z1b/iStock via Getty Images

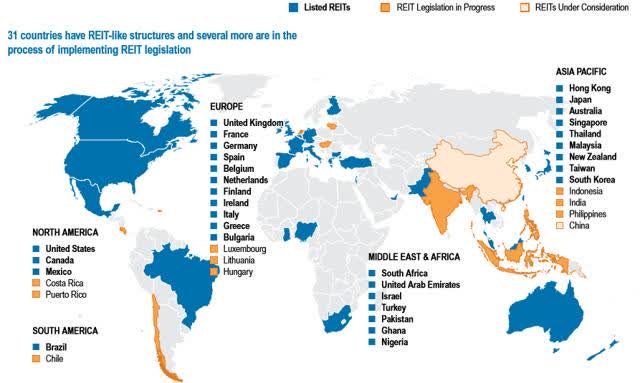

Something unique about High Yield Landlord is that we don’t cover just U.S. REITs, but we also cover foreign markets.

Today, over 30 countries have adopted the REIT regime, providing a lot of opportunities for us to evaluate.

REITs around the world (NAREIT)

Our International Portfolio is optional and intended for investors who want greater diversification to boost risk-adjusted returns.

Personally, I aim to invest at least 25% of my REIT portfolio in non-US markets. Some members may prefer to allocate a higher weight to International opportunities, while others may ignore them altogether. It comes down to your personal preference, risk tolerance, and return objectives.

The goal here is to provide you with the information and tools needed so that you aren’t just limited to US markets. It will allow you to identify and research new investment opportunities in Asia, Europe, South America, and Canada from the comfort of your home.

The Portfolio currently holds 14 positions – out of which 6 invest in Europe, 3 in Asia / Pacific, and 5 in Canada. In today’s article, we share updates on a few of our Canadian Top Picks.

RioCan Real Estate Investment Trust (OTCPK:RIOCF / REI.UN)

Our Canadian shopping center REIT, RioCan, is finally recovering closer to its pre-Covid levels. Since the beginning of the year, it is up 10%+ even as the rest of the market is down.

This is well justified by its fundamental performance. Despite suffering Covid-related restrictions for most of 2021, RioCan demonstrated its resilience by still growing its same property NOI by 3.4%. They also leased a huge amount of space (1.7 million square feet) at 6.3% higher rental rate and reached a ~97% occupancy rate, which is materially higher than the average occupancy of US-based peers.

This really proves a point that we made in our investment thesis:

“Not all retail is created equal.”

RioCan owns mainly service-oriented shopping centers that are anchored by grocery and other essential, Amazon-proof retail concepts.

Shopping center in Toronto (RioCan)

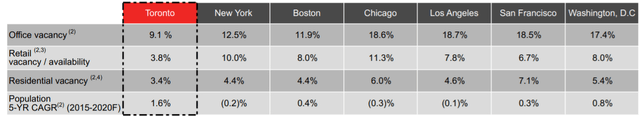

Moreover, about half of its assets are located in Toronto, which is one of the strongest real estate markets in the world. Here is how Toronto compares with major US cities in terms of supply and demand for retail real estate.

Toronto vs. US markets (RioCan)

With that in mind, it is not surprising that RioCan’s assets are performing so well, and we expect this strong performance to continue into 2022 as restrictions are eased and business returns to normal in Toronto.

RioCan has guided for 5-7% FFO growth and hiked its dividend by 6.25%. The CEO stated that their objective is to deliver a 12% annual total return for shareholders, which may signal that they expect to reach the high-end of their growth guidance.

7% growth + 4.2% dividend yield = ~12% annual return

But that’s assuming that RioCan experiences zero upside from multiple expansion.

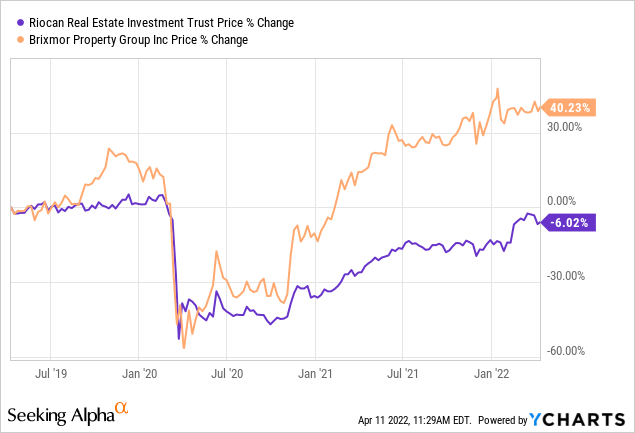

We think that even after the recent surge, RioCan remains undervalued, trading at a 10% discount to pre-covid levels, even as its US peers like Brixmor (BRX) and Kimco (KIM) have already repriced at large premiums in many cases.

RioCan vs. Brixmor (YCharts)

I believe that it is only a question of time before RioCan closes this performance gap because its assets are actually superior to its US peers in many respects, and something that’s often forgotten is that RioCan has a massive development pipeline of residential buildings.

This is important because cap rates have compressed considerably for residential buildings, which also means that RioCan’s pipeline is now a lot more valuable than ever before.

RioCan is building at a ~6% cap and able to sell at a 3.5-4% cap, creating significant value for shareholders. In 2021, they sold nearly a billion of assets at a 3.75% cap rate and reinvested that into higher-yielding development projects.

We expect more of the same in 2022 and given how hot the residential space is right now, we think that further upside is very likely.

