kupicoo/E+ via Getty Images

Investment Thesis: In spite of inflationary pressures and increasing competition in the French market, I take the view that Carrefour could see long-term upside from here.

Carrefour SA (OTCPK:CRRFY) has seen a strong recovery in earnings from 2020 and continues to bolster its e-commerce capabilities. The purpose of this article is to investigate whether Carrefour could see longer-term upside from here, in spite of short-term pressures.

Performance

When looking at the company’s balance sheet over the past five years, we can see that cash as a proportion of total assets has remained more or less consistent:

| Year | 2017 | 2018 | 2019 | 2020 | 2021 |

| Cash and cash equivalents | 3593 | 4300 | 4466 | 4439 | 3703 |

| Long-term borrowings | 6428 | 6936 | 6303 | 6305 | 5491 |

| Total assets | 47813 | 47378 | 50802 | 47588 | 47668 |

| Cash to total assets ratio | 7.51% | 9.08% | 8.79% | 9.33% | 7.77% |

| Long-term borrowings to total assets ratio | 13.44% | 14.64% | 12.41% | 13.25% | 11.52% |

Source: Cash and total assets figures sourced from historical consolidated financial statements. Ratios calculated by author.

This is encouraging as it reflects that the company has not had to reduce its cash reserves to meet liabilities. In addition, we also see that the long-term borrowings to total assets ratio has decreased slightly in the past five years as a result of Carrefour reducing its long-term debt burden.

From this standpoint, the company looks to be in a good position to meet its debt obligations.

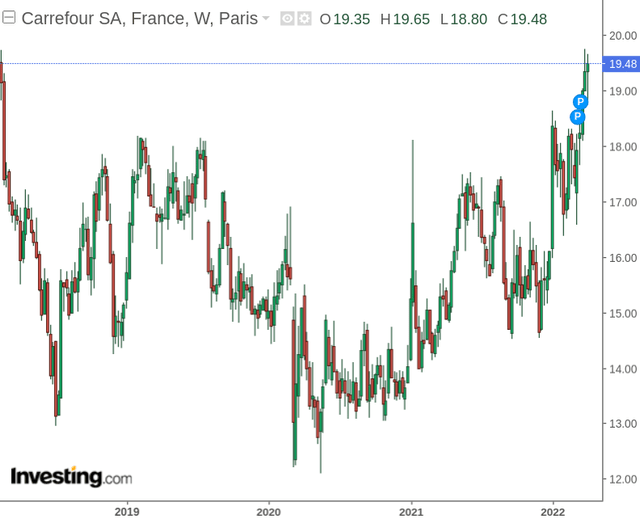

With the group having recorded losses from continuing operations in 2017 and 2018, the P/E ratio over the past three years has ranged between 10-18x.

| Year | 2017 | 2018 | 2019 | 2020 | 2021 |

| Price | 18 | 15.91 | 15 | 14.39 | 16.1 |

| Diluted earnings per share (€ EUR) | -0.7 | -0.72 | 1.42 | 0.79 | 1.35 |

| P/E Ratio | – | – | 10.56 | 18.21 | 11.92 |

Source: Price figure sourced from investing.com, diluted earnings per share figures sourced from historical consolidated financial statements. Ratios calculated by author.

With price having seen a recent surge to above the €19 mark, investors will increasingly demand to see further earnings growth. While earnings recovered swiftly from the decline in 2020, we still have yet to see further growth above the 2019 level.

Looking Forward

With the ongoing macroeconomic situation resulting in supply shortages of certain food items as well as inflation leading to higher costs, this will no doubt be at least of partial concern to Carrefour going forward.

The main risks in this regard are that increases in costs of sourcing supplies will mean passing price increases on to customers which could reduce demand, as well as potential supply shortages meaning that existing demand cannot be met.

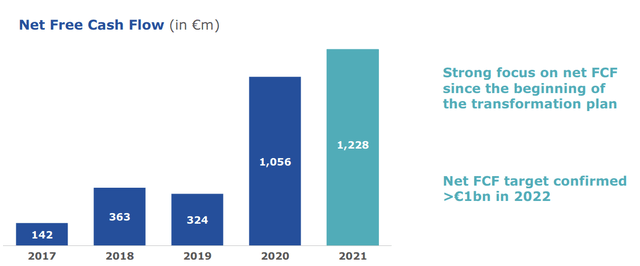

With that being said, the company seems to be in a good position to handle inflationary pressures, given that Carrefour generated record cash flow of over €1 billion in 2021 and is on track to remain above this level in 2022.

One of the big ambitions for Carrefour going forward is its Digital Retail Strategy 2026, which aims to triple its e-commerce Gross Merchandise Value to €10 billion by 2026, which would involve a 50% increase in its digital capabilities.

In this context, Carrefour has done well in bolstering its free cash flow to be able to accommodate the expenses associated with this initiative, and has already made strong inroads into this area. For instance, Carrefour Links is currently recognised as the best Data & Retail Media offer in Europe, with a reach of over 80 million customers.

Additionally, the Data & Retail market itself is expected to reach €30 billion in 2024, which represents a strong opportunity for Carrefour to further bolster e-commerce sales growth in addition to in-store sales.

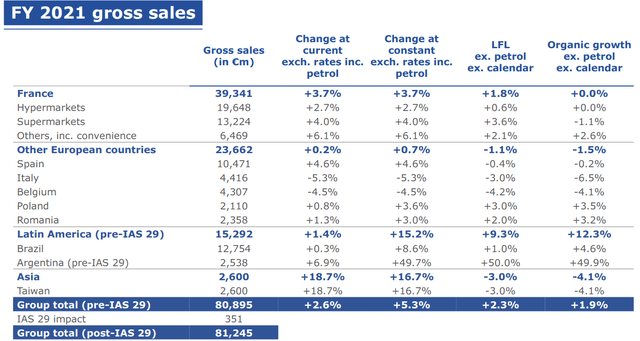

With that being said, one potential obstacle for Carrefour could be increasing competition in the French market. France accounted for nearly half of the company’s gross sales in 2021:

Specifically, while Carrefour has a wider global footprint, competitor E.Leclerc Group remained the largest supermarket chain in France as of April 2021. Moreover, competitors Lidl and Aldi have been steadily gaining market share in France over the past four years and we could see a situation whereby competition in Carrefour’s largest market intensifies, including in the e-commerce space.

From this standpoint, the main risk is that while Carrefour could significantly bolster e-commerce revenue abroad, this could be outweighed by increasing pressure on profit margins in France if competition continues to intensify in this area.

Conclusion

To conclude, Carrefour has shown significant financial resilience over the past couple of years and demonstrates a healthy cash position. While the main risk for Carrefour at this time is intensifying competition in France, the company has a good opportunity to significantly bolster its digital capabilities and expand its e-commerce capabilities.

In spite of challenges, I take the view that the company could still see long-term upside from here.

Be the first to comment