jetcityimage

Carvana Crash & Burn

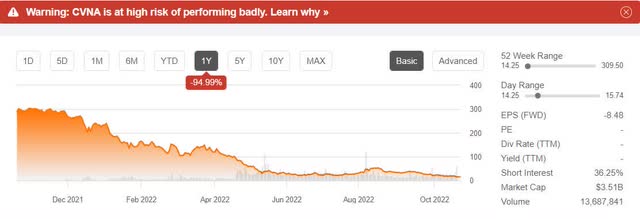

Talk about a crash and burn. E-commerce used car provider Carvana (NYSE:CVNA) gets downgraded following its share decline of more than 90%. And if that wasn’t enough, Ally Financial’s (ALLY) earnings provided an added blow. With approximately 60% of its assets concentrated in the auto market, Ally Financial missed Q3 earnings and revenue targets. It cites a 200,000 fall in auto loan applications since Q2, a $337M decline in auto financing income, and a $1B decline in consumer auto originations, indicating that auto prices may continue to decline. This news on Wednesday prompted a 20% selloff of Carvana shares, marking its 52-week low of $14.55, and falling.

I wrote about Carvana a few times, including its mention in an April piece titled 5 Stocks to Avoid Right Now because of its poor metrics and quant rating of Sell. Incredibly, so many Wall Street analysts got this wrong, as the warning signals were clear and present. The stock lacks fundamentals. Poor fundamentals have resulted in CVNA having a warning banner that the stock is at high risk of performing badly since the 4th quarter of 2021.

If You Own A Stock With These Red Signals, Stay Away!

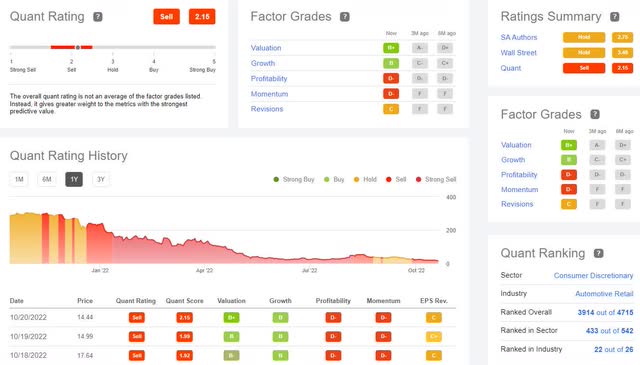

Carvana Stock Quant Ratings & Factor Grades (Seeking Alpha Premium)

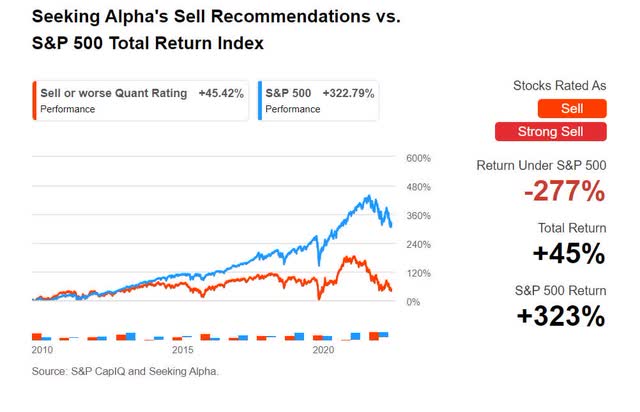

With decelerating momentum and low profitability compared to other Consumer Discretionary stocks, all of our stocks rated sell or strong sell by our quant rating system have massively underperformed the S&P 500. Carvana has a one-year price performance of -95%, while the consumer discretionary median is -34.86%.

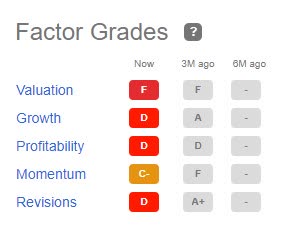

The overarching sentiment moving the markets is fear, with many investors going to cash as stocks receive negative analyst ratings, possess poor fundamentals, and lag in their sectors. In this environment, we strive to select stocks that perform well while highlighting the worst performers. Seeking Alpha’s factor grades provide an instant characterization of a stock’s fundamentals. Stocks with poor fundamentals and factor grades look like Carvana or Just Eat Takeaway (OTCPK:JTKWY), as seen immediately below.