As RioCan reprices near its US peers, it is set to unlock 20% upside, and that’s on top of the 12% return coming from the yield and growth.

Boardwalk Real Estate Investment Trust (OTCPK:BOWFF/ BEI.UN)

Just like RioCan, our Canadian apartment REIT, Boardwalk has escaped the recent market volatility and continued rising in value. It is up another 8% year-to-date, and has now more than doubled in value since our first investment in late 2020.

Canadian apartment community (Boardwalk REIT)

Its share price also now surpasses its pre-Covid levels, which was our target price when we first presented our investment thesis.

Is now time to sell?

As crazy as it may sound, we think that Boardwalk remains undervalued even after doubling over the past 18 months.

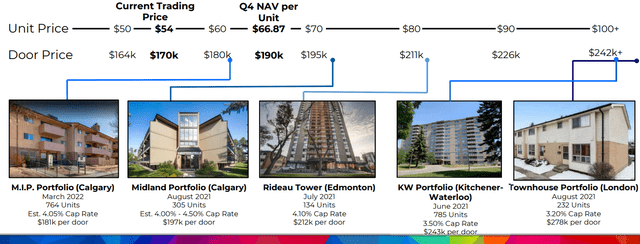

It trades today at closer to fair value, and the market isn’t quite as inefficient as it was back in 2020, but even now, the share price is 15% below its latest NAV estimate. This is quite exceptional for a high-quality apartment REIT in today’s inflationary world. In comparison, most US apartment REITs like Independence Realty (IRT) and Mid-America (MAA) are today priced at steep premiums to our estimate of NAV.

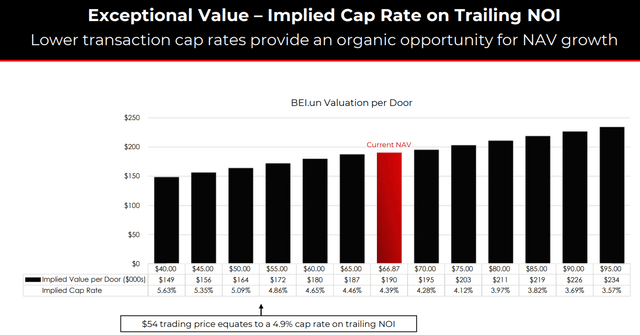

Unlike in the U.S., Canadian REITs must disclose their NAV estimate according to IFRS. Looking at their assumptions, we can also note that they are rather conservative. According to the latest market transactions, Boardwalk could be worth as much as C$100+ per share, but the company’s NAV estimate is just C$66.87. The implied cap rate of this NAV estimate is 4.4%, which is quite high in today’s market.

Boardwalk REIT NAV estimate (Boardwalk REIT) Boardwalk REIT NAV estimate (Boardwalk REIT)

This suggests to us that Boardwalk has further upside potential.

Remember that Boardwalk focuses on value-add type opportunities. This is important because it means that it can force NAV accretion in two ways:

- By hiking rents after making its properties more attractive.

- By forcing cap rate compression by increasing the growth prospects and lowering the risk of its properties.

Today, it may make sense to use a 4.4% cap rate, but as it completes its value-add programs, perhaps the portfolio will deserve closer to a 3.5-4% cap rate. Add to that some organic rent growth, and the NAV per share could be a lot higher in just a few years.

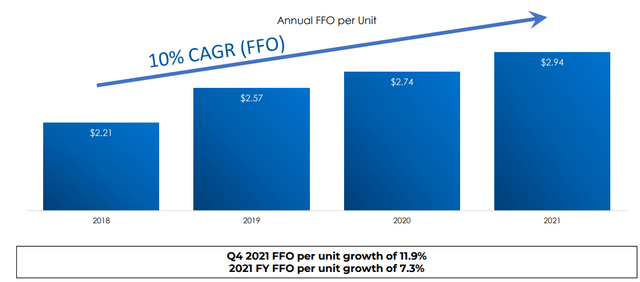

In addition to the upside potential from fair value appreciation, the cash flow of the company continues to rise at a good rate. Over the past few years, Boardwalk has managed to grow at 10% per year.

Boardwalk REIT FFO per share growth (Boardwalk REIT)

The mid-point guidance for 2022 is lower at ~6%, but that remains strong growth for a company that’s priced at a fairly substantial discount to NAV.

Moreover, the guidance was given prior to Russia’s invasion of Ukraine, and we suspect that this crisis could indirectly benefit Boardwalk since more than half of its assets are in the energy-producing regions of Alberta and Saskatchewan.

Now that Russia is being cut off from the rest of the world, the void in global supply needs to be filled by other players, potentially increasing the growth of the Canadian energy sector. Right now, these regions are experiencing a surge in job and population growth, and this could lead to further upside that wasn’t planned for when the guidance was given.

All in all, we think that Boardwalk continues to offer a great combination of value and growth, especially for a REIT that operates in such a hot asset class.

Priced at a 15% discount to a conservatively estimated NAV, and offering attractive growth prospects, we are upgrading Boardwalk back to a Strong Buy rating, even despite all its recent appreciation.

As a final note, Boardwalk just recently announced an 8% dividend hike, which marks the beginning of a new dividend growth streak. Given that its payout ratio is just 34%, we expect many more dividend hikes in the coming years, and this should also help its market sentiment.

Closing Note

Right now, there are many opportunities up north in Canada, and we are busy accumulating them at High Yield Landlord. RioCan and Boardwalk are two examples among many others that we currently own.

Be the first to comment