Dude, When They Go Low, We Get High. Dejan Marjanovic

When we last wrote about Canopy Growth Corporation (NASDAQ:CGC), we expected a decline over time as the company burnt through its remaining cash. Our ending message was.

We expect at least another $300 million of cash burn through the next 3 quarters. Alongside the principal redemption of remaining 2023 notes, CGC will have $700 million of cash on the balance sheet versus its $1.25 billion of remaining debt. That is not terminal by itself but not worthy of investing either. We resume our Sell rating on this stock with a price target of $1.00 (1X sales) per share.

Source: BioSteel Sizzles, Everything Else Fizzles

CGC has notably lagged the broader indices since then, and this has been despite surprisingly positive political news flow for the marijuana industry since then.

Seeking Alpha-returns since last article

We examine the latest results and tell you whether we have seen a turn in the fundamentals.

Canopy Growth Q2 2023 Earnings Results

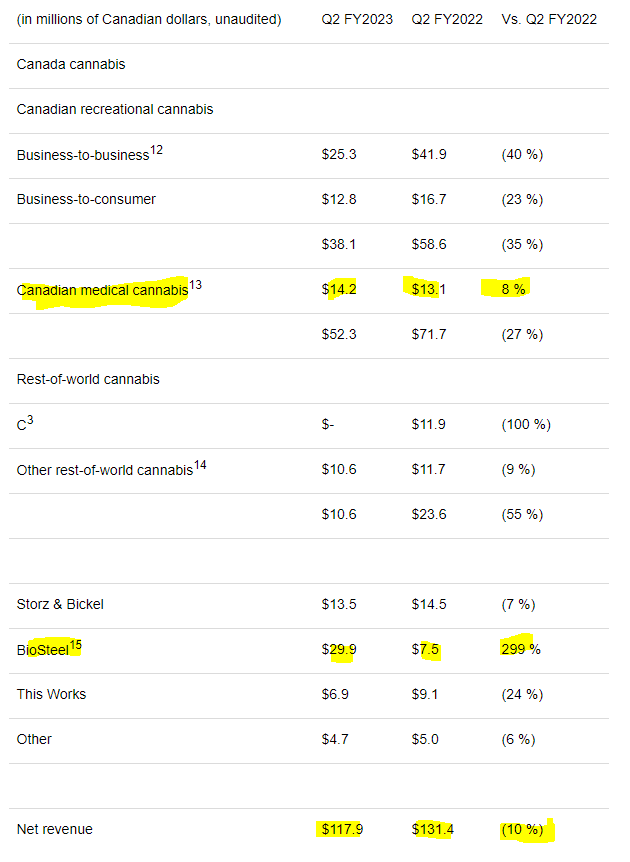

CGC’s fiscal year end is in March, so the current quarter (8-K link) is Q2 of the fiscal year 2023. Revenue declines year over year were just over the 10% mark. Outside of Canadian Medical Cannabis and BioSteel, every single category showed a decline. In other words, the growth crowd got their fourth consecutive disappointment.

Canopy Press Release

One positive here was that BioSteel’s singlehanded vanguard performance actually helped Canopy move into a positive quarter over quarter performance. The $117.86 million revenue number was almost $8 million ahead of the last quarter.

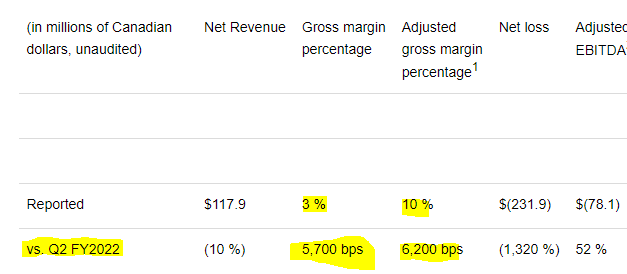

The second positive was the adjusted gross margins, which showed signs of life. It is really hard for a company to make money when they have a negative adjusted gross margin. Yet, this fact was overlooked by multiple bullish calls all the way down. The turnaround this quarter was welcome.

