Stocks that are exposed to consumer discretionary spending have been hammered in recent weeks. This makes sense given the consumer is at risk in terms of being able to make normal earnings due to the virus outbreak, which, in turn, puts spending at risk. Carvana (CVNA) is one such company that is highly exposed to the consumer given it sells cars, which are obviously very large purchases for most consumers.

The stock, however, has been more than cut in half in the space of a few weeks, and I think now is a great opportunity to own a market-disrupting franchise for a reasonable valuation.

Torrid, if slowing, growth

Carvana’s story has been, and will continue to be, about growth. The company calls itself a disruptor, and it is. The model is quite unique in that it has no dealerships and instead, brings the car directly to the consumer. The same is true for when a customer sells a car to Carvana; the company comes and picks it up with no dealer network or hassle of spending hours waiting for someone to acknowledge you. The model is brilliant, and people are responding.

Source: TIKR.com

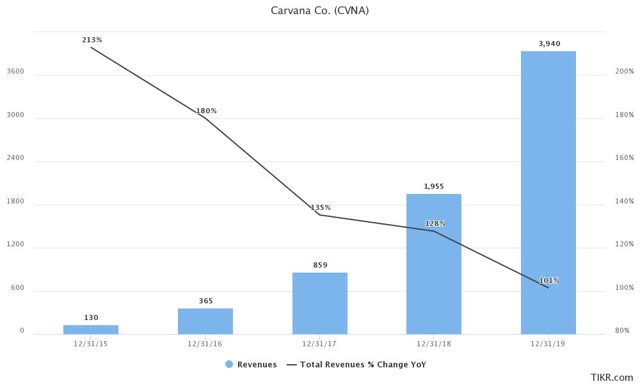

Revenue growth has been in the triple digits since the company was founded, including a +101% showing last year. Estimates are for nearly 50% top-line growth this year, but obviously, we’ll have to wait and see if that comes to fruition. Should the virus outbreak and resulting quarantines last longer than expected, Carvana’s revenue could indeed be at risk for this year.

However, people aren’t going to stop buying cars, as they are necessities for just about every adult in America, so at some point, sales will normalize. This is the principal risk for Carvana today, and it is why the stock has been decimated in recent weeks. The unknown of how long the crisis will last is too much for investors to handle right now, and I get it. However, I also think it will pass and we’ll get back to normal at some point, which is why I’m viewing the stock longer-term in the context of the crisis.

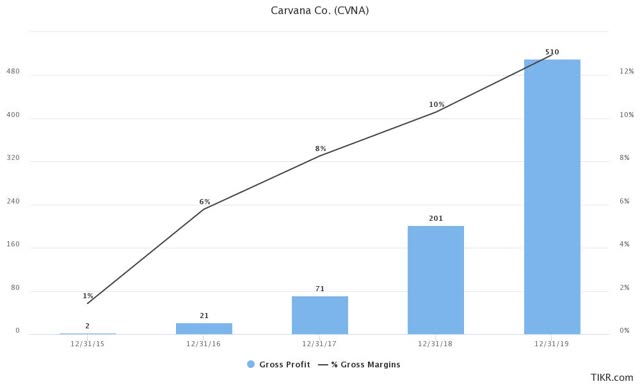

Carvana has also been hard at work with improving its margin profile, which has long been a source of criticism from the bears. However, it is important to understand Carvana has invested in market share by deliberately pricing its cars below what it needed to recover its costs. On the bright side, that condition has been improving rapidly as well, along with revenue growth.

Source: TIKR.com

Gross margins were basically nothing in 2015 but have skyrocketed to more than $500 million and ~13% of revenue. This is what the bears are missing when it comes to assessing Carvana’s long-term potential. Carvana’s model has worked to build market share, which then affords it the infrastructure to deliver cars more efficiently, which then allows it to keep more of the revenue it achieves from each sale. The margin growth story should continue for at least the next couple of years but much depends upon pricing power, which depends upon volume. Still, any business with a margin profile that looks like this is attractive because even if gross margins are too low today, they shouldn’t be for long at the rate they’re growing.

