TeamDAF/iStock via Getty Images

Investment thesis

Since the outbreak of the pandemic, Carnival (NYSE:CCL) has suffered a continuous deterioration that only recently seems to have settled down slightly, at least economically. On the one hand, revenues are finally returning to increase, but the financial structure now seems completely compromised after 2 years of huge losses. Debt has more than tripled, plus there are stringent covenants limiting corporate maneuvering. As low as Carnival’s price is right now, I would avoid investing in this company regardless, as I am concerned about the sustainability of its debt. Under current conditions investing in this company means having very high-risk threshold, which I personally do not have.

Covid-19: Difficulties still persisting

To date, what is left of the 2019 Carnival is very little. The cruise industry has been hammered by repeated difficulties and there is still no end in sight. In 2020 COVID-19 destroyed the entire industry by stalling it for months: in the 4 quarters following August 2020 Carnival generated revenues of only $139 million. For a company that was generating about $4 billion per quarter in 2019, that is a financial disaster.

Initially, it was thought that once Covid-19 was fought the cruise industry could restart as it has in the past, but the situation is more complicated. Demand for cruises is recovering rapidly but there are still issues related to Covid-19 that are preventing the company from returning to 2019 levels. This was discussed extensively in the last Q2. Here are the words of Arnold Donald:

It is reinforcing to see continued strength in demand with our guests overcoming far more restrictive protocols than broader society and travel at large, leading to a near doubling of booking volumes since last quarter with near-term bookings even outpacing 2019. We were encouraged by close-in demand and remain focused on optimizing occupancy while preserving long term pricing.

As friction from protocols is removed and society becomes increasingly more comfortable managing the virus, we expect to see demand continue to build, as we have already seen with the strength in Carnival Cruise Line’s closer-to-home cruises.

It seems from Arnold Donald’s words that Carnival is positive about future profitability; however, I think it is fair to put this in context with the latest reported data.

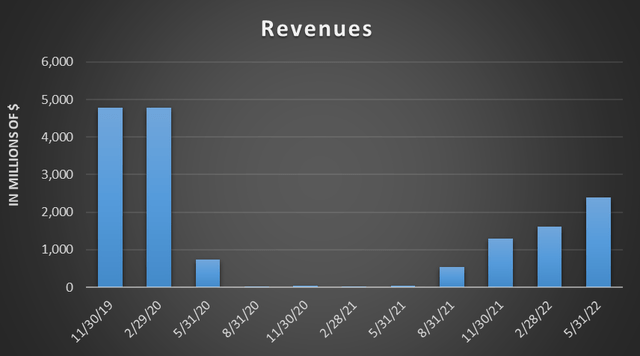

TIKR Terminal

While indeed improvement is evident trimester after trimester we are still a long way from 2019 values: before, having a trimester with revenues of almost $5 billion was the norm, today we are at about half that. Getting back to previous levels will still take time, so the next 2-3 quarters won’t be enough in my opinion.

Inflation and recession

As if Carnival’s problems were not bad enough, 2021 and the current 2022 are years marked by high inflation. Fuel and raw material costs have only exacerbated an already problematic situation derived from COVID-19.

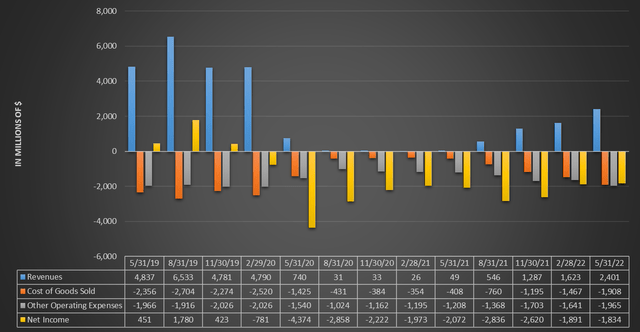

TIKR Terminal

In fact, from what we can see, revenues are increasing but the loss on the income statement is still very high. Cost of goods sold is about $400 million lower than Q2 2019, but revenues are half that. Operating costs are even the same. The presence of fixed costs in Carnival’s business model and high inflation are making the recovery process even more torturous.

Finally, among the difficulties, I have not considered the possibility of a recession in the short-to-medium term, a possibility that becomes higher and higher looking at the yield curve.

Forecasts on Carnival’s future

Assuming that it is very complex to make predictions regarding Carnival’s situation, the company has published several expectations for the end of this year and next year. Here are some of them:

- Expected increases in revenue in 2023 on a per passenger basis compared to 2019.

- Expected improvement in occupancy throughout 2022 and 2023.

- Maintaining collateral and reserves at reasonable levels.

- Expected moderation of fuel prices beginning in the second half of 2022 and continuing into 2023.

- Expected inflation and supply chain challenges to continue to weigh on costs, though moderated by a larger, more efficient fleet as compared to 2019.

According to these guidelines, it is clear that the company expects a marked improvement over recent years, but we cannot be sure that this is the case. I personally believe that Carnival’s management is fully aware of the dire situation and is also doing a good job; however, there are exogenous factors that could reverse the upward trend. We do not know precisely when the supply chain problems will be resolved, and we do not know if inflation has peaked. In addition, with the U.S. having had declining GDP for 2 quarters and Europe hurt by energy costs and inflation, we do not know if this will result in a recession. As weak as this company is financially right now a recession could be a serious problem.

Carnival is currently trading at about $9.50 per share and in 2019 at about $50: it might seem like a bargain but be careful. As far as I am concerned, it would be a big mistake to think that if Carnival returns to $5 billion in revenues per quarter it will price $50 per share again: it has been burning billions of dollars every month since 2020 and its financial position has changed completely since then. Revenues may well return to what they were in the past, but by now the financial structure is compromised. This does not mean that Carnival can never recover, but that before it returns to $50 per share it will no longer be enough to earn as it did in 2019.

Excessive indebtedness

As I announced earlier, the most crucial aspect is debt. To meet short-term liabilities the company was forced to take on debt and dilute its shareholders. After all, there was no other way since the cruise business was restricted due to COVID-19.

There were 684 million shares outstanding in 2019, as of today there are 1.18 billion. This is a huge dilution for shareholders, but less serious compared to the increase in debt.

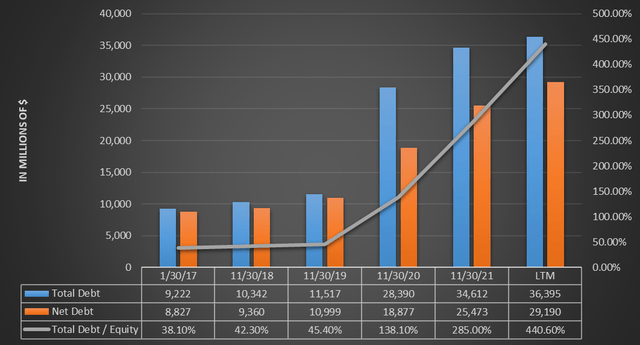

TIKR Terminal

As can be seen, net debt has more than tripled, and its growth has not necessarily stopped. Total debt/equity has reached 440%, manifesting the high leverage the company is facing today. Considering that in the full year 2019 Carnival generated a profit of $2.99 billion, it makes even more of an idea of how high the current debt of $36 billion is.

Moreover, as if that were not bad enough, making matters even worse are debt covenants. Here are the most important ones:

- Maintain minimum interest coverage at the end of each fiscal quarter from August 31, 2023, at a ratio of not less than 2.0 to 1.0 for the August 31, 2023 testing date, 2.5 to 1.0 for the November 30, 2023 testing date, and 3.0 to 1.0 for the February 29, 2024 testing date onwards, or through their respective maturity dates.

- Maintain minimum shareholders’ equity of $5.0 billion.

- Limit debt to capital percentage from the November 30, 2021 testing date until the May 31, 2023 testing date, to a percentage not to exceed 75%, following which it will be tested at levels which decline ratably to 65% from the May 31, 2024 testing date onwards.

- Maintain minimum liquidity of $1.5 billion through November 30, 2026.

- Limit the amounts of secured assets as well as secured and other indebtedness.

As of May 31, Carnival was in compliance with the covenants and had no further penalties. However, it can be seen that the obligation to comply with these capital adequacy limits will last much longer, in some cases until 2026. Currently, the company has many economic and financial difficulties, so it would not be excluded that it may miss some of them. Failure to meet these capital limits would lead the company to sink even deeper, as the change in financial covenants may lead to increased costs, interest rates, and additional restrictive covenants. This would not only affect the balance sheet but also the income statement, as the increased interest payments would reduce net income even more.

You must monitor this situation very well if you want to invest in this company, as compliance with the covenants is crucial in order not to trigger a vicious cycle.

Conclusion

As much as Carnival is among the best companies in its industry and has respectable management, I personally would not buy this company. Although gradually revenues are growing, the dire financial condition pushes me to stay away. It is true that $9.50 per share is a historically low price for a company that has easily reached $50 per share, but the disastrous results of the past 2 years are creating permanent damage to the financial structure. The level of debt is a key factor to look at before investing in any company, and Carnival does not have the right conditions for debt sustainability. It is true that at $9.50 per share it may be a bargain, but is it worth speculating so much when you can invest your money in a thousand other ways?

Be the first to comment