Eoneren

CareTrust REIT (NYSE:CTRE) has largely avoided many of the attention grabbing headlines that peer Omega Healthcare (OHI) has seen over the past several months, all while paying a safe and well-covered dividend.

While CTRE is no longer as cheap as it was in October, I still see value in the stock at its current 5.6% dividend yield. In this article, I highlight why CTRE is a quality high yield not to be overlooked for portfolios in need of a quality income stream.

Why CTRE?

CareTrust is a net lease REIT that specializes in the ownership, acquisition, and development of skilled nursing facilities, representing 71% of its annual base rent. In addition, CTRE also has exposure to multi-service campus and seniors housing which represent 16% and 13% of its ABR, respectively.

It was originally spun off in 2014 from the Ensign Group (ENSG), a skilled nursing operator. Since then, CTRE has greatly diversified its operator base. It currently owns 198 properties spread across 18 operators in 21 states. These properties support 21,505 beds and carry a fair market value of $1.75 billion.

CTRE recently demonstrated a solid quarter considering the current difficult operating environment with labor shortages among some operators. This was reflected by CTRE’s 93.4% rent collection rate during the third quarter, and encouragingly, occupancy rates grew by 53 basis points sequentially over Q2 for skilled nursing and 131 basis points for seniors housing.

Notably, the net lease structure of CTRE means that it comes with higher operating margins than other healthcare REITs that operate senior housing properties. This is reflected by CTRE’s 80% operating margin (with depreciation addback) over the trailing 12 months.

This means that despite the reduction in rental collection, CTRE’s dividend remains well covered at a 71% payout ratio based on normalized funds available for distribution. Notably, management has prioritized dividend growth, as CTRE has grown its dividend every year since going public in 2014 and has an 8.5% 5-year dividend CAGR.

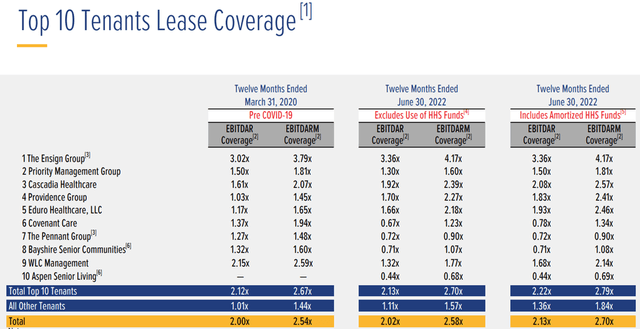

In addition, CTRE’s top 10 tenants, which collectively comprise 90% of CTRE’s annual rent remains overall healthy. As shown below, CTRE’s total portfolio EBTIDAR and EBITDARM to rent coverage (reported 3 months in arrears) are slightly ahead of pre-pandemic levels, and meaningfully higher when health and human services funds are included.

CTRE Tenant Lease Coverage (Investor Presentation)

Meanwhile, CTRE maintains a strong balance sheet to weather near term headwinds. This is reflected by its low net debt to EBITDA ratio of just 4.2x, sitting well below the 6.0x level that I prefer and at the low end of the 4.0 to 5.0x long-term targeted level by management. It also has $405 million (of the total $600 million) in availability on its revolving credit facility, and has no debt maturities prior to 2024, making it immune to high interest rates at present.

While the tight debt market is generally considered a headwind for all real estate companies, it could be a silver lining for those with strong balance sheets, as the CEO noted that the current environment is causing sellers to prioritize transactional partners like CTRE who present more certainty to close, and believes this to be the primary driver behind why more deal opportunities are crossing their desk.

Nonetheless, CTRE will need to remain patient on the acquisitions front, as pricing remains high, with the expectation that valuations will start to come down by early next year, as noted during the recent conference call:

Unfortunately, yet predictably, sellers still believe they are going to achieve peak pricing that they could have received in 2021 and early 2022. It remains to be seen how long this period of price discovery lasts.

The pricing environment is dynamic and we expect to see valuations come down further over the coming months as those operators either having to exit the space or choosing to exit we will have to transact at prices that are more reflective of historical cap rates and price per bed values. We continue to work closely with our current operators and with some new operators we’ve long admired to underwrite and structure each of our acquisition opportunities to ensure the investment pencils for us and our tenants.

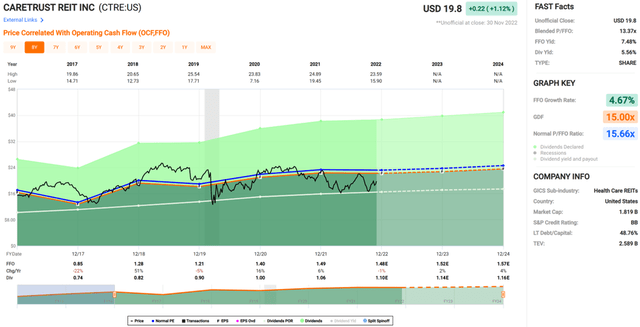

Turning to valuation, CTRE remains attractively priced at the current price of $19.80 with a forward P/FFO of 13.3, sitting below its normal P/FFO of 15.7, and that includes CTRE’s tumultuous early years, as it worked to diversify away from its Ensign exposure. I see potential for CTRE to revert back to its mean valuation with continued improvements in property operating fundamentals.

Investor Takeaway

CTRE remains well positioned to weather the current headwinds in the healthcare space and has a strong balance sheet, which provides it with increased transactional flexibility in the upcoming quarters. CTRE’s dividend appears safe given its high operating margins, well-covered payout ratio, and its 90% rent concentration among stable credit-worthy tenants. Lastly, CTRE trades at an attractive discount to its long-term historical valuation, could be poised for a reversion back to the mean with continued improvements in operating fundamentals.

Be the first to comment