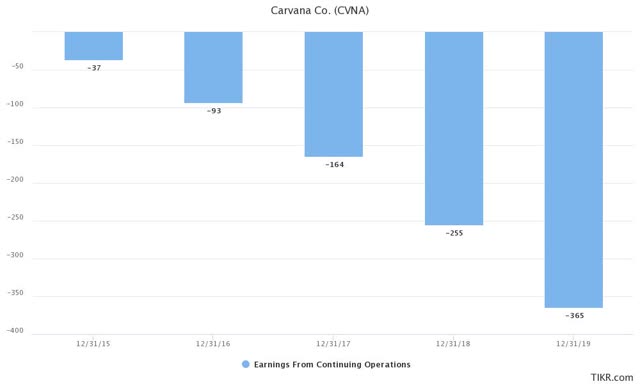

Of course, the problem is that Carvana’s costs to build out and support its infrastructure are huge, and it continues to outspend its gross margin dollars, as we can see below.

Source: TIKR.com

Earnings from continuing operations have deteriorated significantly in recent years, with the company losing $365 million on $3.9 billion in revenue in 2019. That’s not great, but remember that Carvana is still very much in its growth stage, and as such, profits are likely to remain elusive for some time. In addition, the company’s margin profile has actually improved quite significantly in recent years, despite the growing dollar loss seen above.

Source: TIKR.com

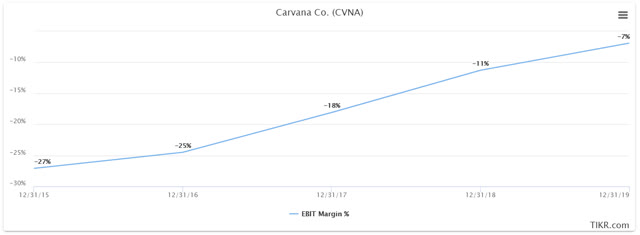

EBIT margin has moved from -27% of revenue to -7% in the past five years, and while no business that loses 7 cents on every dollar of revenue produce should be celebrated, the improvement in this metric is what we’re interested in here. Carvana is, in my view, only a couple of years away from showing profits, and when it does, operating leverage should produce meaningful earnings fairly quickly.

Carvana is going to be unprofitable this year, and probably again next year. However, starting in 2022, I think we’ll see Carvana begin to produce positive earnings as it continues to grow revenue at a rapid rate, and leverages down its operating costs.

There are risks to the bull case

While I am bullish on Carvana, it has its own risks. One risk is the company’s balance sheet, as Carvana has taken on significant debt to fund its expansion.

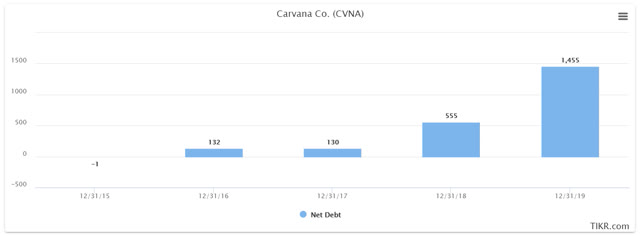

Source: TIKR.com

Net debt was essentially nothing in 2015 but stands at nearly $1.5 billion today. Keep in mind Carvana’s gross profit was just over $500 million last year, so $1.5 billion is a huge amount of debt. This company is quite unprofitable, so it has no ability to pay this debt down anytime soon. Should the expansion not go to plan, this debt may become unserviceable at some point and that would be disastrous. I, obviously, don’t think that would happen, but it is worth mentioning.