Poor Factor Grades For Just Eat Takeaway (OTCPK:JTKWY)

Just Eat Takeaway (OTCPK:JTKWY) Factor Grades (Seeking Alpha Premium)

Seeking Alpha Quants’ ‘Strong Sell and Sell’ ratings result from powerful computer processing, and the quant algorithm picks stocks with the weakest collective investment traits of value, growth, profitability, EPS Revisions, and price momentum metrics vs. the peer sector.

Seeking Alpha Quant Ratings’ Sell Recommendations below have underperformed the S&P 500 for over a decade using quantitative data.

SA Quant Ratings Sell Recommendations vs. S&P 500 Total Return Index (Seeking Alpha Premium)

As if inflation and increasing costs that result in decreased demand for discretionary items like vehicles aren’t enough, Carvana is now involved in a lawsuit with Michigan after its Department of State suspended the dealership’s license due to problems involving the titling of vehicles. This isn’t the first time Carvana has seen a legal battle, and it probably won’t be the last. Caravan filed injunctions in Michigan to stop the “illegal and irresponsible attempt to shut down a growing Michigan business with tens of thousands of customers over what amounts to technical paperwork violations involving title and transfer issues,” emailed Carvana spokesperson Kristin Thwaites to the Free Press.

Continued Fed rate hikes coupled with a mandated halt in business are bound to hurt a stock like CVNA even further. Carvana’s costs and revenue are tied to the sale of vehicles. As spiking prices from inflation continue to take a toll on consumers, spending habits change, and priorities move from luxury items to essentials like Consumer Staples. Where our quant ratings deemed Carvana a strong sell for most of the year, the stock went through a brief rally and period where it changed to Hold due to bullish momentum and EPS revisions during that period. Like many equities that have seen a fall or carry negative analyst ratings, poor fundamentals, slowing growth, and lag in their sectors, the odds are that they will continue this poor performance, resulting in demand destruction.

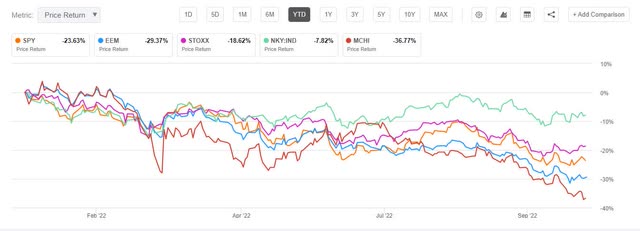

Major Equity Index Outflows YTD

Major Equity Index Outflows YTD (Seeking Alpha Premium)

With $15.5B in April outflows to September experiencing a $26B outflow, it remains to be seen if we’ve experienced the bottom, so investors should avoid catching a falling knife, like Carvana.

Carvana (CVNA)

-

Market Capitalization: $3.51B

-

Quant Rating: Sell

-

Quant Sector Ranking (as of 10/20): 433 out of 542

-

Quant Industry Ranking (as of 10/20): 22 out of 26

-

Analysts’ Downward Earnings Estimates Revisions: 17

RBC Capital Markets analyst Joseph Spak said it best, “Auto sentiment is very poor. We get it. Higher rates, still high prices, low consumer confidence, a potential recession, and European energy risk does not make autos a friendly place.” Factor in the bear market. Then you have Fed tightening, CVNA’s declining margins, and supply chain constraints, including chip shortages and widening semiconductor restrictions. Carvana is an easy pick at risk of performing poorly. Although Carvana’s unique business model triumphed during the pandemic when automakers and dealers experienced a flood of demand, post-pandemic buying patterns have changed. Vehicle production and demand are declining, creating more inventory for an already unprofitable company. Its increasing debt and declining gross margins are indicators that this company may continue its crash.

CVNA Stock Price Performance (Seeking Alpha Premium)

Carvana Valuation & Momentum

Carvana has a B+ valuation grade and is trading at a discount. While on the surface, it seems great to buy a cheap stock trading at $14.48, its all-time low from a 52-week high of $309.50, this stock is approaching zombie territory, just in time for Halloween!

Carvana Momentum Grade (Seeking Alpha Premium)

Where its valuation is one of its only attractive metrics, CVNA’s Momentum grade is a D-, and its shares remain below its 200-day moving average. As we look above at the declining price performance, its bearish trend has analysts calling the stock oversold. Investors are selling its share, given its underperforming sector median peers, which should be no surprise.

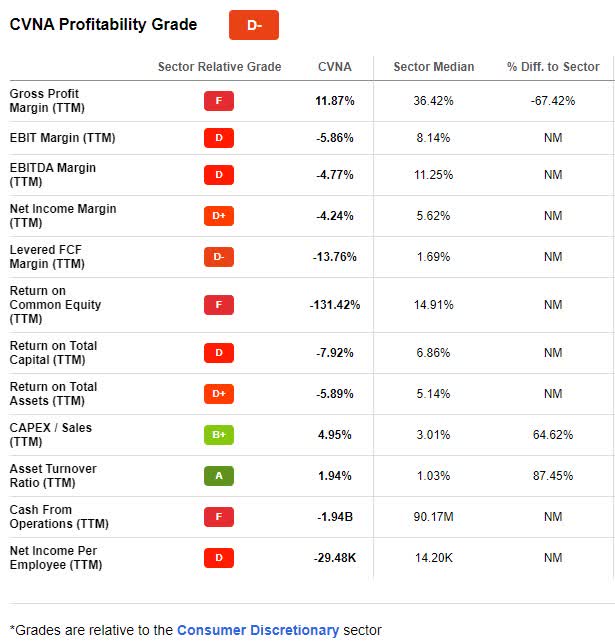

Carvana Growth & Profitability

In a bold statement that may have legs, fellow Seeking Alpha author Harrison Schwartz writes, “Carvana is likely to go bankrupt but may not be a short opportunity due to its high squeeze risk.” Despite the company’s solid B growth grade mostly hinged on forward revenue growth of 47.89%, the remaining scorecard and underlying metrics are lacking in statistics because they are negative.

Since going public in 2017, Carvana has been an unprofitable company, lacking unable to generate positive free cash flow. Q1 2022 earnings resulted in an EPS of -$2.89, which missed by $1.31, despite revenue of $3.50B beating by nearly 56%. Q2 was similarly as bad. And EPS of -$2.35 missed by $0.37, and revenue of $3.88B missed by $109.82M (16.43% YoY). With -$1.94B in cash from operations and facing continued headwinds, Carvana has rapidly declined post-pandemic. Following its first-quarter earnings, SA Marketplace Author David Trainer writes,

“Since 2016, Carvana has burned through $8.3 billion in FCF, (and) the cash bonfire at Carvana is roaring as the company burned through $4.0 billion in FCF over the TTM ended 1Q22. With just $247 million in cash and cash equivalents on the balance sheet at the end of 1Q22, Carvana’s cash balance could only have sustained its cash burn for less than one month after 1Q22.”

CVNA Profitability Grade (Seeking Alpha Premium)

Where investors might have purchased the dips as this stock declined on several occasions, it’s unclear if this stock will ever ride high. Declining cash flows have resulted in Carvana relying on equity dilution and debt financing for its cash needs. As interest rates increase along with vehicle prices; and real wages fall along with personal savings; borrowers are postponing vehicle purchases, making a case for the “auto recession,” With Carvana among the buyer-beware stocks in a highly cyclical industry, heed the quant sell rating!

Conclusion

Avoiding stocks with poor fundamentals in a bear market are instrumental to reducing portfolio risk and losing money. The poor quant factor grades on Carvana last year signaled how to limit your downside risk and avoid stocks with little to no profits, limited growth, and declining analysts’ earnings estimates. Carvana has been rated a Quant sell for the better part of this year. The warning flags and signals highlighted on Caravan late last year are the risk factors that investors need to assess in their investment decision process.

For a list of automotive retailers with quant strong buy recommendations and greater stock price appreciation potential, consider Top Automotive Retail Stocks. In a down market, investors should seek investments with strong metrics and collective characteristics to perform well while attempting to avoid those that may fall.

Be the first to comment