Margarita-Young/iStock Editorial via Getty Images

Introduction

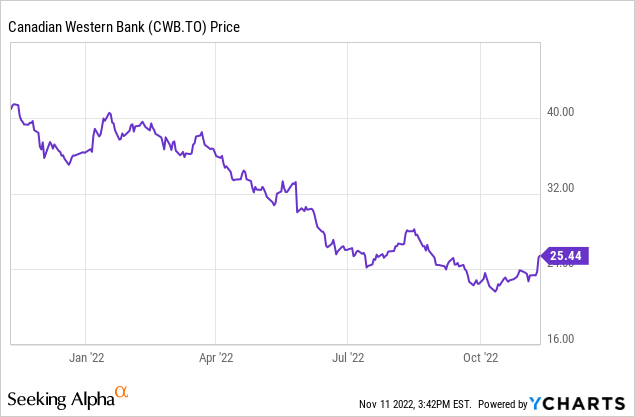

While Canadian Western Bank (TSX:CWB:CA) (OTCPK:CBWBF) doesn’t enjoy the same name recognition the larger banks in Canada like the Bank of Montreal (BMO) and The Toronto-Dominion Bank (TD) enjoy, CWB is a decent mid-sized bank with just over C$40B in assets. The stock is currently trading at a discount of almost 15% to the tangible book value and much to my surprise did Canadian Western decide to sell more stock (at a discount to the book value). While I’m not overly impressed with that decision, I’m giving CWB the benefit of the doubt as it allows the bank to expand its balance sheet which could provide a nice earnings boost as net interest margins are expanding thanks to the higher interest rate environment.

The Q3 results and 9M 2022 results were strong, and Q4 could be even better

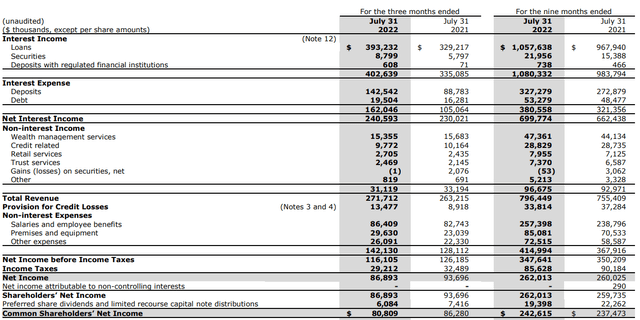

During the third quarter of FY 2022 (the financial year ends in October so the Q3 results include the May-June-July period), CWB saw its interest income increase to just over C$402M. As the interest expenses increased as well but at a slower pace, the net interest income increased quite substantially. Whereas CWB reported a net interest income of C$460M in the first half of the year, this accelerated to just over C$240M in the third quarter. And considering interest rates continued to increase throughout the final quarter of the financial year, I would be surprised if CWB didn’t post another net interest income increase in the final quarter of its year.

The bank was quite profitable: Despite recording about C$31M in loan loss provisions, the net income came in at just under C$87M, and after deducting the preferred dividend payments and the payments to limited recourse capital notes (which are part of the equity side of the balance sheet as well), the net income attributable to the common shareholders was C$80.8M. That’s C$0.88 based on the average share count during the trimester, and C$0.87 if I would use the quarter-end share count of just under 93 million shares.

Canadian Western Bank currently pays a quarterly dividend of C$0.31 per share and with a payout ratio of less than 40%, the dividend (which currently represents a yield of almost 5%) appears to be safe.

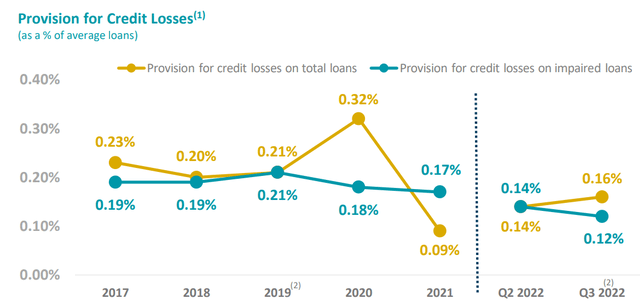

As CWB has a strong history of keeping its loan losses limited, I’m not too worried by the relatively low loan loss provision. I do expect this number to increase, but the impact on the bottom line should be mitigated by the higher net interest income going forward.

