Mrinal Pal/iStock Editorial via Getty Images

Dear readers/followers,

In this article, I’m going to be looking at French IT giant Capgemini (OTCPK:CGEMY). I’ll go through the company from a high level, present upsides and what the company has going for it, and what the risks are to a business like this.

More importantly, I’ll show you what a good price is for buying the company – and what sort of returns you can expect.

Let’s take a look at what this company offers.

Capgemini – What does the company do?

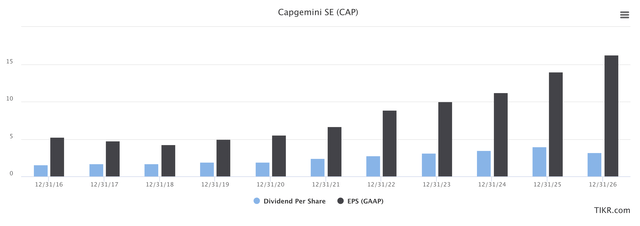

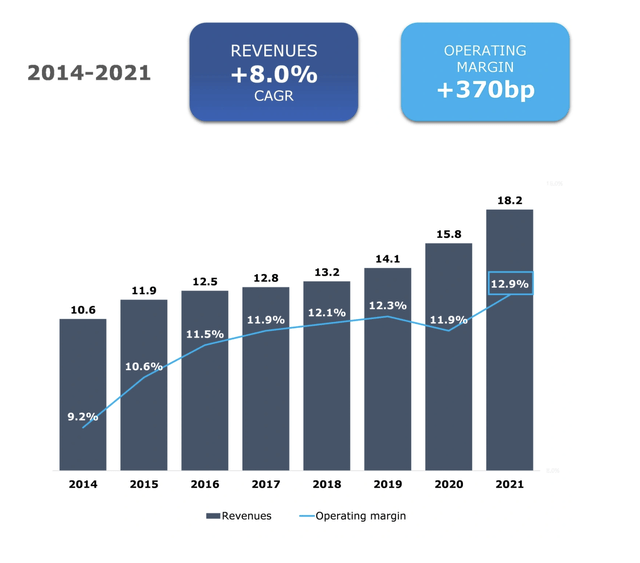

This is a French giant that manages about €18.2B in annual revenues, and from that revenue manages to squeeze a 10-13% operating margin, equalling to an FCF of close to €2B per year.

The company, as of 2022, employs a total of 358,400 people, is active in 55 countries, and 65% of the company’s activities are in digital/cloud.

What the company does and bills customers for is transforming and managing its business through technology. The company has a 50-year-long tradition of these operations.

The company has an impressive history in terms of growing its revenues as well as its margins during difficult times…

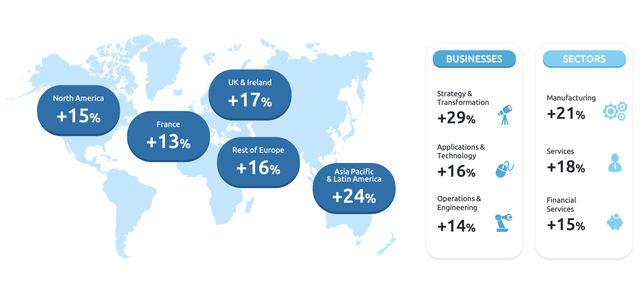

…and the company also has impressive records of increasing its cash flows. Organic FCF has increased by a factor of 2.8x in less than 7 years. The company has clients across the entire world, but it’s a 60%-EU/NA exposure in terms of revenue, with another 21% specifically in France and 11% in UK/Ireland. This means that 92% of revenues are found in Europe or NA, with only 8% found in APAC, LATAM, and other areas.

So when investing in Capgemini – the company’s high EU focus needs to be a part of your considerations.

