benedek

Internally managed business development company Capital Southwest (NASDAQ:CSWC) presents investors with a rising dividend payout fully covered by earnings. This has come on the back of a net interest income profile that has proved resilient against the current economic environment. The Dallas-based company is a credit-focused BDC that provides capital to lower middle market companies.

So why did I back up the truck? Because of the dividend.

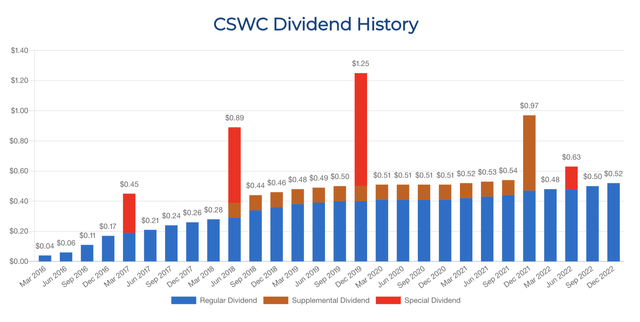

The company recently raised its quarterly cash dividend payout to $0.52, a 4% increase from its prior payout. This is for a yield of around 12% when annualized against the current common share price.

Capital Southwest

Not only is this payout covered by earnings, but it is greater than the current US inflation figure which is still riding at multi-decade highs. This is important for protecting wealth against what was inherently transitory inflation but now looks to be a stickier embedment of general price increases across the economy. Further, and in contrast to initial Fed commentary last year, inflation is not forecasted to fall close to the central bank’s target of 2% until the end of calendar 2023. This places the dividends from Capital Southwest at an elevated level of importance as it will continue to form an integral leg of income for the foreseeable future.

The company has also historically paid out special and supplemental dividends. This helps to augment the 12% yield and accelerates the compounding effect to help oil the long-term wealth creation machinery of marrying rising dividend payouts with an automatic dividend reinvestment plan, also known as DRIP.

Safest Dividend Is One That’s Just Been Raised?

Capital Southwest’s dividend history has been characterised by stability even in periods of economic chaos. The payout was maintained even in the first months of the pandemic and has steadily risen for more than half a decade from fiscal 2016.

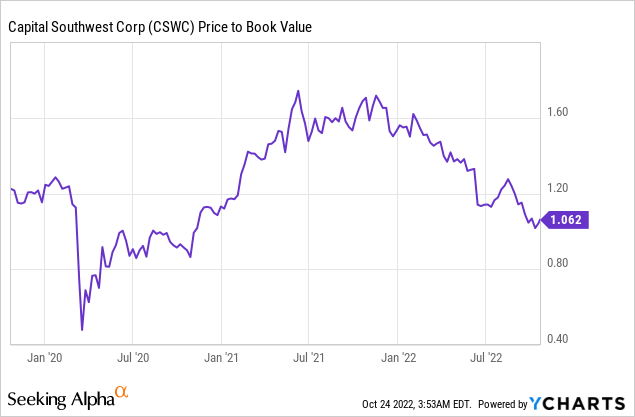

The company’s dividend is also covered with a dividend payout ratio of 97%. With preliminary estimates of fiscal 2023 second quarter NII being between $0.50 to $0.53 per share, up from $0.43 in the year-ago quarter, the higher payout stands to be covered by Q2 NII if the company achieves the higher end of guidance. The company is also guiding for net asset value per share as of the end of the second quarter to be in the range of $16.45 to $16.60. Whilst the shares currently trade on a small premium to this, the company’s price-to-book value of 1.062 has pulled back far below its pre-Covid peak despite an expanded outlook for dividends and higher NII growth.

The core reason for the year-to-date fall in the company’s share price continues to be the poor economic backdrop against what remains a robust investing criterion. Capital Southwest is transparent on this. It targets companies with a minimum EBITDA of $3 million, with most of their direct access borrowers having EBITDA in the range of $3 million to $20 million. The company also invests across a range of credit investment structures including first and second lien debt, unitranche debt, and preferred equity with a targeted investment size of around $5 million to $35 million.

Capital Southwest Is A Good Company, But The Economy Presents Risks

When the company last reported earnings for its fiscal 2023 first quarter, its total investment portfolio reached $1 billion with the equity component of that at $89.5 million. The company made $145 million in new committed credit investments, mainly first lien senior secured debt to maintain a broader weighted average yield on debt investments of 9.3%. Credit investments with a fair value of $16.1 million were non-accrual and represented 1.6% of the total investment portfolio.

The risk is that this rate of default grows higher amidst the current economic discombobulation wrecked by rising Fed fund rates. With inflation running at multi-decade highs real wages are dropping and so too has consumer sentiment. This fell to new all-time lows back in June. Inflation is expected to fall to around 2.5% towards the end of the calendar year 2023, but there will remain material uncertainty around the state of the global economy.

Hence, whilst Capital Southwest stands to benefit from rising Fed fund rates as it generates net investment income from the difference between interest income on its portfolio and interest expense on borrowings, the more volatile economic conditions could see a deterioration of its credit portfolio. This forms the core risk to an investment in the company.

The increased dividend is a sign of management’s faith in the ability of their investment criteria to weather the storm and ride the rising rate cycle to new highs. I have bought shares and will continue to add until I reach my full position before the end of this year.

Be the first to comment