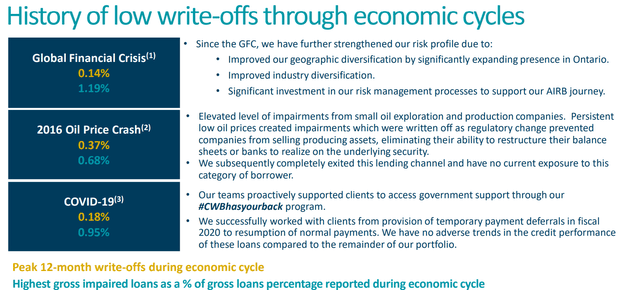

The recent history shows the bank has been able to deal pretty well with the last three major crises and loan losses remained limited.

The capital ratios are fine, and I think CWB should scale back its ATM program

While I generally agree it makes sense for a bank to raise more money if the stock is trading at a premium to book value (if the funds can be successfully deployed in the market), I’m not so sure I’m on board with an at-the-market equity offering where the shares are issued at a discount.

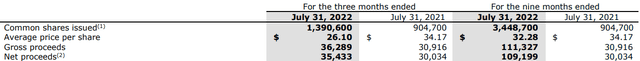

In the first nine months of the year, CWB issued 3.45 million new shares at an average price of $32.28 for total net proceeds of C$109M. While that average price is pretty decent (and the average price the stock was issued at in the first semester was actually north of C$36 per share) I’m surprised to see the ATM program accelerated during the third quarter as 1.39 million new shares were sold at just C$26.10 per share.

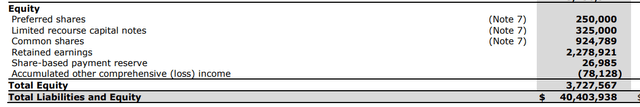

That’s surprising given the current book value and tangible book value per share. Below you can find the equity portion of the balance sheet, which stood at just over C$3.7B.

From that number we need to deduct the C$575M in preferred shares and limited recourse capital notes to end up with C$3.15B in equity attributable to the common shareholders. With a total share count of 93M shares, the book value as of the end of July was C$33.89. And even after deducting the C$364M in goodwill and intangible assets, the tangible equity of C$2.79B still represented a tangible book value of almost exactly C$30 per share. And that is including the negative impact from issuing new shares at a discount.

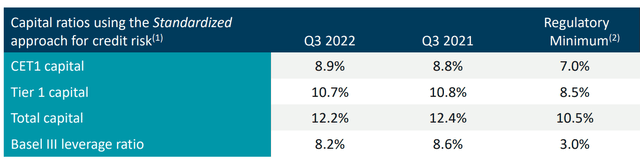

I’m obviously never opposing strengthening a balance sheet, but by issuing stock at a discount to the book value and tangible book value, I’m not so sure the ATM program makes sense. On top of that, the capital ratios appear to be pretty decent (and CWB mentioned it expects a slightly positive impact when the new 2023 capital adequacy rules will be implemented). As of the end of the third quarter, CWB had a CET1 capital ratio of 8.9%, about 190 basis points above the regulatory minimum.

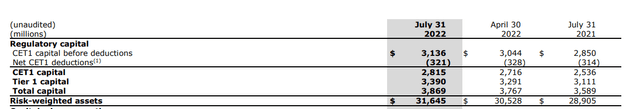

And considering the total amount of risk-weighted assets on the balance sheet came in at C$31.6B, the 190 basis points in “excess” CET1 capital represents a capital surplus of approximately C$600M.

On top of that, CWB is able to retain just over C$50M in earnings per quarter (the difference between the net income and the dividend payments) and retaining C$200M per year boosts the CET1 ratio by about 63 basis points per year. So even if CWB would not issue a single additional share, it would still be able to see its CET1 ratio exceed 10% by the end of Q1 calendar year 2024.

Investment thesis

I also shouldn’t be too harsh on CWB as I like the prudent approach. The C$110M in additional capital helped to keep the balance sheet safe, as the total size of the balance sheet increased by just over C$3B in the same period. So looking at the ATM program from that perspective, it does make sense, especially heading into an era of higher interest rates and higher net interest margins. And that’s exactly what CWB appears to be banking on.

I’m giving the CWB management the benefit of the doubt, and although I’m not sure how I feel about the stock that I might be buying next week may be freshly-printed shares, I like the risk/reward ratio here and I will likely initiate a long position before the bank reports its full-year results.

Be the first to comment