RealPeopleGroup/E+ via Getty Images

Investment Thesis

While Canadian Tire Corporation could see further pressure on earnings, a favourable cash position could mean a rebound in upside if profits start to rise again next year.

Canadian Tire Corporation (CTC.A:CA) (OTCPK:CDNAF) is a group of companies that include a retail and financial services segment, as well as a CT REIT – with the retail side providing products across the Automotive, Fixing, Living, Playing and Seasonal & Gardening divisions.

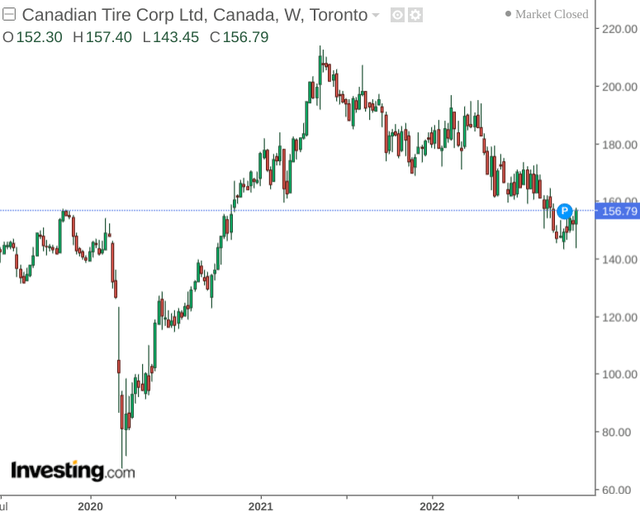

While the company showed a strong rebound up until 2021 – price has been declining since then.

The purpose of this article is to assess why Canadian Tire Corporation has been seeing downside over the last two years, and whether the company can rebound from here.

Performance

When looking at the company’s annual balance sheet, we can see that while the company’s quick ratio has decreased over the past year – the ratio still remains above 1 – indicating that Canadian Tire Corporation is still in a good position to service its current liabilities going forward. Note that the quick ratio below is calculated as total current assets less merchandise inventories and prepaid expenses and deposits all over total current liabilities.

| Jan 2021 | Jan 2022 | |

| Total current assets | 10546.8 | 11646.6 |

| Merchandise inventories | 2312.9 | 2480.6 |

| Prepaid expenses and deposits | 193.8 | 216.1 |

| Total current liabilities | 5205.8 | 6790 |

| Quick ratio | 1.54 | 1.32 |

Source: Figures sourced from Canadian Tire Corporation 2021 Report to Shareholders. Figures provided in C$ in millions (except the quick ratio). Quick ratio calculated by author.

With that being said, we can also see that the long-term debt to total assets ratio has seen a decrease over the past year:

| Jan 2021 | Jan 2022 | |

| Long-term debt | 4115.7 | 3558.7 |

| Total assets | 20377.1 | 21802.2 |

| Long-term debt to total assets ratio | 0.20 | 0.16 |

Source: Figures sourced from Canadian Tire Corporation 2021 Report to Shareholders. Figures provided in C$ in millions (except the long-term debt to total assets ratio). Long-term debt to total assets ratio calculated by author.

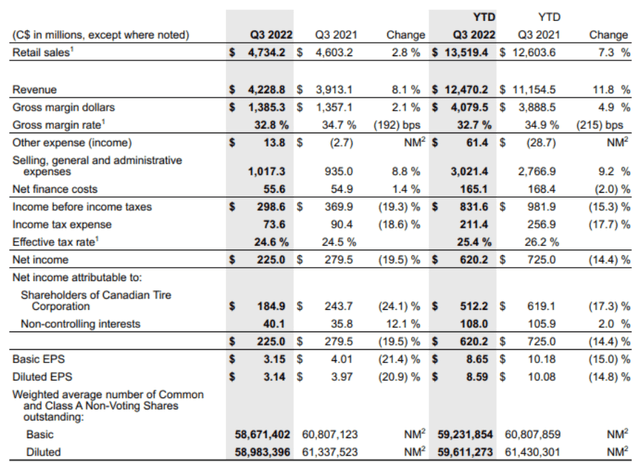

When looking at more recent third quarter results, we can see that while retail sales are up 7.3% on a year-to-date basis – diluted EPS is down by 14.8%.

Canadian Tire Corporation Third Quarter 2022 Financial Results

Moreover, while we also see that Q3 2022 retail sales were up by 2.8% as compared to the same quarter last year – retail sales were only up by 0.6% when excluding the impact of Petroleum.

Therefore, while Canadian Tire Corporation has been benefiting from higher fuel prices from a revenue standpoint – this has not been sufficient to bolster gross profit. Reuters reports that with inflation resulting in consumers cutting back on high-margin discretionary purchases, profits as a whole have been weakening.

Looking Forward

Going forward, inflation is likely to continue to place pressure on Canadian Tire Corporation – as is expected to be the case with other businesses across the consumer goods sector.

With that being said, the company’s cash position continues to remain impressive in spite of recent pressures on earnings. For instance, Canadian Tire Corporation reports that its annual dividend is set to rise to $6.90 per share from March 2023 onward – marking the 13th consecutive year of dividend raises, along with a 33% rise in the cumulative quarterly dividend since last year.

From this standpoint, if the company can continue to demonstrate a favourable cash position in spite of inflation and potential recessionary activity – the company may be able to rebound over the longer-term.

With the Seasonal, Gardening, and Automotive sectors having driven growth in the last quarter – we might see a temporary lull in demand across these sectors before a potential rebound in the spring. With that being said, investors are likely to watch closely whether Canadian Tire Corporation can effectively compete with rival firms such as Walmart (WMT) and Home Depot (HD) in this regard – it is possible that price competition will intensify as these firms attempt to grow sales.

Conclusion

To conclude, Canadian Tire Corporation could see further pressure on profits over the winter months. Additionally, it is not a given that higher petroleum prices will continue to sustain sales growth for the company.

However, the cash position of Canadian Tire Corporation looks favourable, and should the company manage to see a rebound in profits – then longer-term upside remains possible.

Be the first to comment