Joel Carillet/iStock Unreleased via Getty Images

Investment Thesis

Carnival Cruise Line’s (NYSE:CCL) stock cratered at the beginning of the coronavirus pandemic from > $50 in December of 2020 to < $14 (approximately a 72% drop) in March of 2020 due to the global coronavirus pandemic. However, the stock is now down to a low of $9.91 as of June 13, 2022, a level not seen in 25 years. While many have accurately pointed out that this level is wildly unjustified because the stock is now cheaper than it was during the worldwide lockdowns of the pandemic, this conclusion is incomplete. In this article, I will demonstrate why CCL is actually extremely overvalued at present levels, examine the potential for insolvency, investigate potential changes in the company’s capital allocation and corporate governance that could unlock shareholder value, assess the probability that such changes will occur, and finally discuss the implications upon CCL’s intrinsic value that such adaptations to CCL’s corporate governance may have.

Background

CCL’s recent price action has made it optically cheap based upon past, pre-pandemic FCF. Its normalized levered FCF before the pandemic was approximately $2 billion, and the current market capitalization is $12.44 billion. While this may lead one to assign a future FCF multiple of 6.22 to the stock if it can return to pre-pandemic profitability. An FCF multiple of 6.22 is extremely cheap compared to its past trailing FCF multiples, for example, in 2019, its FCF multiple approximated 30. However, it is my opinion that CCL is a prototypical ‘value trap.’ This is because the enormous leverage undertaken during the course of the pandemic will absorb the overwhelming majority, if not all, of its post-pandemic normalized FCF.

CCL Price Action: February 2020 – Present

Pandemic Performance

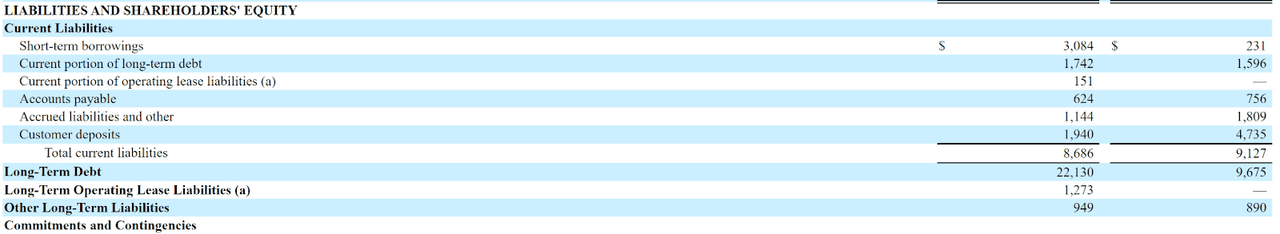

During the early stages of the Coronavirus Pandemic CCL was unable to operate and was only able to operate at severely restricted capacity in the latter stages of the pandemic. This led to major losses and concerns over its solvency. CCL was able to successfully utilize debt and equity financing to meet the enormous liquidity needs necessitated by the pandemic. In fact, the company raised >$11 billion in long-term debt in the period from 2020-2021 and approximately $30 billion in debt throughout the entirety of the pandemic.

CCL 2020 Liabilities – in Millions USD

Pre-Pandemic Performance and Post-Pandemic Prospects

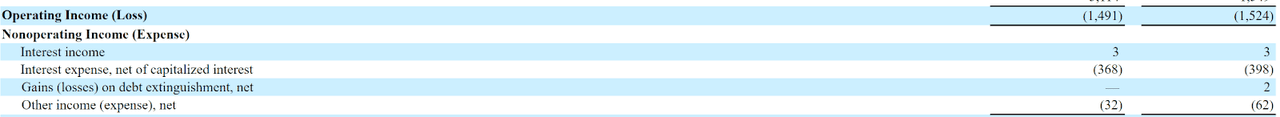

The company’s normalized FCF from the pre-pandemic years of 2016 to 2019 was $1.225 billion. What is notable, however, is that this figure includes large amounts of growth capex, that is, capex that can be eliminated if insolvency looks increasingly likely. To service the debt taken on from the coronavirus pandemic, the company is facing an additional approximate $1.27 billion in interest expense. It should be noted that interest expenses have been reduced by approximately $130 million due to management’s diligent refinancing of this high-yield debt. This was demonstrated in the company’s Q1 2022 results in which interest expense in the first was $368 million, down from $398 million, or $1.472 billion on an annualized basis, down from $1.59 billion.