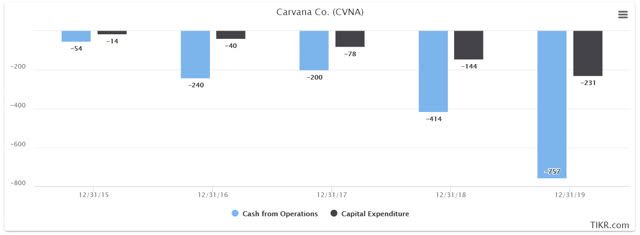

In addition, cash burn has been significant. You’d expect this given that Carvana is aggressively expanding, but the numbers are big.

Source: TIKR.com

Free cash flow, defined as operating cash flow minus capital expenditures, has been solidly negative every year, and last year, was nearly a billion dollars in the red. That means Carvana had to come up with a billion dollars from other sources, which is why it issues stock and raises debt nearly constantly. This has to improve at some point because no company can borrow money forever.

To be fair, a lot of the negative cash flow is from building inventory, so that gets converted into cash at some point. For instance, $345 million of the ~$1 billion in negative free cash flow last year was from building the company’s inventory position. That still leaves ~$650 million that wasn’t from inventory, but it softens the blow a bit. So, there’s that.

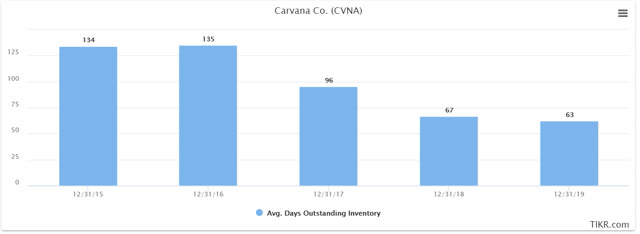

In addition, Carvana has become much better about speeding up its cash conversion thanks to lower days of inventory outstanding.

Source: TIKR.com

Inventory selling has doubled in speed since 2016, which is a fantastic achievement. This means the company has to borrow less to fund its inventory because it holds cars for fewer days and, therefore, turns them into cash more quickly. This cash can then be used to fund inventory purchases, corporate expenses, etc. This helps a growing company borrow less because it generates cash more quickly from its inventory, so this is a positive that shouldn’t be overlooked. It won’t save Carvana if the you-know-what hits the fan, but this company is maturing in the right ways to become free cash flow positive at some point.

Valuing the stock

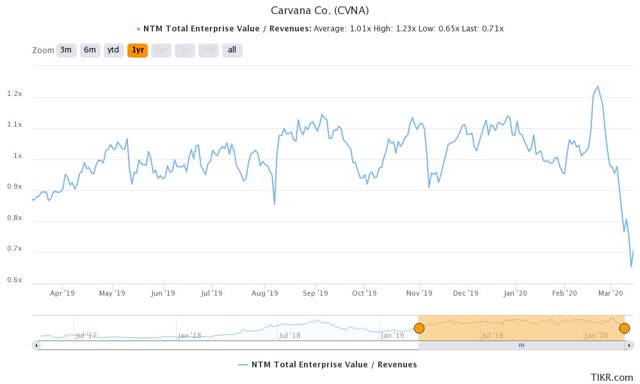

Valuing a stock that has no earnings is always tricky, but Carvana is a true disruptor that is changing an entire industry with its no-dealership model. One way I think is fair to use is enterprise value against revenue, which takes into account the company’s ample debt and market capitalization of its stock.

Source: TIKR.com

This chart shows that Carvana is, by far, the cheapest it has been in the past year or so, despite the fact that its growth trajectory continues to move in the right direction. This is one data point, and you need to evaluate for yourself if you think Carvana will be profitable in the near future. I happen to think profits will begin in 2022, but obviously, there is a lot that needs sorting out between now and then.

Carvana is a bet that its model will continue to gain market share, which will leverage down its operating costs, and drive up pricing power, all while revenue continues to grow. The company has proven it can scale at rapid rates, and it has no plans of slowing that progress. Carvana is a leap of faith because it has no earnings today, but it has the pieces in place to produce strong profits in the years to come. Recent price action is a gift in my view, and I think any investor that wants to own Carvana should strike while the iron is hot.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in CVNA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment