imagedepotpro

The only thing better than a weak open and a strong close is a strong open and a stronger close. That’s what we had yesterday, as stocks soared from the start and finished at their highs for the day. The dollar weakening from what was a 20-year high last week has clearly given stocks a boost, but profit reports are showing that corporations did a better job than expected of managing inflationary headwinds during the second quarter. With a lot of disappointment already factored into stock prices, less bad can be very good for the broad market right now.

Finviz

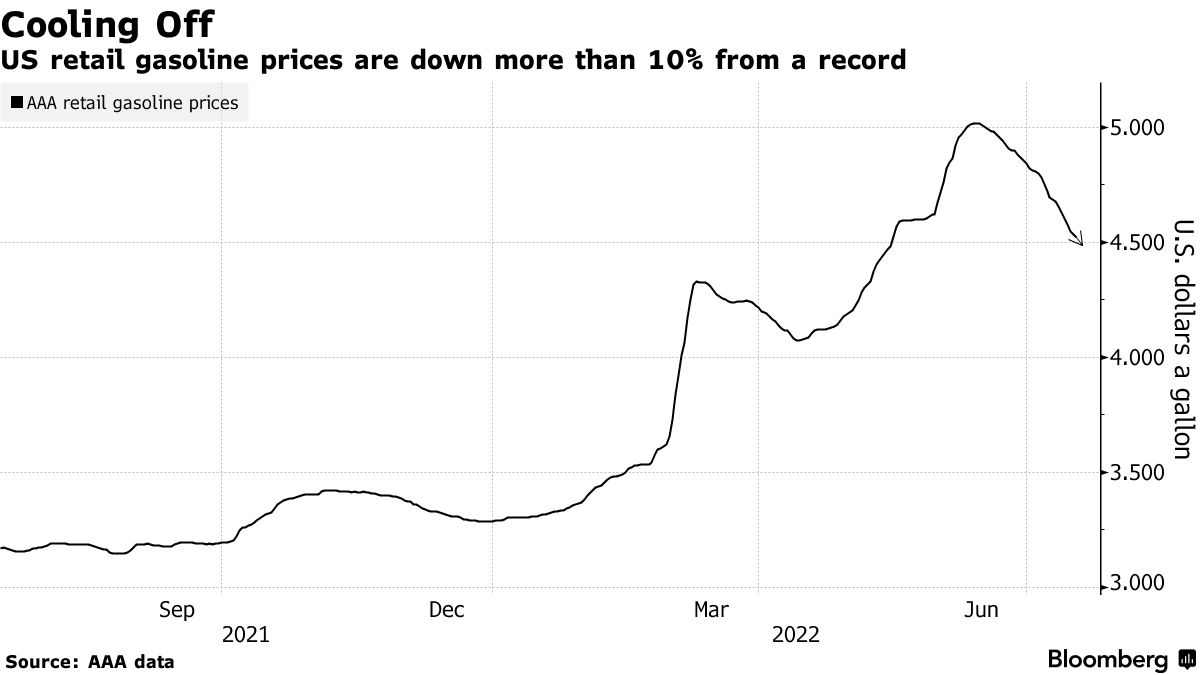

The reason I grow increasingly convinced that the bear-market lows are behind us is that this latest rally is accompanied by a significant drop in commodity prices. A gallon of gas at $4.50 may not sound all that attractive, but when it was $5.00 a month ago, it is very attractive. The price has fallen more than 10% over the past 35 days, which should start to lift consumer sentiment from historically low levels. This is one of the many positive rates of change I have noted in recent weeks, and it should be the impetus for a trend reversal in the market averages that leads to a second-half recovery. At the same time, we are seeing peak levels of pessimism.

Bloomberg

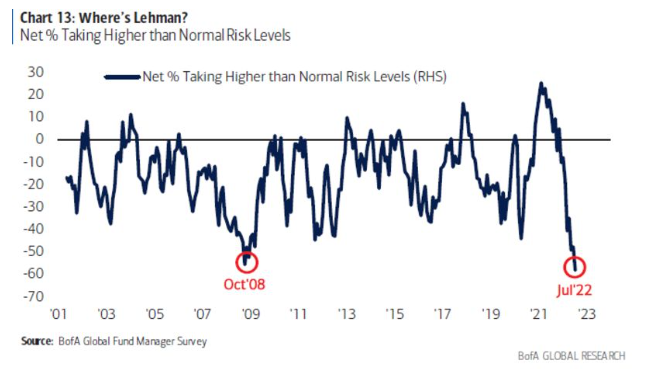

I have inundated readers with contrarian indicators in recent weeks, as I probe for the ultimate bottom in this bear market and birth of a new bull. The most bullish one I have seen yet came yesterday in the form of Bank of America’s latest monthly fund manager survey, which showed that 259 professional investors managing $722 billion reduced their exposure to risk assets down to levels not seen since the global financial crisis in 2008. Their actions were based on a “dire” economic outlook.

Bloomberg

Additionally, expectations for growth in the global economy and corporate profits fell to an all-time low. I love all-time lows, because it tells me we are pretty close to levels where there is nowhere to go but up. Expectations for a recession were their highest since May 2020, inflation is now the biggest tail risk, and cash levels are at their highest percentage since 2001. That is a recipe for a huge rally at worst and a new bull market at best.

Bloomberg

The bears on Wall Street recognize that sentiment sitting at such extremes could produce a sizeable counter-trend rally, as we saw yesterday, but they say it will be short-lived because inflationary pressures will weigh on corporate profit margins and consumer spending, increasing the chances of recession.

I contend that the rate of inflation will fall more rapidly than most expect, allowing the Fed to ease off the economic brakes and not raise short-term rates as high as markets now expect this year or next. That should allow us to avoid recession and pull off a soft landing. The Fed will undoubtedly raise short-term rates by 75 basis points next week, as the consensus expects. Beyond that, I expect expectations for rate hikes to start easing and sentiment to start improving.

The Technical Picture

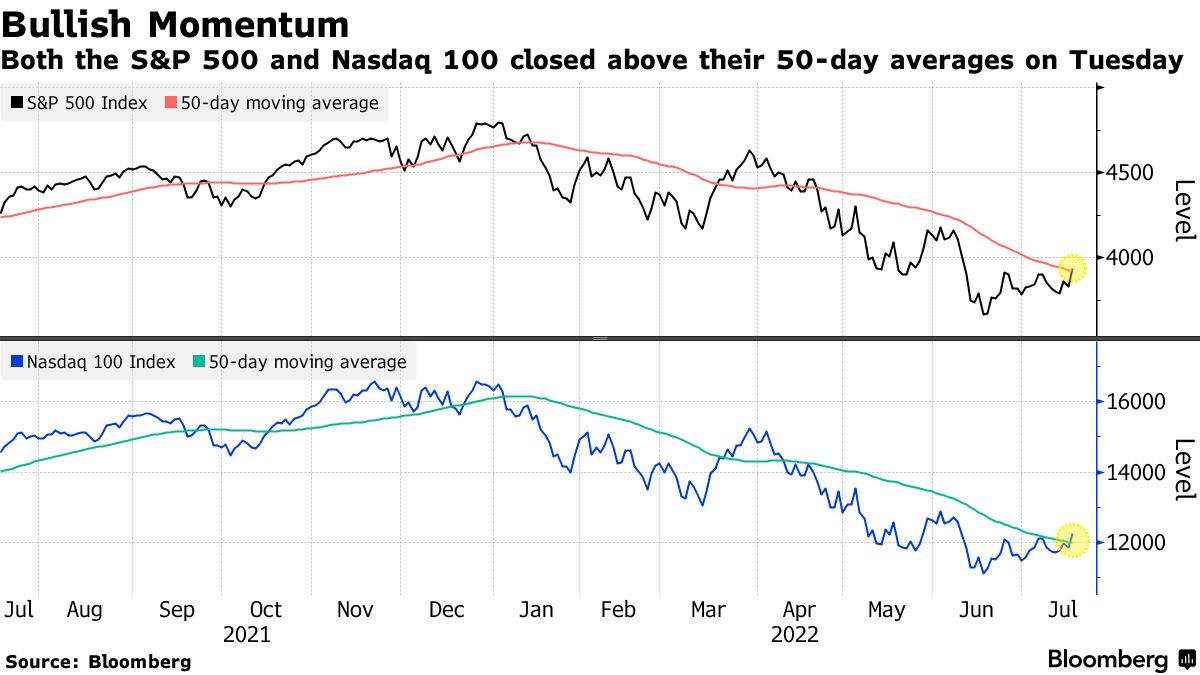

I noted last week that the first major hurdle for the major market indexes would be to clear their 50-day moving averages, which we finally saw yesterday. This should trigger more buying until we hit the next level of overhead resistance, which I see as the June high of approximately 4,150-4,200 for the S&P 500.

Bloomberg

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment