Joe Raedle

Thesis

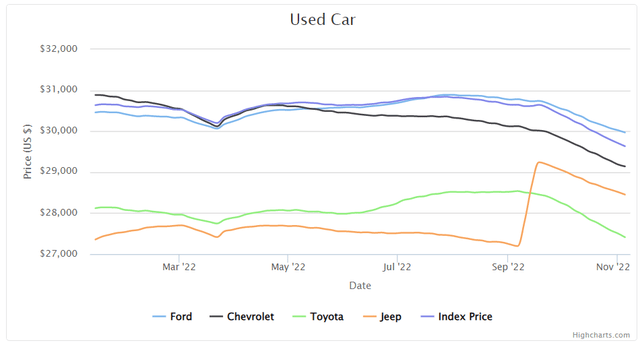

Carvana’s (NYSE:CVNA) stock price is down over -96% year to date and down almost -98% since its peak in August 2021. With rates now closing in on 5% and a Federal reserve set to fight inflation, the ripple effects are spreading across all asset classes. Used and new car prices are no exception, with a well-defined downtrend now in place:

Used Car Prices (CarGurus.com)

What seemed like an innovative way to re-invent a business last year seems to have transformed itself in a cash-burning endeavor in 2022. Excesses are being drained out of the financial system as we speak, with higher rates having a profound effect on all corners of the financial markets.

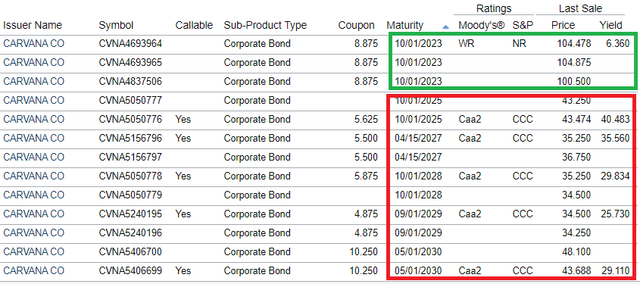

Currently, the financial markets through secondary bond prices are telling us a large proportion of market participants are inferring a potential bankruptcy for Carvana in the not-so-distant future. While the company’s 2023 bonds are still trading close to par (implying a full recovery), longer dated debentures are trading in the 40s across the curve, implying a default and recovery value for the bonds only. This article will explore what the bond market is telling us regarding Carvana’s future, and also present an options-based strategy to profit from a potential bankruptcy.

What is the bond market telling us?

The best way to gauge the financial health of a company is to look at what the financial markets are telling us. On one hand the equity component for Carvana has been pummeled, which implies limited growth and profit potential for the company in the near future. On the other hand bond markets, which asses the probability of default, are also flashing red raising the specter of a potential bankruptcy:

If we look at Carvana’s debenture we can notice an interesting factor – the short dated 2023 debt is trading close to par, implying full recovery. So the market is telling us that even if the company is in trouble, it still has enough cash on the balance sheet to survive and pay its October 2023 bonds. However, if we move out the curve a little bit, we can see that all the remaining debentures are trading distressed.

Looking at the bond matrix we can see that irrespective of maturity dates (be it 2025, 2027 or 2030) the bonds are priced in the high 30s and low 40s. In distressed debt trading this is called “trading recovery”. It means that the market is no longer expecting the principal to be paid, but for the company to default and all bonds to have the same claim to the estate. The only difference in pricing is driven by the different bond coupons and an expectation for interest to be paid for at least another year. This occurrence is a massive red flag and it implied a Carvana default sometimes after October 2023.

How can we profit?

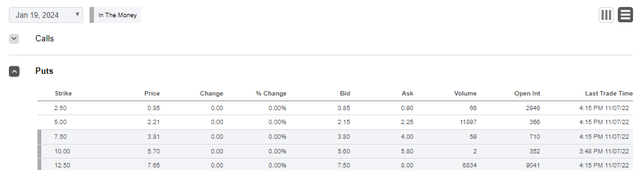

In our mind, the best way to profit from what the bond market is telling us is through an option strategy. Short selling the stock is fairly dangerous given the time-frame (a year) and potential short squeezes and volatility. So let us have a look at put premiums for the stock:

Jan 2024 Put Options (Seeking Alpha)

We are looking here at January 2024 puts for the stock. We like the at the money $7.5 strike put here. On the ask side, the option is trading at $4 per contract. Let us assume a theoretical example where we buy 10 contracts:

* Contracts: 10

* Premium amount: $4 x 10 x 100 = $4,000

* Profit potential: ($7.5 – $4) x 10 x 100 = $3,500

* Loss potential: depends where the stock price ends up on Jan 2024, but loss is capped at premium amount

A bankruptcy can take two forms – Chapter 7 or Chapter 11. Chapter 7 is the most punitive one where the company’s assets are sold and the cash flow is returned to the claimants into the estate. Chapter 11 is a re-organization where there is an infusion of capital, debt is restructured and the equity is wiped out. Both instances result in nearly a zero value for the equity.

Most bankruptcies, especially for very challenged business models with substantial debt, result in zero equity values. The bond market is telling us through the recovery values assigned to the bonds that this is a lower recovery instance. The profit potential here is the difference between the put strike and the premium paid when assuming a zero-recovery potential for the stock.

Why is the option not trading at a higher premium you might ask. Well because nobody really knows what will happen for sure. The bond market is telling us bankruptcy, but some investors who are still holding to the stock or buying the stock are saying there is the potential for a recovery. The options market is following the same thought process – it is assigning a probability to the strike being triggered.

Risks for the Options Strategy

The options strategy put forward involves buying puts. We went forward with a theoretical example involving 10 contracts. When buying puts, a retail investor is only exposed to losing the premium paid for the options (as opposed to short selling where the downside is unlimited). In our example, if the Carvana stock price is above $7.5/share in January 2024, then the puts would expire worthless, and the investor would lose the $4,000 premium amount.

Conclusion

Carvana is a distressed company which has seen most of its stock value being wiped out this year. The bond market is in agreement, flashing a massive red signal through its bond pricing for the company. While CVNA’s 2023 debentures are still trading close to par, all bonds with longer maturities are now trading in the 40s. This indicates that the market is “trading recovery” on the name, meaning the bond market sees a default for Carvana in 2024 or thereafter. Market participants looking to take advantage of a potential bankruptcy can do so via January 2024 put options. Buying a $7.5 strike January 2024 put can results in a profit of $3,500 for a theoretical 10 contracts trade. Buying put options is a much less volatile and capped way to speculate a company restructuring versus short selling.

Be the first to comment