CCL Q1 2022 Interest Expense – in Millions USD

Capital Allocation

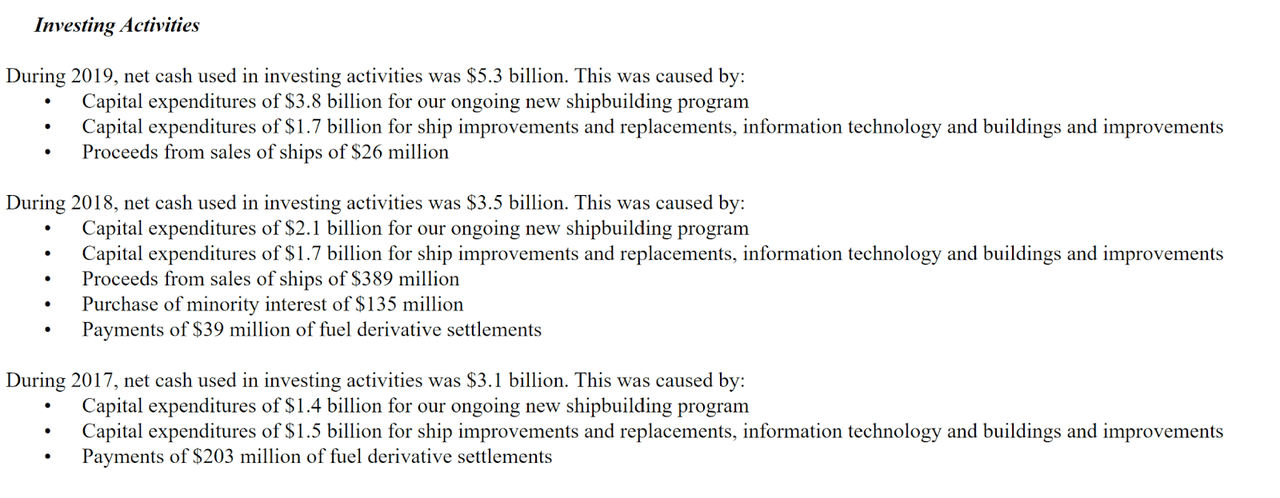

While the leverage incurred during the pandemic means that CCL is facing an increase of $1.27 billion in interest expense from pre-pandemic levels. This makes CCL prima facie non-FCF-generative. However, it should be taken into account that the company spent $3.8, $2.1 and $1.4 billion on its “ongoing new shipbuilding” program in 2019, 2018 and 2017 respectively. This averages out to $2.43 billion annually. If necessary, the company could cut all of this growth capex, but for conservatism’s sake we will only cut $1.3 billion in growth capex, this is because it is highly unlikely that shuttering their ship-building operation entirely would not affect their ongoing operations a few years in the future whether it be from an inability to maintain their competitive position or increased costs due to an aging fleet. In other words, it is likely that, in reality, much of the purported growth capex may, in fact, be maintenance capex in disguise. This would leave the company with > $1.2 billion in FCF annually once business returned to pre-pandemic levels. This is assuming that it is unable to refinance its debt at lower levels. This assumption is necessary because, although the company’s EBITDA is likely to recover to pre-pandemic levels which would traditionally lower its cost of capital due to a more favorable risk profile, the current rising interest rate-environment threatens to maintain CCL’s high cost of capital. However, cutting CCL’s growth capex would likely harm the company’s long-term competitive prospects in an at best moderate-growth industry.

Growth Prospects

The cruise line industry averaged a CAGR of 5.4% from 2009 to 2020 according to the Cruise Lines International Association. While this is not anemic growth, it is certainly not enough for Carnival to maintain its current capex, and its therefore presently normalized non-existent levered FCF, and allow itself to generate enough FCF in the near future to justify its current $12.44 billion market capitalization. For example, 5.4% growth in its pre-pandemic cash flow from operations, even assuming no change in its normalized capex, would generate only around $100 million in FCF growth per year.

