $202 trillion.

I’m going to go ahead and use a 3% adoption rate. This is based on the figure that is proposed in a report by Swissblock. This report does a great job in explaining why hedge funds would adopt Bitcoin, here’s an extract from it:

As attitudes towards digital assets in general and Bitcoin, in particular, improve, driven by increased regulatory and compliance clarity as well as a maturing market infrastructure, we consider an estimate of 3% of all hedge fund assets into Bitcoin over the next 5 years as conservative. This figure, incidentally also roughly representing the average historical exposure to BTC in a risk parity-based multi-asset portfolio including Bitcoin…

In conclusion, we get a market cap for Bitcoin of $6 trillion, which is a bit higher than ARK’s estimate of $4.1 trillion.

Digital Gold

This may be controversial, but I don’t see why ARK adds another $5.5 trillion (50% of the gold market) to its calculations. We have already calculated how much Bitcoin will be held by institutions and private individuals. That is already accounting for the fact that Bitcoin is acting as “digital gold”, so I feel that adding this market cap is double counting.

Therefore, I am not going to add any more value to my Bitcoin forecast.

The Results Are In

So, to sum up, ARK estimates that in 2030, there will be roughly 20.95 million BTC, worth 1.36 million each, and representing a total market cap of 28.5 trillion.

Meanwhile, here are my calculations:

Remittance: $0.3 trillion

Emerging market currency: $1.7 trillion

Nation-state Treasury: $0.48 trillion

Corporate Treasury: $0.37 trillion

Seizure Resistant Asset: $4 trillion

Institutional Investment: $6 trillion

Digital Gold: $0

Total: $12.85 trillion

Therefore, my analysis reaches a target price for Bitcoin of $613,000.

Final Thoughts

In conclusion, I find myself agreeing in principle with ARK’s bullish outlook, but my analysis does differ in some aspects. Bear in mind, that a big difference comes from the “multiplier” that has been applied to Nation-State and Corporate Treasury. This is a complex subject, and worth a whole other article. I have chosen to err on the side of caution here.

Interestingly, the number I reached is very close to gold’s current market cap of $12.568 trillion. Of course, ten-year forecasts are a challenging endeavour, but I do sincerely believe that this is a reasonable price target for Bitcoin. That’s roughly a 40% CAGR, so not too bad an investment.

Be the first to comment