Canopy Press Release

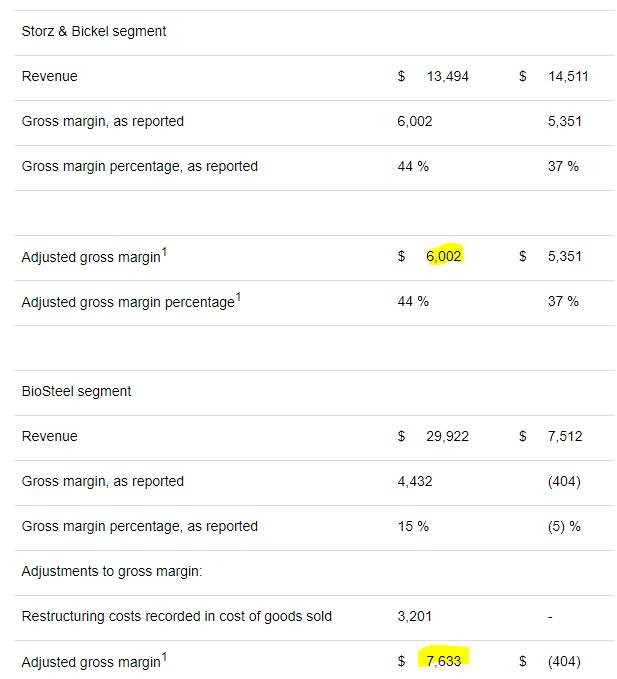

We will caution here that the numbers seemed to be all over the place on a segment level basis and it is very unclear whether we are seeing a turnaround or just quarter to quarter noise. Another reason for being cautious is that results are again being driven by BioSteel and the Storz and Bickel Segments.

Canopy Press Release

Those two are combined producing more than 100% of company reported adjusted gross margin. That means that the other segments are still hemorrhaging.

Cash Burn Still Extremely High

Our outlook for $300 million of cash burn over 3 quarters appears to be looking optimistic.

Free Cash Flow in Q2 FY2023 was an outflow of $135 million, a 34% increase in outflow versus Q2 FY2022. Relative to Q2 FY2022, the outflow increase is due to the timing of certain payments in each period. Year-to-date Free Cash Flow in FY2023 is in line with the prior year period.

Source: Canopy Press Release

Timing of payments aside, the burn rate is not comforting at all and continues to decrease the fair value of the company quarter after quarter.

Verdict

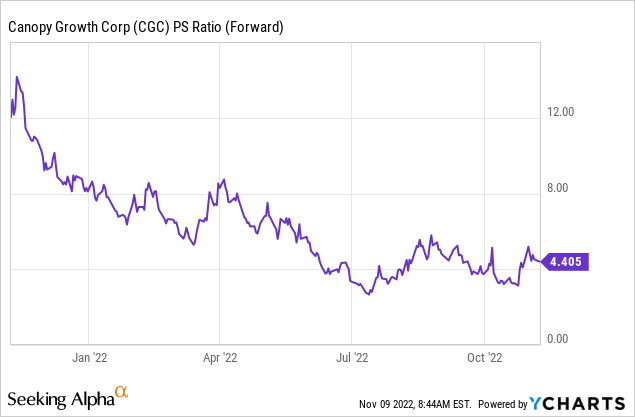

Cannabis decisions were on the ballot in five states this week. Arkansas, Maryland, Missouri, North Dakota and South Dakota all voted on recreational marijuana use. As we write this, it has won in Maryland and Missouri. While we think this wave is gaining momentum, the chances of it doing anything for CGC are remote. The company’s core operations are performing poorly and everyone and their brother overestimated the ultimate size of the Canadian cannabis market. Turned out, even after legalization, a vast majority of people think it is silly to get high. People are perhaps turned off by the vast research that shows the side effects or perhaps they are focusing on the extra costs in this economy. In any case, the hope for smoke is weak north of the border despite many years since legalization. Can their secondary segments bail them out remains the question. Canopy’s nifty debt exchange moves and strong support from Constellation Brands Inc. (STZ), make a complete wipeout improbable. The near-term debt maturities are trading at 96 cents on the dollar, again suggesting that a bankruptcy is not imminent. The fundamental case for investing remains rather weak though. CGC still trades at over 4X forward sales and our upper limit would be a 1X multiple if it could reach a low level of GAAP profitability and address its cash burn issue.

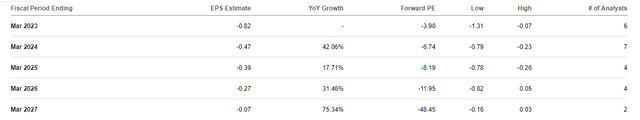

Even the perpetually positive analyst community cannot see profits any time soon.

Seeking Alpha-CGC Earnings Estimates

This is despite projecting revenue growth as if cannabis is about to become as popular in Canada as poutine.

Seeking Alpha-CGC Revenue Estimates

So, our outlook here remains the same. It is going to slowly and methodically go lower. Bulls will hang on to every piece of news which suggests that CGC can make in-roads in the US. We think it is extremely capital constrained and its cash burn likely puts it on a path to bankruptcy within 24-36 months. There is also a ton of capital chasing opportunities within the US market, and we don’t necessarily see Canopy as even a tier two player. We reiterate our Sell rating and look for lower prices up ahead.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment