Joe Raedle

Thesis

Carvana Co. (NYSE:CVNA) is scheduled to report its highly anticipated Q2 earnings release on August 4. We updated investors in our previous article in April that it was still too early to add exposure.

CVNA has continued to fall since our update, down a further 73%, significantly underperforming the SPDR S&P 500 ETF’s (SPY) -7% return over the same period.

However, we are ready to upgrade our rating. We believe the battering in CVNA is almost complete, as it has fallen to its long-term bottom. It has also shown constructive bottoming signals over the past two months, suggesting significant selling exhaustion.

Despite the threat of worsening macros, given the recent US quarterly GDP data suggesting a technical recession, we urge investors to look ahead (since markets are forward-looking). We also noted that the consumer discretionary ETF (XLY) is at its long-term bottom and seems primed to stanch further selling downside.

Our valuation model suggests that CVNA’s valuation is reasonable, even for a speculative stock. Therefore, investors who have been biding their time since its August 2021 highs can consider adding exposure. In addition, we believe the potential re-rating in XLY could broadly lift the sector, including well-beaten speculative stocks like CVNA.

Accordingly, we revise our rating on CVNA from Hold to Speculative Buy.

The Battering On Carvana Is Justified

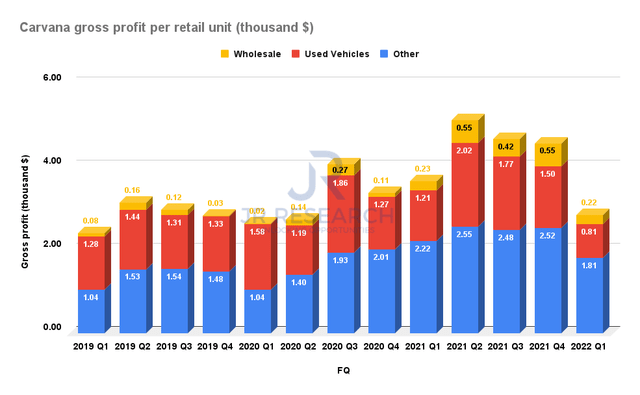

Carvana gross profit per retail unit (Company filings)

Carvana’s Q1 results highlighted that the company saw a material impact as consumers pulled back further on discretionary spending. Hobbled by record inflation rates, the market has justifiably anticipated that companies like Carvana would be markedly affected, complicated by its unprofitability. CEO Ernest Garcia also highlighted in a June conference (edited):

In Q4, we started to have some affordability issues that popped up. Car prices appreciated again. Interest rates had just started to move up, and we had Omicron that also hit us. And so we had less volume than was anticipated. And then in Q1 is where things were really different than expected. I think the affordability issues really showed up, especially for kind of lower socioeconomic portions of the economy. And so we saw significantly less volume than we anticipated in Q1. But, we built a machine for many more sales, and our SG&A per unit was significantly higher. (William Blair 42nd Annual Growth Stock Conference)

But, Management Remains Committed To Achieving Profitability

Notwithstanding, management remains confident that it has a line of sight towards profitability, despite the harsher macro environment and increased interest load from the ADESA acquisition.

The company is committed to reducing its SG&A spending per unit, even as it scales further. Notwithstanding, the company also highlighted that it still depends very much on the company’s ability to execute as it continues to gain market share. Garcia accentuated (edited):

So our primary goal is to get down to where SG&A was per unit in the past. That alone would be an enormous step that would dramatically change our cash consumption and put us in a spot where we have a pretty long runway. So we’ve set a near-term target of $4,000 of cash SG&A for Q4. We’re calling that a stretch goal. I don’t think it’s going to be easy to achieve. It’s also certainly not impossible to achieve, but it is reliant on execution. Scale is obviously helpful in our business. And I would say that is more to get from $3,000 to our long-term goal, which is 6% to 8% of revenue in SG&A. (William Blair Conference)

We view management’s commentary as positive. We like the visibility provided by management on its near-term and intermediate profitability guideposts instead of just lumping them together in a so-called long-term model (how long is long-term?). Therefore, we can continually assess management’s execution against its guidance, which helps us evaluate whether our assumptions are still valid.

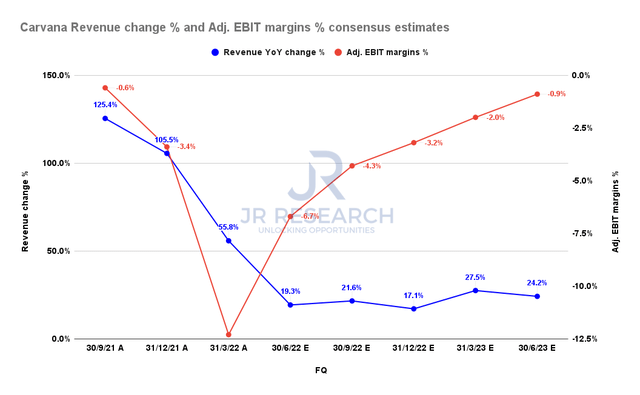

Carvana revenue and adjusted EBIT margins % consensus estimates (S&P Cap IQ)

The consensus estimates (bullish) also concur with management’s commentary. Carvana’s profitability cadence is expected to climb out of its nadir in FQ2 as it gains significant operating leverage through FY23. However, those massive revenue gains before its dramatic bust are likely over, even though it’s expected to remain resilient.

Hence, we urge investors to adjust their expectations about CVNA retaking its all-time high anytime soon.

CVNA’s Valuation Is Reasonable

| Stock | CVNA |

| Current market cap | $3.08B |

| Hurdle rate | 25% |

| Projection through | CQ4’26 |

| Required FCF yield in CQ4’26 | 2.5% |

| Assumed TTM FCF margin in CQ4’26 | 1% |

| Implied TTM revenue by CQ4’26 | $20.66B |

CVNA reverse cash flow valuation model. Data source: S&P Cap IQ, author

We applied a market-outperform hurdle rate of 25% that we think is appropriate for a growth stock. We also used an FCF yield of 2.5% to allow some growth buffer for CVNA.

Consequently, we used an FCF margin of 1% (lower than the Street’s consensus) and require Carvana to post a TTM revenue of $20.66B. We believe our revenue target is achievable based on the revised consensus estimates.

However, it’s highly dependent on management’s ability to execute its profitability roadmap, so investors need to consider that carefully.

Carvana Stock Has Reached Its Long-Term Bottom

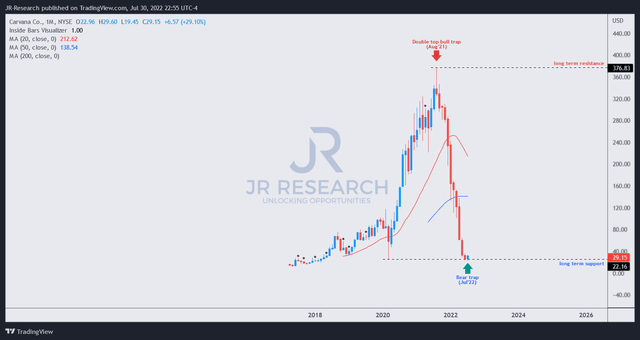

CVNA price chart (monthly) (TradingView)

We also observed constructive price action on CVNA’s long-term chart. As seen above, CVNA re-tested its long-term support ($22) in June and has held its bottom resiliently in July.

We also noticed a bear trap (indicating the market denied further selling downside decisively), which augurs well for its bottoming process.

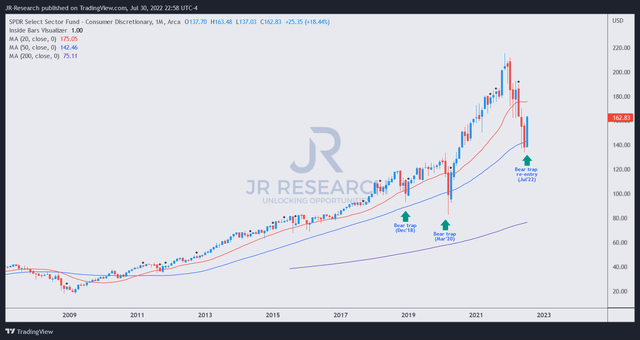

XLY price chart (monthly) (TradingView)

Furthermore, we also observed a long-term bottom in XLY’s long-term chart, suggesting a sector re-rating is on the cards.

As a result, we are confident in CVNA’s long-term bottoming process and believe the worst seems to be over.

Is CVNA Stock A Buy, Sell, Or Hold?

We revise our rating on CVNA from Hold to Speculative Buy, with an intermediate price target (PT) of $40 (a potential upside of 37.2%).

Investors are urged to consider the market’s forward-looking perspective, despite the looming recessionary headwinds. Investors should also continue to assess management’s near- and medium-term profitability execution against its guidance to test the validity of their thesis and valuation models.

Notwithstanding, investors are reminded to build in an appropriate margin of safety in their model parameters, given Carvana’s unprofitability track record.

However, we believe the worst seems to be over, even though we continue to expect short-term volatility.

Be the first to comment