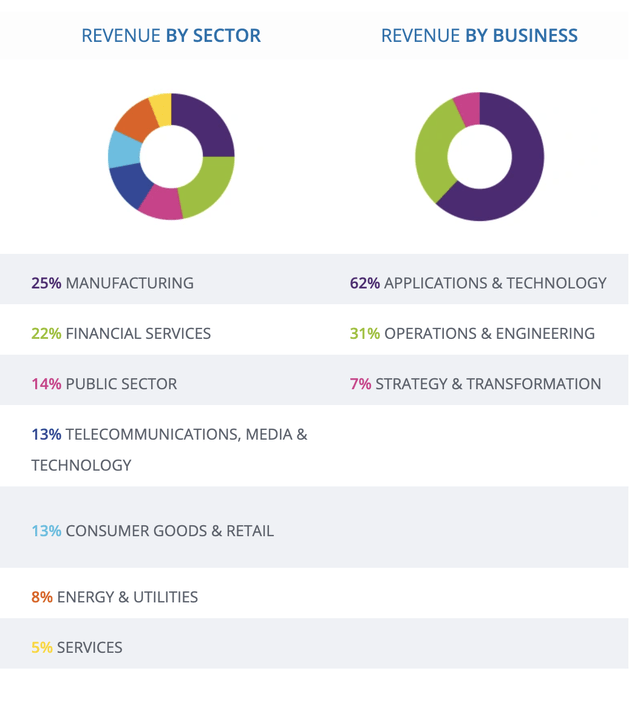

In terms of client sectors, here are how things are looking – an interesting and conservative split without much of a specific risk profile (Manufacturing can be a lot of things).

The company’s high-level targets for the next few years (2025E) include a 7-9% revenue growth CAGR, an operating margin up another 100 bps (14%), and a solid investment-grade credit rating, as it has today.

In terms of sectors/business lines, we have the following things that the company does.

- Strategy & Transformation, which focuses on transformational consulting activities and strategic services, supported by Altran or entities thereof, such as Cambridge Consultants.

- Applications & Technology, focusing on things like developing, modernizing, and extending IT/digital environments using the latest technologies. Capgemini develops solutions for tech and application optimization, including using its Sogeti subsidiary for providing local technology services.

- Engineering & Operations holds the R&D activities of the company as well as business services and process outsourcing/maintenance for IT infrastructures in data centers or in the cloud.

The company owns and runs 12 data centers across the world, 50 delivery centers, and 15 security operation centers.

Use cases are always relevant when presenting businesses such as this. The company recently secured a contract with the London Heathrow Airport, to contribute to and work the digital transformation, and extend the company’s already-existing applications and infrastructure support for the airport as it stands today.

Another example?

The Boston Scientific Corporation (BSX) recently signed a deal with Capgemini on a multi-year basis, again to assist in the digital transformation of the commercial, supply chain, and finance business processes in the company.

So this is a company that assists or handles transformation processes, IT consulting, and management consulting questions for truly massive organizations. Their clients include businesses like Mercedes-Benz (OTCPK:MBGYY), ANZ Banking Group, The Swedish Transport Administration, Airbus (OTCPK:EADSY), The City of Amsterdam, and many other world-class public and private clients.

Capgemini enjoys significant pricing power on the part of its market position – and positive trends and expectations are things we can confirm using the latest sets of results for the company.

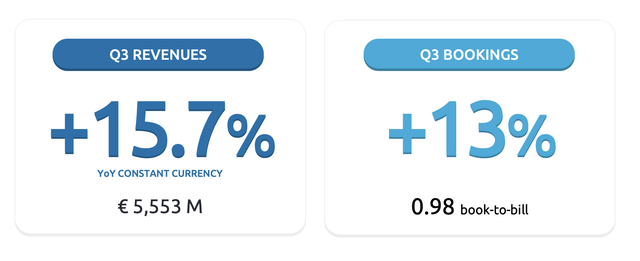

3Q22 is the latest set of company results we have. Revenue trends are very solid, coming in at double digit growth, with a close to 1x book-to-bill ratio.

We can see a €20B+ annual run rate revenue at this pace – and every single geography saw significant growth across every single area and sector. In terms of top-line, there’s very little or nothing negative to be said here.

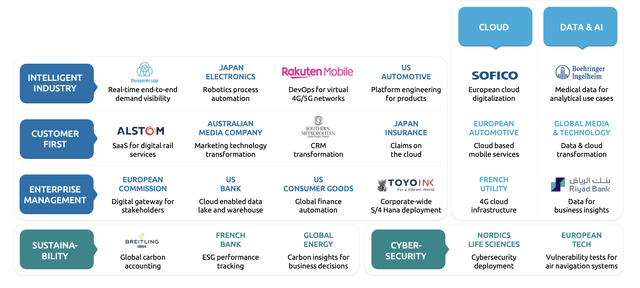

And here are some of the more recent clients the company has secured – again, you’re looking at organizations from public and private sectors across the entire world and really from almost every single business area you can think of.

The company expects double-digit 14-15% revenue growth, an operating margin as high as 13.1% despite input cost increases, and organic FCF on a level above €1,700 – again, despite ongoing pressures.

Risks in the current situation include clients adjusting for macro expectations and expecting more of a recessionary environment. The company, as of this current quarter, hasn’t seen indications of this. There hasn’t been a change worth mentioning in terms of this, but it’s one of the things you may want to continue looking at – things like booking levels, book-to-bill ratios, and ensuring that contracts come in at the margin level that we want. However, given the company’s last few years of margin improvements make it is unlikely that the company is going to accept lower-margin contracts o business.

The company’s headwinds, instead confirmed by the company itself, are primarily two. First, it’s the financing of growth. This is, of course, logical given the increase in interest rates in the past few months. The second change is that the company’s clients, over the past few years, were not interested in having excess cash on their balance sheets given the low-interest rates and returns available. Today, that situation has reversed, and that makes clients less likely to front-load their IT spends and CapEx, another headwind the company needs to work with.

The fourth quarter is expected to come in at below the 3Q22. So we can expect some pressures coming here – but not to any degree that impact the way the company is expected to earn money in the next few years. Take a look at the next few years of analyst expectations.

Capgemini Forecasts (S&P Global/TIKR.com)

We’re also, based on these forecasts, unlikely to see any sort of margin deterioration for the company for the next few years, or any sort of fundamental troubles that would de-rail Capgemini as a business overall.

This leads us to the company’s valuation, and how we would view the company from a valuation perspective.

Capgemini Valuation

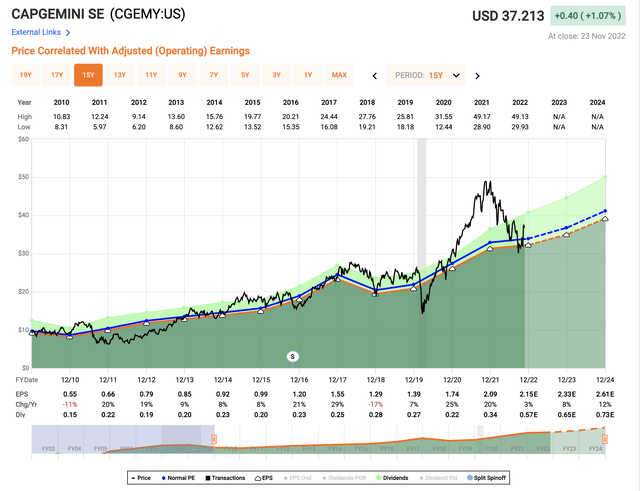

When looking at the company’s valuation, we need to accept a premium for the company. Capgemini typically trades of premium of upwards of the 16-19x P/E or so, and for the past 15 years, it has delivered ample reason for this premium – such as a 10% annualized average EPS growth rate. There’s a decent bit of volatility to the share price, which we can see lows of 9.6x P/E and highs of 24x P/E.

Capgemini Valuation (F.A.S.T Graphs)

Obviously, 24x P/E is too much, and a sub-10x P/E is too low given the growth rates that this company offers – not to mention expected dividend growth in the next few years.

Peers for the company do exist. Larger ones include Accenture (ACN), IBM (IBM), Infosys (INFY), CGI, and others. In terms of peer multiples, Capgemini trades at impressive discounts to any of its peers apart perhaps from IBM – and IBM of course has its own issues to handle. Other typical peers trade much closer to 20-25x P/E, which makes this company relatively cheap – at least from a peer multiple.

In terms of street targets and analyst targets, the company is at a 20% undervaluation to most expectations from analysts following the company’s trends. 18 analysts from S&P Global follow the company, with ranges of €190 on the low side to €241 on the high side, with an average of €215. Out of 18 analysts, 17 have either a “BUY” rating or an equivalent positive outlook on the business.

From a historical perspective, investing here makes sense. The company’s average valuation is around 16-18x P/E, which considering the company’s expected earnings, gives us a 2-3 year upside of at least in the double digits, or close to double digits – around 14% annually given an 18x forward P/E.

The current trends for the native are even better, with averages of around 17.5x, with current trends of about 15.1x.

Current cash flow trends are positive – especially when considering the current trends in how costs and inflation are impacting things.

From a conservatively-adjusted DCF model, assuming an expected EPS growth rate of double digits (around 11%), with a discount rate of around 10%, we get an implied FV for the company of around $33/share.

I choose to allow for a bit of a higher premium here and consider the Capgemini premium of 17-18x P/E to be valid, implying a $40-$45 long-term PT for the company’s CGEMY ADR to be valid – or a PT of €210/share for the native share, traded on the Paris stock market.

This results in the following thesis for the company.

Thesis

My thesis for Capgemini is the following:

- Capgemini is one of the world-leading IT Consulting and Business management companies. It’s inherently EU-focused, but with growing exposure to other areas in the world. The future for this company seems secure, with the ever-important role of IT in today’s world.

- The company is a definite “BUY” at a good valuation – delivering double-digit upside while providing conservative safety owing to very solid processes, background, and customers with very long contracts.

- I give the company a PT of €210 for the native, making the company a “BUY” here with an upside.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

The company fulfills all but one of my criteria for investment – I, therefore, view this as a “BUY”.

Be the first to comment