Tingting Ji/iStock via Getty Images

Not all bees are loyal to the same hive. ― Marty Rubin

Today, we take a look at Catalent, Inc. (NYSE:CTLT) for the first time. This diversified supplier of Biologics, healthcare and pharma products has maintained analyst firm enthusiasm despite a forward guidance cut at its last quarterly earnings report. The company is delivering steady organic sales growth in an uncertain market environment. With the stock down just over 40% over the past year, is this equity in the ‘buy zone‘ yet? An analysis follows below.

Company Overview:

Catalent, Inc. is based just outside of New York City in Somerset, NJ. This diverse company develops and manufactures solutions for drugs, protein-based biologics, cell and gene therapies, and consumer health products. Currently the stock trades just north of $75.00 a share and sports an approximate market capitalization of $13 billion. The company’s fiscal year ends on June 30th.

August Company Presentation

The company recently announced that it restructuring itself from four business divisions to two. They will be Biologics and Pharma/Consumer Health. The Biologic segment will encompass development and manufacturing for biologic proteins; cell, gene, and other nucleic acid therapies; plasmid DNA; iPSCs, and vaccines. The latter segment focus on the development and manufacturing of complex oral solids, softgel formulations, Zydis® fast-dissolve technologies, and gummy, soft chew, and lozenge dosage forms; formulation, development, and manufacturing platforms for oral, nasal, inhaled, and topical dose forms; and clinical trial development and supply services.

Fourth Quarter Results:

On August 29th, the company posted its fourth quarter numbers. The company had a non-GAAP profit of $1.19 a share, four pennies above the consensus. Revenues rose at a 10% clip from the same period a year ago to $1.31 billion, which was $20 million light of expectations. Most of the quarter’s sales growth came from the Biologics segment, which grew double digits despite lower year-on-year revenue in the quarter from its COVID-19 program. The company is in the process of concluding or deemphasizing its COVID-19 program that was classified as a commercial product for revenue recognition purposes. Management is assuming Covid volume falls by two-thirds in its FY2023 guidance (below).

August Company Presentation

Adjusted EBITDA was $384 million for the quarter. Like many companies during the quarter, the company is taking a hit for a strong dollar. EBITDA grew 16% on a constant currency basis and revenues would have been up some 15% in constant currency.

August Company Presentation

Despite a decent quarter, the stock sold off post earnings as management took down their forward sales guidance to a range of $4.975 billion to $5.225 billion in FY2023. The analyst consensus was nearly $5.3 billion prior to this guidance cut.

August Company Presentation

The company is in a bit of transition as their new organizational structure goes into effect and as its Covid program is in the process of concluding. Non-Covid-19 sales are expected to grow organically by more than 25% at constant currency in this new fiscal year.

August Company Presentation

The company will also grow from its recent agreement to acquire Metrics Contract Services from Mayne Pharma for $475 million. This gives Catalent a full services specialty CDMO with a 330,000 square foot facility in Greenville, North Carolina. This acquisition should close prior to the end of 2022.

Analyst Commentary & Balance Sheet:

Since second quarter results posted, nine analyst firms including Barclays, JP Morgan and UBS have reiterated Buy or Outperform ratings on the stock. Price targets proffered range from $105 to $130 a share. Albeit most of these contained downward price target revisions. Deutsche Bank seems the lone dissenter on the stock with a Hold rating and $105 price target (down from $110 previously).

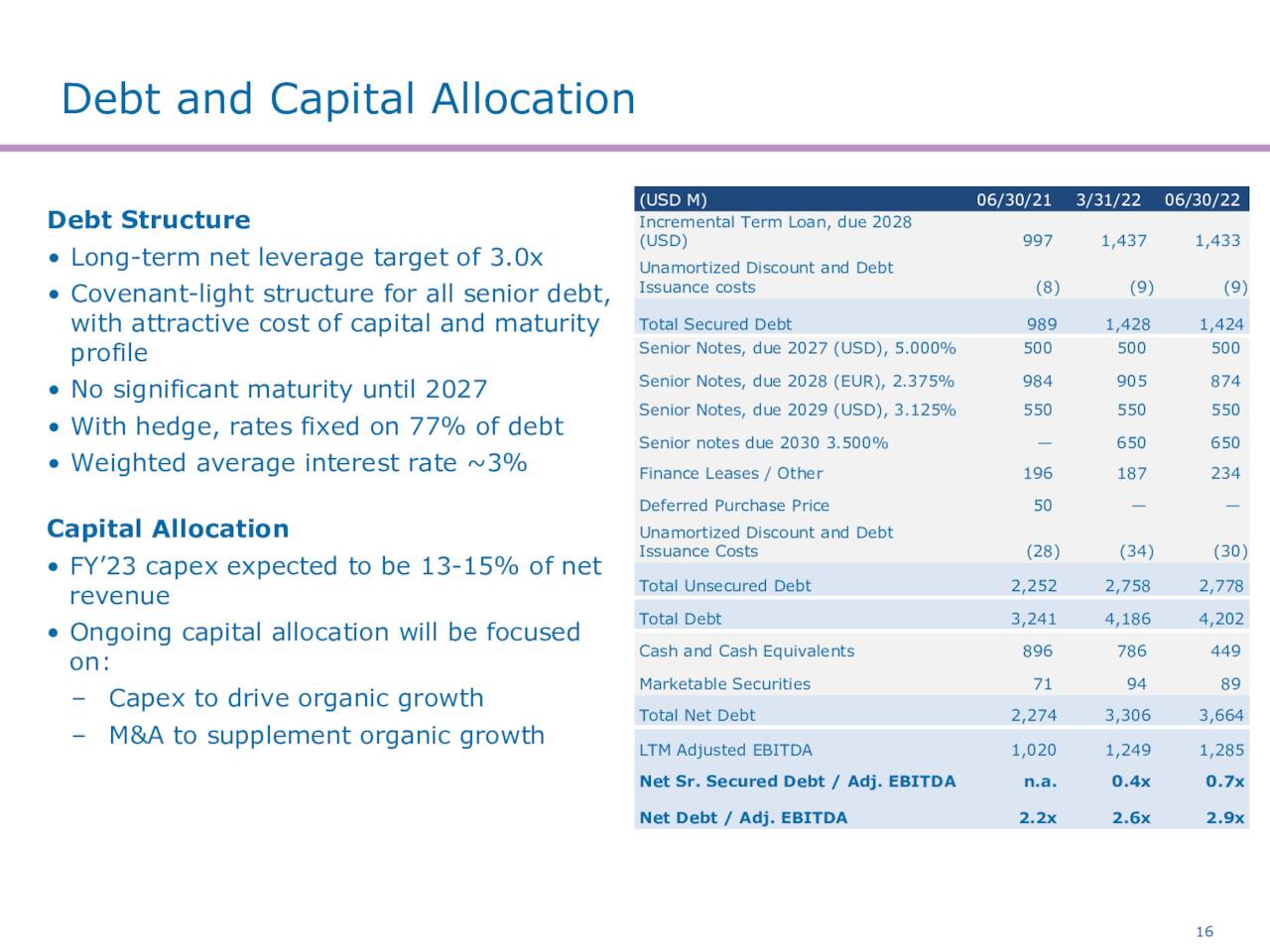

August Company Presentation

Approximately two percent of the outstanding shares are currently held short in CTLT. Numerous insiders have been frequent sellers of the equity throughout 2022. They disposed of approximately $7 million worth of share in aggregate in the third quarter. The last insider purchase I can find in the shares was in February of 2020 when the pandemic was just hitting our shores. The company ended the second quarter with approximately $540 million of cash and securities on its balance sheet against just over $3.9 billion in long term debt. The company had a net leverage rate of 2.9x at the end of the fiscal 2022 year.

Verdict:

The current analyst firm consensus has the company earning $3.80 a share in FY2023 (roughly flat to FY2022’s profits) and revenues rising five percent to just under $5.1 billion. Next fiscal year, they see profits of approximately $4.40 a share as revenues grow 10%.

Catalent is in a defensive sector of the market and is not as vulnerable to economic impacts should a global recession scenario play out in 2023, which seems more and more likely. The stock also maintains strong analyst support.

That said it is hard to get excited about a stock trading at 20 times earnings that is likely to have no earnings growth this fiscal year on mid-single-digit rise in revenues. The stock does not pay a dividend. Therefore, we are passing on any investment recommendation on the stock at this time.

Betrayals rarely come from an enemy. ― Aniekee Tochukwu Ezekiel

Be the first to comment