FG Trade

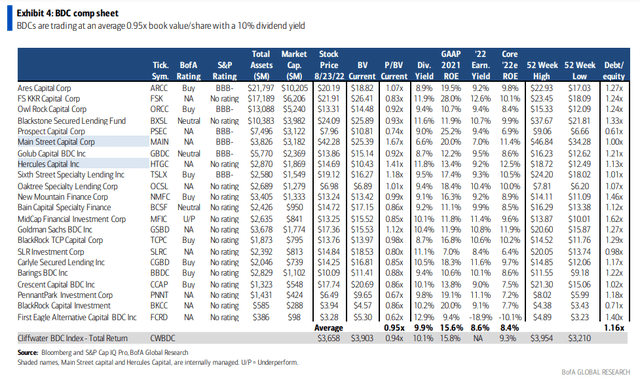

Business Development Companies (BDCs) are trading in the 0.9 to 0.95 book value per share range for the most part. The space should generally benefit from higher interest rates. Stable credit markets with liquidity are also important to their performance. One secured lending fund recently reported very strong earnings figures and hiked its dividend substantially. Are shares of Carlyle Secured Lending a buy now or are things too risky? Let’s assess the situation.

BDCs Overview As of Q3 2022

According to Bank of America Global Research, Carlyle Secured Lending Inc (NASDAQ:CGBD), which commenced investing in 2013, is a specialty finance company, regulated as a BDC under the Investment Company Act of 1940, as amended, that invests in debt and equity of middle market commercial enterprises. CGBD’s objective is to generate current income with the potential for capital appreciation for distribution to shareholders as dividends. The company principally underwrites floating rate credit structures at the upper end of the capital structure.

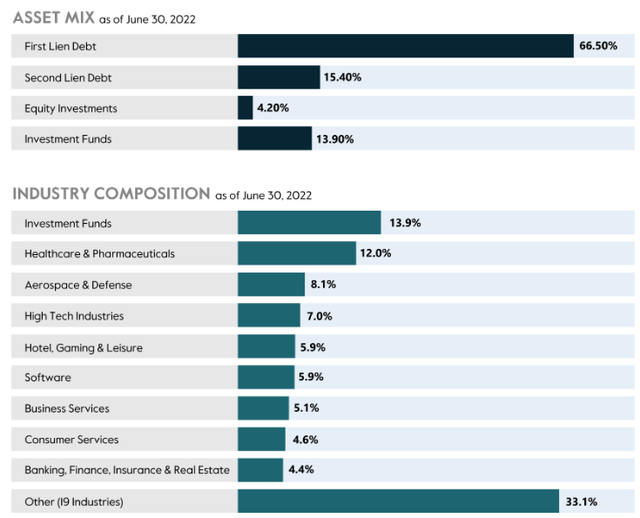

As of June 30, 2022, the business development company had debt and equity investments in 125 portfolio companies with a fair value totaling $1.9 billion. The industry composition is decently diversified to weather capital market volatility.

Carlyle Secured Lending: Asset Mix & Portfolio Composition

The New York-based $727 million market cap Capital Markets industry stock within the Financials sector trades at a low 7.3 trailing 12-month GAAP price-to-earnings ratio and pays a high 10.2% dividend yield, according to The Wall Street Journal.

The externally managed specialty finance company focused on middle-market lending recently beat earnings estimates, and shares have been on the rebound. CGBD also hiked its dividend by 5.9% to $0.36 and issued a special $0.08 payout. What is unsettling, but not a major issue is that the CEO and CIO are slated to step down at the end of the year, but BofA expects a “seamless transition” as the CEO will continue as Chair of the Board.

With a solid, diversified portfolio aligned well with the late-cycle credit environment and a rising yield, there is a lot to like about this BDC. The management team is selective in its deals. Any upturns in the credit markets would be bullish along with an increase in investment activity. Of course, downside risks include a poorer macroeconomic environment in 2023 and colder capital markets.

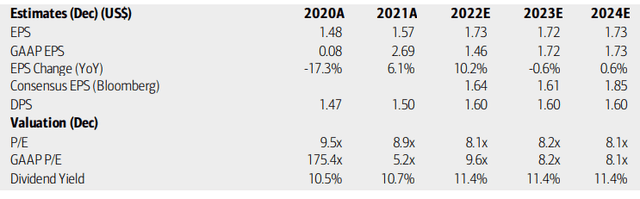

On valuation, analysts at BofA see earnings rising sharply in 2022 before muted growth next year and in 2024 due to soft GDP growth. The Bloomberg consensus forecast for per-share profits is not far from what BofA sees. Dividends should hold steady near $1.60, but I think they could increase based on higher market rates and a string of decent quarters out of the firm. With both operating and GAAP P/Es in the single digits and a double-digit dividend rate, I like the fundamental and valuation cases here.

CGBD: Earnings, Valuation, Dividend Yield Forecasts

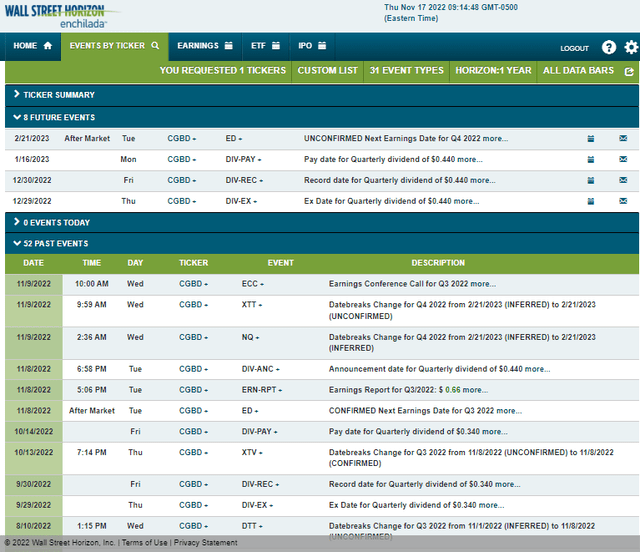

Looking ahead, corporate event data provided by Wall Street Horizon shows an unconfirmed Q4 2022 earnings date of Tuesday, February 21 after market close. Before that, there’s an ex-dividend date of Thursday, December 29.

Corporate Event Calendar

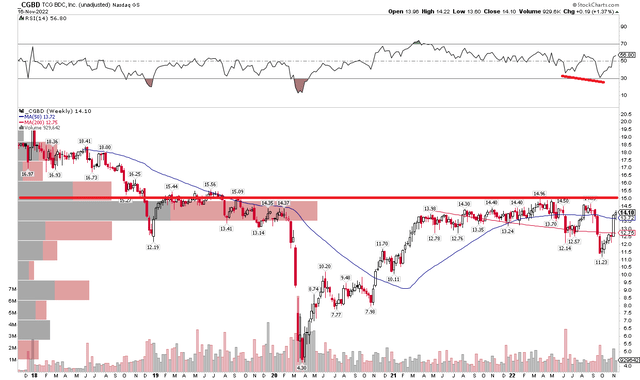

The Technical Take

With a NAV near $17, the technical chart is not quite as attractive as the valuation and yield cases. I see resistance in the $14 to $15 range – near where shares trade today. Notice how there is a high volume of stock traded in the $13.50 to $14.50 area along with frequent selling when CGBD nears $15 in the last 18 months. I suggest caution on an approach of $15 while buying more shares in the $11 to $12 range is a good tactical strategy.

CGBD: Shares Encountering Some Resistance, Buy On Dips

The Bottom Line

I like the valuation, investment mix, credit cycle orientation, and yield on CGBD. The technical picture is not as strong, but not broadly bearish. Overall, I am a buy on the BDC and suggest buying on weakness.

Be the first to comment