CCL Capital Expenditures – 2017-2019

Solvency Risk

Compounding Carnival’s woes is the prospect of an imminent recession. What is notable, however, is that during 2008 and 2009 the company remained profitable. If a recession in the near future will be worse than that precipitated by the GFC, then the company may well break even or even lose money during the next two years. While this scenario is unlikely, this could cause the company to borrow even more. At this point, lenders will command interest rates that would ensure perpetual negative FCF for the company, or refuse to lend to the company altogether, testing CCL’s capacity to remain solvent.

While I have mentioned interest expense multiple times, I have yet to address the necessary refinancing of Carnival’s debt. While I am bearish on the company’s stock, I remain confident that the company will remain solvent and that it will be able to consistently refinance its debt. This is because, as previously mentioned, it could cut its growth capex, or promise lenders it will in the near future and consequently become, albeit marginally, FCF-generative. But, as previously mentioned, this would ensure relative, competitive declines in the future.

Corporate Governance

My thesis on CCL’s corporate governance is that the best course of action is to severely decrease growth capex in order to become sufficiently FCF-generative. However, not only does management’s track record of exorbitant capital expenditures indicate that this is unlikely to occur. In addition, were such changes to be pursued they would spell doom for CCL’s long-term growth prospects and the stock would arrive at an FCF multiple of only around 10, assuming a reduction in growth capex of 50%. Were its growth capex to be entirely expended of its FCF multiple could be as low as 5 initially, but this is a highly unlikely outcome given management’s historical capital allocation and because it would likely result in such a rapid decline in FCF, as compared to a progressive one, that it may impair shareholder value. In other words, the former course of action would turn this company into a ‘cigar butt’ that, instead of selling for fifty cents, would be selling for close to a dollar. Or, alternatively, it could become a cigar butt which, while selling for fifty cents on the dollar, may not even have a few puffs left, so to speak. However, if history is any guide, CCL’s management is likely to continue to deploy large amounts of capital at low rates of return and, while orchestrating a return to profitability on a net income basis, will generate negligible FCF at best, and negative FCF at worst.

The Bull Case

The only potential bull case for this stock, excluding an incredibly optimistic view on the cruise line industry holistically, is that Carnival’s growth capex has not only been superfluous, but that it can and will be significantly reduced in the near future. The catalysts for this decline in capex to be achieved would be the necessity to remain solvent and achieve lower interest rates from lenders, or the involvement of an activist investor who believes the growth capex is either excessive, unnecessary or destructive to shareholder value. While I do agree that Carnival would unlock the most shareholder value by reducing its growth capex, management’s track record indicates that such a change is unlikely to take place.

A tertiary argument that could be made by growth investors is that the growth capex that CCL has been deploying is likely to yield outsized FCF in the future. However, such a view would be ahistorical. This is because its pre-pandemic return on assets ranged from 4.7-5.1%, and with these rates of return, returning capital to shareholders seems a more logical course of action than continuing to reinvest capital at such anemic rates. In addition, the Cruise Line Industry, while possessing moderate growth prospects, simply does not have a CAGR high enough to allow for CCL to expand its passenger capacity significantly enough to generate a sufficient return on the substantial amount of capital being deployed.

Potential for Activism

It is highly unlikely an activist would become involved in CCL given its current valuation. However, assuming an activist did agitate management to reduce growth capex, it’s not clear, as previously mentioned, that CCL could shutter its entire shipbuilding enterprise as some of it is likely required for the continuation of present operations. Secondly, it would inevitably lead to a decline in future revenue as its competitors who did invest in such growth capex would eventually outperform CCL. While this would not necessarily be problematic for a company with the potential to trade at < 5x FCF, CCL would still be trading at > 10x FCF with poor prospects in a post-pandemic environment were they to cut growth capex by 50%, making CCL relatively expensive when the inevitable decline in revenue is taken into account. Therefore, even if the optimal actions to unlock shareholder value were effectuated by an activist or by management’s own volition, the current market capitalization of CCL would still be excessive in relation to its improved financial prospects.

Conclusion

In conclusion, if CCL maintains its current trajectory of reinvesting significant amounts of capital back into the business at anemic rates of return, which is, in my opinion, the most probable outcome, it is severely overvalued. Furthermore, even if management were to take the most beneficial steps to optimize shareholder value, CCL would still not be cheap based upon its current market capitalization. If CCL declines to approximately $5 per share I may begin to look for indications of a change in corporate governance and consequently revise my investment thesis, but absent such a decline in the share price there is simply no potential for compelling returns on an investment in CCL common stock.

Be the first to comment